|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

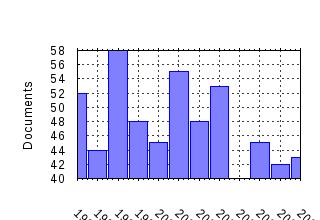

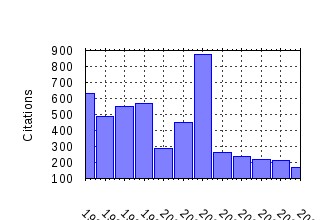

Journal of Business and Economic Statistics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bes:jnlbes:v:13:y:1995:i:3:p:253-63 Comparing Predictive Accuracy. (1995). (2) RePEc:bes:jnlbes:v:10:y:1992:i:3:p:251-70 Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. (1992). (3) RePEc:bes:jnlbes:v:20:y:2002:i:4:p:518-29 A Survey of Weak Instruments and Weak Identification in Generalized Method of Moments. (2002). (4) RePEc:bes:jnlbes:v:20:y:2002:i:2:p:147-62 Macroeconomic Forecasting Using Diffusion Indexes. (2002). (5) RePEc:bes:jnlbes:v:12:y:1994:i:4:p:371-89 Bayesian Analysis of Stochastic Volatility Models. (1994). (6) RePEc:bes:jnlbes:v:3:y:1985:i:4:p:370-79 Estimation and Inference in Two-Step Econometric Models. (1985). (7) RePEc:bes:jnlbes:v:2:y:1984:i:4:p:367-74 Production Frontiers and Panel Data. (1984). (8) RePEc:bes:jnlbes:v:7:y:1989:i:2:p:147-59 Tests for Unit Roots: A Monte Carlo Investigation. (1989). (9) RePEc:bes:jnlbes:v:8:y:1990:i:2:p:153-62 Testing for a Unit Root in a Time Series with a Changing Mean. (1990). (10) RePEc:bes:jnlbes:v:11:y:1993:i:4:p:369-80 Testing for Common Features. (1993). (11) RePEc:bes:jnlbes:v:10:y:1992:i:3:p:301-20 Nonstationarity and Level Shifts with an Application to Purchasing Power Parity. (1992). (12) RePEc:bes:jnlbes:v:14:y:1996:i:1:p:11-30 Evidence on Structural Instability in Macroeconomic Time Series Relations. (1996). (13) RePEc:bes:jnlbes:v:11:y:1993:i:4:p:393-95 Testing for Common Features: Reply. (1993). (14) RePEc:bes:jnlbes:v:12:y:1994:i:3:p:361-68 Estimating Potential Output as a Latent Variable. (1994). (15) RePEc:bes:jnlbes:v:17:y:1999:i:1:p:74-90 Earnings and Employment Effects of Continuous Off-the-Job Training in East Germany after Unification. (1999). (16) RePEc:bes:jnlbes:v:13:y:1995:i:2:p:151-61 Natural and Quasi-experiments in Economics. (1995). (17) RePEc:bes:jnlbes:v:8:y:1990:i:3:p:265-79 Permanent Income, Current Income, and Consumption. (1990). (18) RePEc:bes:jnlbes:v:14:y:1996:i:3:p:262-80 Finite-Sample Properties of Some Alternative GMM Estimators. (1996). (19) RePEc:bes:jnlbes:v:7:y:1989:i:3:p:297-305 The Message in Daily Exchange Rates: A Conditional-Variance Tale. (1989). (20) RePEc:bes:jnlbes:v:10:y:1992:i:3:p:271-87 Recursive and Sequential Tests of the Unit-Root and Trend-Break Hypotheses: Theory and International Evidence. (1992). (21) RePEc:bes:jnlbes:v:8:y:1990:i:2:p:225-34 Persistence in Variance, Structural Change, and the GARCH Model. (1990). (22) RePEc:bes:jnlbes:v:15:y:1997:i:3:p:345-53 When Do Long-Run Identifying Restrictions Give Reliable Results? (1997). (23) RePEc:bes:jnlbes:v:12:y:1994:i:4:p:461-70 Testing for a Unit Root in Time Series with Pretest Data-Based Model Selection. (1994). (24) RePEc:bes:jnlbes:v:20:y:2002:i:2:p:163-82 Regime Switches in Interest Rates. (2002). (25) RePEc:bes:jnlbes:v:24:y:2006:p:127-161 Realized Variance and Market Microstructure Noise (2006). (26) RePEc:bes:jnlbes:v:3:y:1985:i:3:p:216-27 Trends and Cycles in Macroeconomic Time Series. (1985). (27) RePEc:bes:jnlbes:v:16:y:1998:i:2:p:254-59 Tests for Forecast Encompassing. (1998). (28) RePEc:bes:jnlbes:v:3:y:1985:i:1:p:14-22 Business Location Decisions in the United States: Estimates of the Effects of Unionization, Taxes, and Other Characteristics of States. (1985). (29) RePEc:bes:jnlbes:v:17:y:1999:i:1:p:22-35 Humps and Bumps in Lifetime Consumption. (1999). (30) RePEc:bes:jnlbes:v:13:y:1995:i:1:p:27-35 