|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

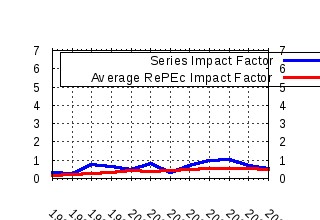

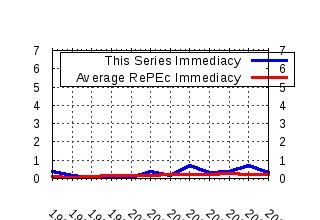

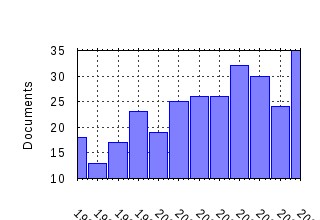

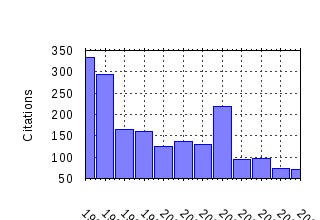

Journal of Empirical Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:empfin:v:1:y:1993:i:1:p:83-106 A long memory property of stock market returns and a new model (1993). (2) RePEc:eee:empfin:v:3:y:1996:i:2:p:123-192 The forward discount anomaly and the risk premium: A survey of recent evidence (1996). (3) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:115-158 Intraday periodicity and volatility persistence in financial markets (1997). (4) RePEc:eee:empfin:v:3:y:1996:i:1:p:15-102 The econometrics of financial markets (1996). (5) RePEc:eee:empfin:v:5:y:1998:i:4:p:397-416 Volatility and cross correlation across major stock markets (1998). (6) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:73-114 High frequency data in financial markets: Issues and applications (1997). (7) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:213-239 Volatilities of different time resolutions -- Analyzing the dynamics of market components (1997). (8) RePEc:eee:empfin:v:10:y:2003:i:1-2:p:3-56 Emerging markets finance (2003). (9) RePEc:eee:empfin:v:4:y:1997:i:4:p:317-340 The incremental volatility information in one million foreign exchange quotations (1997). (10) RePEc:eee:empfin:v:7:y:2000:i:3-4:p:271-300 Estimation of tail-related risk measures for heteroscedastic financial time series: an extreme value approach (2000). (11) RePEc:eee:empfin:v:10:y:2003:i:1-2:p:81-103 A simple measure of the intensity of capital controls (2003). (12) RePEc:eee:empfin:v:1:y:1994:i:3-4:p:313-341 Alternative constructions of Tobins q: An empirical comparison (1994). (13) RePEc:eee:empfin:v:6:y:1999:i:5:p:457-477 Forecasting financial market volatility: Sample frequency vis-a-vis forecast horizon (1999). (14) RePEc:eee:empfin:v:9:y:2002:i:5:p:495-510 Market timing and return prediction under model instability (2002). (15) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:187-212 Forecasting the frequency of changes in quoted foreign exchange prices with the autoregressive conditional duration model (1997). (16) RePEc:eee:empfin:v:12:y:2005:i:3:p:476-489 Testing for contagion: a conditional correlation analysis (2005). (17) RePEc:eee:empfin:v:4:y:1997:i:4:p:295-315 Public information releases, private information arrival and volatility in the foreign exchange market (1997). (18) RePEc:eee:empfin:v:8:y:2001:i:5:p:573-637 The specification of conditional expectations (2001). (19) RePEc:eee:empfin:v:1:y:1994:i:2:p:133-160 A contingent claim approach to performance evaluation (1994). (20) RePEc:eee:empfin:v:1:y:1993:i:1:p:3-31 Common stock offerings across the business cycle : Theory and evidence (1993). (21) RePEc:eee:empfin:v:10:y:2003:i:5:p:603-621 Improved estimation of the covariance matrix of stock returns with an application to portfolio selection (2003). (22) RePEc:eee:empfin:v:5:y:1998:i:2:p:131-154 Testing for mean reversion in heteroskedastic data based on Gibbs-sampling-augmented randomization1 (1998). (23) RePEc:eee:empfin:v:9:y:2002:i:3:p:271-285 Asymmetric information and price discovery in the FX market: does Tokyo know more about the yen? (2002). (24) RePEc:eee:empfin:v:11:y:2004:i:3:p:379-398 Modelling daily Value-at-Risk using realized volatility and ARCH type models (2004). (25) RePEc:eee:empfin:v:7:y:2000:i:3-4:p:225-245 Sensitivity analysis of Values at Risk (2000). (26) RePEc:eee:empfin:v:10:y:2003:i:4:p:505-531 Univariate and multivariate stochastic volatility models: estimation and diagnostics (2003). (27) RePEc:eee:empfin:v:14:y:2007:i:3:p:401-423 Measuring financial contagion: A Copula approach (2007). (28) RePEc:eee:empfin:v:6:y:1999:i:4:p:335-353 Multivariate unit root