|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

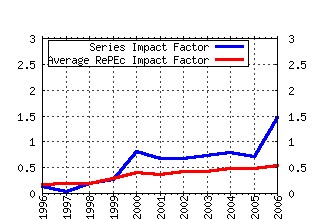

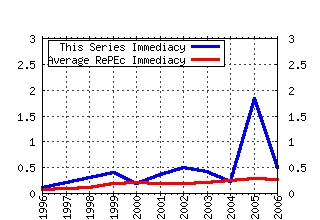

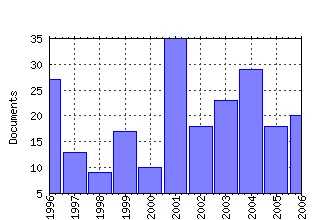

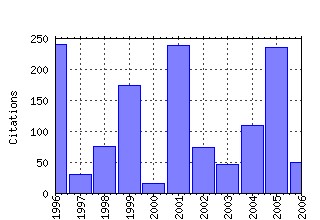

Economics Group, Nuffield College, University of Oxford / Economics Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:nuf:econwp:104 Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. (1995). (2) RePEc:nuf:econwp:0517 Stochastic Volatility (2005). (3) RePEc:nuf:econwp:1999-w12 Auction Theory: a Guide to the Literature. (1999). (4) RePEc:nuf:econwp:0121 GMM Estimation of Empirical Growth Models (2001). (5) RePEc:nuf:econwp:9614 Initial conditions and moment restrictions in dynamic panel data

model (1996). (6) RePEc:nuf:econwp:9604 An omnibus test for univariate and multivariate normalit (1996). (7) RePEc:nuf:econwp:126 Unique Equilibrium in a Model of Self-Fulfilling Currency Attacks. (1996). (8) RePEc:nuf:econwp:0104 Econometric analysis of realised volatility and its use in estimating stochastic volatility models (2001). (9) RePEc:nuf:econwp:049 Auctions: Theory and Practice (2004). (10) RePEc:nuf:econwp:143 Firm-Level Investment in France and the United States: An Exploration of What We Have Learned in Twenty Years (1998). (11) RePEc:nuf:econwp:0213 Econometric Analysis of Realised Covariation: High Frequency Covariance, Regression and Correlation in Financial Economics (2002). (12) RePEc:nuf:econwp:0116 How accurate is the asymptotic approximation to the distribution of realised volatility? (2001). (13) RePEc:nuf:econwp:9713 Filtering via simulation: auxiliary particle filters (1997). (14) RePEc:nuf:econwp:146 Likelihood INference for Discretely Observed Non-linear Diffusions (1998). (15) RePEc:nuf:econwp:0417 We Ran One Regression (2004). (16) RePEc:nuf:econwp:0102 Firm Level Investment and R&D in France and the United States: A Comparison (2001). (17) RePEc:nuf:econwp:1999-w3 Innovation and Market Value. (1999). (18) RePEc:nuf:econwp:0603 Designing realised kernels to measure the ex-post variation of equity prices

in the presence of noise (2006). (19) RePEc:nuf:econwp:048 Capital Accumulation and Growth: A New Look at the Empirical Evidence (2004). (20) RePEc:nuf:econwp:0526 Management of a Capital Stock by Strotzs Naive Planner (2006). (21) RePEc:nuf:econwp:0428 Regular and Modified Kernel-Based Estimators of Integrated Variance:

The Case with Independent Noise (2004). (22) RePEc:nuf:econwp:1999-w20 Income Inequality and Macroeconomic Volatility: an Empirical Investigation. (1999). (23) RePEc:nuf:econwp:1999-w11 The Tobacco Deal. (1999). (24) RePEc:nuf:econwp:0504 Adjustment Costs and the Identification of Cobb Douglas Production Functions (2005). (25) RePEc:nuf:econwp:0224 Power Variation and Time Change (2002). (26) RePEc:nuf:econwp:125 Booms and Busts in the UK Housing Market. (1996). (27) RePEc:nuf:econwp:0216 Unemployment, Labour Market Institutions and Shocks (2002). (28) RePEc:nuf:econwp:0509 Limited Asset Markets Participation, Monetary Policy and (Inverted) Keynesian Logic (2005). (29) RePEc:nuf:econwp:0113 Inferring Repeated Game Strategies From Actions: Evidence From Trust Game Experiments (2001). (30) RePEc:nuf:econwp:0316 Wage and Price Phillips Curves

