|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

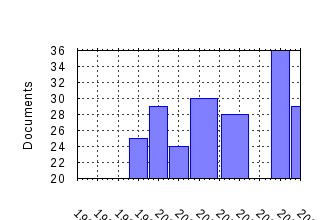

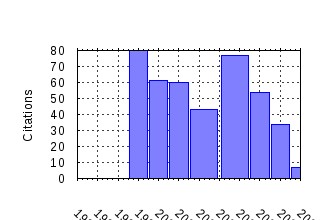

FinanzArchiv: Public Finance Analysis Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:mhr:finarc:urn:sici:0015-2218(200503)61:1_19:fstuec_2.0.tx_2-r Fiscal Sustainability: The Unpleasant European Case (2005). (2) RePEc:mhr:finarc:urn:sici:0015-2218(200207)58:3_286:tgsepi_2.0.tx_2-s The German Shadow Economy: Parted in a United Germany? (2001). (3) RePEc:mhr:finarc:urn:sici:0015-2218(200409)60:3_296:troiid_2.0.tx_2-_ The Role of Immigration in Dealing with the Developed Worlds Demographic Transition (2004). (4) RePEc:mhr:finarc:urn:sici:0015-2218(2002/200312)59:4_504:dcmtmi_2.0.tx_2-4 Does Culture Matter? Tax Morale in East-West-German Comparison (2002). (5) RePEc:mhr:finarc:urn:sici:0015-2218(199906)56:2_174:gvu_2.0.tx_2-k Government versus Union. The Structure of Optimal Taxation in a Unionized Labor Market (1999). (6) RePEc:mhr:finarc:urn:sici:0015-2218(200112)58:1_1:tcatpd_2.0.tx_2-4 Tax Competition and Transfer Pricing Disputes (2001). (7) RePEc:mhr:finarc:urn:sici:0015-2218(2002/200305)59:2_189:tiosso_2.0.tx_2-r The Impact of Social Security on Saving and Fertility in Germany (2002). (8) RePEc:mhr:finarc:urn:sici:0015-2218(200207)58:3_339:iralma_2.0.tx_2-4 Intergenerational Redistribution and Labor Mobility: A Survey (2001). (9) RePEc:mhr:finarc:urn:sici:0015-2218(199903)56:1_18:tciitn_2.0.tx_2-a Taxing Capital Income in the Nordic Countries: A Model for the European Union? (1999). (10) RePEc:mhr:finarc:urn:sici:0015-2218(200009)57:1_22:fpau_2.0.tx_2-h Funded Pensions and Unemployment (2000). (11) RePEc:mhr:finarc:urn:sici:0015-2218(200409)60:3_325:eaeaoa_2.0.tx_2-c Efficiency and Equity Aspects of Alternative Social Security Rules (2004). (12) RePEc:mhr:finarc:urn:sici:0015-2218(200404)60:1_83:cbsstr_2.0.tx_2-g Choosing between School Systems: The Risk of Failure (2004). (13) RePEc:mhr:finarc:urn:sici:0015-2218(200007)56:3/4_389:gotcit_2.0.tx_2-_ Globalization of the Corporate Income Tax: The Role of Allocation (1999). (14) RePEc:mhr:finarc:urn:sici:0015-2218(200409)60:3_393:prigti_2.0.tx_2-s Pension Reform in Germany: The Impact on Retirement Decisions (2004). (15) RePEc:mhr:finarc:urn:sici:0015-2218(200007)56:3/4_443:ctcw_2.0.tx_2-u Can Tax Coordination Work? (1999). (16) RePEc:mhr:finarc:urn:sici:0015-2218(200108)57:4_394:ppaict_2.0.tx_2-q Partial Privatization and Incomplete Contracts: The Proper Scope of Government Reconsidered (2000). (17) RePEc:mhr:finarc:urn:sici:0015-2218(200009)57:1_89:icappt_2.0.tx_2-5 Interjurisdictional Competition and Public-Sector Prodigality: The Triumph of the Market over the State? (2000). (18) RePEc:mhr:finarc:urn:sici:0015-2218(200409)60:3_278:oradbw_2.0.tx_2-o Optimal Retirement and Disability Benefits with Audit (2004). (19) RePEc:mhr:finarc:urn:sici:0015-2218(199903)56:1_104:grpiv_2.0.tx_2-f Gesetzliche Rentenversicherung: Prognosen im Vergleich (1999). (20) RePEc:mhr:finarc:urn:sici:0015-2218(200511)61:3_298:tqaita_2.0.tx_2-v Teacher Quality and Incentives: Theoretical and Empirical Effects of Standards on Teacher Quality (2005). (21) RePEc:mhr:finarc:urn:sici:0015-2218(2002/200302)59:1_141:ctipoa_2.0.tx_2-s Considering the IMFs Perspective on a Sound Fiscal Policy (2002). (22) RePEc:mhr:finarc:urn:sici:0015-2218(199903)56:1_1:caciic_2.0.tx_2-9 