|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

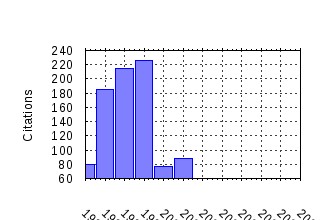

New York University, Leonard N. Stern School of Business- / New York University, Leonard N. Stern School Finance Department Working Paper Seires Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fth:nystfi:98-007 The Effects of Bank Mergers and Acquisitions on Small Business Lending (1998). (2) RePEc:fth:nystfi:99-059 The Distribution of Exchange Rate Volatility (1999). (3) RePEc:fth:nystfi:98-005 Economic News and the Yield Curve: Evidence from the U.S. Treasury Market (1997). (4) RePEc:fth:nystfi:98-022 Cookie-Cutter versus Character: The Micro Structure of Small Business Lending by Large and Small Banks (1997). (5) RePEc:fth:nystfi:96-34 Why Do Security Prices Change? A Transaction-Level Analysis of NYSE Stocks (1996). (6) RePEc:fth:nystfi:96-9 Affine Models of Currency Pricing (1996). (7) RePEc:fth:nystfi:00-07 Stretching Firm and Brand Reputation. (2000). (8) RePEc:fth:nystfi:99-014 Empirical Pricing Kernels (2000). (9) RePEc:fth:nystfi:98-081 Pitfalls and Opportunities in the Use of Extreme Value Theory in Risk Management (1998). (10) RePEc:fth:nystfi:97-1 The Effects of Bank Mergers and Acquisitions on Small Business Lending (1997). (11) RePEc:fth:nystfi:01-11 Financial Globalization and Real Regionalization. (2001). (12) RePEc:fth:nystfi:01-07 The Effects of Dynamic Change in Bank Competition on the Supply of Small Business Credit. (2001). (13) RePEc:fth:nystfi:01-01 Fixed and Random Effects in Nonlinear Models. (2001). (14) RePEc:fth:nystfi:99-064 The Effects of Deregulation on the Performance of Financial Institutions: The Case of Spanish Savings Banks (1999). (15) RePEc:fth:nystfi:99-003 When are Options Overpriced'DONE' The Black-Scholes Model and Alternative Characterizations of the Pricing Kernel (1999). (16) RePEc:fth:nystfi:01-00 The Microsoft Antitrust Case. (2001). (17) RePEc:fth:nystfi:99-046 Portfolio Performance and Agency (1999). (18) RePEc:fth:nystfi:98-004 Market Microstructure and Securities Values: Evidence from the Tel Aviv Stock Exchange (1997). (19) RePEc:fth:nystfi:99-063 Unit Root Tests are Useful for Selecting Forecasting Models (1999). (20) RePEc:fth:nystfi:99-028 Semiparametric Pricing of Multivariate Contingent Claims (1999). (21) RePEc:fth:nystfi:98-038 Where Does the Money Come From? The Financing of Small Entrepreneurial Enterprises (1998). (22) RePEc:fth:nystfi:01-10 Estimating Econometric Models with Fixed Effects. (2001). (23) RePEc:fth:nystfi:99-012 Trading Fast and Slow: Security Market Events in Real Time (1999). (24) RePEc:fth:nystfi:98-054 The Comparative Efficiency of Small-Firm Bankruptcies: A Study of the US and Finnish Bankruptcy Codes (1998). (25) RePEc:fth:nystfi:98-031 Testing the Volatility Term Structure using Option Hedging Criteria (1998). (26) RePEc:fth:nystfi:98-080 How Relevant is Volatility Forecasting for Financial Risk Management'DONE' (1998). (27) RePEc:fth:nystfi:96-14 Managerial Entrenchment and Capital Structure Decisions (1996). (28) RePEc:fth:nystfi:99-054 The IPO Lock-Up Period: Implications for Market Efficiency And Downward Sloping Demand Curves (2000). (29) RePEc:fth:nystfi:98-028 Do Investors Care About Sentiment? (1998). (30) RePEc:fth:nystfi:99-010 Regime Shifts and Bond Returns (1999). (31) RePEc:fth:nystfi:98-014 Hedge Funds and the Asian Currency Crisis of 1997 (1998). (32) RePEc:fth:nystfi:99-036 Viability and Equilibrium in Securities Markets with Frictions (1999). (33) RePEc:fth:nystfi:99-027 Implied Volatility Functions: A Reprise (1999). (34) RePEc:fth:nystfi:96-40 Universal Banking: A Shareholder Value Perspective (1997). (35) RePEc:fth:nystfi:98-013 The Dow Theory: William Peter Hamiltons Track Record Re-Considered (1998). (36) RePEc:fth:nystfi:99-048 Costly Financing, Optimal Payout Policies and the Valuation of Corporate Debt (2000). (37) RePEc:fth:nystfi:99-060 Exchange Rate Returns Standardized by Realized Volatility are (Nearly) Gaussian (1999). (38) RePEc:fth:nystfi:99-083 Enhancing the Liquidity of U.S. Treasury Securities in an Era of Surpluses (1999). (39) RePEc:fth:nystfi:99-061 (Understanding, Optimizing, Using and Forecasting) Realized Volatility and Correlation (1999). (40) RePEc:fth:nystfi:99-086 The Price of Options Illiquidity (1999). (41) RePEc:fth:nystfi:99-062 Modeling Liquidity Risk With Implications for Traditional Market Risk Measurement and Management (1998). (42) RePEc:fth:nystfi:98-068 An Empirical Examination of the Convexity Bias in the Pricing of Interest Rate Swaps (1998). (43) RePEc:fth:nystfi:99-013 A Direct Approach to Arbitrage-Free Pricing of Derivatives (1998). (44) RePEc:fth:nystfi:98-049 Predictability and Transaction Costs: The Impact on Rebalancing Rules and Behavior (1998). (45) RePEc:fth:nystfi:99-057 On the Formation and Structure of International Exchanges (1999). (46) RePEc:fth:nystfi:96-11 Price Barriers and the Dynamics of Asset Prices in Equilibrium (1996). (47) RePEc:fth:nystfi:99-032 Value-at-Risk Based Risk Management: Optimal Policies and Asset Prices (1999). (48) RePEc:fth:nystfi:98-040 Has International Financial Integration Increased? (1997). (49) RePEc:fth:nystfi:99-077 Conditions for Survival: Changing Risk and the Performance of Hedge Fund Managers and CTAs (1999). (50) RePEc:fth:nystfi:99-073 Portfolio Choice and Equity Characteristics: Characterizing the Hedging Demands Induced by Return Predictability (2000). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||