tests of the PPP hypothesis (1999). (29) RePEc:eee:empfin:v:6:y:1999:i:2:p:193-215 Real exchange rates and nontradables: A relative price approach (1999). (30) RePEc:eee:empfin:v:1:y:1994:i:3-4:p:279-311 Neglected common factors in exchange rate volatility (1994). (31) RePEc:eee:empfin:v:1:y:1994:i:2:p:211-248 Testing the covariance stationarity of heavy-tailed time series: An overview of the theory with applications to several financial datasets (1994). (32) RePEc:eee:empfin:v:6:y:1999:i:3:p:309-331 A primer on hedge funds (1999). (33) RePEc:eee:empfin:v:2:y:1995:i:3:p:225-251 The relationship between GARCH and symmetric stable processes: Finding the source of fat tails in financial data (1995). (34) RePEc:eee:empfin:v:4:y:1997:i:1:p:17-46 An artificial neural network-GARCH model for international stock return volatility (1997). (35) RePEc:eee:empfin:v:8:y:2001:i:2:p:111-155 Testing for mean-variance spanning: a survey (2001). (36) RePEc:eee:empfin:v:10:y:2003:i:3:p:321-353 Realized volatility in the futures markets (2003). (37) RePEc:eee:empfin:v:5:y:1998:i:3:p:281-296 International evidence on the stock market and aggregate economic activity (1998). (38) RePEc:eee:empfin:v:1:y:1993:i:1:p:107-131 International asset pricing with alternative distributional specifications (1993). (39) RePEc:eee:empfin:v:8:y:2001:i:5:p:459-491 Why long horizons? A study of power against persistent alternatives (2001). (40) RePEc:eee:empfin:v:14:y:2007:i:2:p:150-167 Firm-level implications of early stage venture capital investment -- An empirical investigation (2007). (41) RePEc:eee:empfin:v:7:y:2000:i:5:p:531-554 Value-at-Risk: a multivariate switching regime approach (2000). (42) RePEc:eee:empfin:v:10:y:2003:i:5:p:641-660 Central bank interventions and jumps in double long memory models of daily exchange rates (2003). (43) RePEc:eee:empfin:v:8:y:2001:i:3:p:325-342 Testing and comparing Value-at-Risk measures (2001). (44) RePEc:eee:empfin:v:1:y:1993:i:1:p:33-55 The performance of international asset allocation strategies using conditioning information (1993). (45) RePEc:eee:empfin:v:2:y:1995:i:3:p:173-197 The structure of international stock returns and the integration of capital markets (1995). (46) RePEc:eee:empfin:v:2:y:1995:i:3:p:199-223 Testing for continuous-time models of the short-term interest rate (1995). (47) RePEc:eee:empfin:v:13:y:2006:i:3:p:274-315 Instability of return prediction models (2006). (48) RePEc:eee:empfin:v:9:y:2002:i:5:p:551-562 Estimating daily volatility in financial markets utilizing intraday data (2002). (49) RePEc:eee:empfin:v:7:y:2000:i:5:p:509-530 Bivariate FIGARCH and fractional cointegration (2000). (50) RePEc:eee:empfin:v:13:y:2006:i:3:p:316-350 Stock market development and internationalization: Do economic fundamentals spur both similarly? (2006). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 (1) RePEc:aah:create:2007-17 Expected Stock Returns and Variance Risk Premia (2007). School of Economics and Management, University of Aarhus / CREATES Research Papers (2) RePEc:cep:stiecm:/2007/524 Efficient Estimation of a SemiparametricCharacteristic-Based Factor Model of Security Returns (2007). Suntory and Toyota International Centres for Economics and Related Disciplines, LSE / STICERD - Econometrics Paper Series (3) RePEc:cmf:wpaper:wp2007_0714 TESTING UNCOVERED INTEREST PARITY: A CONTINUOUS-TIME APPROACH (2007). CEMFI / Working Papers (4) RePEc:col:000094:003961 Evidence of non-Markovian behavior in the process of bank rating migrations (2007). TITULARIZADORA COLOMBIANA / INFORMES (5) RePEc:col:000094:004016 Evidence of non-Markovian behavior in the process of bank rating migrations (2007). TITULARIZADORA COLOMBIANA / INFORMES (6) RePEc:dgr:umamet:2007052 Testing for Asset Market Linkages: A new Approach based on Time-Varying Copulas (2007). