|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

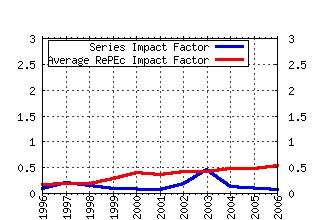

School of Finance and Economics, University of Technology, Sydney / Working Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:uts:wpaper:13 The Dynamics of Speculative Behaviour (1992). (2) RePEc:uts:wpaper:53 Transformation of Heath-Jarrow-Morton Models to Markovian Systems (1995). (3) RePEc:uts:wpaper:90 The Dynamics of the Cobweb when Producers are Risk Averse Learners (1999). (4) RePEc:uts:wpaper:123 Stability Analysis of a High-Dimensional Macrodynamic Model of Real-Financial Interaction: A Cascade of Matrices

Approach (2002). (5) RePEc:uts:wpaper:47 Using Non-Linear Tests to Examine Integration Between Real Estate and Equity Markets (1995). (6) RePEc:uts:wpaper:120 Nonlinear Phillips Curves, Complex Dynamics and Monetary Policy in a Keynesian Macro Model (2002). (7) RePEc:uts:wpaper:111 Real-Financial Interaction: A Reconsideration of the Blanchard Model with a State-of-Market Dependent Reaction

Coefficient (2001). (8) RePEc:uts:wpaper:101 An Economic Analysis of the Peter and Dilbert Principles (2000). (9) RePEc:uts:wpaper:72 Evaluation of Derivative Security Prices in the Heath-Jarrow-Morton Framework as Path Integrals Using Fast Fourier

Transform Techniques (1997). (10) RePEc:uts:wpaper:146 Keynesian Disequilibrium Dynamics: Convergence, Roads to Instability and the Emergence of Complex Business Fluctuations (2006). (11) RePEc:uts:wpaper:63 A Preference Free Partial Differential Equation for the Term Stucture of Interest Rates (1996). (12) RePEc:uts:wpaper:54 The Estimation of the Heath-Jarrow-Morton Model by Use of Kalman Filtering Techniques (1995). (13) RePEc:uts:wpaper:51 Fitting Parsimonious Yield Curve Models to Australian Coupon Bond Data (1995). (14) RePEc:uts:wpaper:14 Developments in Nonlinear Economic Dynamics: Past, Present and Future (1992). (15) RePEc:uts:wpaper:32 The Sources of Unemployment: A Simple Econometric Analysis (1993). (16) RePEc:uts:wpaper:41 The Changing Political Economy of Australian Racism (1994). (17) RePEc:uts:wpaper:6 Monetary and Fiscal Policy Under Nonlinear Exchange Rate Dynamics (1991). (18) RePEc:uts:wpaper:127 Real-Financial Interaction: Implications of Budget Equations and Capital Accumulation (2003). (19) RePEc:uts:wpaper:147 Keynesian Macrodynamics and the Phillips Curve. An Estimated Baseline Macromodel for the U.S. Economy (2006). (20) RePEc:uts:wpaper:113 Failures in B2C Companies; Two Examples and Lessons for New Players (2001). (21) RePEc:uts:wpaper:99 Towards Applied Disequilibrium Growth Theory: VII Intensive Form and Steady State Calculation in the Case of Substitution (1999). (22) RePEc:uts:wpaper:61 Testing for Evidence of Nonlinear Structure in Australian Real Estate Market Returns (1996). (23) RePEc:uts:wpaper:110 The Effects of Inflation and the Business Cycle on Revisions of Macroeconomic Data (2001). (24) RePEc:uts:wpaper:96 Towards Applied Disequilibrium Growth Theory: IV Numerical Investigations of the Core 18D Model (2003). (25) RePEc:uts:wpaper:59 Modelling the Equity Risk Premium in the Long Term (1996). (26) RePEc:uts:wpaper:107 Trading in the Australian Foreign Exchange Market (2000). (27) RePEc:uts:wpaper:22 Bank Interest Rate Margins (1992). (28) RePEc:uts:wpaper:94 Towards Applied Disequilibrium Growth Theory: II Intensive Form and Steady State Analysis of the Model (1999). (29) RePEc:uts:wpaper:125 Output and the Term Structure of Interest Rates: Ways Out of th Jump-Variable Conundrum (2003). (30) RePEc:uts:wpaper:100 The Research Output of Academic Economists in Brazil (2000). (31) RePEc:uts:wpaper:48 Testing for Nonlinearities in Economic and Financial Time Series (1995). (32) RePEc:uts:wpaper:141 A Test of the Strategic Effect of Basel II Operational Risk Requirements on Banks (2005). (33) RePEc:uts:wpaper:98 Towards Applied Disequilibrium Growth Theory: VI Substitution, Money-Holdings, Wealth-Effects and Further Extensions (1999). (34) RePEc:uts:wpaper:139 Keynesian Dynamics and the Wage-Price Spiral: A Baseline Disequilibrium Model (2004). (35) RePEc:uts:wpaper:109 Price Flexibility and Debt Dynamics in a High Order AS-AD Model (2000). (36) RePEc:uts:wpaper:25 Racism, Ethnicity and Immigration in Canada and Australia (1993). (37) RePEc:uts:wpaper:95 Towards Applied Disequilibrium Growth Theory: III Basic Partial Feedback Structures and Stability Issues (1999). (38) RePEc:uts:wpaper:93 Towards Applied Disequilibrium Growth Theory: I The Starting Model (1999). (39) RePEc:uts:wpaper:143 A Test of the Strategic Effect of Basel II Operational Risk Requirements on Banks (2005). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 (1) RePEc:bep:sndecm:10:2006:4:1255-1255 Measuring the Interaction of Wage and Price Phillips Curves for the U.S. Economy (2006). Studies in Nonlinear Dynamics & Econometrics (2) RePEc:imk:wpaper:04-2006 Disequilibrium Macroeconomic Dynamics, Income Distribution and Wage-Price Phillips Curves (2006). IMK at the Hans Boeckler Foundation, Macroeconomic Policy Institute / IMK Working Paper (3) RePEc:uts:wpaper:147 Keynesian Macrodynamics and the Phillips Curve. An Estimated Baseline Macromodel for the U.S. Economy (2006). School of Finance and Economics, University of Technology, Sydney / Working Paper Series Recent citations received in: 2005 Recent citations received in: 2004 Recent citations received in: 2003 (1) RePEc:uts:wpaper:127 Real-Financial Interaction: Implications of Budget Equations and Capital Accumulation (2003). School of Finance and Economics, University of Technology, Sydney / Working Paper Series (2) RePEc:uts:wpaper:97 Towards Applied Disequilibrium Growth Theory: V Housing Investment Cycles, Private Debt Accumulation and Deflation (2003). School of Finance and Economics, University of Technology, Sydney / Working Paper Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||