|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

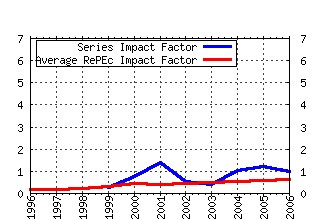

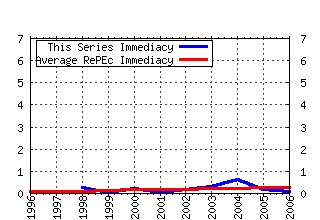

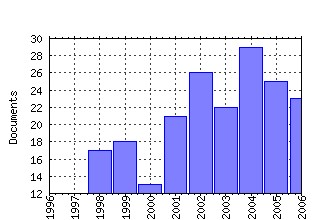

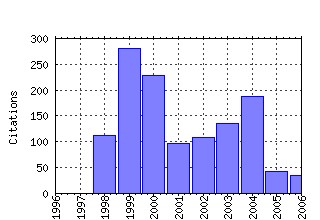

Econometrics Journal Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ect:emjrnl:v:3:y:2000:i:2:p:148-161 Testing for stationarity in heterogeneous panel data (2000). (2) RePEc:ect:emjrnl:v:2:y:1999:i:1:p:107-160 Statistical algorithms for models in state space using SsfPack 2.2 (1999). (3) RePEc:ect:emjrnl:v:2:y:1999:i:2:p:306-333 Some tests for parameter constancy in cointegrated VAR-models (1999). (4) RePEc:ect:emjrnl:v:3:y:2000:i:2:p:216-249 Cointegration analysis in the presence of structural breaks in the deterministic trend (2000). (5) RePEc:ect:emjrnl:v:6:y:2003:i:1:p:217-259 Dynamic panel estimation and homogeneity testing under cross section dependence (2003). (6) RePEc:ect:emjrnl:v:7:y:2004:i:1:p:1-31 Pooling of forecasts (2004). (7) RePEc:ect:emjrnl:v:6:y:2003:i:1:p:72-78 Critical values for multiple structural change tests (2003). (8) RePEc:ect:emjrnl:v:2:y:1999:i:2:p:167-191 Data mining reconsidered: encompassing and the general-to-specific approach to specification search (1999). (9) RePEc:ect:emjrnl:v:5:y:2002:i:2:p:285-318 Distributions of error correction tests for cointegration (2002). (10) RePEc:ect:emjrnl:v:4:y:2001:i:1:p:41 Likelihood-based cointegration tests in heterogeneous panels (2001). (11) RePEc:ect:emjrnl:v:1:y:1998:i:conferenceissue:p:c47-c75 A comparison of the forecast performance of Markov-switching and threshold autoregressive models of US GNP (1998). (12) RePEc:ect:emjrnl:v:7:y:2004:i:2:p:322-340 Some cautions on the use of panel methods for integrated series of macroeconomic data (2004). (13) RePEc:ect:emjrnl:v:1:y:1998:i:conferenceissue:p:c154-c173 Simulation-based finite sample normality tests in linear regressions (1998). (14) RePEc:ect:emjrnl:v:7:y:2004:i:1:p:272-306 Estimation with weak instruments: Accuracy of higher-order bias and MSE approximations (2004). (15) RePEc:ect:emjrnl:v:3:y:2000:i:1:p:84-107 Signal extraction and the formulation of unobserved components models (2000). (16) RePEc:ect:emjrnl:v:2:y:1999:i:2:p:202-219 Improving on Data mining reconsidered by K.D. Hoover and S.J. Perez (1999). (17) RePEc:ect:emjrnl:v:2:y:1999:i:1:p:76-91 Cointegration rank inference with stationary regressors in VAR models (1999). (18) RePEc:ect:emjrnl:v:4:y:2001:i:1:p:s20-s36 Fiscal forecasting: The track record of the IMF, OECD and EC (2001). (19) RePEc:ect:emjrnl:v:1:y:1998:i:conferenceissue:p:c23-c46 Bayesian inference on GARCH models using the Gibbs sampler (1998). (20) RePEc:ect:emjrnl:v:3:y:2000:i:1:p:16-38 Non-monotonic hazard functions and the autoregressive conditional duration model (2000). (21) RePEc:ect:emjrnl:v:7:y:2004:i:1:p:98-119 The behaviour of the maximum likelihood estimator of limited dependent variable models in the presence of fixed effects (2004). (22) RePEc:ect:emjrnl:v:4:y:2001:i:1:p:38 Are apparent findings of nonlinearity due to structural instability in economic time