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (7) RePEc:dgr:uvatin:20070046 Quantile Forecasting for Credit Risk Management using possibly Mis-specified Hidden Markov Models (2007). Tinbergen Institute / Tinbergen Institute Discussion Papers (8) RePEc:imf:imfwpa:07/157 What Drives Stock Market Development in the Middle East and Central Asia--Institutions, Remittances, or Natural Resources? (2007). International Monetary Fund / IMF Working Papers (9) RePEc:pra:mprapa:5319 Forecasting volatility: Evidence from the Macedonian stock exchange (2007). University Library of Munich, Germany / MPRA Paper (10) RePEc:pra:mprapa:6265 Venture Capitalists, Asymmetric Information and Ownership in the Innovation Process (2007). University Library of Munich, Germany / MPRA Paper (11) RePEc:pra:mprapa:6318 Joint Modeling of Call and Put Implied Volatility (2007). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2006 (1) RePEc:bde:opaper:0608 House prices and real interest rates in Spain (2006). Banco de Espana / Banco de Espana Occasional Papers (2) RePEc:bde:wpaper:0605 The interaction between house prices and loans for house purchase. The Spanish case (2006). Banco de Espana / Banco de Espana Working Papers (3) RePEc:bde:wpaper:0609 House prices and rents in Spain: does the discount factor matter? (2006). Banco de Espana / Banco de Espana Working Papers (4) RePEc:cam:camdae:0602 Learning, Structural Instability and Present Value Calculations (2006). Faculty of Economics (formerly DAE), University of Cambridge / Cambridge Working Papers in Economics (5) RePEc:cor:louvco:2006089 The information content of the Bond-Equity Yield Ratio: better than a random walk? (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (6) RePEc:cor:louvco:2006090 Short-term market timing using the Bond-Equity Yield Ratio (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (7) RePEc:cpr:ceprdp:5689 House Prices, Rents and Interest Rates Under Collateral Constraints (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (8) RePEc:cra:wpaper:2006-27 Using Markets to Measure Pre-War Threat Assessments: The Nordic Countries facing World War II (2006). Center for Research in Economics, Management and the Arts (CREMA) / CREMA Working Paper Series (9) RePEc:hhs:iuiwop:0676 Using Markets to Measure Pre-War Threat Assessments: The Nordic Countries Facing World War II (2006). The Research Institute of Industrial Economics / IUI Working Paper Series (10) RePEc:par:dipeco:2006-se02 Robust volatility forecasts and model selection in financial time series (2006). Department of Economics, Parma University (Italy) / Economics Department Working Papers (11) RePEc:sce:scecfa:529 Learning, structural instability and present value calculations (2006). Society for Computational Economics / Computing in Economics and Finance 2006 (12) RePEc:scp:wpaper:06-42 Learning, Structural Instability and Present Value Calculations (2006). Institute of Economic Policy Research (IEPR) / IEPR Working Papers (13) RePEc:tud:ddpiec:169 The Foreign Exchange Rate Exposure of Nations (2006). Institut für Volkswirtschaftslehre (Department of Economics), Technische Universität Darmstadt (Darmstadt University of Technology) / Darmstadt Disc (14) RePEc:wbk:wbrwps:3854 Competitive implications of cross-border banking (2006). The World Bank / Policy Research Working Paper Series (15) RePEc:wbk:wbrwps:3933 Internationalization and the evolution of corporate valuation (2006). The World Bank / Policy Research Working Paper Series (16) RePEc:wbk:wbrwps:3963 Financial development in Latin America : big emerging issues, limited policy answers (2006). The World Bank / Policy Research Working Paper Series (17) RePEc:zbw:bubdp1:4756 Learning, structural instability and present value calculations (2006). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies Recent citations received in: 2005 (1) RePEc:bru:bruedp:05-08 TESTING FOR FINANCIAL CONTAGION BETWEEN DEVELOPED AND EMERGING MARKETS DURING THE 1997 EAST ASIAN CRISIS (2005). Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers (2) RePEc:cfs:cfswop:wp200533 The Volatility of Realized Volatility (2005). Center for Financial Studies / CFS Working Paper Series (3) RePEc:cpr:ceprdp:5261 Rational Inattention: A Solution to the Forward Discount Puzzle (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:crt:wpaper:0521 Conditional autoregressive valu at risk by regression quantile: Estimatingmarket risk for major stock markets (2005). University of Crete, Department of Economics / Working Papers (5) RePEc:dgr:kubcen:200599 Testing for mean-coherent regular risk spanning (2005). Tilburg University, Center for Economic Research / Discussion Paper (6) RePEc:dul:wpaper:06-07rs Sector diversification during crises: A European perspective (2005). Université libre de Bruxelles, Department of Applied Economics (DULBEA) / Working Papers DULBEA (7) RePEc:eea:boewps:wp2005-06 Application of investment models in foreign exchange reserve management in Eesti Pank (2005). Bank of Estonia / Bank of Estonia Working Papers (8) RePEc:ijf:ijfiec:v:10:y:2005:i:4:p:359-367 Testing for financial contagion between developed and emerging markets during the 1997 East Asian crisis (2005). International Journal of Finance & Economics (9) RePEc:nbr:nberwo:11452 The Effects of Taxes on Market Responses to Dividend Announcements and Payments: What Can we Learn from the 2003 Dividend Tax Cut? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (10) RePEc:sca:scaewp:0512 Do the technical indicators reward chartists? A study on the stock markets of China, Hong Kong and Taiwan (2005). National University of Singapore, Department of Economics, SCAPE / SCAPE Policy Research Working Paper Series (11) RePEc:sce:scecf5:384 The Long and the Short of It: Long Memory Regressors and Predictive Regressions (2005). Society for Computational Economics / Computing in Economics and Finance 2005 Recent citations received in: 2004 (1) RePEc:cor:louvco:2004057 Dynamic optimal portfolio selection in a VaR framework (2004). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (2) RePEc:ctl:louvec:2005015 Volatility regimes and the provisions of liquidity in order book markets (2004). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (3) RePEc:dgr:eureri:30001967 Fund liquidation, self-selection and look-ahead bias in the hedge fund industry (2004). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (4) RePEc:dgr:uvatin:20040016 Forecasting Daily Variability of the S&P 100 Stock Index using Historical, Realised and Implied Volatility Measurements (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (5) RePEc:dgr:uvatin:20040067 Modeling and Forecasting S&P 500 Volatility: Long Memory, Structural Breaks and Nonlinearity (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (6) RePEc:ecl:ohidic:2004-2 Limits of Arbitrage, Sentiment and Pricing Kernal: Evidences from Index Options (2004). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (7) RePEc:fip:fedkrw:rwp04-07 Aggregate consumption-wealth ratio and the cross-section of stock returns: some international evidence (2004). Federal Reserve Bank of Kansas City / Research Working Paper (8) RePEc:hkm:wpaper:232004 Momentum Trading, Mean Reveral and Overration in Chinese Stock Market. (2004). Hong Kong Institute for Monetary Research / Working Papers (9) RePEc:nbb:reswpp:200405-5 How does liquidity react to stress periods in a limit order market? (2004). National Bank of Belgium / Research series (10) RePEc:zbw:bubdp1:2162 Who do you trust while bubbles grow and blow? : A comparative analysis of the explanatory power of accounting and patent information for the market values of German firms (2004). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||