|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

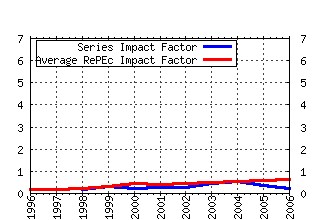

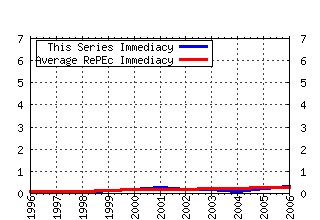

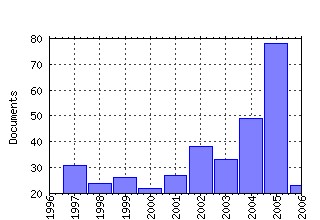

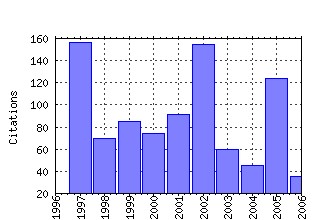

Macroeconomic Dynamics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cup:macdyn:v:1:y:2005:i:01:p:76-101_00 MARKET FRICTIONS, SAVINGS BEHAVIOR, AND PORTFOLIO CHOICE (2005). (2) RePEc:cup:macdyn:v:6:y:2002:i:1:p:111-44 Does Model Uncertainty Justify Caution? Robust Optimal Monetary Policy in a Forward-Looking Model. (2002). (3) RePEc:cup:macdyn:v:3:y:1999:i:2:p:204-25 A Mixed Blessing: Natural Resources and Economic Growth. (1999). (4) RePEc:cup:macdyn:v:1:y:1997:i:2:p:387-422 Income and Wealth Heterogeneity, Portfolio Choice, and Equilibrium Asset Returns. (1997). (5) RePEc:cup:macdyn:v:1:y:1997:i:1:p:7-44 Two Computations to Fund Social Security. (1997). (6) RePEc:cup:macdyn:v:2:y:1998:i:3:p:287-321 Consistent Expectations Equilibria. (1998). (7) RePEc:cup:macdyn:v:1:y:1997:i:1:p:76-101 Market Frictions, Savings Behavior, and Portfolio Choice. (1997). (8) RePEc:cup:macdyn:v:6:y:2002:i:5:p:633-64 Fiscal Policy, Increasing Returns, and Endogenous Fluctuations. (2002). (9) RePEc:cup:macdyn:v:6:y:2002:i:1:p:85-110 Robust Monetary Policy under Model Uncertainty in a Small Model of the U.S. Economy. (2002). (10) RePEc:cup:macdyn:v:5:y:2002:i:05:p:742-747_03 DOES INTRAFIRM BARGAINING MATTER IN THE LARGE FIRMS MATCHING MODEL? (2002). (11) RePEc:cup:macdyn:v:1:y:1997:i:2:p:312-32 Habit Persistence and Asset Returns in an Exchange Economy. (1997). (12) RePEc:cup:macdyn:v:1:y:1997:i:1:p:45-75 Solving Large-Scale Rational-Expectations Models. (1997). (13) RePEc:cup:macdyn:v:4:y:2000:i:4:p:423-47 Financial Intermediation and Aggregate Fluctuations: A Quantitative Analysis. (2000). (14) RePEc:cup:macdyn:v:8:y:2004:i:01:p:27-50_02 SIGNAL EXTRACTION AND NON-CERTAINTY-EQUIVALENCE IN OPTIMAL MONETARY POLICY RULES (2004). (15) RePEc:cup:macdyn:v:5:y:2001:i:1:p:81-100 Comparison of Bootstrap Confidence Intervals for Impulse Responses of German Monetary Systems. (2001). (16) RePEc:cup:macdyn:v:7:y:2003:i:2:p:239-62 The Real-Interest-Rate Gap as an Inflation Indicator. (2003). (17) RePEc:cup:macdyn:v:5:y:2001:i:3:p:413-33 Financial Development and Economic Growth. (2001). (18) RePEc:cup:macdyn:v:6:y:2002:i:1:p:40-84 Robust Permanent Income and Pricing with Filtering. (2002). (19) RePEc:cup:macdyn:v:6:y:2002:i:5:p:713-47 Stabilization Policy as Bifurcation Selection: Would Stabilization Policy Work if the Economy Really Were Unstable? (2002). (20) RePEc:cup:macdyn:v:11:y:2007:i:s1:p:1-7_06 INTRODUCTION (2007). (21) RePEc:cup:macdyn:v:2:y:1998:i:3:p:322-44 Virtues of Bad Times: Interaction between Productivity Growth and Economic Fluctuations. (1998). (22) RePEc:cup:macdyn:v:5:y:2001:i:2:p:272-302 Learning and Excess Volatility. (2001). (23) RePEc:cup:macdyn:v:5:y:2001:i:4:p:533-76 Threshold Cointegration and Nonlinear Adjustment to the Law of One Price. (2001). (24) RePEc:cup:macdyn:v:8:y:2004:i:1:p:27-50 Signal Extraction and Non-certainty-Equivalence in Optimal