Estimation of Common Long-Memory Components in Cointegrated Systems. (1995). (31) RePEc:bes:jnlbes:v:20:y:2002:i:1:p:45-59 Tests for Parameter Instability in Regressions with I(1) Processes. (2002). (32) RePEc:bes:jnlbes:v:9:y:1991:i:3:p:279-86 A Generalized Production Frontier Approach for Estimating Determinants of Inefficiency in U.S. Dairy Farms. (1991). (33) RePEc:bes:jnlbes:v:20:y:2002:i:3:p:339-50 Dynamic Conditional Correlation: A Simple Class of Multivariate Generalized Autoregressive Conditional Heteroskedasticity Models. (2002). (34) RePEc:bes:jnlbes:v:5:y:1987:i:4:p:437-42 Vector Autoregressions and Reality. (1987). (35) RePEc:bes:jnlbes:v:10:y:1992:i:3:p:237-50 Searching for a Break in GNP. (1992). (36) RePEc:bes:jnlbes:v:14:y:1996:i:3:p:353-66 Small-Sample Bias in GMM Estimation of Covariance Structures. (1996). (37) RePEc:bes:jnlbes:v:13:y:1995:i:4:p:409-17 Sustainability of the Deficit Process with Structural Shifts. (1995). (38) RePEc:bes:jnlbes:v:17:y:1999:i:1:p:36-49 Symmetrically Normalized Instrumental-Variable Estimation Using Panel Data. (1999). (39) RePEc:bes:jnlbes:v:16:y:1998:i:3:p:304-11 Unit-Root Tests and Asymmetric Adjustment with an Example Using the Term Structure of Interest Rates. (1998). (40) RePEc:bes:jnlbes:v:11:y:1993:i:1:p:103-12 A Fractional Cointegration Analysis of Purchasing Power Parity. (1993). (41) RePEc:bes:jnlbes:v:12:y:1994:i:3:p:299-308 Business-Cycle Phases and Their Transitional Dynamics. (1994). (42) RePEc:bes:jnlbes:v:10:y:1992:i:4:p:561-65 A Simple Nonparametric Test of Predictive Performance. (1992). (43) RePEc:bes:jnlbes:v:16:y:1998:i:4:p:388-99 Asymptotic Inference on Cointegrating Rank in Partial Systems. (1998). (44) RePEc:bes:jnlbes:v:13:y:1995:i:1:p:37-45 Long Memory in Inflation Rates: International Evidence. (1995). (45) RePEc:bes:jnlbes:v:3:y:1985:i:3:p:254-83 Estimating Gross Labor-Force Flows. (1985). (46) RePEc:bes:jnlbes:v:15:y:1997:i:3:p:300-309 Reconciling the Old and New Census Bureau Education Questions: Recommendations for Researchers. (1997). (47) RePEc:bes:jnlbes:v:11:y:1993:i:1:p:1-15 Bayes Inference via Gibbs Sampling of Autoregressive Time Series Subject to Markov Mean and Variance Shifts. (1993). (48) RePEc:bes:jnlbes:v:8:y:1990:i:1:p:1-17 Solving Nonlinear Stochastic Growth Models: A Comparison of Alternative Solution Methods. (1990). (49) RePEc:bes:jnlbes:v:9:y:1991:i:4:p:345-59 Semiparametric ARCH Models. (1991). (50) RePEc:bes:jnlbes:v:19:y:2001:i:2:p:166-76 Cointegration and Threshold Adjustment. (2001). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 (1) RePEc:aah:create:2007-14 A Reduced Form Framework for Modeling Volatility of Speculative Prices based on Realized Variation Measures (2007). School of Economics and Management, University of Aarhus / CREATES Research Papers (2) RePEc:acb:camaaa:2007-18 CONSTRUCTING HISTORICAL EURO AREA DATA (2007). Australian National University, Centre for Applied Macroeconomic Analysis / CAMA Working Papers (3) RePEc:bcb:wpaper:136 Identifying Volatility Risk Premium from Fixed Income Asian Options (2007). Central Bank of Brazil, Research Department / Working Papers Series (4) RePEc:bde:wpaper:0715 Back to square one: identification issues in DSGE models (2007). Banco de Espana / Banco de Espana Working Papers (5) RePEc:bde:wpaper:0729 What do micro price data tell us on the validity of the New Keynesian Phillips Curve? (2007). Banco de Espana / Banco de Espana Working Papers (6) RePEc:cpr:ceprdp:6119 Forming Priors for DSGE Models (and How It Affects the Assessment of Nominal