An empirical analysis of destabilizing wage-price spirals (2003). (31) RePEc:nuf:econwp:0011 Bartlett correction of the unit root test in autoregressive models (1995). (32) RePEc:nuf:econwp:141 Aggregation and Model Construction for Volatility Models (1998). (33) RePEc:nuf:econwp:0005 An evaluation of forecasting using leading indicators (1994). (34) RePEc:nuf:econwp:0209 Pooling of Forecasts (2001). (35) RePEc:nuf:econwp:0217 Testing the Assumptions Behind the Use of Importance Sampling (2002). (36) RePEc:nuf:econwp:0008 Generalized linear autoregressions (1995). (37) RePEc:nuf:econwp:0211 Economic Forecasting: Some Lessons from Recent Research (2001). (38) RePEc:nuf:econwp:2000-w11 Does Competition Solve the Hold-Up Problem?. (2000). (39) RePEc:nuf:econwp:0320 Multimodality in the GARCH Regression Model (2003). (40) RePEc:nuf:econwp:0321 Econometrics of testing for jumps in financial economics using bipower variation (2003). (41) RePEc:nuf:econwp:0507 Limit theorems for multipower variation in the presence of jumps (2006). (42) RePEc:nuf:econwp:0505 Estimating quadratic variation when quoted prices jump by a constant increment (2005). (43) RePEc:nuf:econwp:1999-w2 Covariate Measurement Error in Quadratic Regression. (1999). (44) RePEc:nuf:econwp:0204 The Biggest Auction Ever: the Sale of the British 3G Telecom Licenses (2001). (45) RePEc:nuf:econwp:115 Pathological Outcomes of Observational Learning. (1996). (46) RePEc:nuf:econwp:0129 Institutions and Wage Determination: a Multi-Country Approach (2001). (47) RePEc:nuf:econwp:149 A Theory of the Onset of Currency Attacks. (1998). (48) RePEc:nuf:econwp:0310 Identifying, Estimating and Testing Restricted Cointegrated Systems: An Overview (2003). (49) RePEc:nuf:econwp:0318 Power and bipower variation with stochastic volatility and jumps (2003). (50) RePEc:nuf:econwp:0118 Realised power variation and stochastic volatility models (2001). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:cep:stiecm:/2006/509 Estimating Quadratic VariationConsistently in thePresence of Correlated MeasurementError (2006). Suntory and Toyota International Centres for Economics and Related Disciplines, LSE / STICERD - Econometrics Paper Series (2) RePEc:nuf:econwp:0506 Limit theorems for bipower variation in financial econometrics (2006). Economics Group, Nuffield College, University of Oxford / Economics Papers (3) RePEc:nuf:econwp:0610 Subsampling realised kernels (2006). Economics Group, Nuffield College, University of Oxford / Economics Papers (4) RePEc:nuf:econwp:0612 High Dimensional Yield Curves: Models and Forecasting (2006). Economics Group, Nuffield College, University of Oxford / Economics Papers (5) RePEc:oxf:wpaper:278 Subsampling realised kernels (2006). University of Oxford, Department of Economics / Economics Series Working Papers (6) RePEc:oxf:wpaper:290 Open Economy Codependence: U.S. Monetary Policy and Interest Rate Pass-through (2006). University of Oxford, Department of Economics / Economics Series Working Papers (7) RePEc:rut:rutres:200620 Predictive Density Estimators for Daily Volatility Based on the Use of Realized Measures (2006). Rutgers University, Department of Economics / Departmental Working Papers (8) RePEc:sbs:wpsefe:2006fe06 Subsampling realised kernels (2006). Oxford Financial Research Centre / OFRC Working Papers Series (9) RePEc:sbs:wpsefe:2006fe11 High Dimensional Yield Curves: Models and Forecasting (2006). Oxford Financial Research Centre / OFRC Working Papers Series (10) RePEc:stn:sotoec:0615 Open Economy Codependence: U.S. Monetary Policy and Interest Rate Pass-through (2006). Economics Division, School of Social Sciences, University of Southampton / Discussion Paper Series In Economics And Econometrics Recent citations received in: 2005 (1) RePEc:cpr:ceprdp:5212 Understanding the Effects of Government Spending on Consumption (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (2) RePEc:cte:wsrepe:ws053605 BAYESIAN ESTIMATION OF THE GAUSSIAN MIXTURE GARCH MODEL (2005). Universidad Carlos III, Departamento de Estadística y Econometría / Statistics