|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

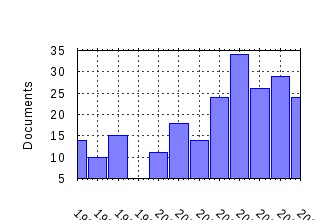

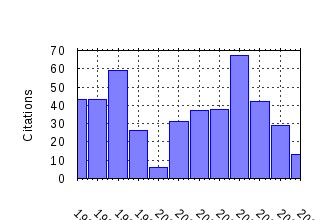

Studies in Nonlinear Dynamics & Econometrics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bpj:sndecm:v:3:y:1998:i:1:n:2 The Decomposition of Economic Relationships by Time Scale Using Wavelets: Expenditure and Income (1998). (2) RePEc:bpj:sndecm:v:2:y:1997:i:1:n:1 Inference in TAR Models (1997). (3) RePEc:bpj:sndecm:v:1:y:1996:i:1:n:re1 A Check on the Robustness of Hamiltons Markov Switching Model Approach to the Economic Analysis of the Business Cycle (1996). (4) RePEc:bpj:sndecm:v:7:y:2003:i:4:n:3 Nonlinearities and Cyclical Behavior: The Role of Chartists and Fundamentalists (2003). (5) RePEc:bpj:sndecm:v:8:y:2004:i:3:n:1 The Long Memory of the Efficient Market (2004). (6) RePEc:bpj:sndecm:v:6:y:2002:i:2:n:3 Asymmetries in Monetary Policy Reaction Function: Evidence for U.S. French and German Central Banks (2002). (7) RePEc:bpj:sndecm:v:9:y:2005:i:1:n:2 A Practitioners Guide to Lag Order Selection For VAR Impulse Response Analysis (2005). (8) RePEc:bpj:sndecm:v:8:y:2004:i:2:n:14 Inference and Forecasting for ARFIMA Models With an Application to US and UK Inflation (2004). (9) RePEc:bpj:sndecm:v:3:y:1999:i:4:n:1 Stability Analysis of Continuous-Time Macroeconometric Systems (1999). (10) RePEc:bpj:sndecm:v:5:y:2001:i:3:n:1 Real Exchange Rate Dynamics in Transition Economies: A Nonlinear Analysis (2001). (11) RePEc:bpj:sndecm:v:11:y:2007:i:4:n:3 Jump-and-Rest Effect of U.S. Business Cycles (2007). (12) RePEc:bpj:sndecm:v:2:y:1997:i:2:n:2 Finite Sample Properties of the Efficient Method of Moments (1997). (13) RePEc:bpj:sndecm:v:3:y:1999:i:4:n:4 Monetary Policy with a Nonlinear Phillips Curve and Asymmetric Loss (1999). (14) RePEc:bpj:sndecm:v:1:y:1997:i:4:n:1 Endogenous Cycles in Competitive Models: An Overview (1997). (15) RePEc:bpj:sndecm:v:2:y:1998:i:4:n:4 GARCH for Irregularly Spaced Financial Data: The ACD-GARCH Model (1998). (16) RePEc:bpj:sndecm:v:9:y:2005:i:4:n:6 Forecasting Stock Market Volatility with Regime-Switching GARCH Models (2005). (17) RePEc:bpj:sndecm:v:3:y:1998:i:3:n:1 Information-Theoretic Analysis of Serial Dependence and Cointegration (1998). (18) RePEc:bpj:sndecm:v:8:y:2004:i:3:n:2 Nonlinear Monetary Policy Rules: Some New Evidence for the U.S. (2004). (19) RePEc:bpj:sndecm:v:6:y:2002:i:3:n:3 Common Persistent Factors in Inflation and Excess Nominal Money Growth and a New Measure of Core Inflation (2002). (20) RePEc:bpj:sndecm:v:8:y:2004:i:2:n:8 Mixture Processes for Financial Intradaily Durations (2004). (21) RePEc:bpj:sndecm:v:8:y:2004:i:3:n:4 Household Income Dynamics in Two Transition Economies (2004). (22) RePEc:bpj:sndecm:v:1:y:1996:i:3:n:al1 SIMANN: A Global Optimization Algorithm using Simulated Annealing (1996). (23) RePEc:bpj:sndecm:v:6:y:2002:i:1:n:3 Characterizing the Degree of Stability of Non-linear Dynamic Models (2002). (24) RePEc:bpj:sndecm:v:7:y:2003:i:4:n:4 The Relationship Between Financial Variables and Real Economic Activity: Evidence