|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

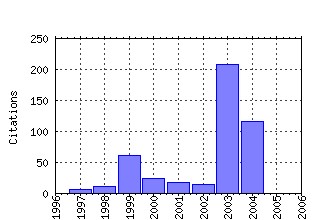

International Tax and Public Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:itaxpf:v:6:y:1999:i:4:p:459-472 (). (2) RePEc:kap:itaxpf:v:10:y:2003:i:2:p:107-26 Evaluating Tax Policy for Location Decisions. (2003). (3) RePEc:kap:itaxpf:v:10:y:2003:i:6:p:673-93 Taxation and Foreign Direct Investment: A Synthesis of Empirical Research. (2003). (4) RePEc:kap:itaxpf:v:6:y:1999:i:3:p:389-410

The Impact of Firing Costs on Turnover and Unemployment: Evidence from the Colombian Labour Market Reform. (1999). (5) RePEc:kap:itaxpf:v:6:y:1999:i:3:p:421-443 (). (6) RePEc:kap:itaxpf:v:6:y:1999:i:4:p:621-639 (). (7) RePEc:kap:itaxpf:v:10:y:2003:i:4:p:469-87 Taxing Multinationals. (2003). (8) RePEc:kap:itaxpf:v:9:y:2002:i:6:p:631-649 (). (9) RePEc:kap:itaxpf:v:6:y:1999:i:4:p:537-577 (). (10) RePEc:kap:itaxpf:v:10:y:2003:i:3:p:259-80 Is Targeted Tax Competition Less Harmful Than Its Remedies? (2003). (11) RePEc:kap:itaxpf:v:7:y:2000:i:2:p:141-162 (). (12) RePEc:kap:itaxpf:v:10:y:2003:i:4:p:419-34 The Double Dividend of Postponing Retirement. (2003). (13) RePEc:kap:itaxpf:v:10:y:2003:i:4:p:489-503 On Forest Rotation under Interest Rate Variability. (2003). (14) RePEc:kap:itaxpf:v:8:y:2001:i:2:p:119-128 (). (15) RePEc:kap:itaxpf:v:11:y:2004:i:5:p:601-622 The Effects of Bilateral Tax Treaties on U.S. FDI Activity (2004). (16) RePEc:kap:itaxpf:v:6:y:1999:i:3:p:339-360 (). (17) RePEc:kap:itaxpf:v:9:y:2002:i:4:p:409-421 (). (18) RePEc:kap:itaxpf:v:5:y:1998:i:3:p:429-442 (). (19) RePEc:kap:itaxpf:v:4:y:1997:i:3:p:277-290 (). (20) RePEc:kap:itaxpf:v:8:y:2001:i:2:p:191-210

Reforming Business Taxation: Lessons from Italy? (2001). (21) RePEc:kap:itaxpf:v:11:y:2004:i:6:p:775-802 Tax Treaties and Foreign Direct Investment: Potential versus Performance (2004). (22) RePEc:kap:itaxpf:v:11:y:2004:i:4:p:469-485 Economic Effects of Taxing Different Organizational Forms under the Nordic Dual Income Tax (2004). (23) RePEc:kap:itaxpf:v:13:y:2006:i:5:p:565-585 (). (24) RePEc:kap:itaxpf:v:11:y:2004:i:5:p:623-645 Agglomeration Effects and the Competition for Firms (2004). (25) RePEc:kap:itaxpf:v:7:y:2000:i:6:p:699-719

Education, Mobility of Labour and Tax Competition. (2000). (26) RePEc:kap:itaxpf:v:6:y:1999:i:3:p:263-287 (). (27) RePEc:kap:itaxpf:v:7:y:2000:i:4:p:547-562 (). (28) RePEc:kap:itaxpf:v:8:y:2001:i:5:p:753-774 (). (29) RePEc:kap:itaxpf:v:6:y:1999:i:1:p:7-26

Tax Coordination and Unemployment. (1999). (30) RePEc:kap:itaxpf:v:4:y:1997:i:4:p:407-427 (). (31) RePEc:kap:itaxpf:v:12:y:2005:i:5:p:667-687 (). (32) RePEc:kap:itaxpf:v:4:y:1997:i:4:p:485-497 (). (33) RePEc:kap:itaxpf:v:6:y:1999:i:4:p:507-535 (). (34) RePEc:kap:itaxpf:v:10:y:2003:i:6:p:651-71 Tax Competition and Tax Coordination in the European Union. (2003). (35) RePEc:kap:itaxpf:v:6:y:1999:i:3:p:239-262 (). (36) RePEc:kap:itaxpf:v:14:y:2007:i:2:p:151-164 (). (37) RePEc:kap:itaxpf:v:4:y:1997:i:2:p:107-127 (). (38) RePEc:kap:itaxpf:v:10:y:2003:i:2:p:189-203 Behavioral Public Finance: Tax Design As Price Presentation. (2003). (39) RePEc:kap:itaxpf:v:7:y:2000:i:1:p:83-91