and Econometrics Working Papers (3) RePEc:cwl:cwldpp:1523 A Two-Stage Realized Volatility Approach to the Estimation for Diffusion Processes from Discrete Observations (2005). Cowles Foundation, Yale University / Cowles Foundation Discussion Papers (4) RePEc:dgr:uvatin:20050002 Model-based Measurement of Actual Volatility in High-Frequency Data (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (5) RePEc:dgr:uvatin:20050060 A Non-Gaussian Panel Time Series Model for Estimating and Decomposing Default Risk (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (6) RePEc:dgr:uvatin:20050092 Outlier Detection in GARCH Models (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (7) RePEc:dgr:uvatin:20050103 The Impact of Central Bank FX Interventions on Currency Components (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (8) RePEc:dgr:uvatin:20050117 On Importance Sampling for State Space Models (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (9) RePEc:dnb:dnbwpp:055 A Non-Gaussian Panel Time Series Model for Estimating and Decomposing Default Risk (2005). Netherlands Central Bank, Research Department / DNB Working Papers (10) RePEc:fip:fedgfe:2005-63 Explaining credit default swap spreads with the equity volatility and jump risks of individual firms (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (11) RePEc:nbr:nberwo:11380 Ultra High Frequency Volatility Estimation with Dependent Microstructure Noise (2005). National Bureau of Economic Research, Inc / NBER Working Papers (12) RePEc:nbr:nberwo:11578 Understanding the Effects of Government Spending on Consumption (2005). National Bureau of Economic Research, Inc / NBER Working Papers (13) RePEc:nuf:econwp:0505 Estimating quadratic variation when quoted prices jump by a constant increment (2005). Economics Group, Nuffield College, University of Oxford / Economics Papers (14) RePEc:nuf:econwp:0516 Variation, jumps, market frictions and high frequency data in financial econometrics (2005). Economics Group, Nuffield College, University of Oxford / Economics Papers (15) RePEc:nuf:econwp:0517 Stochastic Volatility (2005). Economics Group, Nuffield College, University of Oxford / Economics Papers (16) RePEc:nuf:econwp:0524 Outlier Detection in GARCH Models (2005). Economics Group, Nuffield College, University of Oxford / Economics Papers (17) RePEc:oxf:wpaper:240 Variation, jumps, market frictions and high frequency data in financial econometrics (2005). University of Oxford, Department of Economics / Economics Series Working Papers (18) RePEc:red:issued:v:8:y:2005:i:2:p:420-451 Changing Beliefs and the Term Structure of Interest Rates: Cross-Equation Restrictions with Drifting Parameters (2005). Review of Economic Dynamics (19) RePEc:sbs:wpsefe:2005fe05 Estimating quadratic variation when quoted prices jump by a constant increment (2005). Oxford Financial Research Centre / OFRC Working Papers Series (20) RePEc:sbs:wpsefe:2005fe06 Limit theorems for multipower variation in the presence of jumps (2005). Oxford Financial Research Centre / OFRC Working Papers Series (21) RePEc:sbs:wpsefe:2005fe09 Limit theorems for bipower variation in financial econometrics (2005). Oxford Financial Research Centre / OFRC Working Papers Series (22) RePEc:taf:apfiec:v:15:y:2005:i:2:p:121-135 Stochastic volatility forecasting and risk management (2005). Applied Financial Economics (23) RePEc:taf:apmtfi:v:12:y:2005:i:1:p:53-85 Stochastic Modelling of Temperature Variations with a View Towards Weather Derivatives (2005). Applied Mathematical Finance (24) RePEc:taf:eurjfi:v:11:y:2005:i:1:p:33-57 Forecasting variance using stochastic volatility and GARCH (2005). European Journal of Finance (25) RePEc:ubi:deawps:12 Asymmetric Multivariate Stochastic Volatility (2005). Universitat de les Illes Balears, Departament d'Economía Aplicada / DEA Working Papers (26) RePEc:upf:upfgen:911 Understanding the Effects of Government Spending on Consumption (2005). