|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

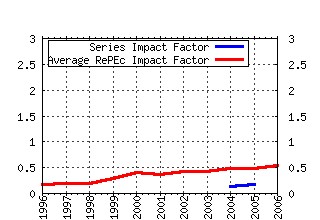

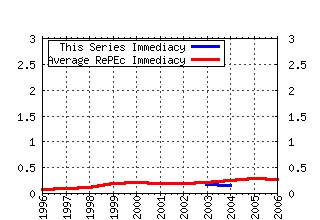

Finance Lab, Ibmec São Paulo / Finance Lab Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

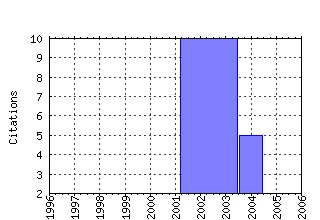

Most cited documents in this series: (1) RePEc:ibm:finlab:flwp_68 Endogenous Collateral (2004). (2) RePEc:ibm:finlab:flwp_57 Generalized Hyperbolic Distributions and Brazilian Data (2003). (3) RePEc:ibm:finlab:flwp_14 Alternative Models to extract asset volatility: a comparative study (1999). (4) RePEc:ibm:finlab:flwp_54 Put-Call Duality and Symmetry (2003). (5) RePEc:ibm:finlab:flwp_55 Goodness-of-fit Tests focus on VaR Estimation (2003). (6) RePEc:ibm:finlab:flwp_51 Markov Switching Based Nonlinear Tests for Market Efficiency Using the R$/US$ Exchange Rate (2003). (7) RePEc:ibm:finlab:flwp_49 Evaluating an Alternative Risk Preference in Affine Term Structure Models (2003). (8) RePEc:ibm:finlab:flwp_50 Long Memory int the R$/US$ Exchange Rate: A Robust Analysis (2003). (9) RePEc:ibm:finlab:flwp_48 Small Sample Properties of GARCH Estimates and Persistence (2003). (10) RePEc:ibm:finlab:flwp_58 Analyzing the Use of Generalized Hyperbolic Distributions to Value at Risk Calculations (2003). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 (1) RePEc:ecm:latm04:161 Endogenous Collateral (2004). Econometric Society / Econometric Society 2004 Latin American Meetings (2) RePEc:rio:texdis:490 General equilibrium existence with asset-backed securitization (2004). Department of Economics PUC-Rio (Brazil) / Textos para discussão Recent citations received in: 2003 (1) RePEc:ibm:finlab:flwp_53 Volatility Estimation and Option Pricing with Fractional Brownian Motion (2003). Finance Lab, Ibmec São Paulo / Finance Lab Working Papers (2) RePEc:ibm:finlab:flwp_58 Analyzing the Use of Generalized Hyperbolic Distributions to Value at Risk Calculations (2003). Finance Lab, Ibmec São Paulo / Finance Lab Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||