|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

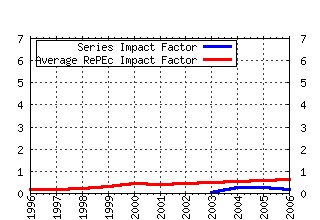

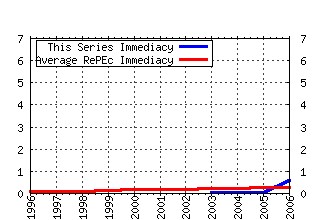

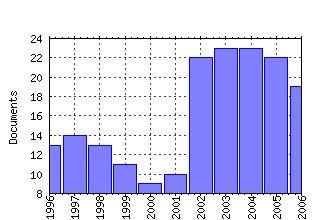

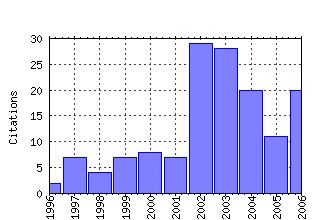

Review of Financial Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:revfin:v:11:y:2002:i:2:p:119-130 Long-term nominal interest rates and domestic fundamentals (2002). (2) RePEc:eee:revfin:v:15:y:2006:i:4:p:289-304 The impact of macroeconomic uncertainty on non-financial firms demand for liquidity (2006). (3) RePEc:eee:revfin:v:11:y:2002:i:2:p:91-108 Interrelationships among regional stock indices (2002). (4) RePEc:eee:revfin:v:11:y:2002:i:2:p:131-150 Financial development and economic growth: Another look at the evidence from developing countries (2002). (5) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:41-63 Portuguese banking: A structural model of competition in the deposits market (2004). (6) RePEc:eee:revfin:v:12:y:2003:i:4:p:363-380 The day of the week effect on stock market volatility and volume: International evidence (2003). (7) RePEc:eee:revfin:v:9:y:2000:i:2:p:121-128 Microeconomic foundations of an optimal currency area (2000). (8) RePEc:eee:revfin:v:15:y:2006:i:3:p:193-221 Financial deregulation and efficiency: An empirical analysis of Indian banks during the post reform period (2006). (9) RePEc:eee:revfin:v:12:y:2003:i:2:p:191-205 The macroeconomic determinants of technology stock price volatility (2003). (10) RePEc:eee:revfin:v:15:y:2006:i:4:p:331-349 Variations in effects of monetary policy on stock market returns in the past four decades (2006). (11) RePEc:eee:revfin:v:10:y:2001:i:3:p:191-212 Twenty-five years of corporate governance research ... and counting (2001). (12) RePEc:eee:revfin:v:6:y:1997:i:1:p:95-112 Foreign trade and exchange-rate risk in the G-7 countries: Cointegration and error-correction models (1997). (13) RePEc:eee:revfin:v:12:y:2003:i:2:p:207-231 Macroeconomic influences on optimal asset allocation (2003). (14) RePEc:eee:revfin:v:14:y:2005:i:1:p:81-91 Non-linear dynamics in international stock market returns (2005). (15) RePEc:eee:revfin:v:15:y:2006:i:1:p:28-48 Fractional integration in daily stock market indexes (2006). (16) RePEc:eee:revfin:v:8:y:1999:i:1:p:25-39 An analysis of nontraditional activities at U.S. commercial banks (1999). (17) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:323-351 The option value of patent litigation: Theory and evidence (2005). (18) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:7-39 Consolidation in US banking: Which banks engage in mergers? (2004). (19) RePEc:eee:revfin:v:8:y:1999:i:1:p:41-60 An empirical analysis of the equity markets in China (1999). (20) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:371-393 Flexibility and technology choice in gas fired power plant investments (2005). (21) RePEc:eee:revfin:v:7:y:1998:i:2:p:143-155 The effect of ownership structure on firm performance: Additional evidence (1998). (22) RePEc:eee:revfin:v:12:y:2003:i:2:p:131-159 Is presidential cycle in security returns merely a reflection of business conditions? (2003). (23) RePEc:eee:revfin:v:13:y:2004:i:3:p:269-281 Relative risk aversion among the elderly (2004). (24) RePEc:eee:revfin:v:11:y:2002:i:1:p:19-36 A model of brokers trading, with applications to order flow internalization (2002). (25) RePEc:eee:revfin:v:12:y:2003:i:4:p:327-344 Explaining credit rating differences between Japanese and U.S. agencies (2003). (26) RePEc:eee:revfin:v:12:y:2003:i:1:p:7-33 The failure of new entrants in commercial banking markets: a split-population duration analysis (2003). (27) RePEc:eee:revfin:v:12:y:2003:i:3:p:301-313 Dollar exchange rate and stock price: evidence from multivariate cointegration and error correction model (2003). (28) RePEc:eee:revfin:v:11:y:2002:i:4:p:299-315 Long-term trends and cycles in ASEAN stock markets (2002). (29) RePEc:eee:revfin:v:12:y:2003:i:2:p:161-172 Corporate governance and market valuation of capital and R&D investments (2003). (30) RePEc:eee:revfin:v:7:y:1998:i:1:p:1-19 Founding family controlled firms: Efficiency and value (1998). (31) RePEc:eee:revfin:v:12:y:2003:i:1:p:99-126 The Basel Committee proposals for a new capital accord: implications for Italian banks (2003). (32) RePEc:eee:revfin:v:13:y:2004:i:3:p:245-258 Fractional cointegration and tests of present value models (2004). (33) RePEc:eee:revfin:v:9:y:2000:i:2:p:101-120 Market perception of efficiency in bank holding company mergers: the roles of the DEA and SFA models in capturing merger potential (2000). (34) RePEc:eee:revfin:v:10:y:2001:i:3:p:251-277 CEO compensation, option incentives, and information disclosure (2001). (35) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:297-310 Real options and the value of generation capacity in the