|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

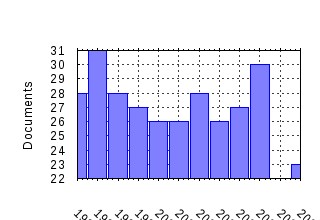

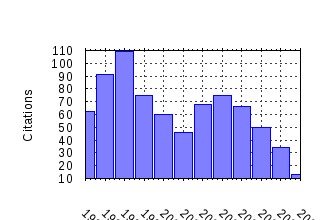

Real Estate Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:reesec:v:18:y:1990:i:4:p:431-452 Risk and Return on Real Estate: Evidence from Equity REITs (1990). (2) RePEc:bla:reesec:v:17:y:1989:i:4:p:389-402 The Impacts of Borrowing Constraints on Homeownership (1989). (3) RePEc:bla:reesec:v:18:y:1990:i:3:p:253-273 Forecasting Prices and Excess Returns in the Housing Market (1990). (4) RePEc:bla:reesec:v:16:y:1988:i:4:p:396-410 The Duration of Marketing Time of Residential Housing (1988). (5) RePEc:bla:reesec:v:12:y:1984:i:3:p:219-242 Real Estate Returns: A Comparison with Other Investments (1984). (6) RePEc:bla:reesec:v:20:y:1992:i:3:p:457-485 What Does the Stock Market Tell Us About Real Estate Returns? (1992). (7) RePEc:bla:reesec:v:12:y:1984:i:3:p:333-354 Real Estate Investment Funds: Performance and Portfolio Considerations (1984). (8) RePEc:bla:reesec:v:14:y:1986:i:2:p:230-254 Diversification Categories in Investment Real Estate (1986). (9) RePEc:bla:reesec:v:13:y:1985:i:1:p:32-47 Rental Price Adjustment and Investment in the Office Market (1985). (10) RePEc:bla:reesec:v:19:y:1991:i:3:p:286-307 On Choosing Among House Price Index Methodologies (1991). (11) RePEc:bla:reesec:v:26:y:1998:i:4:p:719-740 Selling Time and Selling Price: The Influence of Seller Motivation (1998). (12) RePEc:bla:reesec:v:32:y:2004:i:4:p:541-569 The Effect of Conforming Loan Status on Mortgage Yield Spreads: A Loan Level Analysis (2004). (13) RePEc:bla:reesec:v:4:y:1976:i:2:p:57-75 An Empirical Study of Time on Market Using Multidimensional Segmentation of Housing Markets (1976). (14) RePEc:bla:reesec:v:20:y:1992:i:4:p:533-548 A Simple Search and Bargaining Model of Real Estate Markets (1992). (15) RePEc:bla:reesec:v:23:y:1995:i:3:p:347-368 The Strategic Role of Listing Price in Marketing Real Estate: Theory and Evidence (1995). (16) RePEc:bla:reesec:v:31:y:2003:i:2:p:269-303 Controlling for the Impact of Variable Liquidity in Commercial Real Estate Price Indices (2003). (17) RePEc:bla:reesec:v:32:y:2004:i:1:p:1-32 An Anatomy of Price Dynamics in Illiquid Markets: Analysis and Evidence from Local Housing Markets (2004). (18) RePEc:bla:reesec:v:22:y:1994:i:1:p:33-58 Bank Real Estate Lending and the New England Capital Crunch (1994). (19) RePEc:bla:reesec:v:27:y:1999:i:2:p:365-387 The Workings of the London Office Market (1999). (20) RePEc:bla:reesec:v:25:y:1997:i:2:p:253-270 Follow the Leader: How Changes in Residential and Non-residential Investment Predict Changes in GDP (1997). (21) RePEc:bla:reesec:v:25:y:1997:i:2:p:321-345 Do Common Risk Factors in the Returns on Stocks and Bonds Explain Returns on REITs? (1997). (22) RePEc:bla:reesec:v:21:y:1993:i:4:p:431-449 Mortgage Prepayment and Default Decisions: A Poisson Regression Approach (1993). (23) RePEc:bla:reesec:v:30:y:2002:i:4:p:635-666 Does Homeownership Affect Child Outcomes? (2002). (24) RePEc:bla:reesec:v:33:y:2005:i:3:p:427-463 The Effect of Housing Government-Sponsored Enterprises on Mortgage Rates (2005). (25) RePEc:bla:reesec:v:26:y:1998:i:4:p:555-580 Dividend Policy and Cash-Flow Uncertainty (1998). (26) RePEc:bla:reesec:v:18:y:1990:i:3:p:302-312 Retail Leasing: The Determinants of Shopping Center Rents (1990). (27) RePEc:bla:reesec:v:27:y:1999:i:2:p:209-230 Real Estate Cycles: Some Fundamentals (1999). (28) RePEc:bla:reesec:v:29:y:2001:i:3:p:361-387 The Information Content of Method of Payment in Mergers: Evidence from Real Estate Investment Trusts (REITs) (2001). (29) RePEc:bla:reesec:v:22:y:1994:i:1:p:59-94 Bank Capital and the Credit Crunch: The Roles of Risk-Weighted and Unweighted Capital Regulations (1994). (30) RePEc:bla:reesec:v:25:y:1997:i:4:p:631-655 Mortgage Default in Local Markets (1997). (31) RePEc:bla:reesec:v:17:y:1989:i:2:p:218-230 Inferring an Investment Return Series for Real Estate from Observations on Sales (1989). (32) RePEc:bla:reesec:v:17:y:1989:i:2:p:261-266 The Economics of Architecture and Urban Design: Some Preliminary Findings (1989). (33) RePEc:bla:reesec:v:19:y:1991:i:3:p:259-269 House Price Indexes: Issues and Results (1991). (34) RePEc:bla:reesec:v:17:y:1989:i:2:p:231-234 Inferring an Investment Return Series for Real Estate from Observations on Sales (1989). (35) RePEc:bla:reesec:v:19:y:1991:i:3:p:396-416 House Prices and Regional Real Estate Cycles: Market Adjustments in Houston (1991). (36) RePEc:bla:reesec:v:23:y:1995:i:1:p:21-44 Price Discovery in American and British Property Markets (1995). (37) RePEc:bla:reesec:v:26:y:1998:i:2:p:235-274 New Place-to-Place Housing Price Indexes for U.S. Metropolitan Areas, and Their Determinants (1998). (38) RePEc:bla:reesec:v:20:y:1992:i:1:p:25-54 The Fractal Structure of Real Estate Investment Trust Returns: The Search for Evidence of Market Segmentation and Nonlinear Dependency (1992). (39) RePEc:bla:reesec:v:17:y:1989:i:4:p:463-481 Estimating Real Estates Systematic Risk from Aggregate Level Appraisal-Based Returns (1989). (40) RePEc:bla:reesec:v:19:y:1991:i:3:p:270-285 Housing Price Indices Based on All Transactions Compared to Repeat Subsamples (1991). (41) RePEc:bla:reesec:v:17:y:1989:i:2:p:235-260 The Economics of Architecture and Urban Design: Some Preliminary Findings (1989). (42) RePEc:bla:reesec:v:30:y:2002:i:2:p:213-237 Listing Price, Time on Market, and Ultimate Selling Price: Causes and Effects of Listing Price Changes (2002). (43) RePEc:bla:reesec:v:17:y:1989:i:2:p:177-193 Credit Rationing and Government Loan Programs: A Welfare Analysis (1989). (44) RePEc:bla:reesec:v:14:y:1986:i:3:p:414-431 Risk and the Performance of Real Estate Investment Trusts: A Multiple Index Approach (1986). (45) RePEc:bla:reesec:v:23:y:1995:i:1:p:85-100 Market Microstructure and Real Estate Returns (1995). (46) RePEc:bla:reesec:v:27:y:1999:i:3:p:483-515 The Integration of Commercial Real Estate Markets and Stock Markets (1999). (47) RePEc:bla:reesec:v:26:y:1998:i:3:p:511-535 Appraisal Smoothing: The Other Side of the Story (1998). (48) RePEc:bla:reesec:v:25:y:1997:i:3:p:487-503 Using Nonlinear Tests to Examine Integration Between Real Estate and Stock Markets (1997). (49) RePEc:bla:reesec:v:26:y:1998:i:3:p:259-289 The Conditional Probability of Mortgage Default (1998). (50) RePEc:bla:reesec:v:15:y:1987:i:1:p:601-616 Has the United States Overinvested in Housing? (1987). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 (1) RePEc:fip:fedgfe:2007-28 Racial dispersion in consumer credit interest rates (2007). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (2) RePEc:fip:fedlsp:2007-05 Understanding the subprime mortgage crisis (2007). Federal Reserve Bank of St. Louis / Supervisory Policy Analysis Working Papers Recent citations received in: 2006 (1) RePEc:spe:wpaper:0616 The Impact of Stadium Announcements on Residential Property Values: Evidence from a Natural Experiment in Dallas-Fort Worth (2006). International Association of Sports Economists / Working Papers Recent citations received in: 2005 (1) RePEc:hud:wpaper:39137 The Relationship Between Homeowner Age and House Price Appreciation (2005). HUD USER, Economic Development / Economic Development Publications (2) RePEc:max:cprwps:74 Do Credit Market Barriers Exist for Minority and Women Entrepreneurs? (2005). Center for Policy Research, Maxwell School, Syracuse University / Center for Policy Research Working Papers (3) RePEc:sce:scecf5:38 Optimal Capital Structure and the Term Structure of Interest Rates (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (4) RePEc:uct:uconnp:2005-21 Economies of Scale and Cost Efficiencies: A Panel-Data Stochastic-Frontier Analysis of Real Estate Investment Trusts (2005). University of Connecticut, Department of Economics / Working papers Recent citations received in: 2004 (1) RePEc:fip:fedawp:2004-26 Fussing and fuming over Fannie and Freddie: how much smoke, how much fire? (2004). Federal Reserve Bank of Atlanta / Working Paper (2) RePEc:kap:jrefec:v:30:y:2004:i:2:p:167-196 On the Economics of Subprime Lending (2004). The Journal of Real Estate Finance and Economics (3) RePEc:ste:nystbu:04-27 Fussing and Fuming over Fannie and Freddie: How Much Smoke, How Much Fire? (2004). New York University, Leonard N. Stern School of Business, Department of Economics / Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||