|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

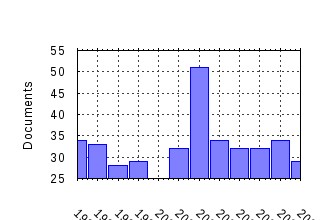

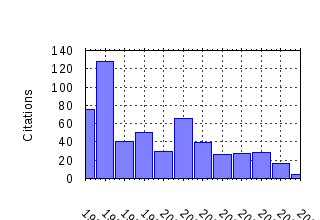

Journal of Financial Research Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:jfnres:v:20:y:1997:i:2:p:275-89 Banking Relationships and the Effect of Monitoring on Loan Pricing (1997). (2) RePEc:bla:jfnres:v:20:y:1997:i:2:p:145-58 Cognitive Dissonance and Mutual Fund Investors (1997). (3) RePEc:bla:jfnres:v:24:y:2001:i:2:p:161-78 Systematic Liquidity (2001). (4) RePEc:bla:jfnres:v:19:y:1996:i:1:p:59-74 The Costs of Raising Capital (1996). (5) RePEc:bla:jfnres:v:21:y:1998:i:3:p:333-53 Cross-Autocorrelation between A Shares and B Shares in the Chinese Stock Market (1998). (6) RePEc:bla:jfnres:v:19:y:1996:i:2:p:193-207 On the Dynamic Relation between Stock Prices and Exchange Rates (1996). (7) RePEc:bla:jfnres:v:22:y:1999:i:1:p:107-30 A State-Space Approach to Estimate and Test Multifactor Cox-Ingersoll-Ross Models of the Term Structure (1999). (8) RePEc:bla:jfnres:v:19:y:1996:i:2:p:175-92 Skewness and Kurtosis in S&P 500 Index Returns Implied by Option Prices (1996). (9) RePEc:bla:jfnres:v:13:y:1990:i:4:p:285-96 Call Option Valuation for Discrete Normal Mixtures (1990). (10) RePEc:bla:jfnres:v:20:y:1997:i:2:p:175-90 An Empirical Analysis of Mutual Fund Expenses (1997). (11) RePEc:bla:jfnres:v:13:y:1990:i:1:p:71-79 Interest Rate Changes and Common Stock Returns of Financial Institutions: Revisited (1990). (12) RePEc:bla:jfnres:v:16:y:1993:i:4:p:337-50 Mean and Volatility Spillovers across Major National Stock Markets: Further Empirical Evidence (1993). (13) RePEc:bla:jfnres:v:22:y:1999:i:2:p:161-87 How Firm Characteristics Affect Capital Structure: An International Comparison (1999). (14) RePEc:bla:jfnres:v:28:y:2005:i:1:p:41-57 SOCIALLY RESPONSIBLE INVESTING AND PORTFOLIO DIVERSIFICATION (2005). (15) RePEc:bla:jfnres:v:13:y:1990:i:2:p:155-65 Risky Debt Maturity Choice in a Sequential Game Equilibrium (1990). (16) RePEc:bla:jfnres:v:16:y:1993:i:4:p:269-83 Dual Betas from Bull and Bear Markets: Reversal of the Size Effect (1993). (17) RePEc:bla:jfnres:v:20:y:1997:i:4:p:509-27 Corporate Control in Commercial Banks (1997). (18) RePEc:bla:jfnres:v:26:y:2003:i:3:p:275-299 Equity Market Liberalization in Emerging Markets (2003). (19) RePEc:bla:jfnres:v:24:y:2001:i:4:p:495-512 Executive Compensation Structure and Corporate Governance Choices (2001). (20) RePEc:bla:jfnres:v:22:y:1999:i:4:p:371-83 Random Walk Tests for Latin American Equity Indexes and Individual Firms (1999). (21) RePEc:bla:jfnres:v:25:y:2002:i:4:p:559-575 The Effect of Credit Risk on Bank and Bank Holding Company Bond Yields: Evidence from the Post-FDICIA Period (2002). (22) RePEc:bla:jfnres:v:20:y:1997:i:3:p:305-22 Co-movements in International Equity Markets (1997). (23) RePEc:bla:jfnres:v:23:y:2000:i:4:p:469-93 Alternative Tests of the Zero-Beta CAPM (2000). (24) RePEc:bla:jfnres:v:25:y:2002:i:2:p:283-299 A COMPARISON OF SEASONAL ADJUSTMENT METHODS WHEN FORECASTING INTRADAY VOLATILITY (2002). (25) RePEc:bla:jfnres:v:18:y:1995:i:1:p:1-13 Bank Exposure to Interest Rate Risk: A Global Perspective (1995). (26) RePEc:bla:jfnres:v:20:y:1997:i:3:p:291-304 Market Structure and Reported Trading Volume: NASDAQ versus the NYSE (1997). (27) RePEc:bla:jfnres:v:27:y:2004:i:1:p:75-94 Decimals And Liquidity: A Study Of The Nyse (2004). (28) RePEc:bla:jfnres:v:20:y:1997:i:1:p:93-110 The Survival of Initial Public Offerings in the Aftermarket (1997). (29) RePEc:bla:jfnres:v:19:y:1996:i:2:p:273-92 Mutual Fund Brokerage Commissions (1996). (30) RePEc:bla:jfnres:v:24:y:2001:i:4:p:523-43 Stock Returns and Volatility on Chinas Stock Markets (2001). (31) RePEc:bla:jfnres:v:18:y:1995:i:4:p:415-30 Determinants of Persistence in Relative Performance of Mutual Funds (1995). (32) RePEc:bla:jfnres:v:24:y:2001:i:1:p:133-55 Foreign Ownership Restrictions and Market Segmentation in Chinas Stock Markets (2001). (33) RePEc:bla:jfnres:v:14:y:1991:i:2:p:155-65 Bank Failure and Contagion Effects: Evidence from Hong Kong (1991). (34) RePEc:bla:jfnres:v:17:y:1994:i:2:p:231-40 A Re-examination of the Effect of 12B-1 Plans on Mutual Fund Expense Ratios (1994). (35) RePEc:bla:jfnres:v:20:y:1997:i:2:p:211-29 Price Pressure and the Role of Institutional Investors in Closed-End Funds (1997). (36) RePEc:bla:jfnres:v:23:y:2000:i:3:p:373-90 The Effect of CEO Tenure on the Relation between Firm Performance and Turnover (2000). (37) RePEc:bla:jfnres:v:29:y:2006:i:4:p:463-479 INDIVIDUAL EQUITY RETURN DATA FROM THOMSON DATASTREAM: HANDLE WITH CARE! (2006). (38) RePEc:bla:jfnres:v:28:y:2005:i:3:p:385-402 AGENT BANK BEHAVIOR IN BANK LOAN SYNDICATIONS (2005). (39) RePEc:bla:jfnres:v:24:y:2001:i:4:p:465-93 Venture Capital and IPO Lockup Expiration: An Empirical Analysis (2001). (40) RePEc:bla:jfnres:v:14:y:1991:i:4:p:303-15 Hourly Returns, Volume, Trade Size, and Number of Trades (1991). (41) RePEc:bla:jfnres:v:20:y:1997:i:3:p:355-72 Fractional Differencing Modeling and Forecasting of Eurocurrency Deposit Rates (1997). (42) RePEc:bla:jfnres:v:15:y:1992:i:3:p:285-96 The Term Structure of Interest Rates as a Cointegrated System: Empirical Evidence from the Eurocurrency Market (1992). (43) RePEc:bla:jfnres:v:24:y:2001:i:4:p:587-602 Stock Prices and Inflation (2001). (44) RePEc:bla:jfnres:v:27:y:2004:i:1:p:115-132 The Evolution Of Bank Resolution Policies In Japan: Evidence From Market Equity Values (2004). (45) RePEc:bla:jfnres:v:16:y:1993:i:4:p:309-20 The Debt Maturity Choice: An Empirical Investigation (1993). (46) RePEc:bla:jfnres:v:17:y:1994:i:2:p:187-203 Nonlinear Dynamics and the Distribution of Daily Stock Index Returns (1994). (47) RePEc:bla:jfnres:v:20:y:1997:i:3:p:389-406 Changes in Market Perception of Riskiness: The Case of Too-Big-to-Fail (1997). (48) RePEc:bla:jfnres:v:22:y:1999:i:4:p:385-411 An Empirical Examination of Financial Liberalization and the Efficiency of Emerging Market Stock Prices (1999). (49) RePEc:bla:jfnres:v:26:y:2003:i:1:p:19-30 Regulation And The Rise In Asset-Based Mutual Fund Management Fees (2003). (50) RePEc:bla:jfnres:v:24:y:2001:i:3:p:403-18 Analysis of Federal Funds Rate Changes and Variance Patterns (2001). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 (1) RePEc:nbr:nberwo:11701 International Capital Flows, Returns and World Financial Integration (2005). National Bureau of Economic Research, Inc / NBER Working Papers Recent citations received in: 2004 (1) RePEc:fip:fedfpb:2004-27 Market price accounting and depositor discipline in Japanese regional banks (2004). Federal Reserve Bank of San Francisco / Pacific Basin Working Paper Series Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||