Competition and Co-ordination in International Capital Income Taxation (1999). (23) RePEc:mhr:finarc:urn:sici:0015-2218(200105)57:3_261:stitri_2.0.tx_2-b Smoothing the Implicit Tax Rate in a Pay-as-you-go Pension System (2000). (24) RePEc:mhr:finarc:urn:sici:0015-2218(199903)56:1_51:ntuu-a_2.0.tx_2-i Neutral Taxation under Uncertainty - a Real Options Approach (1999). (25) RePEc:mhr:finarc:urn:sici:0015-2218(200202)58:2_158:otatia_2.0.tx_2-m Optimal Taxes and Transfers in a Multilevel Public Sector (2001). (26) RePEc:mhr:finarc:urn:sici:0015-2218(200105)57:3_243:bvb_2.0.tx_2-k Bismarck versus Beveridge. Flat-Rate and Earnings-Related Unemployment Insurance in a General Efficiency Wage Framework (2000). (27) RePEc:mhr:finarc:urn:sici:0015-2218(199906)56:2_141:dpag_2.0.tx_2-2 Does Policy Affect Growth? (1999). (28) RePEc:mhr:finarc:urn:sici:0015-2218(200207)58:3_207:ctauii_2.0.tx_2-6 Corporate Tax Asymmetries under Investment Irreversibility (2001). (29) RePEc:mhr:finarc:urn:sici:0015-2218(200007)56:3/4_363:dotril_2.0.tx_2-u Determinants of Tax Rates in Local Capital Income Taxation: A Theoretical Model and Evidence from Germany (1999). (30) RePEc:mhr:finarc:urn:sici:0015-2218(200612)62:4_579:ccctci_2.0.tx_2-5 Company-Tax Coordination cum Tax-Rate Competition in the European Union (2006). (31) RePEc:mhr:finarc:urn:sici:0015-2218(200612)62:4_471:fatnfu_2.0.tx_2-g Financing and Taxing New Firms under Asymmetric Information (2006). (32) RePEc:mhr:finarc:urn:sici:0015-2218(200606)62:2_168:tnaotr_2.0.tx_2-1 The Normative Analysis of Tagging Revisited: Dealing with Stigmatization (2006). (33) RePEc:mhr:finarc:urn:sici:0015-2218(200007)56:3/4_335:ctiiaa_2.0.tx_2-s Corporate Tax in Italy: An Analysis of the 1998 Reform (1999). (34) RePEc:mhr:finarc:urn:sici:0015-2218(199906)56:2_241:ppag_2.0.tx_2-q Public Pensions and Growth (1999). (35) RePEc:mhr:finarc:urn:sici:0015-2218(200603)62:1_68:ototoi_2.0.tx_2-e On the Optimal Timing of Implicit Social Security Taxes Over the Life Cycle (2006). (36) RePEc:mhr:finarc:urn:sici:0015-2218(200408)60:2_160:rscful_2.0.tx_2-3 Reducing Social Contributions for Unskilled Labor as a Way of Fighting Unemployment: An Empirical Evaluation for the Case of Spain (2004). (37) RePEc:mhr:finarc:urn:sici:0015-2218(200105)57:3_316:iareot_2.0.tx_2-j Incentive and Redistribution Effects of the German Tax Reform 2000 (2000). (38) RePEc:mhr:finarc:urn:sici:0015-2218(200809)64:3_311:trci-a_2.0.tx_2-e Taxing Risky Capital Income - A Commodity Taxation Approach (2008). (39) RePEc:mhr:finarc:urn:sici:0015-2218(200009)57:1_63:anottr_2.0.tx_2-5 A Note on the Tax Rate implicit in Contributions to Pay-as-you-go Public Pension Systems (2000). (40) RePEc:mhr:finarc:urn:sici:0015-2218(200202)58:2_167:mapeip_2.0.tx_2-r Monitoring and Productive Efficiency in Public and Private Firms (2001). (41) RePEc:mhr:finarc:urn:sici:0015-2218(200606)62:2_221:epaevi_2.0.tx_2-9 Efficiency Potential and Efficiency Variation in Norwegian Lower Secondary Schools (2006). (42) RePEc:mhr:finarc:urn:sici:0015-2218(200009)57:1_1:ciatdb_2.0.tx_2-5 Can Immigration Alleviate the Demographic Burden? (2000). (43) RePEc:mhr:finarc:urn:sici:0015-2218(200803)64:1_1:lhsapp_2.0.tx_2-f Longevity, Health Spending, and Pay-as-you-Go Pensions (2008). (44) RePEc:mhr:finarc:urn:sici:0015-2218(200409)60:3_359:almapr_2.0.tx_2-l Aging, Labor Markets, and