|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

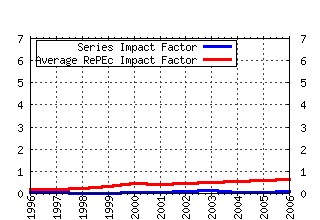

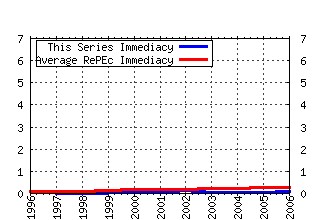

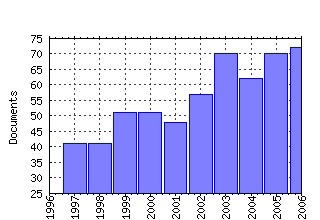

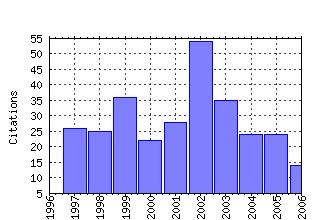

Insurance: Mathematics and Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:insuma:v:33:y:2003:i:1:p:29-47 Pensionmetrics 2: stochastic pension plan design during the distribution phase (2003). (2) RePEc:eee:insuma:v:31:y:2002:i:2:p:249-265 Optimal portfolio and background risk: an exact and an approximated solution (2002). (3) RePEc:eee:insuma:v:31:y:2002:i:1:p:3-33 The concept of comonotonicity in actuarial science and finance: theory (2002). (4) RePEc:eee:insuma:v:21:y:1997:i:2:p:173-183 Axiomatic characterization of insurance prices (1997). (5) RePEc:eee:insuma:v:31:y:2002:i:1:p:35-69 Optimal investment strategies and risk measures in defined contribution pension schemes (2002). (6) RePEc:eee:insuma:v:31:y:2002:i:2:p:267-284 Insurance premia consistent with the market (2002). (7) RePEc:eee:insuma:v:17:y:1995:i:1:p:43-54 Insurance pricing and increased limits ratemaking by proportional hazards transforms (1995). (8) RePEc:eee:insuma:v:30:y:2002:i:2:p:199-209 Optimal asset allocation in life annuities: a note (2002). (9) RePEc:eee:insuma:v:21:y:1997:i:2:p:113-127 Reserving for maturity guarantees: Two approaches (1997). (10) RePEc:eee:insuma:v:31:y:2002:i:2:p:133-161 The concept of comonotonicity in actuarial science and finance: applications (2002). (11) RePEc:eee:insuma:v:22:y:1998:i:2:p:145-161 Ordering risks: Expected utility theory versus Yaaris dual theory of risk (1998). (12) RePEc:eee:insuma:v:25:y:1999:i:1:p:11-21 The safest dependence structure among risks (1999). (13) RePEc:eee:insuma:v:25:y:1999:i:3:p:337-347 A synthesis of risk measures for capital adequacy (1999). (14) RePEc:eee:insuma:v:24:y:1999:i:1-2:p:139-148 Fitting bivariate loss distributions with copulas (1999). (15) RePEc:eee:insuma:v:31:y:2002:i:3:p:373-393 A Poisson log-bilinear regression approach to the construction of projected lifetables (2002). (16) RePEc:eee:insuma:v:16:y:1995:i:3:p:225-253 Equity-linked life insurance: A model with stochastic interest rates (1995). (17) RePEc:eee:insuma:v:22:y:1998:i:3:p:235-242 Comonotonicity, correlation order and premium principles (1998). (18) RePEc:eee:insuma:v:28:y:2001:i:3:p:305-308 Does positive dependence between individual risks increase stop-loss premiums? (2001). (19) RePEc:eee:insuma:v:27:y:2000:i:2:p:151-168 Upper and lower bounds for sums of random variables (2000). (20) RePEc:eee:insuma:v:11:y:1992:i:4:p:249-257 A Hilbert space proof of the fundamental theorem of asset pricing in finite discrete time (1992). (21) RePEc:eee:insuma:v:33:y:2003:i:2:p:255-272 Lee-Carter mortality forecasting with age-specific enhancement (2003). (22) RePEc:eee:insuma:v:35:y:2004:i:1:p:113-136 Stochastic mortality in life insurance: market reserves and mortality-linked insurance contracts (2004). (23) RePEc:eee:insuma:v:29:y:2001:i:1:p:35-45 Minimization of risks in pension funding by means of contributions and portfolio selection (2001). (24) RePEc:eee:insuma:v:11:y:1992:i:2:p:113-127 Stochastic discounting (1992). (25) RePEc:eee:insuma:v:29:y:2001:i:2:p:187-215 Pensionmetrics: stochastic pension plan design and value-at-risk during the accumulation phase (2001). (26) RePEc:eee:insuma:v:37:y:2005:i:1:p:101-114 Bivariate option pricing using dynamic copula models (2005). (27) RePEc:eee:insuma:v:23:y:1998:i:3:p:263-286 Pension schemes as options on pension fund assets: implications for pension fund management (1998). (28) RePEc:eee:insuma:v:26:y:2000:i:2-3:p:175-183 An easy computable upper bound for the price of an arithmetic Asian option (2000). (29) RePEc:eee:insuma:v:35:y:2004:i:2:p:321-342 Optimal investment choices post-retirement in a defined contribution pension scheme (2004). (30) RePEc:eee:insuma:v:35:y:2004:i:2:p:187-203 Another look at the Picard-Lefevre formula for finite-time ruin probabilities (2004). (31) RePEc:eee:insuma:v:38:y:2006:i:3:p:427-440 Mortality-dependent financial risk measures (2006). (32) RePEc:eee:insuma:v:16:y:1995:i:1:p:7-22 Ruin estimates under interest force (1995). (33) RePEc:eee:insuma:v:11:y:1992:i:4:p:259-269 Estimation of the yield curve and the forward rate curve starting