|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

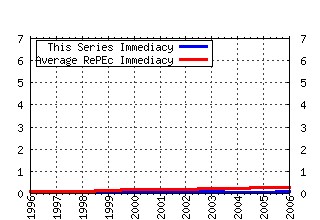

International Review of Financial Analysis Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:finana:v:10:y:2001:i:3:p:203-218 What drives contagion: Trade, neighborhood, or financial links? (2001). (2) RePEc:eee:finana:v:13:y:2004:i:5:p:633-647 Equity market integration in Central European emerging markets: A cointegration analysis with shifting regimes (2004). (3) RePEc:eee:finana:v:13:y:2004:i:5:p:571-583 International equity market integration: Theory, evidence and implications (2004). (4) RePEc:eee:finana:v:7:y:1998:i:2:p:95-111 Two puzzles in the analysis of foreign exchange market efficiency (1998). (5) RePEc:eee:finana:v:1:y:1992:i:3:p:179-193 Prices and hedge ratios of average exchange rate options (1992). (6) RePEc:eee:finana:v:11:y:2002:i:2:p:219-227 The aggregate credit spread and the business cycle (2002). (7) RePEc:eee:finana:v:11:y:2002:i:1:p:39-57 The costs of bankruptcy: A review (2002). (8) RePEc:eee:finana:v:10:y:2001:i:2:p:175-185 Response asymmetries in the Latin American equity markets (2001). (9) RePEc:eee:finana:v:10:y:2001:i:2:p:135-156 Trading rule profits in Latin American currency spot rates (2001). (10) RePEc:eee:finana:v:11:y:2002:i:1:p:1-27 The explanatory power of political risk in emerging markets (2002). (11) RePEc:eee:finana:v:8:y:1999:i:1:p:67-82 Forecasting currency prices using a genetically evolved neural network architecture (1999). (12) RePEc:eee:finana:v:9:y:2000:i:3:p:235-245 On the conditional relationship between beta and return in international stock returns (2000). (13) RePEc:eee:finana:v:10:y:2001:i:1:p:87-96 Dynamic interdependence and volatility transmission of Asian stock markets: Evidence from the Asian crisis (2001). (14) RePEc:eee:finana:v:6:y:1997:i:3:p:179-192 The Big Mac: More than a junk asset allocator? (1997). (15) RePEc:eee:finana:v:8:y:1999:i:2:p:123-138 Scaling laws in variance as a measure of long-term dependence (1999). (16) RePEc:eee:finana:v:11:y:2002:i:2:p:111-138 Dividend policy theories and their empirical tests (2002). (17) RePEc:eee:finana:v:8:y:1999:i:1:p:35-52 Size and book-to-market factors in a multivariate GARCH-in-mean asset pricing application (1999). (18) RePEc:eee:finana:v:11:y:2002:i:1:p:29-38 The volatility of Japanese interest rates: evidence for Certificate of Deposit and Gensaki rates (2002). (19) RePEc:eee:finana:v:11:y:2002:i:4:p:407-431 Stochastic chaos or ARCH effects in stock series?: A comparative study (2002). (20) RePEc:eee:finana:v:2:y:1993:i:2:p:121-141 The event study: An industrial strength method (1993). (21) RePEc:eee:finana:v:13:y:2004:i:5:p:649-668 Equity market integration in Latin America: A time-varying integration score analysis (2004). (22) RePEc:eee:finana:v:17:y:2008:i:3:p:539-556 Idiosyncratic volatility and equity returns: UK evidence (2008). (23) RePEc:eee:finana:v:12:y:2003:i:5:p:579-590 Testing weak-form market efficiency: Evidence from the Istanbul Stock Exchange (2003). (24) RePEc:eee:finana:v:10:y:2001:i:2:p:99-122 A nonparametric approach to model the term structure of interest rates: The case of Chile (2001). (25) RePEc:eee:finana:v:5:y:1996:i:1:p:19-38 Prospect theory: A literature review (1996). (26) RePEc:eee:finana:v:11:y:2002:i:3:p:375-406 Corporate bankruptcy prognosis: An attempt at a combined prediction of the bankruptcy event and time interval of its occurrence (2002). (27) RePEc:eee:finana:v:13:y:2004:i:2:p:227-244 Private benefits, block transaction premiums and ownership structure (2004). (28) RePEc:eee:finana:v:8:y:1999:i:2:p:177-197 Agency problems and the simultaneity of financial decision making: The role of institutional ownership (1999). (29) RePEc:eee:finana:v:10:y:2001:i:4:p:395-406 Multiperiod hedging in the presence of stochastic volatility (2001). (30) RePEc:eee:finana:v:9:y:2000:i:4:p:405-420 Volatility and information flows in emerging equity market: A case of the Korean Stock Exchange (2000). (31) RePEc:eee:finana:v:14:y:2005:i:5:p:508-532 Put-call parity and cross-markets efficiency in the index options markets: evidence from the Italian market (2005). (32) RePEc:eee:finana:v:16:y:2007:i:2:p:172-182 