From Spectral and Wavelet Analyses (2003). (25) RePEc:bpj:sndecm:v:2:y:1997:i:1:n:2 Investigating Cyclical Asymmetries (1997). (26) RePEc:bpj:sndecm:v:3:y:1998:i:1:n:1 Avoiding the Pitfalls: Can Regime-Switching Tests Reliably Detect Bubbles? (1998). (27) RePEc:bpj:sndecm:v:3:y:1999:i:4:n:2 Sectoral Investigation of Asymmetries in the Conditional Mean Dynamics of the Real U.S. GDP (1999). (28) RePEc:bpj:sndecm:v:10:y:2006:i:4:n:1 Interest Rate Setting and Inflation Targeting: Evidence of a Nonlinear Taylor Rule for the United Kingdom (2006). (29) RePEc:bpj:sndecm:v:8:y:2004:i:1:n:4 An Investigation of Current Account Solvency in Latin America Using Non Linear Nonstationarity Tests (2004). (30) RePEc:bpj:sndecm:v:5:y:2001:i:3:n:2 Evaluating the Persistence and Structuralist Theories of Unemployment from a Nonlinear Perspective (2001). (31) RePEc:bpj:sndecm:v:10:y:2006:i:3:n:2 Point and Interval Forecasting of Spot Electricity Prices: Linear vs. Non-Linear Time Series Models (2006). (32) RePEc:bpj:sndecm:v:7:y:2003:i:4:n:5 Credit Market Imperfections and Business Cycle Dynamics: A Nonlinear Approach (2003). (33) RePEc:bpj:sndecm:v:5:y:2001:i:1:n:7 Wavelet Analysis of the Cost-of-Carry Model (2001). (34) RePEc:bpj:sndecm:v:6:y:2002:i:3:n:2 Power Properties of Nonlinearity Tests for Time Series with Markov Regimes (2002). (35) RePEc:bpj:sndecm:v:5:y:2001:i:3:n:3 Energy Shocks and Financial Markets: Nonlinear Linkages (2001). (36) RePEc:bpj:sndecm:v:10:y:2006:i:3:n:3 The Nature of Power Spikes: A Regime-Switch Approach (2006). (37) RePEc:bpj:sndecm:v:9:y:2005:i:3:n:2 Investigating Nonlinearity: A Note on the Estimation of Hamiltons Random Field Regression Model (2005). (38) RePEc:bpj:sndecm:v:12:y:2008:i:3:n:8 Threshold Adjustment of Deviations from the Law of One Price (2008). (39) RePEc:bpj:sndecm:v:1:y:1996:i:2:n:1 If Nonlinear Models Cannot Forecast, What Use Are They? (1996). (40) RePEc:bpj:sndecm:v:12:y:2008:i:3:n:1 Non-Linear Models: Where Do We Go Next - Time Varying Parameter Models? (2008). (41) RePEc:bpj:sndecm:v:1:y:1996:i:1:n:da1 Forecasting Using First-Available Versus Fully Revised Economic Time-Series Data (1996). (42) RePEc:bpj:sndecm:v:3:y:1998:i:3:n:2 Characterizing Asymmetries in Business Cycles Using Smooth-Transition Structural Time-Series Models (1998). (43) RePEc:bpj:sndecm:v:8:y:2004:i:4:n:2 Combining Forecasts with Nonparametric Kernel Regressions (2004). (44) RePEc:bpj:sndecm:v:10:y:2006:i:2:n:4 Estimation of Value-at-Risk and Expected Shortfall based on Nonlinear Models of Return Dynamics and Extreme Value Theory (2006). (45) RePEc:bpj:sndecm:v:3:y:1999:i:4:n:3 Should Policy Makers Worry about Asymmetries in the Business Cycle? (1999). (46) RePEc:bpj:sndecm:v:6:y:2002:i:1:n:2 Stock Market, Interest Rate and Output: A Model and Estimation for US Time Series Data (2002). (47) RePEc:bpj:sndecm:v:9:y:2005:i:4:n:4 The International CAPM and a Wavelet-Based Decomposition of Value at Risk (2005). (48) RePEc:bpj:sndecm:v:10:y:2006:i:4:n:2 Measuring the Interaction of Wage and Price Phillips Curves for the U.S. Economy (2006). (49) RePEc:bpj:sndecm:v:9:y:2005:i:1:n:re1 Inflation Dynamics of Turkey: A Structural Estimation (2005). (50) RePEc:bpj:sndecm:v:8:y:2004:i:2:n:7 GARCH-type Models with Generalized Secant Hyperbolic Innovations (2004). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:deg:conpap:c011_019 Growth, Sectoral Composition, and the Wealth of Nations (2006). Dynamics, Economic Growth, and International Trade (DEGIT) / Conference Papers (2) RePEc:fip:fedgfe:2007-03 Linear cointegration of nonlinear time series with an application to interest rate dynamics (2006). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (3) RePEc:imk:wpaper:04-2006 Disequilibrium Macroeconomic Dynamics, Income Distribution and Wage-Price Phillips Curves (2006). IMK at the Hans Boeckler Foundation, Macroeconomic Policy Institute / IMK Working Paper (4) RePEc:mcl:mclwop:2006-14 EXTREME DEPENDENCE IN THE NASDAQ AND S&P COMPOSITE INDEXES (2006). McGill University, Department of Economics / Departmental Working Papers (5) RePEc:pra:mprapa:1363 Point and interval forecasting of wholesale electricity prices: Evidence from the Nord Pool market (2006). University Library of Munich, Germany / MPRA Paper (6) RePEc:udc:esteco:v:33:y:2006:i:1:p:65-81 Regime-Dependent output convergence in Latin America (2006). Journal Estudios de Economia Recent citations received in: 2005 (1) RePEc:kap:apfinm:v:12:y:2005:i:3:p:245-271 The volumeââ¬âvolatility relationship and the opening of the Korean stock market to foreign investors after the financial turmoil in 1997 (2005). Asia-Pacific Financial Markets Recent citations received in: 2004 (1) RePEc:ces:ceswps:_1280 Inflation Targeting and Nonlinear Policy Rules: The Case of Asymmetric Preferences (2004). CESifo GmbH / CESifo Working Paper Series (2) RePEc:ecl:riceco:2004-11 A Test of the Martingale Hypothesis (2004). Rice University, Department of Economics / Working Papers (3) RePEc:ecm:ausm04:272 Duration and Order Type Clusters (2004). Econometric Society / Econometric Society 2004 Australasian Meetings (4) RePEc:ecm:feam04:730 Duration and Order Type Clusters (2004). Econometric Society / Econometric Society 2004 Far Eastern Meetings (5) RePEc:kap:apfinm:v:11:y:2004:i:1:p:79-105 A Benchmark Approach to Filtering in Finance (2004). Asia-Pacific Financial Markets (6) RePEc:pit:wpaper:322 Classical and Bayesian Analysis of Univariate and Multivariate Stochastic Volatility Models (2004). University of Pittsburgh, Department of Economics / Working Papers (7) RePEc:sce:scecf4:306 Aggregation of Dependent Risks with Specific Marginals by the Family of Koehler-Symanowski Distributions (2004). Society for Computational Economics / Computing in Economics and Finance 2004 (8) RePEc:ukc:ukcedp:0412 Current Account Sustainability in the US: What Do We Really Know About It? (2004). Department of Economics, University of Kent / Studies in Economics (9) RePEc:zbw:cauewp:2443 Classical and Bayesian Analysis of Univariate and Multivariate Stochastic Volatility Models (2004). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||