Rules and Levels in the Provision of Public Goods: The Role of Complementarities between the Public Good and Taxed Commodities. (2000). (40) RePEc:kap:itaxpf:v:9:y:2002:i:4:p:331-348 (). (41) RePEc:kap:itaxpf:v:4:y:1997:i:2:p:167-176 (). (42) RePEc:kap:itaxpf:v:5:y:1998:i:3:p:329-343 (). (43) RePEc:kap:itaxpf:v:7:y:2000:i:6:p:753-761 (). (44) RePEc:kap:itaxpf:v:12:y:2005:i:1:p:29-45 (). (45) RePEc:kap:itaxpf:v:5:y:1998:i:3:p:283-306

Price Subsidies versus Public Provision. (1998). (46) RePEc:kap:itaxpf:v:10:y:2003:i:6:p:713-34 Financing Retirement in the European Union. (2003). (47) RePEc:kap:itaxpf:v:6:y:1999:i:1:p:39-59

Taxation, Migration, and Pollution. (1999). (48) RePEc:kap:itaxpf:v:10:y:2003:i:5:p:549-64 Mobility and the Role of Education as a Commitment Device. (2003). (49) RePEc:kap:itaxpf:v:5:y:1998:i:3:p:307-327 (). (50) RePEc:kap:itaxpf:v:4:y:1997:i:1:p:25-37 (). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 (1) RePEc:ays:ispwps:paper0419 Intergovernmental Transfers: The Vertical Sharing Dimension (2004). International Studies program, Andrew young School of policy Studies, Georgia State University / International Studies Program Working P (2) RePEc:ces:ceswps:_1277 Capital Tax Competition with Heterogeneous Firms and Agglomeration Effects (2004). CESifo GmbH / CESifo Working Paper Series (3) RePEc:ces:ceswps:_1311 Efficiency Effects of Tax Deductions for Work-Related Expenses (2004). CESifo GmbH / CESifo Working Paper Series (4) RePEc:ces:ceswps:_1355 Taxes and the Financial Structure of German Inward FDI (2004). CESifo GmbH / CESifo Working Paper Series (5) RePEc:chm:wpaper:wp2004-10 Decentralisation and corruption (2004). CMI (Chr. Michelsen Institute), Bergen, Norway / CMI Working Papers (6) RePEc:cpb:memodm:100 Towards efficient unemployment insurance in the Netherlands (2004). CPB Netherlands Bureau for Economic Policy Analysis / CPB Memoranda (7) RePEc:kap:apfinm:v:11:y:2004:i:1:p:71-89 Debating Proposed Reforms of the Taxation of Corporate Income in the European Union (2004). Asia-Pacific Financial Markets (8) RePEc:kap:apfinm:v:11:y:2004:i:2:p:199-220 The European Commissions Report on Company Income Taxation: What the EU Can Learn from the Experience of the US States (2004). Asia-Pacific Financial Markets (9) RePEc:kap:apfinm:v:11:y:2004:i:6:p:775-802 Tax Treaties and Foreign Direct Investment: Potential versus Performance (2004). Asia-Pacific Financial Markets (10) RePEc:nbr:nberwo:10939 FDI in Space: Spatial Autoregressive Relationships in Foreign Direct Investment (2004). National Bureau of Economic Research, Inc / NBER Working Papers (11) RePEc:wiw:wiwrsa:ersa04p104 Interregional differences in taxes and population mobility (2004). European Regional Science Association / ERSA conference papers (12) RePEc:zbw:zewdip:2361 Public Sector Decentralization : Measurement Concepts and Recent International Trends (2004). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Recent citations received in: 2003 (1) RePEc:ces:ceswps:_1040 Investment Size and Firms Value under Profit Sharing Regulation (2003). CESifo GmbH / CESifo Working Paper Series (2) RePEc:ces:ceswps:_1090 Transport Subsidies, System Choice, and Urban Sprawl (2003). CESifo GmbH / CESifo Working Paper Series (3) RePEc:ces:ceswps:_934 Irreversible Investments and Regulatory Risk (2003). CESifo GmbH / CESifo Working Paper Series (4) RePEc:ces:ceswps:_962 Measuring Taxes on Income from Capital (2003). CESifo GmbH / CESifo Working Paper Series (5) RePEc:ces:ceswps:_968 Measuring Taxes on Income from Capital: Evidence from the UK (2003). CESifo GmbH / CESifo