Rigidities) (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (7) RePEc:cpr:ceprdp:6158 Economic Forecasting (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (8) RePEc:cpr:ceprdp:6239 Understanding Index Option Returns (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (9) RePEc:cwl:cwldpp:1570 Evaluating Inflation Targeting Using a Macroeconometric Model (2007). Cowles Foundation, Yale University / Cowles Foundation Discussion Papers (10) RePEc:cwl:cwldpp:1577 A Comparison of Five Federal Reserve Chairmen: Was Greenspan the Best? (2007). Cowles Foundation, Yale University / Cowles Foundation Discussion Papers (11) RePEc:fip:fedgfe:2007-60 Gauging the uncertainty of the economic outlook from historical forecasting errors (2007). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (12) RePEc:hhs:bofrdp:2007_014 Estimating a small DSGE model under rational and measured expectations: some comparisons (2007). Bank of Finland / Research Discussion Papers (13) RePEc:icr:wpicer:8-2007 On the macroeconomic causes of exchange rates volatility (2007). ICER - International Centre for Economic Research / ICER Working Papers (14) RePEc:igi:igierp:324 On the Statistical Identification of DSGE Models (2007). IGIER (Innocenzo Gasparini Institute for Economic Research), Bocconi University / Working Papers (15) RePEc:igi:igierp:329 The Econometrics of Monetary Policy: an Overview (2007). IGIER (Innocenzo Gasparini Institute for Economic Research), Bocconi University / Working Papers (16) RePEc:kap:jrefec:v:35:y:2007:i:3:p:315-331 Monetary Shocks and REIT Returns (2007). The Journal of Real Estate Finance and Economics (17) RePEc:kie:kieliw:1330 What Do Micro Price Data Tell Us on the Validity of the New Keynesian Phillips Curve? (2007). Kiel Institute for World Economics / Working Papers (18) RePEc:mod:recent:008 Opening the Black Box: Structural Factor Models with Large Cross-Sections (2007). University of Modena and Reggio E., Dept. of Economics / Center for Economic Research (RECent) (19) RePEc:nbr:nberwo:13043 Technology and the Demand for Skill:An Analysis of Within and Between Firm Differences (2007). National Bureau of Economic Research, Inc / NBER Working Papers (20) RePEc:nbr:nberwo:13099 Monetary Policy Analysis with Potentially Misspecified Models (2007). National Bureau of Economic Research, Inc / NBER Working Papers (21) RePEc:nbr:nberwo:13112 Daily Changes in Fed Funds Futures Prices (2007). National Bureau of Economic Research, Inc / NBER Working Papers (22) RePEc:nbr:nberwo:13569 Assessing Monetary Policy Effects Using Daily Fed Funds Futures Contracts (2007). National Bureau of Economic Research, Inc / NBER Working Papers (23) RePEc:nzb:nzbdps:2007/13 An analysis of the informational content of New Zealand data releases: the importance of business opinion surveys (2007). Reserve Bank of New Zealand / Reserve Bank of New Zealand Discussion Paper Series (24) RePEc:pad:wpaper:0055 Bowling Alone, Drinking Together (2007). Marco Fanno Working Papers (25) RePEc:ssa:lemwps:2007/19 A Robust Criterion for Determining the Number of Static Factors in Approximate Factor Models (2007). Laboratory of Economics and Management (LEM), Sant'Anna School of Advanced Studies, Pisa, Italy / LEM Papers Series (26) RePEc:swe:wpaper:2007-33 Comparing House Prices Across Regions and Time: An Hedonic Approach (2007). School of Economics, The University of New South Wales / Discussion Papers (27) RePEc:ucn:wpaper:200722 Federal Reserve Information during the Great Moderation (2007). School Of Economics, University College Dublin / Working