|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

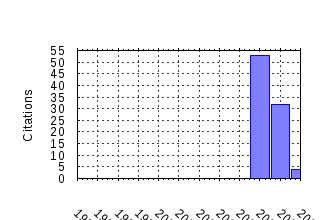

Annals of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:annfin:v:1:y:2005:i:2:p:197-224 A risk assessment model for banks (2005). (2) RePEc:kap:annfin:v:1:y:2005:i:1:p:35-50 On user costs of risky monetary assets (2005). (3) RePEc:kap:annfin:v:2:y:2006:i:1:p:1-21 A Time Series Analysis of Financial Fragility in the UK Banking System (2006). (4) RePEc:kap:annfin:v:1:y:2005:i:2:p:149-177 Relative arbitrage in volatility-stabilized markets (2005). (5) RePEc:kap:annfin:v:2:y:2006:i:3:p:259-285 Heterogeneous Beliefs, the Term Structure and Time-varying Risk Premia (2006). (6) RePEc:kap:annfin:v:2:y:2006:i:3:p:229-258 The Discounted Economic Stock of Money with VAR Forecasting (2006). (7) RePEc:kap:annfin:v:5:y:2009:i:3:p:341-359 Small firms in the SSBF (2009). (8) RePEc:kap:annfin:v:1:y:2005:i:2:p:109-147 Determinants of stock market volatility and risk premia (2005). (9) RePEc:kap:annfin:v:1:y:2005:i:4:p:423-432 Option pricing and Esscher transform under regime switching (2005). (10) RePEc:kap:annfin:v:2:y:2006:i:1:p:51-71 Risk measure pricing and hedging in incomplete markets (2006). (11) RePEc:kap:annfin:v:2:y:2006:i:1:p:101-122 Stochastic equilibria for economies under uncertainty with intertemporal substitution (2006). (12) RePEc:kap:annfin:v:1:y:2005:i:1:p:73-107 On the microstructure of price determination and information aggregation with sequential and asymmetric information arrival in an experimental asset market (2005). (13) RePEc:kap:annfin:v:3:y:2007:i:1:p:131-153 Pursuing financial stability under an inflation-targeting regime (2007). (14) RePEc:kap:annfin:v:1:y:2005:i:3:p:293-326 Completion time structures of stock price movements (2005). (15) RePEc:kap:annfin:v:5:y:2009:i:3:p:295-311 Entrepreneurship in macroeconomics (2009). (16) RePEc:kap:annfin:v:3:y:2007:i:1:p:75-105 An equilibrium approach to financial stability analysis: the Colombian case (2007). (17) RePEc:kap:annfin:v:5:y:2009:i:3:p:443-464 A dynamic model of entrepreneurship with borrowing constraints: theory and evidence (2009). (18) RePEc:kap:annfin:v:4:y:2008:i:1:p:75-103 Who controls Allianz? (2008). (19) RePEc:kap:annfin:v:4:y:2008:i:1:p:1-28 Optimal portfolio allocation with higher moments (2008). (20) RePEc:kap:annfin:v:1:y:2005:i:3:p:267-292 American options: the EPV pricing model (2005). (21) RePEc:kap:annfin:v:3:y:2007:i:1:p:5-35 Financial distress, bankruptcy law and the business cycle (2007). (22) RePEc:kap:annfin:v:5:y:2009:i:3:p:465-494 Entrepreneurship and firm heterogeneity with limited enforcement (2009). (23) RePEc:kap:annfin:v:4:y:2008:i:2:p:255-268 On the semimartingale property via bounded logarithmic utility (2008). (24) RePEc:kap:annfin:v:5:y:2009:i:3:p:397-419 The financing of small entrepreneurs in Italy (2009). (25) RePEc:kap:annfin:v:4:y:2008:i:1:p:55-74 A PDE approach for risk measures for derivatives with regime switching (2008). (26) RePEc:kap:annfin:v:2:y:2006:i:4:p:407-420 Common Shocks and Relative Compensation (2006). (27) RePEc:kap:annfin:v:3:y:2007:i:3:p:351-367 A multicriteria discrimination approach for the credit rating of Asian banks (2007). (28) RePEc:kap:annfin:v:5:y:2009:i:3:p:495-519 Self-employment rates and business size: the roles of occupational choice and credit market frictions (2009). (29) RePEc:kap:annfin:v:2:y:2006:i:2:p:225-227 Hedging decisions with price and output uncertainty (2006). (30) RePEc:kap:annfin:v:4:y:2008:i:3:p:345-367 Optimal portfolio allocation under the probabilistic VaR constraint