Monetary Policy Rules. (2004). (25) RePEc:cup:macdyn:v:4:y:2000:i:2:p:170-96 Herd Behavior and Aggregate Fluctuations in Financial Markets. (2000). (26) RePEc:cup:macdyn:v:5:y:2001:i:4:p:598-620 Out-of-Sample Tests for Granger Causality. (2001). (27) RePEc:cup:macdyn:v:1:y:1997:i:2:p:355-86 Solving Dynamic Models with Aggregate Shocks and Heterogeneous Agents. (1997). (28) RePEc:cup:macdyn:v:1:y:1997:i:3:p:615-39 Fiscal Policy in a Growing Economy with Public Capital. (1997). (29) RePEc:cup:macdyn:v:4:y:2000:i:2:p:197-221 The Exact Theoretical Rational Expectations Monetary Aggregate. (2000). (30) RePEc:cup:macdyn:v:2:y:1998:i:3:p:383-400 Superneutrality of Money in Staggered Wage-Setting Models. (1998). (31) RePEc:cup:macdyn:v:3:y:1999:i:2:p:243-77 Equilibrium Asset Prices and Savings of Heterogeneous Agents in the Presence of Incomplete Markets and Portfolio Constraints. (1999). (32) RePEc:cup:macdyn:v:6:y:2002:i:1:p:167-85 Robust Decision Theory and the Lucas Critique. (2002). (33) RePEc:cup:macdyn:v:2:y:1998:i:4:p:443-55 Uncertain Duration of Reform: Dynamic Implications. (1998). (34) RePEc:cup:macdyn:v:3:y:1999:i:4:p:482-505 Minimum Consumption Requirements: Theoretical and Quantitative Implications for Growth and Distribution. (1999). (35) RePEc:cup:macdyn:v:6:y:2002:i:2:p:284-306 Recursive Equilibria in Economies with Incomplete Markets. (2002). (36) RePEc:cup:macdyn:v:3:y:1999:i:3:p:311-40 Modeling Multiple Regimes in the Business Cycle. (1999). (37) RePEc:cup:macdyn:v:1:y:2005:i:03:p:640-657_00 REGIME-SENSITIVE COINTEGRATION WITH AN APPLICATION TO INTEREST-RATE PARITY (2005). (38) RePEc:cup:macdyn:v:7:y:2003:i:3:p:333-62 Optimal Inflation Tax and Structural Reform. (2003). (39) RePEc:cup:macdyn:v:9:y:2005:i:02:p:276-287_04 E-STABILITY DOES NOT IMPLY LEARNABILITY (2005). (40) RePEc:cup:macdyn:v:10:y:2006:i:02:p:231-272_05 DOES MONETARY POLICY GENERATE RECESSIONS? (2006). (41) RePEc:cup:macdyn:v:4:y:2000:i:3:p:343-72 Stock Returns, Term Structure, Inflation, and Real Activity: An International Perspective. (2000). (42) RePEc:cup:macdyn:v:10:y:2006:i:03:p:317-348_05 LOCK-IN OF EXTRAPOLATIVE EXPECTATIONS IN AN ASSET PRICING MODEL (2006). (43) RePEc:cup:macdyn:v:12:y:2007:i:01:p:1-21_06 WHY ARE THE WAGES OF JOB STAYERS PROCYCLICAL? (2007). (44) RePEc:cup:macdyn:v:1:y:2005:i:02:p:485-512_00 CAPM RISK ADJUSTMENT FOR EXACT AGGREGATION OVER FINANCIAL ASSETS (2005). (45) RePEc:cup:macdyn:v:8:y:2004:i:5:p:559-81 Endogenous Growth and Endogenous Business Cycles. (2004). (46) RePEc:cup:macdyn:v:12:y:2008:i:s1:p:45-59_07 IMPLEMENTING INTERNATIONAL MONETARY COOPERATION THROUGH INFLATION TARGETING (2008). (47) RePEc:cup:macdyn:v:8:y:2004:i:05:p:559-581_04 ENDOGENOUS GROWTH AND ENDOGENOUS BUSINESS CYCLES (2004). (48) RePEc:cup:macdyn:v:9:y:2005:i:04:p:542-559_04 SEMI-NONPARAMETRIC ESTIMATES OF THE DEMAND FOR MONEY IN THE UNITED STATES (2005). (49) RePEc:cup:macdyn:v:4:y:2000:i:3:p:373-414 Evolutionary Algorithms in Macroeconomic Models. (2000). (50) RePEc:cup:macdyn:v:6:y:2002:i:2:p:242-65 The Sharpe Ratio and Preferences: A Parametric Approach. (2002). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:eui:euiwps:eco2006/35 Employment Protection, Firm Selection, and Growth (2006). European University Institute / Economics Working Papers (2) RePEc:fip:fedfwp:2006-15 Time-varying U.S. inflation dynamics and the New-Keynesian Phillips Curve (2006). Federal Reserve Bank of San Francisco / Working Paper Series (3) RePEc:pid:journl:v:45:y:2006:i:2:p:185-202 Inflation in Pakistan (2006). The Pakistan Development Review (4) RePEc:red:issued:v:9:y:2006:i:2:p:224-241 Employment Protection and High-Tech Aversion (2006). Review of Economic Dynamics (5) RePEc:sce:scecfa:488 Time-Varying U.S. Inflation Dynamics and the New Keynesian Phillips Curve (2006). Society for Computational Economics / Computing in Economics and Finance 2006 (6) RePEc:uow:depec1:wp06-16 Depression and Substance Abuse: A Rationalization of a Vicious Circle (2006). School of Economics, University of Wollongong, NSW, Australia / Economics Working Papers (7) RePEc:uow:depec1:wp06-20 A Theory of Relative Deprivation and Myopic Addiction (2006). School of Economics, University of Wollongong, NSW, Australia / Economics Working Papers Recent citations received in: 2005 (1) RePEc:bep:eapadv:v:5:y:2005:i:1:p:1414-1414 Risk and Career Choice (2005). Advances in Economic Analysis & Policy (2) RePEc:cem:doctra:302 It is for global governance to sharpen up international relations by fulfilling a fiduciary role and carrying out the brokerage of asymmetric information (2005). Universidad del CEMA / CEMA Working Papers: Serie Documentos de Trabajo. (3) RePEc:cpr:ceprdp:4852 Wealth Accumulation and Portfolio Choice with Taxable and Tax-Deferred Accounts (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:cwl:cwldpp:1504 The Life-Cycle Personal Accounts Proposal for Social Security: An Evaluation (2005). Cowles Foundation, Yale University / Cowles Foundation Discussion Papers (5) RePEc:eab:microe:580 The Economic Payoffs from Marine Reserves: Resource Rents in a Stochastic Environment (2005). East Asian Bureau of Economic Research / Microeconomics Working Papers (6) RePEc:eab:microe:616 Cod Today and None Tomorrow: The Economic Value of a Marine Reserve (2005). East Asian Bureau of Economic Research / Microeconomics Working Papers (7) RePEc:fip:fedbwp:05-7 Borrowing costs and the demand for equity over the life cycle (2005). Federal Reserve Bank of Boston / Working Papers (8) RePEc:fip:fedfap:2005-19 Monetary policy inertia: fact or fiction? (2005). Federal Reserve Bank of San Francisco / Working Papers in Applied Economic Theory (9) RePEc:fip:fedgfe:2005-01 Precautionary savings motives and tax efficiency of household portfolios: an empirical analysis (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (10) RePEc:fip:fedgfe:2005-52 Solving stochastic money-in-the-utility-function models (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (11) RePEc:fip:fedhep:y:2005:i:qi:p:32-49:n:v.29no.1 The cost of business cycles and the benefits of stabilization (2005). Economic Perspectives (12) RePEc:fip:fedlrv:y:2005:i:nov:p:735-50:n:v.87no.6 Revisions to user costs for the Federal