Papers (28) RePEc:unu:wpaper:rp2007-01 Global Inequality: Recent Evidence and Trends (2007). World Institute for Development Economic Research (UNU-WIDER) / Working Papers Recent citations received in: 2006 (1) RePEc:bar:bedcje:2006159 New evidence of the real interest rate parity for OECD countries using panel unit root tests with breaks (2006). Universitat de Barcelona. Espai de Recerca en Economia / Working Papers in Economics (2) RePEc:bbk:bbkefp:0617 Forecasting Substantial Data Revisions in the Presence of Model Uncertainty (2006). Birkbeck, School of Economics, Mathematics & Statistics / Birkbeck Working Papers in Economics and Finance (3) RePEc:cbi:wpaper:4/rt/06 Consumption and Expected Asset Returns Without Assumptions About Unobservables (2006). Central Bank & Financial Services Authority of Ireland (CBFSAI) / Research Technical Papers (4) RePEc:cep:stiecm:/2006/509 Estimating Quadratic VariationConsistently in thePresence of Correlated MeasurementError (2006). Suntory and Toyota International Centres for Economics and Related Disciplines, LSE / STICERD - Econometrics Paper Series (5) RePEc:cfr:cefirw:w0070 Trade intensity in the Russian stock market:dynamics, distribution and determinants (2006). Center for Economic and Financial Research / CEFIR Working Papers (6) RePEc:cfr:cefirw:w0092 Dynamic modeling under linear-exponential loss (2006). Center for Economic and Financial Research / CEFIR Working Papers (7) RePEc:cor:louvco:2006080 Modelling financial high frequency data using point processes (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (8) RePEc:cor:louvco:2006110 Does the open limit order book matter in explaining long run volatility ? (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (9) RePEc:cri:cespri:wp183 Are U.S. White-Collar Really at Risk of Service Offshoring? (2006). CESPRI, Centre for Research on Innovation and Internationalisation, Universita' Bocconi, Milano, Italy / CESPRI Working Papers (10) RePEc:cte:wsrepe:ws062509 VOLATILITY FORECASTS: A CONTINUOUS TIME MODEL VERSUS DISCRETE TIME MODELS1 (2006). Universidad Carlos III, Departamento de EstadÃstica y EconometrÃa / Statistics and Econometrics Working Papers (11) RePEc:ctl:louvec:2006039 Modelling Financial High Frequency Data Using Point Processes (2006). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (12) RePEc:dgr:uvatin:20050089 Predicting the Daily Covariance Matrix for S&P 100 Stocks Using Intraday Data - But Which Frequency to Use? (2006). Tinbergen Institute / Tinbergen Institute Discussion Papers (13) RePEc:dgr:uvatin:20060089 The Entrepreneurs Mode of Entry: Business Takeover or New Venture start? (2006). Tinbergen Institute / Tinbergen Institute Discussion Papers (14) RePEc:ecl:ohidic:2006-8 Investor Overreaction, Cross-Sectional Dispersion of Firm Valuations, and Expected Stock Returns (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (15) RePEc:esi:egpdis:2006-26 The entrepreneurâs mode of entry: Business takeover or new venture start? (2006). Max Planck Institute of Economics, Group for Entrepreneurship, Growth and Public Policy / Discussion Papers on Entrepreneurship, Growth and Public Pol (16) RePEc:fip:fedlwp:2005-026 Is value premium a proxy for time-varying investment opportunities: some time series evidence (2006). Federal Reserve Bank of St. Louis / Working Papers (17) RePEc:fip:fedlwp:2006-047 Does aggregate relative risk aversion change countercyclically over time? evidence from the stock market (2006). Federal Reserve Bank of St. Louis / Working Papers (18) RePEc:hep:macppr:200606 The