German electricity market (2005). (36) RePEc:eee:revfin:v:12:y:2003:i:3:p:247-270 Return predictability in African stock markets (2003). (37) RePEc:eee:revfin:v:13:y:2004:i:4:p:327-340 Fractional cointegration and real exchange rates (2004). (38) RePEc:eee:revfin:v:5:y:1996:i:2:p:181-190 Mergers and macro-economic factors (1996). (39) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:121-148 Postmortem on the Federal Reserves Functional Cost Analysis Program: how useful was the FCA? (2004). (40) RePEc:eee:revfin:v:16:y:2007:i:3:p:305-320 A portfolio balance approach to the Canadian-U.S. exchange rate (2007). (41) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:311-322 How to analyze the investment-uncertainty relationship in real option models? (2005). (42) RePEc:eee:revfin:v:4:y:1995:i:2:p:197-210 Financial variables contributing to savings and loan failures from 1980-1989 (1995). (43) RePEc:eee:revfin:v:6:y:1997:i:2:p:225-232 Prospect theory as an explanation of risky choice by professional investors: Some evidence (1997). (44) RePEc:eee:revfin:v:13:y:2004:i:1-2:p:79-102 The impact of banks expanded securities powers on small-business lending (2004). (45) RePEc:eee:revfin:v:9:y:2000:i:1:p:43-53 A stochastic model of superstardom: evidence from institutional investors All-American Research Team (2000). (46) RePEc:eee:revfin:v:14:y:2005:i:3-4:p:255-279 Real options, irreversible investment and firm uncertainty: New evidence from U.S. firms (2005). (47) RePEc:eee:revfin:v:4:y:1995:i:2:p:141-155 Inter-industry differences and the impact of operating and financial leverages on equity risk (1995). (48) RePEc:eee:revfin:v:8:y:1999:i:2:p:149-163 Jump risk in the U.S. stock market: Evidence using political information (1999). (49) RePEc:eee:revfin:v:10:y:2001:i:1:p:57-70 Mother Jones: Do better places to work imply better places to invest? (2001). (50) RePEc:eee:revfin:v:4:y:1994:i:1:p:79-91 Professional portfolio managers and the January effect: theory and evidence (1994). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:boc:bocoec:634 Uncertainty Determinants of Corporate Liquidity (2006). Boston College Department of Economics / Boston College Working Papers in Economics (2) RePEc:boc:bocoec:637 The Effects of Industry-Level Uncertainty on Cash Holdings: The Case of Germany (2006). Boston College Department of Economics / Boston College Working Papers in Economics (3) RePEc:diw:diwwpp:dp637 Macroeconomic Uncertainty and Bank Lending : The Case of Ukraine (2006). DIW Berlin, German Institute for Economic Research / Discussion Papers of DIW Berlin (4) RePEc:diw:diwwpp:dp638 The Effects of Industry-Level Uncertainty on Cash Holdings : The Case of Germany (2006). DIW Berlin, German Institute for Economic Research / Discussion Papers of DIW Berlin (5) RePEc:fem:femwpa:2006.22 On the Robustness of Robustness Checks of the Environmental Kuznets Curve (2006). Fondazione Eni Enrico Mattei / Working Papers (6) RePEc:gla:glaewp:2006_8 Reexamining the linkages between inflation and output growth: A bivariate ARFIMA-FIGARCH approach (2006). Department of Economics, University of Glasgow / Working Papers (7) RePEc:lbo:lbowps:2006_18 Non-Parametric Analysis of Efficiency Gains from Bank Mergers in India (2006). Economics Dept, Loughborough University / Discussion Paper Series (8) RePEc:mis:wpaper:20060501 On the Robustness of Robustness Checks of the Environmental Kuznets Curve (2006). Università degli Studi di Milano-Bicocca, Dipartimento di Statistica / Working Papers (9) RePEc:pra:mprapa:252 Long memory and non-linearity in Stock Markets (2006). University Library of Munich, Germany / MPRA Paper (10) RePEc:tcb:wpaper:0606 The Determinants and Implications of Financial Asset Holdings of Non-Financial Firms in Turkey : An Emprical Investigation (2006). Research and Monetary Policy Department, Central Bank of the Republic of Turkey / Working Papers (11) RePEc:tcb:wpaper:0607 Corporate Sector Financial Structure in Turkey : A Descriptive Analysis (2006). Research and Monetary Policy Department, Central Bank of the Republic of Turkey / Working Papers Recent citations received in: 2005 (1) RePEc:car:carecp:05-07 Overnight Monetary Policy in the United States: Active or Interest-Rate Smoothing? (2005). Carleton University, Department of Economics / Carleton Economic Papers Recent citations received in: 2004 (1) RePEc:mmf:mmfc04:26 Competition and Concentration (2004). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2004 Recent citations received in: 2003 (1) RePEc:qut:dpaper:159 Weak-form market efficiency in European emerging and developed stock markets (2003). School of Economics and Finance, Queensland University of Technology / School of Economics and Finance Discussion Papers and Working Papers Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||