Reserve Bank of St. Louis monetary services indices (2005). Review (13) RePEc:idc:wpaper:idec05-7 Cod Today and None Tomorrow: The Economic Value of a Marine Reserve (2005). International and Development Economics / International and Development Economics Working Papers (14) RePEc:kap:openec:v:16:y:2005:i:4:p:399-405 Solution to the Siegel Paradox (2005). Open Economies Review (15) RePEc:nbr:nberwo:11300 The Life-Cycle Personal Accounts Proposal for Social Security: A Review (2005). National Bureau of Economic Research, Inc / NBER Working Papers (16) RePEc:san:cdmacp:0502 Uninsured Risks, Loan Contracts and the Declining Equity Premium (2005). Centre for Dynamic Macroeconomic Analysis / CDMA Conference Paper Series (17) RePEc:sce:scecf5:194 Dominant Firms, Barriers to Entry Capital and Entry Dynamics (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (18) RePEc:wpa:wuwpif:0502010 Does Asian foreign exchange intervention really hurt Europe? Lessons from a three-asset portfolio model (2005). EconWPA / International Finance (19) RePEc:wpa:wuwpif:0505003 The Revived Bretton Woods System seen from the Benches - Lessons for Europe from a Three-Asset-Portfolio Model (2005). EconWPA / International Finance Recent citations received in: 2004 (1) RePEc:bru:bruedp:04-11 Uncertainty and UK Monetary Policy (2004). Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers (2) RePEc:bru:bruppp:04-11 Uncertainty and UK Monetary Policy (2004). Economics and Finance Section, School of Social Sciences, Brunel University / Public Policy Discussion Papers (3) RePEc:cty:dpaper:0405 Uncertainty and UK Monetary Policy (2004). Department of Economics, City University, London / City University Economics Discussion Papers (4) RePEc:ecm:latm04:132 The Use and Abuse of Taylor Rules: How precisely can we estimate them? (2004). Econometric Society / Econometric Society 2004 Latin American Meetings (5) RePEc:mmf:mmfc04:65 Uncertainty and UK Monetary Policy (2004). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2004 Recent citations received in: 2003 (1) RePEc:del:abcdef:2003-28 Coordination on Saddle-Path Solutions: the Eductive Viewpoint - Linear Multivariate Models. (2003). DELTA (Ecole normale supérieure) / DELTA Working Papers (2) RePEc:eui:euiwps:eco2003/10 Will the Monetary Pillar Stay? A Few Lessons from the UK (2003). European University Institute / Economics Working Papers (3) RePEc:kie:kieliw:1179 Is European Money Demand Still Stable? (2003). Kiel Institute for World Economics / Working Papers (4) RePEc:nbr:nberwo:9960 The Unique Minimum State Variable RE Solution is E-Stable in All Well Formulated Linear Models (2003). National Bureau of Economic Research, Inc / NBER Working Papers (5) RePEc:nus:nusewp:wp0306 Non-Fundamental Expectations and Economic Fluctuations: Evidence from Professional Forecasts (2003). National University of Singapore, Department of Economics / Departmental Working Papers (6) RePEc:uno:wpaper:2003-02 Explaining speculative expansions (2003). University of New Orleans, Department of Economics and Finance / Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||