|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

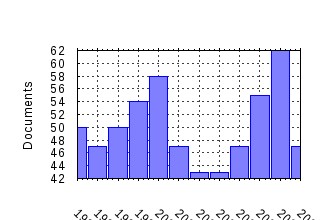

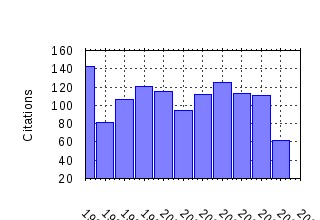

Journal of Mathematical Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:mateco:v:18:y:1989:i:2:p:141-153 Maxmin expected utility with non-unique prior (1989). (2) RePEc:eee:mateco:v:1:y:1974:i:1:p:67-96 Subjectivity and correlation in randomized strategies (1974). (3) RePEc:eee:mateco:v:19:y:1990:i:3:p:305-321 Nash equilibrium with strategic complementarities (1990). (4) RePEc:eee:mateco:v:16:y:1987:i:1:p:65-88 Expected utility with purely subjective non-additive probabilities (1987). (5) RePEc:eee:mateco:v:1:y:1974:i:1:p:23-37 On cores and indivisibility (1974). (6) RePEc:eee:mateco:v:10:y:1982:i:1:p:67-81 Optimal coordination mechanisms in generalized principal-agent problems (1982). (7) RePEc:eee:mateco:v:1:y:1974:i:1:p:15-21 Excess demand functions (1974). (8) RePEc:eee:mateco:v:14:y:1985:i:3:p:285-300 Equilibrium in incomplete markets: I : A basic model of generic existence (1985). (9) RePEc:eee:mateco:v:21:y:1992:i:5:p:461-481 Benefit functions and duality (1992). (10) RePEc:eee:mateco:v:20:y:1991:i:4:p:371-395 Asset pricing for general processes (1991). (11) RePEc:eee:mateco:v:4:y:1977:i:2:p:131-137 Weak versus strong domination in a market with indivisible goods (1977). (12) RePEc:eee:mateco:v:23:y:1994:i:1:p:45-58 Intermediate preferences and stable coalition structures (1994). (13) RePEc:eee:mateco:v:11:y:1983:i:2:p:161-169 Competitive bidding and proprietary information (1983). (14) RePEc:eee:mateco:v:31:y:1999:i:4:p:493-522 Which one should I imitate? (1999). (15) RePEc:eee:mateco:v:2:y:1975:i:3:p:345-348 Equilibrium in abstract economies without ordered preferences (1975). (16) RePEc:eee:mateco:v:2:y:1975:i:1:p:9-15 An equilibrium existence theorem for a general model without ordered preferences (1975). (17) RePEc:eee:mateco:v:14:y:1985:i:2:p:113-128 The taxation principle and multi-time Hamilton-Jacobi equations (1985). (18) RePEc:eee:mateco:v:41:y:2005:i:1-2:p:7-42 Evolutionary dynamics in markets with many trader types (2005). (19) RePEc:eee:mateco:v:18:y:1989:i:2:p:129-139 An equivalence theorem for a bargaining set (1989). (20) RePEc:eee:mateco:v:10:y:1982:i:2-3:p:233-267 An integration of equilibrium theory and turnpike theory (1982). (21) RePEc:eee:mateco:v:19:y:1990:i:1-2:p:1-38 An introduction to general equilibrium with incomplete asset markets (1990). (22) RePEc:eee:mateco:v:26:y:1996:i:1:p:103-131 Debt constraints and equilibrium in infinite horizon economies with incomplete markets (1996). (23) RePEc:eee:mateco:v:25:y:1996:i:1:p:123-141 Sensitivity analysis of multisector optimal economic dynamics (1996). (24) RePEc:eee:mateco:v:26:y:1996:i:1:p:133-170 Incomplete markets over an infinite horizon: Long-lived securities and speculative bubbles (1996). (25) RePEc:eee:mateco:v:17:y:1988:i:1:p:77-87 Anonymous sequential games (1988). (26) RePEc:eee:mateco:v:21:y:1992:i:5:p:483-508 Optimal licensing of cost-reducing innovation (1992). (27) RePEc:eee:mateco:v:2:y:1975:i:2:p:263-295 A model of equilibrium with differentiated commodities (1975). (28) RePEc:eee:mateco:v:38:y:2002:i:3:p:329-339 Strategy-proofness and population-monotonicity for house allocation problems (2002). (29) RePEc:eee:mateco:v:21:y:1992:i:3:p:271-299 The market game: existence and structure of equilibrium (1992). (30) RePEc:eee:mateco:v:11:y:1983:i:3:p:277-300 The epsilon core of a large replica game (1983). (31) RePEc:eee:mateco:v:40:y:2004:i:1-2:p:1-40 Equilibrium behavior in markets and games: testable restrictions and identification (2004). (32) RePEc:eee:mateco:v:20:y:1991:i:5:p:465-487 A variational problem arising in financial economics (1991). (33) RePEc:eee:mateco:v:10:y:1982:i:1:p:115-145 Cores of effectivity functions and implementation theory (1982). (34) RePEc:eee:mateco:v:8:y:1981:i:1:p:15-35 Arbitrage and equilibrium in economies with infinitely many commodities (1981). (35) RePEc:eee:mateco:v:39:y:2003:i:7:p:777-802 Intertemporal equity and the extension of the Ramsey criterion (2003). (36) RePEc:eee:mateco:v:19:y:1990:i:1-2:p:113-151 Generic inefficiency of stock market equilibrium when markets are incomplete (1990). (37) RePEc:eee:mateco:v:19:y:1990:i:1-2:p:153-165 Observability and optimality (1990). (38) RePEc:eee:mateco:v:39:y:2003:i:5-6:p:619-655 Equilibrium analysis, banking and financial instability (2003). (39) RePEc:eee:mateco:v:18:y:1989:i:1:p:1-27 Continuous subjective expected utility with non-additive probabilities (1989). (40) RePEc:eee:mateco:v:1:y:1974:i:1:p:51-62 Random economies with many interacting agents (1974). (41) RePEc:eee:mateco:v:3:y:1976:i:2:p:131-134 How to discard `free disposability - at no cost (1976). (42) RePEc:eee:mateco:v:40:y:2004:i:6:p:647-681 Decision making with imprecise probabilistic information (2004). (43) RePEc:eee:mateco:v:38:y:2002:i:1-2:p:1-41 Incentives and the core of an exchange economy: a survey (2002). (44) RePEc:eee:mateco:v:3:y:1976:i:2:p:107-120 A convergent process of price adjustment and global newton methods (1976). (45) RePEc:eee:mateco:v:19:y:1990:i:1-2:p:195-216 The structure of financial equilibrium with exogenous yields : The case of restricted participation (1990). (46) RePEc:eee:mateco:v:9:y:1982:i:1-2:p:83-97 Simplicial approximation of unemployment equilibria (1982). (47) RePEc:eee:mateco:v:4:y:1977:i:1:p:1-56 Concavifiability and constructions of concave utility functions (1977). (48) RePEc:eee:mateco:v:34:y:2000:i:1:p:77-97 Consistency in house allocation problems (2000). (49) RePEc:eee:mateco:v:21:y:1992:i:4:p:301-342 Real effects of money in general equilibrium (1992). (50) RePEc:eee:mateco:v:10:y:1982:i:1:p:1-3 Introduction (1982). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 (1) RePEc:iza:izadps:dp3246 Stability and Dynamics in an Overlapping Generations Economy with Flexible Wage Negotiations (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (2) RePEc:kyo:wpaper:643 Reexamination on Updating Choquet Beliefs (2007). Kyoto University, Institute of Economic Research / Working Papers (3) RePEc:kyo:wpaper:644 A General Update Rule for Convex Capacities (2007). Kyoto University, Institute of Economic Research / Working Papers (4) RePEc:man:sespap:0720 Capital growth theory and von Neumann-Gale dynamics (2007). School of Economics, The University of Manchester / The School of Economics Discussion Paper Series (5) RePEc:pra:mprapa:7514 Characterizing Pure-strategy Equilibria in Large Games (2007). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2006 (1) RePEc:ams:ndfwpp:06-12 More hedging instruments may destabilize markets (2006). Universiteit van Amsterdam, Center for Nonlinear Dynamics in Economics and Finance / CeNDEF Working Papers (2) RePEc:chm:wpaper:wp2006-4 Business corruption, uncertainty and risk aversion (2006). CMI (Chr. Michelsen Institute), Bergen, Norway / CMI Working Papers (3) RePEc:clu:wpaper:0506-18 States, models and information: A reconsideration of Ellsbergs paradox (2006). Columbia University, Department of Economics / Discussion Papers (4) RePEc:dgr:kubcen:200651 Competitive equilibria in economies with multiple divisible and indivisible commodities and no money (2006). Tilburg University, Center for Economic Research / Discussion Paper (5) RePEc:isu:genres:12552 On the Nature of Certainty Equivalent Functionals (2006). Iowa State University, Department of Economics / Staff General Research Papers (6) RePEc:kob:dpaper:189 