|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

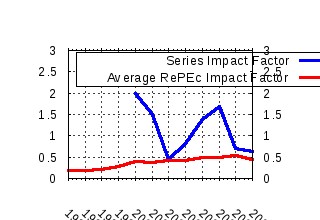

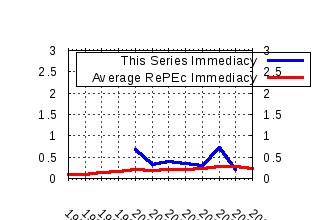

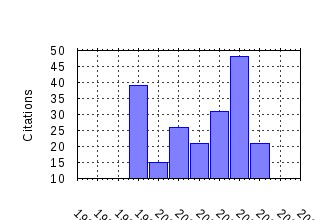

EUROMOD at the Institute for Social and Economic Research / EUROMOD Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ese:emodwp:em0/99 An Introduction To EUROMOD (1999). (2) RePEc:ese:emodwp:em1/03 Social Indicators And Other Income Statistics Using The Euromod Baseline: A Comparison With Eurostat And National Statistics (2003). (3) RePEc:ese:emodwp:em1/04 Welfare Reform In European Countries: A Micro Simulation Analysis (2004). (4) RePEc:ese:emodwp:em9/01 EUROMOD: An Integrated European Benefit Tax Model - Final Report (2001). (5) RePEc:ese:emodwp:em2/02 The Distribution Of Average And Marginal Effective Tax Rates In European Union Member States (2002). (6) RePEc:ese:emodwp:em4/05 The Impact Of Tax And Transfer Systems On Children In The European Union (2005). (7) RePEc:ese:emodwp:em1/01 Imputation Of Gross Amounts From Net Incomes In Household Surveys: An Application Using EUROMOD (2001). (8) RePEc:ese:emodwp:em3/04 Falling Up The Stairs. An Exploration Of The Effects Of Bracket Creep On Household Incomes (2004). (9) RePEc:ese:emodwp:em1/06 Assessing The Impact Of Tax/Transfer Policy Changes On Poverty: Methodological Issues And Some European Evidence (2006). (10) RePEc:ese:emodwp:em4/04 In Work Policies In Europe: Killing Two Birds With One Stone? (2004). (11) RePEc:ese:emodwp:em/3/03 Employment Transitions In 13 European Countries. Levels, Distributions And Determining Factors Of Net Replacement Rates (2003). (12) RePEc:ese:emodwp:em5/04 Redistributive Effect And Progressivity Of Taxes An International Comparison Across The EU Using EUROMOD (2004). (13) RePEc:ese:emodwp:em1/00 Child Poverty And Child Benefits In The European Union (2000). (14) RePEc:ese:emodwp:em1/05 EUROMOD And The Development Of EU Social Policy (2005). (15) RePEc:ese:emodwp:em3/00 A European Social Agenda: Poverty Benchmarking And Social Transfers (2000). (16) RePEc:ese:emodwp:em3/01 The Impact Of Tax Benefit Systems On Low Income Households In The Benelux Countries. A Simulation Approach Using Synthetic Datasets (2001). (17) RePEc:ese:emodwp:em2/03 Child Targeted Tax Benefit Reform In Spain In A European Context: A Microsimulation Analysis Using EUROMOD (2003). (18) RePEc:ese:emodwp:em2/04 Child Poverty And Family Transfers In Southern Europe (2004). (19) RePEc:ese:emodwp:em1/02 Evaluation Of National Action Plans On Social Inclusion: The Role Of EUROMOD (2002). (20) RePEc:ese:emodwp:em9/05 Household Incomes And Redistribution In The European Union: Quantifying The Equalising Properties Of Taxes And Benefits (2005). (21) RePEc:ese:emodwp:em2/08 Effects Of Flat Tax Reforms In Western Europe On Equity And Efficiency (2008). (22) RePEc:ese:emodwp:em4/01 Welfare Benefits And Work Incentives: The Distribution Of Net Replacement Rates In Europe Using A Cross Country Microsimulation Model, EUROMOD (2002). (23) RePEc:ese:emodwp:em2/00 The Impact Of Inflation On Income Tax And Social Insurance Contributions In Europe (2000). (24) RePEc:ese:emodwp:em5/05 Pension Incomes In The European Union: Policy Reform Strategies In Comparative Perspective (2005). (25) RePEc:ese:emodwp:em3/05 Sharing Resources Within The Household: A Multi Country Microsimulation Analysis Of The Determinants Of Intrahousehold Strategic Weight Differentials And Their Distributional Outcomes (2005). (26) RePEc:ese:emodwp:em9/04 The Role Of Tax And Transfers In Reducing Personal Income Inequality In EuropeÃÂs Regions: Evidence From EUROMOD (2004). (27) RePEc:ese:emodwp:em2/99 Microsimulation And The Formulation Of Policy: A Case Study Of Targeting In The European Union (1999). (28) RePEc:ese:emodwp:em2/06 Beans For