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (27) RePEc:vcu:wpaper:0505 The smooth transition autoregressive target zone model with the Gaussian stochastic volatility and TGARCH error terms with applications (2005). VCU School of Business, Department of Economics / Working Papers (28) RePEc:wpa:wuwpem:0501003 The Variance Ratio Statistic at large Horizons (2005). EconWPA / Econometrics (29) RePEc:wpa:wuwpem:0508015 The smooth transition autoregressive target zone model with the Gaussian stochastic volatility and TGARCH error terms with applications (2005). EconWPA / Econometrics (30) RePEc:wpa:wuwpem:0509006 Can fear beat hope? A story of GARCH-in-Mean-Level effects for Emerging Market Country Risks (2005). EconWPA / Econometrics (31) RePEc:wpa:wuwpfi:0510029 Time-varying Beta Risk of Pan-European Industry Portfolios: A Comparison of Alternative Modeling Techniques (2005). EconWPA / Finance (32) RePEc:zbw:bubdp1:4224 Ultra high frequency volatility estimation with dependent microstructure noise (2005). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies (33) RePEc:zbw:cauewp:3829 The Introduction of the Euro and its Effects on Investment Decisions (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers Recent citations received in: 2004 (1) RePEc:ads:wpaper:0044 The Unity of Auction Theory: Paul Milgroms Masterclass (2004). Institute for Advanced Study, School of Social Science / Economics Working Papers (2) RePEc:fip:fedgfe:2004-56 Dynamic estimation of volatility risk premia and investor risk aversion from option-implied and realized volatilities (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (3) RePEc:iza:izadps:dp1441 Normative Evaluation of Tax Policies: From Households to Individuals (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (4) RePEc:nuf:econwp:0430 Multipower Variation and Stochastic Volatility (2004). Economics Group, Nuffield College, University of Oxford / Economics Papers (5) RePEc:oxf:wpaper:210 `Weak` trends for inference and forecasting in finite samples (2004). University of Oxford, Department of Economics / Economics Series Working Papers (6) RePEc:oxf:wpaper:212 A Comparison of Multi-step GDP Forecasts for South Africa (2004). University of Oxford, Department of Economics / Economics Series Working Papers (7) RePEc:sbs:wpsefe:2004fe22 Multipower Variation and Stochastic Volatility (2004). Oxford Financial Research Centre / OFRC Working Papers Series Recent citations received in: 2003 (1) RePEc:cfs:cfswop:wp200335 Some Like it Smooth, and Some Like it Rough: Untangling Continuous and Jump Components in Measuring, Modeling, and Forecasting Asset Return Volatility (2003). Center for Financial Studies / CFS Working Paper Series (2) RePEc:fip:feddcl:0203 The openness-inflation puzzle revisited (2003). Federal Reserve Bank of Dallas / Center for Latin America Working Papers (3) RePEc:nuf:econwp:0308 Step-by-Step Evolution with State-Dependent Mutations (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers (4) RePEc:nuf:econwp:0315 General-to-Specific Model Selection Procedures for Structural Vector Autoregressions (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers (5) RePEc:nuf:econwp:0317 Sub-sample Model Selection Procedures in Gets Modelling (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers (6) RePEc:nuf:econwp:0318 Power and bipower variation with stochastic volatility and jumps (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers (7) RePEc:nuf:econwp:0319 Power variation & stochastic volatility: a review and some new results (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers (8) RePEc:nuf:econwp:0321 Econometrics of testing for jumps in financial economics using bipower variation (2003). Economics Group, Nuffield College, University of Oxford / Economics Papers (9) RePEc:uts:wpaper:124 Keynes-Metzler-Goodwin Model Building: The Closed Economy (2003). School of Finance and Economics, University of Technology, Sydney / Working Paper Series (10) RePEc:uts:wpaper:129 The Structure of Keynesian Macrodynamics: A Framework for Future Research (2003). School of Finance and Economics, University of Technology, Sydney / Working Paper Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||