from a finite number of observations (1992). (34) RePEc:eee:insuma:v:29:y:2001:i:3:p:375-386 An improved finite-time ruin probability formula and its Mathematica implementation (2001). (35) RePEc:eee:insuma:v:19:y:1996:i:1:p:19-30 Valuation of the early-exercise price for options using simulations and nonparametric regression (1996). (36) RePEc:eee:insuma:v:24:y:1999:i:1-2:p:67-81 Modelling different types of automobile insurance fraud behaviour in the Spanish market (1999). (37) RePEc:eee:insuma:v:22:y:1998:i:3:p:209-228 Stochastic cooperative games in insurance (1998). (38) RePEc:eee:insuma:v:26:y:2000:i:1:p:37-57 Fair valuation of life insurance liabilities: The impact of interest rate guarantees, surrender options, and bonus policies (2000). (39) RePEc:eee:insuma:v:28:y:2001:i:2:p:233-262 Optimal investment strategy for defined contribution pension schemes (2001). (40) RePEc:eee:insuma:v:37:y:2005:i:1:p:13-26 Some notions of multivariate positive dependence (2005). (41) RePEc:eee:insuma:v:28:y:2001:i:1:p:83-90 On the form and risk-sensitivity of zero coupon bonds for a class of interest rate models (2001). (42) RePEc:eee:insuma:v:30:y:2002:i:3:p:405-420 Copula convergence theorems for tail events (2002). (43) RePEc:eee:insuma:v:12:y:1993:i:2:p:133-142 Ruin probabilities in the compound binomial model (1993). (44) RePEc:eee:insuma:v:26:y:2000:i:2-3:p:239-250 Discounted probabilities and ruin theory in the compound binomial model (2000). (45) RePEc:eee:insuma:v:33:y:2003:i:3:p:595-609 Fair valuation of path-dependent participating life insurance contracts (2003). (46) RePEc:eee:insuma:v:3:y:1984:i:2:p:101-110 Insurance and saving: some further results (1984). (47) RePEc:eee:insuma:v:4:y:1985:i:3:p:179-189 On convex principles of premium calculation (1985). (48) RePEc:eee:insuma:v:24:y:1999:i:3:p:229-247 A longitudinal data analysis interpretation of credibility models (1999). (49) RePEc:eee:insuma:v:27:y:2000:i:2:p:237-259 Contribution and solvency risk in a defined benefit pension scheme (2000). (50) RePEc:eee:insuma:v:25:y:1999:i:2:p:197-217 A new stochastically flexible event methodology with application to Proposition 103 (1999). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:bca:bocawp:06-43 Efficient Hedging and Pricing of Equity-Linked Life Insurance Contracts on Several Risky Assets (2006). Bank of Canada / Working Papers (2) RePEc:cte:wsrepe:ws063815 MULTIVARIATE RISKS AND DEPTH-TRIMMED REGIONS (2006). Universidad Carlos III, Departamento de Estadística y Econometría / Statistics and Econometrics Working Papers (3) RePEc:dgr:uvatin:20060062 Insurance Sector Risk (2006). Tinbergen Institute / Tinbergen Institute Discussion Papers (4) RePEc:hhb:aarbfi:2006-09 Lognormal Approximation of Complex Path-dependent Pension Scheme Payoffs (2006). Aarhus School of Business, Department of Business Studies / Finance Research Group Working Papers (5) RePEc:lmu:msmdpa:1220 The Impact of Surplus Distribution on the Risk Exposure of With Profit Life Insurance Policies Including Interest Rate Guarantees (2006). University of Munich, Munich School of Management / Discussion Papers in Business Administration (6) RePEc:nbr:nberwo:11984 Life is Cheap: Using Mortality Bonds to Hedge Aggregate Mortality Risk (2006). National Bureau of Economic Research, Inc / NBER Working Papers Recent citations received in: 2005 (1) RePEc:bon:bonedp:bgse19_2005 Loss Analysis of a Life Insurance Company Applying Discrete-time Risk-minimizing Hedging Strategies (2005). University of Bonn, Germany / Bonn Econ Discussion Papers (2) RePEc:dnb:dnbwpp:063 Defined Benefit Pension Plans and Regulation (2005). Netherlands Central Bank, Research Department / DNB Working Papers (3) RePEc:ins:quaeco:qf05010 Multivariate hazard orderings of discrete random vectors (2005). Department of Economics, University of Insubria / Economics and Quantitative Methods Recent citations received in: 2004 Recent citations received in: 2003 (1) RePEc:mrr:papers:wp063 Betting on Death and Capital Markets in Retirement: A Shortfall Risk Analysis of Life Annuities versus Phased Withdrawal Plans (2003). University of Michigan, Michigan Retirement Research Center / Working Papers (2) RePEc:xrs:sfbmaa:03-02 Risk Based Capital Allocation (2003). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||