|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

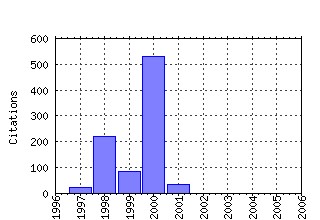

Center for Research in Security Prices, Graduate School of Business, University of Chicago / CRSP working papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:wop:chispw:412 By Force of Habit: A Consumption-Based Explanation of Aggregate Stock Market Behavior (1994). (2) RePEc:wop:chispw:363 A Theory of Bank Capital (2000). (3) RePEc:wop:chispw:357 The Cost of Diversity: The Diversification Discount and Inefficient Investment (2000). (4) RePEc:wop:chispw:463 The Cost of Diversity: The Diversification Discount and Inefficient Investment. (2000). (5) RePEc:wop:chispw:339 The Paradox of Liquidity (1998). (6) RePEc:wop:chispw:479 A Frictionless View of U.S. Inflation (1998). (7) RePEc:wop:chispw:496 What Determines Firm Size'DONE' (2000). (8) RePEc:wop:chispw:486 Which Capitalism? Lessons from the East Asian Crisis (1998). (9) RePEc:wop:chispw:324 Legal Determinants of External Finance, (2000). (10) RePEc:wop:chispw:513 Financial Contracting Theory Meets the Real World: An Empirical Analysis of Venture Capital Contracts (2000). (11) RePEc:wop:chispw:490 New Facts in Finance (1999). (12) RePEc:wop:chispw:349 Interest Group Competition and the Organization of Congress: Theory and Evidence from Financial Services Political Action Committees (1998). (13) RePEc:wop:chispw:511 The Role of Social Capital in Financial Development (2000). (14) RePEc:wop:chispw:515 In Search of New Foundations (2000). (15) RePEc:wop:chispw:478 Long-term Debt and Optimal Policy in the Fiscal Theory of the Price Level (1998). (16) RePEc:wop:chispw:526 The Great Reversals: The Politics of Financial Development in the 20th Century (2001). (17) RePEc:wop:chispw:360 Information Acquisition in Financial Markets (2000). (18) RePEc:wop:chispw:487 The Governance of the New Enterprise (1998). (19) RePEc:wop:chispw:484 Information Acquisition in Financial Markets. (2000). (20) RePEc:wop:chispw:523 Occupation-Level Income Shocks and Asset Returns: Their Covariance and Implications for Portfolio Choice (2000). (21) RePEc:wop:chispw:455 Do Changes in Dividends Signal the Future or the Past? (1997). (22) RePEc:wop:chispw:358 Forecasting Profitability and Earnings (2000). (23) RePEc:wop:chispw:456 Forecasting Profitability and Earnings. (2000). (24) RePEc:wop:chispw:488 Investment Plans and Stock Returns. (2000). (25) RePEc:wop:chispw:462 How Does Information Quality Affect Stock Returns?. (2000). (26) RePEc:wop:chispw:361 How Does Information Quality Affect Stock Returns? (2000). (27) RePEc:wop:chispw:491 Portfolio Advice for a Multifactor World (1999). (28) RePEc:wop:chispw:356 Portfolio Selection and Asset Pricing Models (2000). (29) RePEc:wop:chispw:325 Organization Structure and Credibility: Evidence from Commercial Bank Securities Activities Before the Glass-Steagall Act (2000). (30) RePEc:wop:chispw:518 Banks, Short Term Debt and Financial Crises: Theory, Policy Implications and Applications. (2000). (31) RePEc:wop:chispw:498 Portfolio Selection and Asset Pricing Models. (2000). (32) RePEc:wop:chispw:459 Conflicts of Interest and Market Illiquidity in Bankruptcy Auctions: Theory and Tests (2000). (33) RePEc:wop:chispw:525 The Influence of the Financial Revolution on the Nature of Firms (2001). (34) RePEc:wop:chispw:512 Obstacles to Optimal Policy: The Interplay of Politics and Economics in Shaping Bank Supervision and Regulation Reforms (2000). (35) RePEc:wop:chispw:505 Asset Pricing with Heterogeneous Consumers and Limited Participation: Empirical Evidence (1999). (36) RePEc:wop:chispw:494 Prospect Theory and Asset Prices. (2000). (37) RePEc:wop:chispw:497 Comparing Asset Pricing Models: An Investment Perspective (1999). (38) RePEc:wop:chispw:509 Disappearing Dividends: Changing Firm Characteristics or Lower Propensity to Pay?. (2000). (39) RePEc:wop:chispw:492 Is the Financial System Politically Independent'DONE' Perspectives on the Political Economy of Banking and Financial Regulation (1999). (40) RePEc:wop:chispw:423 The Tyranny of Inequality (1999). (41) RePEc:wop:chispw:499 Organization Design (1999). (42) RePEc:wop:chispw:343 Capital Budgeting and Delegation (2000). (43) RePEc:wop:chispw:335 Power in a Theory of the Firm (2000). (44) RePEc:wop:chispw:477 Bureaucracy as a Mechanism to Generate Information (1998). (45) RePEc:wop:chispw:480 Do Industries Explain Momentum?. (2000). (46) RePEc:wop:chispw:522 The Equity Premium. (2000). (47) RePEc:wop:chispw:510 Asset Pricing Models: Implications for Expected Returns and Portfolio Selection. (2000). (48) RePEc:wop:chispw:457 Junior Cant borrow: A New Perspective on the Equity Premium Puzzle. (2000). (49) RePEc:wop:chispw:495 Bounds on Derivative Prices in an Intertemporal Setting with Proportional Transaction Costs and Multiple Securities. (2000). (50) RePEc:wop:chispw:466 Efficiency and Distribution in Financial Restructuring: The Case of the Ferruzzi Group (1997). Recent citations received in: | 2006 | 2005 | 2004 | 2003 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 Recent citations received in: 2003 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||