and incentives for financial innovation (2008). (31) RePEc:kap:annfin:v:3:y:2007:i:1:p:155-192 Devaluation with contract redenomination in Argentina (2007). (32) RePEc:kap:annfin:v:1:y:2005:i:1:p:51-72 Shaking the tree: an agency-theoretic model of asset pricing (2005). (33) RePEc:kap:annfin:v:3:y:2007:i:1:p:107-130 Financial stability and Basel II (2007). (34) RePEc:kap:annfin:v:5:y:2009:i:3:p:361-396 Minority self-employment in the United States and the impact of affirmative action programs (2009). (35) RePEc:kap:annfin:v:2:y:2006:i:4:p:327-355 Asset Pricing and Hedging in Financial Markets with Transaction Costs: An Approach Based on the Von Neumannââ¬âGale Model (2006). (36) RePEc:kap:annfin:v:5:y:2009:i:3:p:313-340 A conversation with 590 Nascent Entrepreneurs (2009). (37) RePEc:kap:annfin:v:3:y:2007:i:2:p:241-255 An empirical model for durations in stocks (2007). (38) RePEc:kap:annfin:v:5:y:2009:i:3:p:521-541 Uninsurable investment risks and capital income taxation (2009). (39) RePEc:kap:annfin:v:5:y:2009:i:2:p:231-241 The profitability of carry trades (2009). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 (1) RePEc:ffe:journl:v:4:y:2007:i:1:p:65-90 Multicriteria Framework for the Prediction of Corporate Failure in the UK (2007). Frontiers in Finance and Economics (2) RePEc:kap:annfin:v:3:y:2007:i:1:p:1-4 Financial stability: theory and applications (2007). Annals of Finance Recent citations received in: 2006 (1) RePEc:kan:wpaper:200607 Supply of Money (2006). University of Kansas, Department of Economics / WORKING PAPERS SERIES IN THEORETICAL AND APPLIED ECONOMICS (2) RePEc:nst:samfok:6806 Evaluation of macroeconomic models for financial stability analysis (2006). Department of Economics, Norwegian University of Science and Technology / Working Paper Series (3) RePEc:pra:mprapa:247 Risk Premia, diverse belief and beauty contests (2006). University Library of Munich, Germany / MPRA Paper (4) RePEc:pra:mprapa:419 Supply of Money (2006). University Library of Munich, Germany / MPRA Paper (5) RePEc:sbs:wpsefe:2006fe04 Towards a Measure of Financial Fragility (2006). Oxford Financial Research Centre / OFRC Working Papers Series (6) RePEc:sbs:wpsefe:2006fe10 Banks, Relative Performance, and Sequential Contagion (2006). Oxford Financial Research Centre / OFRC Working Papers Series (7) RePEc:sbs:wpsefe:2006fe15 Endogenous State Prices, Liquidity, Default, and the Yield Curve (2006). Oxford Financial Research Centre / OFRC Working Papers Series Recent citations received in: 2005 (1) RePEc:fip:fedgfe:2005-52 Solving stochastic money-in-the-utility-function models (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (2) RePEc:fip:fedlrv:y:2005:i:nov:p:735-50:n:v.87no.6 Revisions to user costs for the Federal Reserve Bank of St. Louis monetary services indices (2005). Review (3) RePEc:kan:wpaper:200513 Exchange Rate Determination from Monetary Fundamentals: an Aggregation Theoretic Approach (2005). University of Kansas, Department of Economics / WORKING PAPERS SERIES IN THEORETICAL AND APPLIED ECONOMICS (4) RePEc:wpa:wuwpfi:0511001 General option exercise rules, with applications to embedded options and monopolistic expansion (2005). EconWPA / Finance (5) RePEc:wpa:wuwpit:0505004 Exchange Rate Determination from Monetary Fundamentals: an Aggregation Theoretic Approach (2005). EconWPA / International Trade (6) RePEc:wpa:wuwpmi:0510013 Discount factors ex post and ex ante, and discounted utility anomalies (2005). EconWPA / Microeconomics Recent citations received in: 2004 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||