Breakfast? How Exportable Is The British Workfare Model? (2006). (29) RePEc:ese:emodwp:em7/01 Modelling The Redistributive Impact Of Indirect Taxes In Europe: An Application Of EUROMOD (2004). (30) RePEc:ese:emodwp:em6/01 The Impact Of Means Tested Assistance In Southern Europe (2002). (31) RePEc:ese:emodwp:em5/01 Reducing Child Poverty In Europe: What Can Static Microsimulation Models Tell Us? (2001). (32) RePEc:ese:emodwp:em7/05 Static Data Ageing Techniques. Accounting For Population Changes In Tax Benefit Microsimulation Models (2005). (33) RePEc:ese:emodwp:em11/05 Sharing And Choosing Within The Household: A Survey (2005). (34) RePEc:ese:emodwp:em8/04 EU Action On Social Inclusion And Gender Mainstreaming (2004). (35) RePEc:ese:emodwp:em1/99 Integrating Output In Euromod: An Assessment Of The Sensitivity Of Multi Country Microsimulation Results (1999). (36) RePEc:ese:emodwp:em10/05 Alternative Tax Benefit Strategies To Support Children In The European Union: Recent Reforms In Austria, Spain And The United Kingdom (2005). (37) RePEc:ese:emodwp:em6/05 Social Indicators And Other Income Statistics Using EUROMOD: An Assessment Of The 2001 Baseline And Changes 1998 2001 (2005). (38) RePEc:ese:emodwp:em5/08 Behavioural And Welfare Effects Of Basic Income Policies: A Simulation For European Countries (2008). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:ese:emodwp:em5/06 Lessons From Building And Using EUROMOD (2006). EUROMOD at the Institute for Social and Economic Research / EUROMOD Working Papers Recent citations received in: 2005 (1) RePEc:diw:diwwpp:dp542 Income Taxation and Household Size: Would French Family Splitting Make German Families Better Off ? (2005). DIW Berlin, German Institute for Economic Research / Discussion Papers of DIW Berlin (2) RePEc:ese:emodwp:em10/05 Alternative Tax Benefit Strategies To Support Children In The European Union: Recent Reforms In Austria, Spain And The United Kingdom (2005). EUROMOD at the Institute for Social and Economic Research / EUROMOD Working Papers (3) RePEc:ese:emodwp:em4/05 The Impact Of Tax And Transfer Systems On Children In The European Union (2005). EUROMOD at the Institute for Social and Economic Research / EUROMOD Working Papers (4) RePEc:ese:emodwp:em8/05 Micro Level Analysis Of The European Social Agenda: Combating Poverty And Social Exclusion Through Changes In Social And Fiscal Policy Final Report (2005). EUROMOD at the Institute for Social and Economic Research / EUROMOD Working Papers (5) RePEc:iza:izadps:dp1528 A Portrait of Child Poverty in Germany (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (6) RePEc:iza:izadps:dp1589 The Impact of Tax and Transfer Systems on Children in the European Union (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (7) RePEc:iza:izadps:dp1894 Income Taxation and Household Size: Would French Family Splitting Make German Families Better Off? (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (8) RePEc:rwi:dpaper:0026 A Portrait of Child Poverty in Germany (2005). Rheinisch-Westfälisches Institut für Wirtschaftsforschung / RWI Discussion Papers Recent citations received in: 2004 (1) RePEc:ese:emodwp:em5/04 Redistributive Effect And Progressivity Of Taxes An International Comparison Across The EU Using EUROMOD (2004). EUROMOD at the Institute for Social and Economic Research / EUROMOD Working Papers (2) RePEc:nbr:nberwo:10935 Evaluation of Four Tax Reforms in the United States: Labor Supply and Welfare Effects for Single Mothers (2004). National Bureau of Economic Research, Inc / NBER Working Papers (3) RePEc:nbr:nberwo:10968 The Integration of Child Tax Credits and Welfare: Evidence from the National Child Benefit Program (2004). National Bureau of Economic Research, Inc / NBER Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||