|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

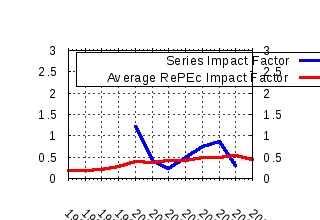

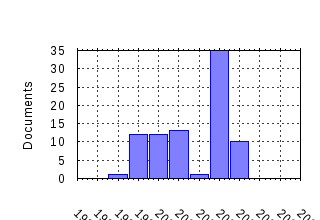

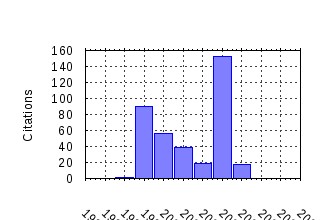

Netherlands Central Bank / DNB Staff Reports (discontinued) Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:dnb:staffs:33 Taylor Rules in a Limited Participation Model (1999). (2) RePEc:dnb:staffs:47 Systemic Risk, Interbank Relations and Liquidity Provision by theCentral Bank (2000). (3) RePEc:dnb:staffs:98 Long-Term Global Market Correlations (2003). (4) RePEc:dnb:staffs:34 The Precarious Fiscal Foundations of EMU (1999). (5) RePEc:dnb:staffs:75 A Theory of the Currency Denomination of International Trade (2002). (6) RePEc:dnb:staffs:65 What Weight Should be Given to Asset Prices in the Measurementof Inflation? (2001). (7) RePEc:dnb:staffs:86 Cyclical Patterns in Profits, Provisioning and Lending of Banks (2003). (8) RePEc:dnb:staffs:100 Globalisation and Market Structure (2003). (9) RePEc:dnb:staffs:91 Foreign Bank Penetration and Private Sector Credit in Central and Eastern Europe (2003). (10) RePEc:dnb:staffs:79 How has the euro Changed the Foreign Exchange Market? (2003). (11) RePEc:dnb:staffs:35 The Exchange Rate and the Monetary Transmission Mechanism in Germany (1999). (12) RePEc:dnb:staffs:76 Commodity Currencies and Empirical Exchange Rate Puzzles (2003). (13) RePEc:dnb:staffs:62 Asset Prices in the Measurement of Inflation (2001). (14) RePEc:dnb:staffs:101 Is Wealth Increasingly Driving Consuption? (2003). (15) RePEc:dnb:staffs:105 Central Bank Transparency in Theory and Practice (2003). (16) RePEc:dnb:staffs:109 Foreign Banks and Credit Stability in Central and Eastern Europe: A Panel Data Analysis (2003). (17) RePEc:dnb:staffs:114 A Taylor Rule for the Euro Area Based on Quasi-Real Time Data (2004). (18) RePEc:dnb:staffs:119 Coordination of Expectations in Asset Pricing Experiments (0000). (19) RePEc:dnb:staffs:40 Value-at-Risk Analysis of Stock Returns Historical Simulation,Variance Techniques or Tail Index Estimation? (1999). (20) RePEc:dnb:staffs:44 Output Gap and Inflation in the EU (2000). (21) RePEc:dnb:staffs:55 Consumers Inflation Expectations and Monetary Policy in Europe (2000). (22) RePEc:dnb:staffs:93 Is Financial Market Volatility Informative to Predict Recessions? (2003). (23) RePEc:dnb:staffs:110 Corporate Investment and Financing Constraints: Connections with Cash management (2003). (24) RePEc:dnb:staffs:67 Core Inflation and Monetary Policy (2001). (25) RePEc:dnb:staffs:125 Market Impact Costs of Institutional Equity Trades (2004). (26) RePEc:dnb:staffs:92 Does Competition Enhancement Have Permanent Inflation Effects? (2003). (27) RePEc:dnb:staffs:95 Financial Globalization and Monetary Policy (2003). (28) RePEc:dnb:staffs:107 Forecasting inflation: An art as well as a science! (2003). (29) RePEc:dnb:staffs:38 Fiscal Restraints, ECB Credibility and the Stability Pact:A Game-Theoretic Perspective (1999). (30) RePEc:dnb:staffs:97 Global vs.Local Competition (2003). (31) RePEc:dnb:staffs:111 Bank Provisioning Behaviour and Procyclicality (2003). (32) RePEc:dnb:staffs:63 Performance of core inflation measures (2001). (33) repec:dnb:staffs:60 (). (34) RePEc:dnb:staffs:88 Aiming for the Bulls Eye: Inflation Targeting under Uncertainty (2004). (35) RePEc:dnb:staffs:48 Banking and Currency Crises and Systemic Risk: A Taxonomy and Review (2000). (36) RePEc:dnb:staffs:99 The Importance of Multinational Companies for Global Economic Linkages (2003). (37) repec:dnb:staffs:53 (). (38) RePEc:dnb:staffs:36 Monetary Transmission and Controllability of Money in Europe: aStructural Vector Error Correction Approach (1999). (39) RePEc:dnb:staffs:66 Evaluating Core Inflation (2001). (40) RePEc:dnb:staffs:78 Exchange Rates and Fundamentals a Non-Linear Relationship? (2003). (41) RePEc:dnb:staffs:64 Asset Prices, Monetary Policy and Macroeconomic Stability (2001). (42) RePEc:dnb:staffs:122 Central Bank Communication and Output Stabilization (2004). (43) RePEc:dnb:staffs:70 Banking competition, risk and regulation (2001). (44) RePEc:dnb:staffs:87 Efficiency and Cost Differences across Countries in a Unified EuropeanBanking Market (2003). (45) RePEc:dnb:staffs:113 The Dynamic Properties of Inflation Targeting Under Uncertainty (2004). (46) RePEc:dnb:staffs:94 The Trilemma in History:Tradeoffs among Exchange Rates, Monetary Policies,and Capital Mobility (2003). (47) RePEc:dnb:staffs:72 Low inflation at no cost? A numerical simulations exercise (2001). (48) RePEc:dnb:staffs:121 Inflation Expectations and Learning about Monetary Policy (2004). (49) RePEc:dnb:staffs:106 The (A)Symmetry of shocks in the EMU (2003). (50) RePEc:dnb:staffs:68 Competition, Concentration and their Relationship: an EmpiricalAnalysis of the Banking Industry (2001). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 (1) RePEc:ces:ceswps:_1204 The Role of the IFO Business Climate Indicator and Asset Prices in German Monetary Policy (2004). CESifo GmbH / CESifo Working Paper Series (2) RePEc:dnb:dnbwpp:017 Inflation Targets as Focal Points (2004). Netherlands Central Bank, Research Department / DNB Working Papers (3) RePEc:dnb:staffs:113 The Dynamic Properties of Inflation Targeting Under Uncertainty (2004). Netherlands Central Bank / DNB Staff Reports (discontinued) (4) RePEc:zbw:bubdp1:2299 Interest rate reaction functions for the euro area Evidence from panel data analysis (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||