Stochastic Optimal Growth with Bounded or Unbounded Utility and with Bounded or Unbounded Shocks (2006). Research Institute for Economics & Business Administration, Kobe University / Discussion Paper Series (7) RePEc:kyo:wpaper:624 Welfare Gains and Losses in Sunspot Equilibria (2006). Kyoto University, Institute of Economic Research / Working Papers (8) RePEc:man:sespap:0634 A three way equivalence (2006). School of Economics, The University of Manchester / The School of Economics Discussion Paper Series (9) RePEc:sce:scecfa:466 Asset price volatilities and trading volumes in heterogeneous agent economies (2006). Society for Computational Economics / Computing in Economics and Finance 2006 (10) RePEc:spr:joecth:v:29:y:2006:i:1:p:231-237 Almost sure convergence to zero in stochastic growth models (2006). Economic Theory Recent citations received in: 2005 (1) RePEc:ams:ndfwpp:05-01 Heterogeneous Agents Models: two simple examples, forthcoming In: Lines, M. (ed.) Nonlinear Dynamical Systems in Economics, CISM Courses and Lectures, Springer, 2005, pp.131-164. (2005). Universiteit van Amsterdam, Center for Nonlinear Dynamics in Economics and Finance / CeNDEF Working Papers (2) RePEc:ams:ndfwpp:05-17 Wealth-Driven Competition in a Speculative Financial Market: Examples With Maximizing Agents (2005). Universiteit van Amsterdam, Center for Nonlinear Dynamics in Economics and Finance / CeNDEF Working Papers (3) RePEc:att:wimass:200511 Optimal control and spatial heterogeneity : pattern formation in economic-ecological models (2005). Wisconsin Madison - Social Systems / Working papers (4) RePEc:ces:ceswps:_1462 Putting Risk in its Proper Place (2005). CESifo GmbH / CESifo Working Paper Series (5) RePEc:cla:levarc:784828000000000422 Economic Survival when Markets are Incomplete (2005). UCLA Department of Economics / Levine's Working Paper Archive (6) RePEc:cla:levrem:122247000000000935 Bargaining Sets of Majority Voting Games (2005). UCLA Department of Economics / Levine's Bibliography (7) RePEc:dgr:uvatin:20050055 Heterogeneous Agent Models: Two Simple Case Studies (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (8) RePEc:fip:fedbwp:05-16 Heterogeneous beliefs and inflation dynamics: a general equilibrium approach (2005). Federal Reserve Bank of Boston / Working Papers (9) RePEc:hhs:nhhfms:2005_017 Globally Evolutionarily Stable Portfolio Rules (2005). Department of Finance and Management Science, Norwegian School of Economics and Business Administration / Discussion Papers (10) RePEc:huj:dispap:dp410 Bargaining Sets of Majority Voting Games (2005). Center for Rationality and Interactive Decision Theory, Hebrew University, Jerusalem / Discussion Paper Series (11) RePEc:mse:wpsorb:b05098 Asset market equilibrium with short-selling and differential information. (2005). Université Panthéon-Sorbonne (Paris 1) / Cahiers de la Maison des Sciences Economiques (12) RePEc:pra:mprapa:190 On the neutrality of redistribution in a general equilibrium model with public goods (2005). University Library of Munich, Germany / MPRA Paper (13) RePEc:sap:wpaper:88 Asset Price Dynamics in a Financial Market with Heterogeneous Trading Strategies and Time Delays (2005). University of Rome La Sapienza, Department of Public Economics / Working Papers (14) RePEc:ssa:lemwps:2005/06 Price and Wealth Dynamics in a Speculative Market with an Arbitrary Number of Generic Technical Traders (2005). Laboratory of Economics and Management (LEM), Sant'Anna School of Advanced Studies, Pisa, Italy / LEM Papers Series (15) RePEc:ssa:lemwps:2005/27 Wealth-Driven Competition in a Speculative Financial Market: Examples with Maximizing Agents (2005). Laboratory of Economics and Management (LEM), Sant'Anna School of Advanced Studies, Pisa, Italy / LEM Papers Series (16) RePEc:uts:rpaper:162 Market Mood, Adaptive Beliefs and Asset Price Dynamics (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (17) RePEc:wpa:wuwpco:0506001 Breeds of risk-adjusted fundamentalist strategies in an order- driven market (2005). EconWPA / Computational Economics (18) RePEc:wpa:wuwpfi:0504019 Simple market protocols for efficient risk sharing (2005). EconWPA / Finance (19) RePEc:wpa:wuwpfi:0510026 Asset Price Dynamics in a Financial Market with Heterogeneous Trading Strategies and Time Delays (2005). EconWPA / Finance (20) RePEc:zbw:cauewp:3559 A noise trader model as a generator of apparent financial power laws and long memory (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers (21) RePEc:zbw:cauewp:3560 Time-variation of higher moments in a financial market with heterogeneous agents : an analytical approach (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers Recent citations received in: 2004 (1) RePEc:bro:econwp:2004-08 Welfare Cost of Business Cycles When Markets Are Incomplete (2004). Brown University, Department of Economics / Working Papers (2) RePEc:bro:econwp:2004-18 The Type-Agent Core for Exchange Economies with Asymmetric Information (2004). Brown University, Department of Economics / Working Papers (3) RePEc:clt:sswopa:1190 The Relevance of a Choice of Auction Format in a Competitive Environment (2004). California Institute of Technology, Division of the Humanities and Social Sciences / Working Papers (4) RePEc:dgr:kubcen:200476 The collective model of household consumption : a nonparametric characterization (2004). Tilburg University, Center for Economic Research / Discussion Paper (5) RePEc:ecm:nasm04:283 welfare cost of business cycles when markets are incomplete (2004). Econometric Society / Econometric Society 2004 North American Summer Meetings (6) RePEc:hal:cesptp:halshs-00086021_v1 Decision Making with Imprecise Probabilistic Information (2004). HAL / Université Paris1 Panthéon-Sorbonne, Post-Print (7) RePEc:hol:holodi:0428 Testable Restrictions of General Equilibrium Theory in Exchange Economies with Externalities (2004). Department of Economics, Royal Holloway University of London / Royal Holloway, University of London: Discussion Papers in Economics (8) RePEc:hol:holodi:0430 Global identification from the equilibrium manifold under incomplete markets (2004). Department of Economics, Royal Holloway University of London / Royal Holloway, University of London: Discussion Papers in Economics (9) RePEc:iep:wpidep:0406 Lorenz Non-Consistent Welfare and Inequality Measurement (2004). Institut d'economie publique (IDEP), Marseille, France / IDEP Working Papers 2004 (10) RePEc:kap:apfinm:v:11:y:2004:i:3:p:267-300 Numerical Approach to Asset Pricing Models with Stochastic Differential Utility (2004). Asia-Pacific Financial Markets (11) RePEc:mse:wpsorb:b04116 Equilibria in production economies. (2004). Université Panthéon-Sorbonne (Paris 1) / Cahiers de la Maison des Sciences Economiques (12) RePEc:mse:wpsorb:b04123 Existence of competitive equilibrium in a single-sector growth model with elastic labour. (2004). Université Panthéon-Sorbonne (Paris 1) / Cahiers de la Maison des Sciences Economiques (13) RePEc:mse:wpsorb:v04056 Coping with imprecise information : a decision theoretic approach (2004). Université Panthéon-Sorbonne (Paris 1) / Cahiers de la Maison des Sciences Economiques (14) RePEc:nuf:econwp:0418 The aggregate weak axiom in a financial economy through dominant substitution effects (2004). Economics Group, Nuffield College, University of Oxford / Economics Papers (15) RePEc:upf:upfgen:785 Noise and Aggregation of Information in Large Markets (2004). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||