|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

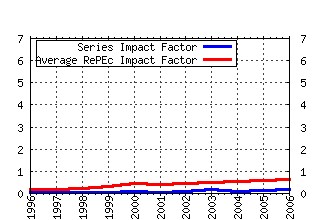

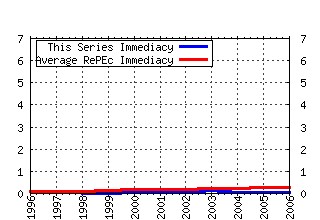

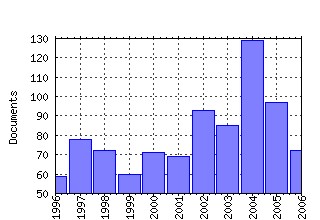

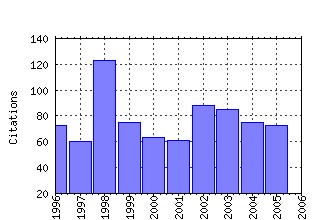

Applied Financial Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:apfiec:v:15:y:2005:i:5:p:315-326 Can mergers in Europe help banks hedge against macroeconomic risk? (2005). (2) RePEc:taf:apfiec:v:8:y:1998:i:6:p:607-14 Linkages between the US and European Equity Markets: Further Evidence from Cointegration Tests. (1998). (3) RePEc:taf:apfiec:v:8:y:1998:i:6:p:689-96 Efficiency of Multinational Banks: An Empirical Investigation. (1998). (4) RePEc:taf:apfiec:v:4:y:1994:i:2:p:121-32 Investment Decisions and the Role of Debt, Liquid Assets and Cash Flow: Evidence from Panel Data. (1994). (5) RePEc:taf:apfiec:v:15:y:2005:i:14:p:1007-1017 Does patenting increase the probability of being acquired? Evidence from cross-border and domestic acquisitions (2005). (6) RePEc:taf:apfiec:v:6:y:1996:i:6:p:463-75 The Stable Paretian Hypothesis and the Frequency of Large Returns: An Examination of Major German Stocks. (1996). (7) RePEc:taf:apfiec:v:5:y:1995:i:4:p:257-64 The Effect of Financial Liberalization on the Efficiency of Turkish Commercial Banks. (1995). (8) RePEc:taf:apfiec:v:11:y:2001:i:1:p:1-8 Nonparametric Cointegration Analysis of Real Exchange Rates. (2001). (9) RePEc:taf:apfiec:v:8:y:1998:i:3:p:245-56 Volatility Spillovers across Equity Markets: European Evidence. (1998). (10) RePEc:taf:apfiec:v:7:y:1997:i:2:p:177-91 Regime Switching in Stock Market Returns. (1997). (11) RePEc:taf:apfiec:v:6:y:1996:i:4:p:307-17 Testing for Non-linearity in Daily Sterling Exchange Rates. (1996). (12) RePEc:taf:apfiec:v:6:y:1996:i:4:p:367-75 Economies of Scale and Scope in European Banking. (1996). (13) RePEc:taf:apfiec:v:12:y:2002:i:7:p:475-84 African Stock Markets: Multiple Variance Ratio Tests of Random Walks. (2002). (14) RePEc:taf:apfiec:v:13:y:2003:i:7:p:477-486 Stock market integration and financial crises: the case of Asia (2003). (15) RePEc:taf:apfiec:v:2:y:1992:i:4:p:191-98 The Form of Time Variation of Systematic Risk: Some Australian Evidence. (1992). (16) RePEc:taf:apfiec:v:12:y:2002:i:1:p:19-24 The Determinants of Corporate Debt Maturity: Evidence from UK Firms. (2002). (17) RePEc:taf:apfiec:v:15:y:2005:i:15:p:1041-1051 Financial development and economic growth in the Middle East (2005). (18) RePEc:taf:apfiec:v:2:y:1992:i:1:p:43-47 The International Transmission of Stock Market Fluctuation between the Developed Markets and the Asian-Pacific Markets. (1992). (19) RePEc:taf:apfiec:v:8:y:1998:i:6:p:577-87 Modelling Real Exchange Rate Behaviour: A Cross-Country Study. (1998). (20) RePEc:taf:apfiec:v:13:y:2003:i:2:p:113-122 Technical analysis in foreign exchange markets: evidence from the EMS (2003). (21) RePEc:taf:apfiec:v:4:y:1994:i:1:p:33-39 Some International Evidence Regarding the Stochastic Memory of Stock Returns. (1994). (22) RePEc:taf:apfiec:v:3:y:1993:i:2:p:119-26 Stochastic Behaviour of the Athens Stock Exchange. (1993). (23) RePEc:taf:apfiec:v:9:y:1999:i:1:p:73-85 Macroeconomic Determinants of Long-Term Stock Market Comovements among Major EMS Countries. (1999). (24) RePEc:taf:apfiec:v:14:y:2004:i:17:p:1253-1268 International portfolio diversification to Central European stock markets (2004). (25) RePEc:taf:apfiec:v:8:y:1998:i:4:p:401-07 Continuous-Time Short Term Interest Rate Models. (1998). (26) RePEc:taf:apfiec:v:4:y:1994:i:1:p:1-10 International Diversification among the Capital Markets of the EEC. (1994). (27) RePEc:taf:apfiec:v:9:y:1999:i:4:p:385-95 The Information Content of the German Term Structure Regarding Inflation. (1999). (28) RePEc:taf:apfiec:v:3:y:1993:i:3:p:255-66 