|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

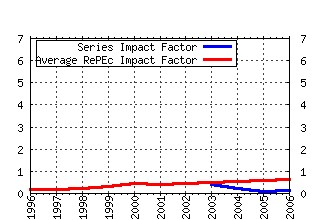

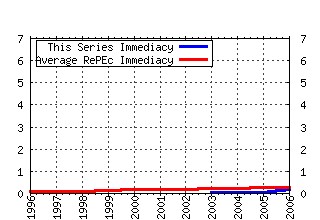

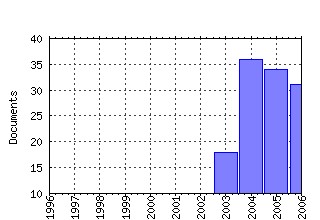

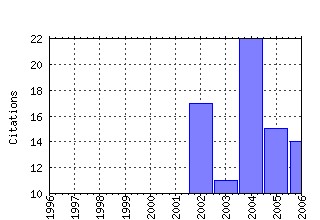

Journal of Pension Economics and Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cup:jpenef:v:1:y:2002:i:01:p:77-83_00 International pension swaps (2002). (2) RePEc:cup:jpenef:v:4:y:2005:i:03:p:225-248_00 Annuitization and asset allocation with HARA utility (2005). (3) RePEc:cup:jpenef:v:3:y:2004:i:01:p:35-62_00 On the optimality of PAYG pension systems in an endogenous fertility setting (2004). (4) RePEc:cup:jpenef:v:1:y:2002:i:02:p:111-130_00 Incentives to retire later a solution to the social security crisis? (2002). (5) RePEc:cup:jpenef:v:3:y:2004:i:02:p:109-143_00 Household annuitization decisions: simulations and empirical analyses (2004). (6) RePEc:cup:jpenef:v:2:y:2003:i:01:p:41-65_00 Life annuities of compulsory savings and income adequacy of the elderly in Singapore (2003). (7) RePEc:cup:jpenef:v:5:y:2006:i:01:p:69-90_00 Pension reform and demographic uncertainty: the case of Germany (2006). (8) RePEc:cup:jpenef:v:5:y:2006:i:02:p:121-154_00 The payout stage in Chile: who annuitizes and why? (2006). (9) RePEc:cup:jpenef:v:1:y:2002:i:01:p:9-33_00 Controlling the cost of minimum benefit guarantees in public pension conversions (2002). (10) RePEc:cup:jpenef:v:2:y:2003:i:02:p:181-219_00 The gender impact of pension reform (2003). (11) RePEc:cup:jpenef:v:4:y:2005:i:02:p:139-153_00 Controlling the effects of demographic risks: the role of pension indexation schemes (2005). (12) RePEc:cup:jpenef:v:5:y:2006:i:01:p:1-25_00 Planning for the optimal mix of paygo tax and funded savings (2006). (13) RePEc:cup:jpenef:v:4:y:2005:i:03:p:291-312_00 Public pensions in the national accounts and public finance targets (2005). (14) RePEc:cup:jpenef:v:6:y:2007:i:01:p:45-66_00 Private pensions and government guarantees: clues from Canada (2007). (15) RePEc:cup:jpenef:v:3:y:2004:i:01:p:77-97_00 The outlook for pension contributions and profits in the US (2004). (16) RePEc:cup:jpenef:v:2:y:2004:i:03:p:247-272_00 Protecting underfunded pensions: the role of guarantee funds (2004). (17) RePEc:cup:jpenef:v:2:y:2003:i:01:p:67-89_00 Privatising provision and attacking poverty? The direction of UK Pension Policy under new Labour (2003). (18) RePEc:cup:jpenef:v:1:y:2003:i:03:p:197-222_00 Asset rich and cash poor: retirement provision and housing policy in Singapore (2003). (19) RePEc:cup:jpenef:v:4:y:2005:i:02:p:115-138_00 The rate of return of pay-as-you-go pension systems: a more exact consumption-loan model of interest (2005). (20) RePEc:cup:jpenef:v:3:y:2004:i:02:p:145-164_00 Gender differences in retirement savings decisions (2004). (21) RePEc:cup:jpenef:v:5:y:2006:i:02:p:197-229_00 Demand for life annuities from married couples with a bequest motive (2006). (22) RePEc:cup:jpenef:v:4:y:2005:i:01:p:31-55_00 Administrative fees and costs of mandatory private pensions in transition economies (2005). (23) RePEc:cup:jpenef:v:3:y:2004:i:03:p:297-314_00 Cash balance pension plan conversions and the new economy (2004). (24) RePEc:cup:jpenef:v:3:y:2004:i:02:p:165-195_00 The social security reform process in Italy: where do we stand? (2004). (25) RePEc:cup:jpenef:v:6:y:2007:i:02:p:147-185_00 What can the life-cycle model tell us about 401(k) contributions and participation? (2007). (26) RePEc:cup:jpenef:v:5:y:2006:i:03:p:299-324_00 The impact of agency costs on the investment performance of Australian pension funds (2006). (27) RePEc:cup:jpenef:v:3:y:2004:i:01:p:63-76_00 New evidence on pension plan design and administrative expenses: the Australian experience (2004). (28) RePEc:cup:jpenef:v:3:y:2004:i:03:p:315-337_00 Promoting work at older ages: the role of hybrid pension plans in an aging population (2004). (29) RePEc:cup:jpenef:v:2:y:2004:i:03:p:273-293_00 Designing optimal linear rules for flexible retirement (2004). (30) RePEc:cup:jpenef:v:5:y:2006:i:01:p:27-44_00 Asset allocation in Finnish pension funds (2006). (31) RePEc:cup:jpenef:v:3:y:2004:i:02:p:197-232_00 Pension funds and corporate governance in developing countries: what do we know and what do we need to know? (2004). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:ces:ceswps:_1759 Intergenerational Risk Sharing by Means of Pay-as-you-go Programs â an Investigation of Alternative Mechanisms (2006). CESifo GmbH / CESifo Working Paper Series (2) RePEc:kap:fmktpm:v:20:y:2006:i:3:p:265-285 Portfolio management and retirement: what is the best arrangement for a family? (2006). Financial Markets and Portfolio Management (3) RePEc:mrr:papers:wp111 How to Integrate Disability Benefits into a System with Individual Accounts: The Chilean Model (2006). University of Michigan, Michigan Retirement Research Center / Working Papers (4) RePEc:mrr:papers:wp147 Crowd-out, Adverse Selection and Information in Annuity Markets: Evidence from a New Retrospective Data Set in Chile (2006). University of Michigan, Michigan Retirement Research Center / Working Papers (5) RePEc:nbr:nberwo:12135 Political Risk Versus Market Risk in Social Security (2006). National Bureau of Economic Research, Inc / NBER Working Papers (6) RePEc:nbr:nberwo:12401 The Chilean Pension Reform Turns 25: Lessons From the Social Protection Survey (2006). National Bureau of Economic Research, Inc / NBER Working Papers Recent citations received in: 2005 (1) RePEc:ces:ceswps:_1501 Actuarial Neutrality across Generations Applied to Public Pensions under Population Ageing: Effects on Government Finances and National Saving (2005). CESifo GmbH / CESifo Working Paper Series Recent citations received in: 2004 (1) RePEc:ces:ceswps:_1370 Designing Benefit Rules for Flexible Retirement with or without Redistribution (2004). CESifo GmbH / CESifo Working Paper Series Recent citations received in: 2003 (1) RePEc:wbk:wbrwps:3110 Governance of public pension funds : lessons from corporate governance and international evidence (2003). The World Bank / Policy Research Working Paper Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||