Store-of-Value-Function of Money as a Component of Household Risk Management (2006). Hamburg University, Department Wirtschaft und Politik / Macroeconomics and Finance Series (19) RePEc:iza:izadps:dp2382 The Entrepreneurââ¬â¢s Mode of Entry: Business Takeover or New Venture Start (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (20) RePEc:kap:sbusec:v:27:y:2006:i:1:p:41-58 Entrepreneurship in the Region: Breeding Ground for Nascent Entrepreneurs? (2006). Small Business Economics (21) RePEc:knz:cofedp:0606 A Multivariate Integer Count Hurdle Model: Theory and Application to Exchange Rate Dynamics (2006). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (22) RePEc:mrr:papers:wp145 How the Distribution of After-Tax Income Changed Over the 1990s Business Cycle: A Comparison of the United States, Great Britain, Germany and Japan (2006). University of Michigan, Michigan Retirement Research Center / Working Papers (23) RePEc:msh:ebswps:2006-10 Assessing the Impact of Market Microstructure Noise and Random Jumps on the Relative Forecasting Performance of Option-Implied and Returns-Based Volatility (2006). Monash University, Department of Econometrics and Business Statistics / Monash Econometrics and Business Statistics Working Papers (24) RePEc:nuf:econwp:0506 Limit theorems for bipower variation in financial econometrics (2006). Economics Group, Nuffield College, University of Oxford / Economics Papers (25) RePEc:nuf:econwp:0603 Designing realised kernels to measure the ex-post variation of equity prices in the presence of noise (2006). Economics Group, Nuffield College, University of Oxford / Economics Papers (26) RePEc:nuf:econwp:0610 Subsampling realised kernels (2006). Economics Group, Nuffield College, University of Oxford / Economics Papers (27) RePEc:nwu:cmsems:1422 Private Information in Sequential Common-Value Auctions (2006). Northwestern University, Center for Mathematical Studies in Economics and Management Science / Discussion Papers (28) RePEc:nzb:nzbdps:2006/02 Forecasting Substantial Data Revisions in the Presence of Model Uncertainty (2006). Reserve Bank of New Zealand / Reserve Bank of New Zealand Discussion Paper Series (29) RePEc:oxf:wpaper:264 Designing realised kernels to measure the ex-post variation of equity prices in the presence of noise (2006). University of Oxford, Department of Economics / Economics Series Working Papers (30) RePEc:oxf:wpaper:278 Subsampling realised kernels (2006). University of Oxford, Department of Economics / Economics Series Working Papers (31) RePEc:pra:mprapa:1413 A Pure-Jump Transaction-Level Price Model Yielding Cointegration, Leverage, and Nonsynchronous Trading Effects (2006). University Library of Munich, Germany / MPRA Paper (32) RePEc:qed:wpaper:1188 The Information Content of Treasury Bond Options Concerning Future Volatility and Price Jumps (2006). Queen's University, Department of Economics / Working Papers (33) RePEc:rio:texdis:531 Realized volatility: a review (2006). Department of Economics PUC-Rio (Brazil) / Textos para discussão (34) RePEc:rio:texdis:532 Asymmetric effects and long memory in the volatility of Dow Jones stocks (2006). Department of Economics PUC-Rio (Brazil) / Textos para discussão (35) RePEc:rut:rutres:200616 Predictive Inference for Integrated Volatility (2006). Rutgers University, Department of Economics / Departmental Working Papers (36) RePEc:rut:rutres:200620 Predictive Density Estimators for Daily Volatility Based on the Use of Realized Measures (2006). Rutgers University, Department of Economics / Departmental Working Papers (37) RePEc:sbs:wpsefe:2006fe05 Designing realised kernels to measure the ex-post variation of equity prices in the presence of noise (2006). Oxford Financial Research Centre / OFRC Working Papers Series (38) RePEc:sbs:wpsefe:2006fe06 Subsampling realised kernels (2006). Oxford Financial Research Centre / OFRC Working Papers Series (39) RePEc:taf:apeclt:v:13:y:2006:i:13:p:873-876 A note on uncertainty and investment across the spectrum of irreversibility (2006). Applied Economics Letters (40) RePEc:vie:viennp:0606 Non-Market Household Time and the cost of Children (2006). University of Vienna, Department of Economics / Vienna Economics Papers Recent citations received in: 2005 (1) RePEc:acb:camaaa:2005-07 SOME ECONOMETRIC ANALYSIS OF CONSTRUCTED BINARY TIME SERIES (2005). Australian National University, Centre for Applied Macroeconomic Analysis / CAMA Working Papers (2) RePEc:aea:aecrev:v:95:y:2005:i:3:p:724-738 Understanding European Real Exchange Rates (2005). American Economic Review (3) RePEc:ags:eaae05:24709 Hedonic Housing Prices and Agricultural Pollution: An Empirical Investigation on Semiparametric Models (2005). European Association of Agricultural Economists / 2005 International Congress, August 23-27, 2005, Copenhagen, Denmark (4) RePEc:ces:ceswps:_1465 Heterogeneity within Communities: A Stochastic Model with Tenure Choice (2005). CESifo GmbH / CESifo Working Paper Series (5) RePEc:cpr:ceprdp:5361 Forecast Combinations (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (6) RePEc:emo:wp2003:0502 Higher Power Tests for Bilateral Failure of PPP after 1973 (2005). Department of Economics, Emory University (Atlanta) / Emory Economics (7) RePEc:emo:wp2003:0503 Residuals Bases Tests for the Null of No Cointegration: an Analytical Comparison (2005). Department of Economics, Emory University (Atlanta) / Emory Economics (8) RePEc:fip:fedawp:2005-02 Testing the significance of calendar effects (2005). Federal Reserve Bank of Atlanta / Working Paper (9) RePEc:hal:journl:halshs-00179343_v1 How can we define the concept of long memory ? An econometric survey, (2005). HAL / Post-Print (10) RePEc:hhs:bofitp:2005_009 A ten-year retrospection of the behavior of Russian stock returns (2005). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (11) RePEc:iae:iaewps:wp2005n14 Is There a Unit Root in East-Asian Short-Term Interest Rates? (2005). Melbourne Institute of Applied Economic and Social Research, The University of Melbourne / Melbourne Institute Working Paper Series (12) RePEc:rba:rbaacv:acv2005-06 Assessing the Sources of Changes in the Volatility of Real Growth (2005). Reserve Bank of Australia / RBA Annual Conference Volume (13) RePEc:rba:rbaacv:acv2005-07 Discussion of Assessing the Sources of Changes in the Volatility of Real Growth (2005). Reserve Bank of Australia / RBA Annual Conference Volume (14) RePEc:sca:scaewp:0515 Determinants of Job Turnover Intentions: Evidence from Singapore (2005). National University of Singapore, Department of Economics, SCAPE / SCAPE Policy Research Working Paper Series (15) RePEc:ucy:cypeua:3-2005 A Textbook Example of International Price Discrimination (2005). University of Cyprus Department of Economics / University of Cyprus Working Papers in Economics (16) RePEc:wpa:wuwpma:0510016 What Happens After A Technology Shock? A Bayesian Perspective (2005). EconWPA / Macroeconomics (17) RePEc:zur:iewwpx:259 Formalized Data Snooping Based on Generalized Error Rates (2005). Institute for Empirical Research in Economics - IEW / IEW - Working Papers Recent citations received in: 