Working Paper Series (6) RePEc:eap:articl:v:33:y:2003:i:2:p:275-292 The Impact of Corporate Taxation on the Location of Capital: A Review (2003). Economic Analysis and Policy (EAP) (7) RePEc:ebl:ecbull:v:8:y:2003:i:15:p:1-7 A dynamic measure of the effective tax rate (2003). Economics Bulletin (8) RePEc:fem:femwpa:2003.80 Investment Size and Firms Value Under Profit Sharing Regulation (2003). Fondazione Eni Enrico Mattei / Working Papers (9) RePEc:ifs:ifsewp:03/03 Measuring taxes on income from capital: evidence from the UK (2003). Institute for Fiscal Studies / IFS Working Papers (10) RePEc:ifs:ifsewp:03/04 Measuring taxes on income from capital (2003). Institute for Fiscal Studies / IFS Working Papers (11) RePEc:iza:izadps:dp962 Norm-Based Trade Union Membership: Evidence for Germany (2003). Institute for the Study of Labor (IZA) / IZA Discussion Papers (12) RePEc:kap:apfinm:v:10:y:2003:i:4:p:469-487 Taxing Multinationals (2003). Asia-Pacific Financial Markets (13) RePEc:kap:apfinm:v:10:y:2003:i:6:p:625-649 How Much Tax Coordination in the European Union? (2003). Asia-Pacific Financial Markets (14) RePEc:kap:ejlwec:v:16:y:2003:i:3:p:303-326 An Analysis of Institutional Change in the European Union (2003). European Journal of Law and Economics (15) RePEc:rif:dpaper:843 The Impact of Regionalism on Trade in Europe (2003). The Research Institute of the Finnish Economy / Discussion Papers (16) RePEc:rif:dpaper:845 Knowledge-intensive Services and Competitiveness of the Forest Cluster (2003). The Research Institute of the Finnish Economy / Discussion Papers (17) RePEc:rif:dpaper:847 Entry and Exit in the ICT Sector - New Markets, New Industrial Dynamics? (2003). The Research Institute of the Finnish Economy / Discussion Papers (18) RePEc:rif:dpaper:849 Reconfiguring Knowledge Management. Combining Intellectual Capital, Intangible Assets and Knowledge Creation (2003). The Research Institute of the Finnish Economy / Discussion Papers (19) RePEc:rif:dpaper:851 Quality Competition and Social Welfare in Markets with Partial Coverage: New Results (2003). The Research Institute of the Finnish Economy / Discussion Papers (20) RePEc:rif:dpaper:853 Does Public Funding Have a Halo Effect? (2003). The Research Institute of the Finnish Economy / Discussion Papers (21) RePEc:rif:dpaper:857 Government Size and Output Volatility: New International Evidence (2003). The Research Institute of the Finnish Economy / Discussion Papers (22) RePEc:rif:dpaper:860 Technology, Labor Characteristic and Wage-productivity Gaps (2003). The Research Institute of the Finnish Economy / Discussion Papers (23) RePEc:rif:dpaper:861 Worker Inflow, Outflow, and Churning (2003). The Research Institute of the Finnish Economy / Discussion Papers (24) RePEc:rif:dpaper:863 Profit Sharing and Unemployment: An Approach with Bargaining and Efficiency Wage Economics (2003). The Research Institute of the Finnish Economy / Discussion Papers (25) RePEc:rif:dpaper:864 The Capital Structure of Finnish Biotechnology SMEs - An empirical analysisi (2003). The Research Institute of the Finnish Economy / Discussion Papers (26) RePEc:rif:dpaper:865 Convergence of Real GDP per Capita in the EU15 area: How do the Accession Countries Fit in ? (2003). The Research Institute of the Finnish Economy / Discussion Papers (27) RePEc:rif:dpaper:869 An Assessment of Russia´s Growth Prospects in 2003 - 2010 (2003). The Research Institute of the Finnish Economy / Discussion Papers (28) RePEc:wpa:wuwppe:0302008 Educating Europe (2003). EconWPA / Public Economics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||