The Causality between Official and Parallel Exchange Rates in Developing Countries. (1993). (29) RePEc:taf:apfiec:v:6:y:1996:i:3:p:293-300 Does It Matter How Seigniorage Is Measured. (1996). (30) RePEc:taf:apfiec:v:8:y:1998:i:2:p:167-74 Stock Market Prices, Causality and Efficiency: Evidence from the Athens Stock Exchange. (1998). (31) RePEc:taf:apfiec:v:8:y:1998:i:2:p:145-53 Modelling the Asymmetry of Stock Market Volatility. (1998). (32) RePEc:taf:apfiec:v:12:y:2002:i:8:p:589-600 Accounting for Conditional Leptokurtosis and Closing Days Effects in FIGARCH Models of Daily Exchange Rates. (2002). (33) RePEc:taf:apfiec:v:10:y:2000:i:2:p:177-84 Long Memory in the Greek Stock Market. (2000). (34) RePEc:taf:apfiec:v:9:y:1999:i:1:p:1-9 Short- and Long-Term links among European and US Stock Markets. (1999). (35) RePEc:taf:apfiec:v:11:y:2001:i:5:p:557-71 Efficiency and Productivity Change in UK Banking. (2001). (36) RePEc:taf:apfiec:v:5:y:1995:i:1:p:11-18 Long Run Behaviour of Pacific-Basin Stock Prices. (1995). (37) RePEc:taf:apfiec:v:7:y:1997:i:1:p:59-74 A Comparative Analysis of the Propagation of Stock Market Fluctuations in Alternative Models of Dynamic Causal Linkages. (1997). (38) RePEc:taf:apfiec:v:8:y:1998:i:3:p:289-300 Efficiency and Technical Change for Spanish Banks. (1998). (39) RePEc:taf:apfiec:v:14:y:2004:i:2:p:83-92 A simple test of the Fama and French model using daily data: Australian evidence (2004). (40) RePEc:taf:apfiec:v:5:y:1995:i:1:p:43-50 Day of the Week Effect on the Greek Stock Market. (1995). (41) RePEc:taf:apfiec:v:9:y:1999:i:2:p:173-81 Setting Futures Margins: The Extremes Approach. (1999). (42) RePEc:taf:apfiec:v:9:y:1999:i:5:p:501-11 Short-Term and Long-Term Price Linkages between the Equity Markets of Australia and Its Major Trading Partners. (1999). (43) RePEc:taf:apfiec:v:2:y:1992:i:3:p:145-59 Dynamics of the Composition of Household Asset Portfolios and the Life Cycle. (1992). (44) RePEc:taf:apfiec:v:10:y:2000:i:6:p:615-22 Purchasing Power Parity, Nonlinearity and Chaos. (2000). (45) RePEc:taf:apfiec:v:12:y:2002:i:12:p:895-911 Credit Risk and Efficiency in the European Banking System: A Three-Stage Analysis. (2002). (46) RePEc:taf:apfiec:v:5:y:1995:i:1:p:33-42 The Long-Run Gains from International Equity Diversification: Australian Evidence from Cointegration Tests. (1995). (47) RePEc:taf:apfiec:v:8:y:1998:i:6:p:559-66 A Fractional Cointegration Test of Purchasing Power Parity: The Case of Selected Members of OPEC. (1998). (48) RePEc:taf:apfiec:v:12:y:2002:i:1:p:47-55 Modelling Volatility and Testing for Efficiency in Emerging Capital Markets: The Case of the Athens Stock Exchange. (2002). (49) RePEc:taf:apfiec:v:6:y:1996:i:3:p:287-92 Betting Bias and Market Equilibrium in Racetrack Betting. (1996). (50) RePEc:taf:apfiec:v:7:y:1997:i:5:p:493-98 Stock Market Returns in Thin Markets: Evidence from the Vienna Stock Exchange. (1997). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:crt:wpaper:0615 The Components of the Bid-Ask Spread: The case of the Athens Stock Exchange (2006). University of Crete, Department of Economics / Working Papers (2) RePEc:ega:wpaper:200607 Technology and Customer Value Dynamics in Banking Industry: Measuring Symbiotic Influence in Growth and Performance (2006). Tecnológico de Monterrey, Campus Ciudad de México / Marketing Working Papers (3) RePEc:kap:ecopln:v:39:y:2006:i:1:p:105-124 Consolidation and Competition in Emerging Market: An Empirical Test for Malaysian Banking Industry (2006). Economics of Planning (4) RePEc:taf:apfelt:v:2:y:2006:i:2:p:99-103 Market trader heterogeneity and high frequency volatility dynamics: further evidence from intra-day FTSE-100 futures data (2006). Applied Financial Economics