|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

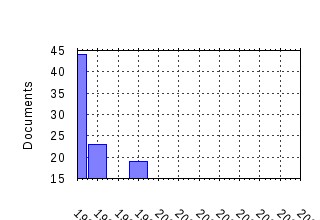

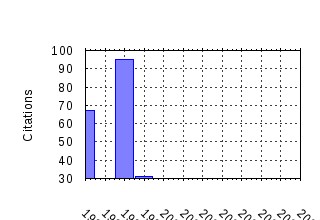

University of Bonn, Germany / Discussion Paper Serie B Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bon:bonsfb:437 Volatility Clustering in Financial Markets: A Micro-Simulation of Interacting Agents (1998). (2) RePEc:bon:bonsfb:325 RatImage - research Assistance Toolbox for Computer-Aided Human Behavior Experiments (1995). (3) RePEc:bon:bonsfb:270 Experimental Sealed Bid First Price Auctions with Directly Observed Bid Functions (1994). (4) RePEc:bon:bonsfb:438 Scaling and Criticality in a Stochastic Multi-Agent Model of a Financial Market (1998). (5) RePEc:bon:bonsfb:308 Closed Form Solutions for Term Structure Derivatives with Log-Normal Interest Rates (1994). (6) RePEc:bon:bonsfb:343 Money does Not Induce Risk Neutral Behavior, but Binary Lotteries Do even Worse (1995). (7) RePEc:bon:bonsfb:228 An evolutionary analysis of backward and forward induction (0000). (8) RePEc:bon:bonsfb:209 Option Pricing under Incompleteness and Stochastic Volatility (1992). (9) RePEc:bon:bonsfb:275 Muddling Through: Noisy Equilibrium Selection (1994). (10) RePEc:bon:bonsfb:215 Large Games and Economies With Effective Small Groups (1992). (11) RePEc:bon:bonsfb:386 Experimental Proof for the Motivational Importance of Reciprocity (1996). (12) RePEc:bon:bonsfb:391 Market Organization (1996). (13) RePEc:bon:bonsfb:287 Strategic Non-Participation (1994). (14) RePEc:bon:bonsfb:296 Why Imitate, and if so, How? Exploring a Model of Social Evolution (1994). (15) RePEc:bon:bonsfb:447 Testing for Non-Linear Structure in an Artificial Financial Market (1999). (16) RePEc:bon:bonsfb:280 Asymmetry in the EMS revisited: Evidence from the causality analysis of daily Eurorates (1994). (17) RePEc:bon:bonsfb:294 Optional decomposition of supermartingales and hedging contingent claims in incomplete security markets (1994). (18) RePEc:bon:bonsfb:381 Adaptive Learning versus Punishment in Ultimatum Bargaining (1996). (19) RePEc:bon:bonsfb:236 Experimental Results on Interactive Competitive Guessing (1993). (20) RePEc:bon:bonsfb:242 Cheap talk and evolutionary dynamics (0000). (21) RePEc:bon:bonsfb:337 The Stability of European Money Demand: An Investigation of M3H (1995). (22) RePEc:bon:bonsfb:347 The Dynamic (In)Stability of Backwards Induction (1995). (23) RePEc:bon:bonsfb:212 The Direct Approach to Debt Option Pricing (1995). (24) RePEc:bon:bonsfb:452 Teams Take the Better Risks (1999). (25) RePEc:bon:bonsfb:401 Derivative Asset Analysis in Models with Level-Dependent and Stochastic Volatility (1997). (26) RePEc:bon:bonsfb:302 On Smile and Skewness (1994). (27) RePEc:bon:bonsfb:349 Experimental Methods and Elicitation of Values (1995). (28) RePEc:bon:bonsfb:419 Sources of Purchasing Power Disparities Between the G3-Economies (1997). (29) RePEc:bon:bonsfb:191 A demand commitment model of coalition bargaining (0000). (30) RePEc:bon:bonsfb:291 Equity-linked life insurance - a model with stochastic interest rates (1995). (31) RePEc:bon:bonsfb:389 Aspiration Adaptation Theory (1996). (32) RePEc:bon:bonsfb:299 When Does Evolution Lead to Efficiency in Communication Games? (1994). (33) RePEc:bon:bonsfb:131 Staggered entry and unemployment durations - An application to german

data (0000). (34) RePEc:bon:bonsfb:421 Features of Experimentally Observed Bounded Rationality (1997). (35) RePEc:bon:bonsfb:268 An Experiment on Forward- versus Backward Induction (1994). (36) RePEc:bon:bonsfb::181 Envy,greed and anticipation in ultimatum games with incomplete

information: An experimental study (0000). (37) RePEc:bon:bonsfb:292 Descriptive Approaches to Cooperation (1994). (38) RePEc:bon:bonsfb:129 A term structure model and the pricing of interest rate options (0000). (39) RePEc:bon:bonsfb:263 On the Stability of Log-Normal Interest Rate Models and the Pricing

of Eurodollar Futures (1994). (40) RePEc:bon:bonsfb:179 The efficaciousness of small groups and the approximate core property

in games without side payments: Some first results (0000). (41) RePEc:bon:bonsfb:346 Lot Sizing in General Assembly Systems with Setup Costs, Setup Times and Multiple Constrained Resources (1995). (42) RePEc:bon:bonsfb:180 A Term Structure Model and the Pricing of Interest Rate Derivative (1993). (43) RePEc:bon:bonsfb:252 An axiomatic theory of a risk dominance measure for bipolar games

with linear incentives (0000). (44) RePEc:bon:bonsfb:395 Factor Models and the Shape of the Term Structure (1997). (45) RePEc:bon:bonsfb:372 The Pricing and Hedging of Options in Finitely Elastic Markets (1996). (46) RePEc:bon:bonsfb:281 Testing Long-run Neutrality: Empirical Evidence for G7-Countries with Special Emphasis on Germany (1994). (47) RePEc:bon:bonsfb:408 An Experimental Study of Adaptive Behavior in an Oligopolistic Market Game (1997). (48) RePEc:bon:bonsfb:310 Market Volatility and Feedback Effects from Dynamic Hedging (1995). (49) RePEc:bon:bonsfb:363 Anticipatory Learning in Two-Person Games: An Experimental Study, Part II. Learning (1996). (50) RePEc:bon:bonsfb:251 Auctions With Endogenous Bidder Participation (1993). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||