2004 (1) RePEc:cam:camdae:0433 ââ¬ËForecasting Time Series Subject to Multiple Structural Breaksââ¬â¢ (2004). Faculty of Economics (formerly DAE), University of Cambridge / Cambridge Working Papers in Economics (2) RePEc:ces:ceswps:_1237 Forecasting Time Series Subject to Multiple Structural Breaks (2004). CESifo GmbH / CESifo Working Paper Series (3) RePEc:ctl:louvir:2004024 Business Cycle Turning Points : Mixed-Frequency Data with Structural Breaks (2004). Université catholique de Louvain, Institut de Recherches Economiques et Sociales (IRES) / Université catholique de Louvain, Institut de Recherches Eco (4) RePEc:dgr:uvatin:20040015 Inference for Adaptive Time Series Models: Stochastic Volatility and Conditionally Gaussian State Space form (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (5) RePEc:dnb:dnbwpp:022 A Copula-Based Autoregressive Conditional Dependence Model of International Stock Markets (2004). Netherlands Central Bank, Research Department / DNB Working Papers (6) RePEc:ecm:latm04:132 The Use and Abuse of Taylor Rules: How precisely can we estimate them? (2004). Econometric Society / Econometric Society 2004 Latin American Meetings (7) RePEc:fip:fedgfe:2004-52 Macroeconomic volatility, predictability and uncertainty in the Great Moderation: evidence from the survey of professional forecasters (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (8) RePEc:hhs:hastef:0557 Evaluating models of autoregressive conditional duration (2004). Stockholm School of Economics / Working Paper Series in Economics and Finance (9) RePEc:hst:hstdps:d04-43 An Extension of the Markov-Switching Model with Time-Varying Transition Probabilities: Bull-Bear Analysis of the Japanese Stock Market (2004). Institute of Economic Research, Hitotsubashi University / Hi-Stat Discussion Paper Series (10) RePEc:iea:carech:0414 Evaluating Portfolio Value-at-Risk using Semi-Parametric GARCH Models (2004). HEC Montréal, Institut d'économie appliquée / Cahiers de recherche (11) RePEc:ifs:cemmap:09/04 Pessimistic portfolio allocation and Choquet expected utility (2004). Centre for Microdata Methods and Practice, Institute for Fiscal Studies / CeMMAP working papers (12) RePEc:iza:izadps:dp1196 Forecasting Time Series Subject to Multiple Structural Breaks (2004). Institute for the Study of Labor (IZA) / IZA Discussion Papers (13) RePEc:jae:japmet:v:19:y:2004:i:3:p:339-354 Why were changes in the federal funds rate smaller in the 1990s? (2004). Journal of Applied Econometrics (14) RePEc:lvl:lacicr:0429 Identification and Estimation of the Economic Performance of Outmigrants using Panel Attrition (2004). (15) RePEc:nuf:econwp:042 Inference for Adaptive Time Series Models: Stochastic Volatility and Conditionally Gaussian State Space Form (2004). Economics Group, Nuffield College, University of Oxford / Economics Papers (16) RePEc:rpo:ripoec:v:94:y:2004:i:6:p:49-100 Quantile Regression Evidence on Italian Education Returns (2004). Rivista di Politica Economica (17) RePEc:siu:wpaper:23-2004 Multivariate Stochastic Volatility Models: Bayesian Estimation and Model Comparison (2004). Singapore Management University, School of Economics / Working Papers (18) RePEc:siu:wpaper:24-2004 Asymmetric Response of Volatility: Evidence from Stochastic Volatility Models and Realized Volatility (2004). Singapore Management University, School of Economics / Working Papers (19) RePEc:xrs:sfbmaa:04-23 The Relationship Between Risk Attitudes and Heuristics in Search Tasks: A Laboratory Experiment (2004). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||