|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

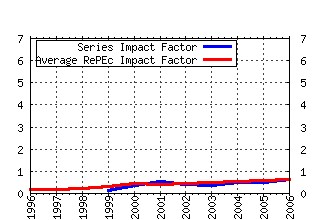

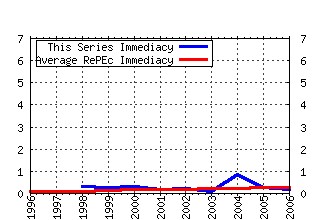

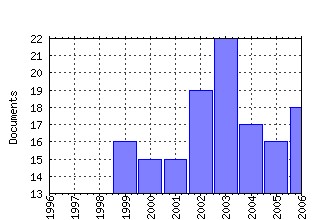

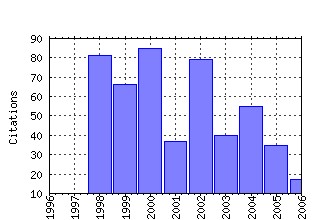

Journal of Financial Markets Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:finmar:v:3:y:2000:i:3:p:205-258 Market microstructure: A survey (2000). (2) RePEc:eee:finmar:v:5:y:2002:i:1:p:31-56 Illiquidity and stock returns: cross-section and time-series effects (2002). (3) RePEc:eee:finmar:v:1:y:1998:i:3-4:p:353-383 Aggressiveness and survival of overconfident traders (1998). (4) RePEc:eee:finmar:v:2:y:1999:i:2:p:99-134 Order flow composition and trading costs in a dynamic limit order market1 (1999). (5) RePEc:eee:finmar:v:7:y:2004:i:1:p:53-74 Order aggressiveness in limit order book markets (2004). (6) RePEc:eee:finmar:v:1:y:1998:i:1:p:1-50 Optimal control of execution costs (1998). (7) RePEc:eee:finmar:v:3:y:2000:i:2:p:83-111 Inferring investor behavior: Evidence from TORQ data (2000). (8) RePEc:eee:finmar:v:4:y:2001:i:1:p:73-84 On the survival of overconfident traders in a competitive securities market (2001). (9) RePEc:eee:finmar:v:8:y:2005:i:2:p:217-264 Market microstructure: A survey of microfoundations, empirical results, and policy implications (2005). (10) RePEc:eee:finmar:v:7:y:2004:i:1:p:1-25 Impacts of trades in an error-correction model of quote prices (2004). (11) RePEc:eee:finmar:v:1:y:1998:i:2:p:203-219 Liquidity and stock returns: An alternative test (1998). (12) RePEc:eee:finmar:v:3:y:2000:i:3:p:259-286 On the occurrence and consequences of inaccurate trade classification (2000). (13) RePEc:eee:finmar:v:5:y:2002:i:3:p:309-321 Price discovery and common factor models (2002). (14) RePEc:eee:finmar:v:2:y:1999:i:4:p:329-357 The organization of financial exchange markets: Theory and evidence (1999). (15) RePEc:eee:finmar:v:2:y:1999:i:3:p:227-271 Reputation and performance fee effects on portfolio choice by investment advisers1 (1999). (16) RePEc:eee:finmar:v:6:y:2003:i:1:p:1-21 Excess demand and equilibration in multi-security financial markets: the empirical evidence (2003). (17) RePEc:eee:finmar:v:7:y:2004:i:3:p:271-299 Market liquidity as a sentiment indicator (2004). (18) RePEc:eee:finmar:v:5:y:2002:i:3:p:259-276 Some desiderata for the measurement of price discovery across markets (2002). (19) RePEc:eee:finmar:v:5:y:2002:i:3:p:277-308 Security price adjustment across exchanges: an investigation of common factor components for Dow stocks (2002). (20) RePEc:eee:finmar:v:6:y:2003:i:4:p:461-489 Quote setting and price formation in an order driven market (2003). (21) RePEc:eee:finmar:v:5:y:2002:i:2:p:127-167 Market architecture: limit-order books versus dealership markets (2002). (22) RePEc:eee:finmar:v:8:y:2005:i:3:p:265-287 Should securities markets be transparent? (2005). (23) RePEc:eee:finmar:v:2:y:1999:i:3:p:193-226 Intra-day market activity (1999). (24) RePEc:eee:finmar:v:3:y:2000:i:4:p:333-363 Market structure, informational efficiency and liquidity: An experimental comparison of auction and dealer markets (2000). (25) RePEc:eee:finmar:v:4:y:2001:i:2:p:113-142 Predicting VNET: A model of the dynamics of market depth (2001). (26) RePEc:eee:finmar:v:5:y:2002:i:2:p:223-257 The impact of the Federal Reserve Banks open market operations (2002). (27) RePEc:eee:finmar:v:7:y:2004:i:2:p:145-185 Expandable limit order markets (2004). (28) RePEc:eee:finmar:v:1:y:1998:i:3-4:p:321-352 Strategic trading, asymmetric information and heterogeneous prior beliefs (1998). (29) RePEc:eee:finmar:v:2:y:1999:i:1:p:49-68 The alpha factor asset pricing model: A parable (1999). (30) RePEc:eee:finmar:v:5:y:2002:i:1:p:57-82 Intraday analysis of market integration: Dutch blue chips traded in Amsterdam and New York (2002). (31) RePEc:eee:finmar:v:4:y:2001:i:4:p:385-412 Knowing me, knowing you: : Trader anonymity and informed trading in parallel markets (2001). (32) RePEc:eee:finmar:v:6:y:2003:i:4:p:517-538 Traders choice between limit and market orders: evidence from NYSE stocks (2003). (33) RePEc:eee:finmar:v:8:y:2005:i:4:p:377-399 Duration, volume and volatility impact of trades (2005). (34) RePEc:eee:finmar:v:1:y:1998:i:2:p:175-201 Financial analysts and information-based trade (1998). (35) RePEc:eee:finmar:v:6:y:2003:i:3:p:233-257 Issues in assessing trade execution costs (2003). (36) RePEc:eee:finmar:v:3:y:2000:i:1:p:69-81 The capital asset pricing model and the liquidity effect: A theoretical approach (2000). (37) RePEc:eee:finmar:v:3:y:2000:i:1:p:17-43 Asset market equilibrium with general tastes, returns, and informational asymmetries (2000). (38) RePEc:eee:finmar:v:2:y:1999:i:1:p:29-48 Market depth and order size1 (1999). (39) RePEc:eee:finmar:v:5:y:2002:i:3:p:329-339 Stalking the efficient price in market microstructure specifications: an overview (2002). (40) RePEc:eee:finmar:v:6:y:2003:i:2:p:99-141 Reputation and interdealer trading: a microstructure analysis of the Treasury Bond market (2003). (41) RePEc:eee:finmar:v:3:y:2000:i:1:p:45-67 Stock returns and trading at the close (2000). (42) RePEc:eee:finmar:v:8:y:2005:i:1:p:1-23 Trade-through prohibitions and market quality (2005). (43) RePEc:eee:finmar:v:7:y:2004:i:3:p:301-333 Trading strategies during circuit breakers and extreme market movements (2004). (44) RePEc:eee:finmar:v:3:y:2000:i:4:p:365-387 Investor risk evaluation in the determination of management incentives in the mutual fund industry (2000). (45) RePEc:eee:finmar:v:9:y:2006:i:2:p:144-161 Cross-listing, price discovery and the informativeness of the trading process (2006). (46) RePEc:eee:finmar:v:1:y:1998:i:1:p:51-87 Decimalization and competition among stock markets: Evidence from the Toronto Stock Exchange cross-listed securities (1998). (47) RePEc:eee:finmar:v:4:y:2001:i:3:p:231-260 Teenies anyone? (2001). (48) RePEc:eee:finmar:v:10:y:2007:i:1:p:1-25 Measuring the resiliency of an electronic limit order book (2007). (49) RePEc:eee:finmar:v:4:y:2001:i:2:p:185-208 An experimental study of circuit breakers: The effects of mandated market closures and temporary halts on market behavior (2001). (50) RePEc:eee:finmar:v:6:y:2003:i:3:p:259-280 Evaluation of the biases in execution cost estimation using trade and quote data (2003). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:bde:wpaper:0630 Option-implied preferences adjustments, density forecasts, and the equity risk premium (2006). Banco de Espana / Banco de Espana Working Papers (2) RePEc:crt:wpaper:0615 The Components of the Bid-Ask Spread: The case of the Athens Stock Exchange (2006). University of Crete, Department of Economics / Working Papers (3) RePEc:ebg:essewp:dr-06017 Preferencing, internalization and inventory position (2006). ESSEC Research Center, ESSEC Business School / ESSEC Working Papers Recent citations received in: 2005 (1) RePEc:ide:wpaper:4639 