series? (2001). (23) RePEc:ect:emjrnl:v:5:y:2002:i:1:p:1-39 Model selection tests for nonlinear dynamic models (2002). (24) RePEc:ect:emjrnl:v:8:y:2005:i:2:p:159-175 Breaking the panels: An application to the GDP per capita (2005). (25) RePEc:ect:emjrnl:v:2:y:1999:i:1:p:49-75 Inference for Lorenz curve orderings (1999). (26) RePEc:ect:emjrnl:v:7:y:2004:i:2:p:550-565 Forecasting in dynamic factor models using Bayesian model averaging (2004). (27) RePEc:ect:emjrnl:v:6:y:2003:i:2:p:430-461 Econometric inflation targeting (2003). (28) RePEc:ect:emjrnl:v:5:y:2002:i:2:p:263-284 An investigation of tests for linearity and the accuracy of likelihood based inference using random fields (2002). (29) RePEc:ect:emjrnl:v:1:y:1998:i:regularpapers:p:1-9 The relation between conditionally heteroskedastic factor models and factor GARCH models (1998). (30) RePEc:ect:emjrnl:v:5:y:2002:i:1:p:76-90 Notation in econometrics: a proposal for a standard (2002). (31) RePEc:ect:emjrnl:v:2:y:1999:i:1:p:1-28 Nonparametric bounds on employment and income effects of continuous vocational training in East Germany (1999). (32) RePEc:ect:emjrnl:v:7:y:2004:i:2:p:585-617 A comparison of autoregressive distributed lag and dynamic OLS cointegration estimators in the case of a serially correlated cointegration error (2004). (33) RePEc:ect:emjrnl:v:3:y:2000:i:2:p:177-197 Testing for linear autoregressive dynamics under heteroskedasticity (2000). (34) RePEc:ect:emjrnl:v:6:y:2003:i:2:p:261-290 Semiparametric estimation of Value at Risk (2003). (35) RePEc:ect:emjrnl:v:5:y:2002:i:2:p:319-344 Modelling methodology and forecast failure (2002). (36) RePEc:ect:emjrnl:v:7:y:2004:i:2:p:528-549 Testing for duration dependence in economic cycles (2004). (37) RePEc:ect:emjrnl:v:6:y:2003:i:2:p:291-311 Tests for a change in persistence against the null of difference-stationarity (2003). (38) RePEc:ect:emjrnl:v:7:y:2004:i:1:p:249-271 Cointegration analysis in the presence of outliers (2004). (39) RePEc:ect:emjrnl:v:1:y:1998:i:conferenceissue:p:c113-c128 Estimating stochastic volatility models through indirect inference (1998). (40) RePEc:ect:emjrnl:v:1:y:1998:i:conferenceissue:p:c228-c266 A framework for economic forecasting (1998). (41) RePEc:ect:emjrnl:v:10:y:2007:i:3:p:554-579 Expectations hypotheses tests at Long Horizons (2007). (42) RePEc:ect:emjrnl:v:8:y:2005:i:1:p:55-69 Testing for stationarity in heterogeneous panel data where the time dimension is finite (2005). (43) RePEc:ect:emjrnl:v:5:y:2002:i:1:p:40-64 Progress from forecast failure -- the Norwegian consumption function (2002). (44) RePEc:ect:emjrnl:v:9:y:2006:i:1:p:23-47 Dynamic adjustment cost models with forward-looking behaviour (2006). (45) RePEc:ect:emjrnl:v:9:y:2006:i:3:p:357-372 Temporal disaggregation by state space methods: Dynamic regression methods revisited (2006). (46) RePEc:ect:emjrnl:v:4:y:2001:i:2:p:10 The NIG-S&ARCH model: a fat-tailed, stochastic, and autoregressive conditional