Letters Recent citations received in: 2005 (1) RePEc:kap:openec:v:16:y:2005:i:2:p:107-133 A Sequential Test for Structural Breaks in the Causal Linkages Between the G7 Short-Term Interest Rates (2005). Open Economies Review (2) RePEc:ntd:wpaper:2005-08 El impacto de la liquidez corporativa sobre el valor de las decisiones financieras de la empresa (2005). Interuniversitary Doctorate Program New Trends on Business Administration, Universities of Valladolid, Burgos and Salamanca (Spain). Programa de Docto (3) RePEc:taf:apfelt:v:1:y:2005:i:6:p:343-347 An alternative method to test for contagion with an application to the Asian financial crisis (2005). Applied Financial Economics Letters (4) RePEc:taf:applec:v:37:y:2005:i:18:p:2161-2166 Are the Australian and New Zealand stock prices nonlinear with a unit root? (2005). Applied Economics (5) RePEc:wpa:wuwpfi:0504020 An Analysis of the Impacts of Non-Synchronous Trading On (2005). EconWPA / Finance Recent citations received in: 2004 (1) RePEc:may:mayecw:n1411004 The effect of the Euro on country versus industry portfolio diversification (2004). Department of Economics, National University of Ireland - Maynooth / Economics Department Working Paper Series (2) RePEc:pra:mprapa:3532 Modelling extreme financial returns of global equity markets (2004). University Library of Munich, Germany / MPRA Paper (3) RePEc:rtv:ceisrp:52 Industry and Time Specific Deviations from Fundamental Values in a Random Coefficient Model (2004). Tor Vergata University, CEIS / Research Paper Series (4) RePEc:una:unccee:wp0408 Fundamentals and the origin of Fama-French factors (2004). School of Economics and Business Administration, University of Navarra / Faculty Working Papers (5) RePEc:wpa:wuwpfi:0408006 Performance of Indian commercial banks (1995-2002): an application of data envelopment analysis and Malmquist productivity index (2004). EconWPA / Finance Recent citations received in: 2003 (1) RePEc:bep:sndecm:7:2003:3:1160-1160 An Empirical Evaluation of Non-Linear Trading Rules (2003). Studies in Nonlinear Dynamics & Econometrics (2) RePEc:bog:wpaper:02 Greek Monetary Economics in Retrospect: The Adventures of the Drachma (2003). Special Studies Division, Economic Research Department, Bank of Greece / Working Papers (3) RePEc:car:carecp:03-13 Modeling Money Demand under the Profit-Sharing Banking Scheme: Evidence on Policy Invariance and Long-Run Stability. (2003). Carleton University, Department of Economics / Carleton Economic Papers (4) RePEc:ebl:ecbull:v:7:y:2003:i:3:p:1-13 Long memory in a small stock market (2003). Economics Bulletin (5) RePEc:fda:fdaddt:2003-15 Forecasting the Dollar/Euro Exchange Rate: Can International Parities Help? (2003). FEDEA / Working Papers (6) RePEc:fem:femwpa:2003.43 STAR-GARCH Models for Stock Market Interactions in the Pacific Basin Region, Japan and US (2003). Fondazione Eni Enrico Mattei / Working Papers (7) RePEc:hhs:umnees:0614 Temporal Aggregation of the Returns of a Stock Index Series (2003). Umeå University, Department of Economics / Umeå Economic Studies (8) RePEc:taf:apeclt:v:10:y:2003:i:10:p:643-645 An empirical comparison of interest rates using an interest rate model and nonparametric methods (2003). Applied Economics Letters (9) RePEc:taf:apeclt:v:10:y:2003:i:9:p:527-533 Financial crisis and African stock market integration (2003). Applied Economics Letters (10) RePEc:taf:applec:v:35:y:2003:i:18:p:1923-1933 Regimen changes and duration in the European Monetary System (2003). Applied Economics (11) RePEc:tky:fseres:2003cf208 Modelling the Asymmetric Volatility of Electronics Patents in the USA (2003). CIRJE, Faculty of Economics, University of Tokyo / CIRJE F-Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||