Does Order Flow Fragmentation Impact Market Quality? The Case of Nasdaq SuperMontage (2005). Institut d'Économie Industrielle (IDEI), Toulouse / IDEI Working Papers (2) RePEc:nbr:nberwo:11444 Optimal Trading Strategy and Supply/Demand Dynamics (2005). National Bureau of Economic Research, Inc / NBER Working Papers (3) RePEc:sbs:wpsefe:2005fe10 Price, Trade Size, and Information Revelation in Multi-Period Securities Markets (2005). Oxford Financial Research Centre / OFRC Working Papers Series (4) RePEc:wpa:wuwpfi:0510031 Price, Trade Size, and Information Revelation in Multi-Period Securities Markets (2005). EconWPA / Finance Recent citations received in: 2004 (1) RePEc:ctl:louvec:2005015 Volatility regimes and the provisions of liquidity in order book markets (2004). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (2) RePEc:ecl:ohidic:2004-8 Feedback and the Success of Irrational Investors (2004). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (3) RePEc:ecm:ausm04:272 Duration and Order Type Clusters (2004). Econometric Society / Econometric Society 2004 Australasian Meetings (4) RePEc:ecm:feam04:730 Duration and Order Type Clusters (2004). Econometric Society / Econometric Society 2004 Far Eastern Meetings (5) RePEc:ecm:latm04:142 Understanding limit order book depth: conditioning on trade informativeness (2004). Econometric Society / Econometric Society 2004 Latin American Meetings (6) RePEc:ecm:nasm04:476 Estimation and Testing for Partially Nonstationary Vector Autoregressive Models with GARCH: WLS versus QMLE (2004). Econometric Society / Econometric Society 2004 North American Summer Meetings (7) RePEc:kud:kuiedp:0407 A Continuous-Time Measurement of the Buy-Sell Pressure in a Limit Order Book Market (2004). University of Copenhagen. Department of Economics (formerly Institute of Economics) / Discussion Papers (8) RePEc:kud:kuiefr:200403 A Continuous-Time Measurement of the Buy-Sell Pressure in a Limit Order Book Market (2004). University of Copenhagen. Institute of Economics. Finance Research Unit / FRU Working Papers (9) RePEc:kud:kuiefr:200504 Order Aggressiveness and Order Book Dynamics (2004). University of Copenhagen. Institute of Economics. Finance Research Unit / FRU Working Papers (10) RePEc:nbb:reswpp:200405-5 How does liquidity react to stress periods in a limit order market? (2004). National Bank of Belgium / Research series (11) RePEc:nbr:nberwo:10823 Pseudo Market Timing and Predictive Regressions (2004). National Bureau of Economic Research, Inc / NBER Working Papers (12) RePEc:pen:papers:04-010 The Nobel Memorial Prize for Robert F. Engle (2004). Penn Institute for Economic Research, Department of Economics, University of Pennsylvania / PIER Working Paper Archive (13) RePEc:uts:rpaper:121 A Continuous-Time Measurement of the Buy-Sell Pressure in a Limit Order Book Market (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (14) RePEc:wpa:wuwpfi:0408009 A local non-parametric model for trade sign inference (2004). EconWPA / Finance (15) RePEc:wpa:wuwpfi:0412012 A piecewise linear model for trade sign inference (2004). EconWPA / Finance Recent citations received in: 2003 (1) RePEc:rut:rutres:200307 Analyst Recommendations and Nasdaq Market Making Activity (2003). Rutgers University, Department of Economics / Departmental Working Papers (2) RePEc:xrs:sfbmaa:03-14 Behavioral Finance (2003). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||