heteroskedastic volatility model (2001). (47) RePEc:ect:emjrnl:v:7:y:2004:i:2:p:505-527 Asymptotic confidence intervals for impulse responses of near-integrated processes (2004). (48) RePEc:ect:emjrnl:v:6:y:2003:i:2:p:312-334 A full-factor multivariate GARCH model (2003). (49) RePEc:ect:emjrnl:v:8:y:2005:i:1:p:23-38 Grangers representation theorem: A closed-form expression for I(1) processes (2005). (50) RePEc:ect:emjrnl:v:7:y:2004:i:1:p:232-248 Modelling phase shifts among stochastic cycles (2004). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:pra:mprapa:1641 Consumption risk sharing and adjustment costs (2006). University Library of Munich, Germany / MPRA Paper (2) RePEc:pra:mprapa:1642 Present value relations, Granger non-causality and VAR stability (2006). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2005 (1) RePEc:aea:aecrev:v:95:y:2005:i:1:p:161-182 Estimation and Inference of Impulse Responses by Local Projections (2005). American Economic Review (2) RePEc:imf:imfwpa:05/164 Real Exchange Rate Misalignment: A Panel Co-Integration and Common Factor Analysis (2005). International Monetary Fund / IMF Working Papers (3) RePEc:ins:quaeco:qf0504 Design of vector autoregressive processes for invariant statistics (2005). Department of Economics, University of Insubria / Economics and Quantitative Methods (4) RePEc:uts:rpaper:168 Multivariate Autoregressive Conditional Heteroskedasticity with Smooth Transitions in Conditional Correlations (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series Recent citations received in: 2004 (1) RePEc:ces:ceswps:_1290 Dualism and Cross-Country Growth Regressions (2004). CESifo GmbH / CESifo Working Paper Series (2) RePEc:ces:ceswps:_1358 Model Averaging and Value-at-Risk Based Evaluation of Large Multi Asset Volatility Models for Risk Management (2004). CESifo GmbH / CESifo Working Paper Series (3) RePEc:cpr:ceprdp:4304 Regional Treatment Intensity as an Instrument for the Evaluation of Labour Market Policies (2004). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:ctl:louvir:2004024 Business Cycle Turning Points : Mixed-Frequency Data with Structural Breaks (2004). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (5) RePEc:dgr:umamet:2004040 Panel Unit Root Tests in the Presence of Cross-Sectional Dependencies: Comparison and Implications for Modelling (2004). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (6) RePEc:ecm:feam04:567 Simultaneous Equations and Weak Instruments under Conditionally Heteroscedastic Disturbances (2004). Econometric Society / Econometric Society 2004 Far Eastern Meetings (7) RePEc:ecm:latm04:91 The estimation of simultaneous equation models under conditional heteroscedasticity (2004). Econometric Society / Econometric Society 2004 Latin American Meetings (8) RePEc:gen:geneem:2004.05 Stock and Bond Return Predictability : The Discrimination Power of Model Selection Criteria (2004). Département d'Econométrie, Université de Genève / Cahiers du Département d'Econométrie (9) RePEc:iza:izadps:dp1095 Regional Treatment Intensity as an Instrument for the Evaluation of Labour Market Policies (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (10) RePEc:knz:hetero:0404 University Spillovers: Does the Kind of Science Matter? (2004). Research Group Heterogeneous Labor, University of Konstanz/ZEW Mannheim / Working Papers of the Research Group Heterogenous Labor (11) RePEc:knz:hetero:0405 The Causal Effect of Schooling : empirical Evidence from Germany (2004). Research Group Heterogeneous Labor, University of Konstanz/ZEW Mannheim / Working Papers of the Research Group Heterogenous Labor (12) RePEc:mmf:mmfc04:101 Model Averaging and Value-at-Risk based Evaluation of Large Multi Asset Volatility Models for Risk Management (2004). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2004 (13) RePEc:nbr:nberte:0302 Bootstrap and Higher-Order Expansion Validity When Instruments May Be Weak (2004). National Bureau of Economic Research, Inc / NBER Technical Working Papers (14) RePEc:onb:oenbwp:90 Modeling Credit Aggregates (2004). Oesterreichische Nationalbank (Austrian National Bank) / Working Papers (15) RePEc:qed:wpaper:1031 The Case Against JIVE (2004). Queen's University, Department of Economics / Working Papers (16) RePEc:sce:scecf4:230 Forecasting euro area inflation: Does aggregating forecasts by HICP component improve forecast accuracy? (2004). Society for Computational Economics / Computing in Economics and Finance 2004 (17) RePEc:sce:scecf4:273 Density Estimation and Combination under Model Ambiguity (2004). Society for Computational Economics / Computing in Economics and Finance 2004 (18) RePEc:scp:wpaper:04-3 Model Averaging and Value-at-Risk based Evaluation of Large Multi Asset Volatility Models for Risk Management (2004). Institute of Economic Policy Research (IEPR) / IEPR Working Papers Recent citations received in: 2003 (1) RePEc:cep:stiecm:/2003/460 LARCH, Leverage and Long Memory (2003). Suntory and Toyota International Centres for Economics and Related Disciplines, LSE / STICERD - Econometrics Paper Series (2) RePEc:cpr:ceprdp:3758 Is Official Exchange Rate Intervention Effective? (2003). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:hhs:osloec:2002_018 Testing the New Keynesian Phillips curve (2003). Oslo University, Department of Economics / Memorandum (4) RePEc:ibm:ibmecp:wpe_37 Structural Break Threshold VARs for Predicting US Recessions using the Spread (2003). Ibmec Working Paper, Ibmec São Paulo / Ibmec Working Papers (5) RePEc:nbr:nberwo:9452 Omitted Product Attributes in Discrete Choice Models (2003). National Bureau of Economic Research, Inc / NBER Working Papers (6) RePEc:taf:apeclt:v:10:y:2003:i:15:p:985-988 Structural breaks in the U.S. inflation process: a further investigation (2003). Applied Economics Letters (7) RePEc:wpa:wuwpio:0309001 The Fall in British Electricity Prices: Market Rules, Market Structure, or Both? (2003). EconWPA / Industrial Organization Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||