The comovement of US and German bond markets (2007). (33) RePEc:eee:finana:v:9:y:2000:i:2:p:163-174 International acquisitions and shareholder wealth Evidence from the Netherlands (2000). (34) RePEc:eee:finana:v:11:y:2002:i:3:p:331-344 Scaling the volatility of credit spreads: Evidence from Australian dollar eurobonds (2002). (35) RePEc:eee:finana:v:16:y:2007:i:1:p:41-60 Dynamic linkages between emerging European and developed stock markets: Has the EMU any impact? (2007). (36) RePEc:eee:finana:v:9:y:2000:i:2:p:197-218 Restructuring the Japanese banking system Has Japan gone far enough? (2000). (37) RePEc:eee:finana:v:9:y:2000:i:1:p:21-43 Pre-bid price run-ups and insider trading activity: Evidence from Canadian acquisitions (2000). (38) RePEc:eee:finana:v:12:y:2003:i:4:p:349-377 The dividend and share repurchase policies of Canadian firms: empirical evidence based on an alternative research design (2003). (39) RePEc:eee:finana:v:12:y:2003:i:2:p:173-188 Liquidity and stock returns in pure order-driven markets: evidence from the Australian stock market (2003). (40) RePEc:eee:finana:v:6:y:1997:i:1:p:37-47 The lead-lag structure of stock returns and accounting earnings: Implications to the returns-earnings relation in Finland (1997). (41) RePEc:eee:finana:v:13:y:2004:i:1:p:83-103 Long-run abnormal return after IPOs and optimistic analysts forecasts (2004). (42) RePEc:eee:finana:v:12:y:2003:i:1:p:3-23 IMF bailouts, contagion effects, and bank security returns (2003). (43) RePEc:eee:finana:v:5:y:1996:i:1:p:39-53 Common factors in international stock prices: Evidence from a cointegration study (1996). (44) RePEc:eee:finana:v:12:y:2003:i:5:p:563-577 An empirical examination of the impact of market microstructure changes on the determinants of option bid-ask spreads (2003). (45) RePEc:eee:finana:v:14:y:2005:i:3:p:283-303 Cost frontier efficiency and risk-return analysis in an emerging market (2005). (46) RePEc:eee:finana:v:7:y:1998:i:3:p:191-206 Forecasting U.K. and U.S. interest rates using continuous time term structure models (1998). (47) RePEc:eee:finana:v:13:y:2004:i:3:p:333-347 European foreign exchange market efficiency: Evidence based on crisis and noncrisis periods (2004). (48) RePEc:eee:finana:v:16:y:2007:i:1:p:22-40 Evidence of an asymmetry in the relationship between volatility and autocorrelation (2007). (49) RePEc:eee:finana:v:4:y:1995:i:1:p:35-66 Stein and CAPM estimators of the means in asset allocation (1995). (50) RePEc:eee:finana:v:11:y:2002:i:1:p:101-110 The relationship between conditional stock market volatility and conditional macroeconomic volatility: Empirical evidence based on UK data (2002). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:ebl:ecbull:v:7:y:2006:i:4:p:1-7 Equity Diversification in Two Chinese Share Markets: Old Wine and New Bottle (2006). Economics Bulletin (2) RePEc:edj:ceauch:219 Portfolio management implications of volatility shifts: Evidence from simulated data (2006). Centro de Economía Aplicada, Universidad de Chile / Documentos de Trabajo Recent citations received in: 2005 (1) RePEc:wpa:wuwpfi:0512030 Methodology and Implementation of Value-at-Risk Measures in Emerging Fixed-Income Markets with Infrequent Trading. (2005). EconWPA / Finance Recent citations received in: 2004 (1) RePEc:qut:dpaper:170 Equity Premium: - Does it exist? Evidence from Germany and United Kingdom (2004). School of Economics and Finance, Queensland University of Technology / School of Economics and Finance Discussion Papers and Working Papers Series Recent citations received in: 2003 (1) RePEc:dgr:kubcen:200328 Why individual investors want dividends (2003). Tilburg University, Center for Economic Research / Discussion Paper (2) RePEc:qut:dpaper:159 Weak-form market efficiency in European emerging and developed stock markets (2003). School of Economics and Finance, Queensland University of Technology / School of Economics and Finance Discussion Papers and Working Papers Series (3) RePEc:taf:apeclt:v:10:y:2003:i:10:p:643-645 An empirical comparison of interest rates using an interest rate model and nonparametric methods (2003). Applied Economics Letters Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||