Pension Reform in Austria (2004). (45) RePEc:mhr:finarc:urn:sici:0015-2218(200108)57:4_361:daeies_2.0.tx_2-i Debt- and Equity-Financed Investment: Equilibrium Structure and Efficiency Implications (2000). (46) RePEc:mhr:finarc:urn:sici:0015-2218(200404)60:1_94:aetotp_2.0.tx_2-m An Experimental Test of the Public Goods Crowing Out Hypothesis when Taxation Is Endogenous (2004). (47) RePEc:mhr:finarc:urn:sici:0015-2218(2002/200305)59:2_177:iieart_2.0.tx_2-j Investment in Education and Redistributive Taxation without Precommitment (2002). (48) RePEc:mhr:finarc:urn:sici:0015-2218(200703)63:1_1:cfasae_2.0.tx_2-9 Capital-Market Failure, Adverse Selection, and Equity Financing of Higher Education (2007). (49) RePEc:mhr:finarc:urn:sici:0015-2218(200412)60:4_482:wvntbu_2.0.tx_2-6 Wide versus Narrow Tax Bases under Optimal Investment Timing (2004). (50) RePEc:mhr:finarc:urn:sici:0015-2218(200103)57:2_216:tdocea_2.0.tx_2-9 Tax Deductibility of Commuting Expenses and Leisures: On the Tax Treatment of Time-Saving Expenditure (2000). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 (1) RePEc:ays:ispwps:paper0712 From Income Tax to Consumption Tax? The Case of Jamaica (2007). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (2) RePEc:rif:dpaper:1098 An Equity Perspective on Access to, Enrolment in and Finance of Tertiary Education (2007). The Research Institute of the Finnish Economy / Discussion Papers Recent citations received in: 2006 (1) RePEc:adr:anecst:y:2006:i:83-84:p:05 Tagging and redistributive taxation (2006). Annales d'Economie et de Statistique (2) RePEc:ctl:louvec:2006051 Getting Rid of Keynes ? A reflection on the history of macroeconomics (2006). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (3) RePEc:ctl:louvec:2006052 Optimal disability assistance when fraud and stigma matter (2006). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (4) RePEc:hhs:umnees:0697 Technology Transfers and the Clean Development Mechanism in a North-South General Equilibrium Model (2006). UmeÃ¥ University, Department of Economics / UmeÃ¥ Economic Studies (5) RePEc:hhs:umnees:0699 Optimal Taxation and Transboundary Externalities - Are Endogenous World Market Prices Important? (2006). UmeÃ¥ University, Department of Economics / UmeÃ¥ Economic Studies (6) RePEc:iep:wpidep:0606 Optimal Non-Linear Income Tax when Highly Skilled Individuals Vote with their Feet (2006). Institut d'economie publique (IDEP), Marseille, France / IDEP Working Papers 2004 (7) RePEc:nst:samfok:7606 Property taxation as incentive for cost control:Empirical evidence for utility services in Norway (2006). Department of Economics, Norwegian University of Science and Technology / Working Paper Series (8) RePEc:qed:wpaper:1069 Entrepreneurship and Asymmetric Information in Input Markets (2006). Queen's University, Department of Economics / Working Papers (9) RePEc:qed:wpaper:1098 Optimal disability assistance when fraud and stigma matter (2006). Queen's University, Department of Economics / Working Papers Recent citations received in: 2005 (1) RePEc:ise:isegwp:wp182005 Ricardian Fiscal Regimes in the European Union (2005). Department of Economics, Institute for Economics and Business Administration (ISEG), Technical University of Lisbon / Working Papers (2) RePEc:nst:samfok:5305 Decentralization with Property Taxation to Improve Incentives: Evidence from Local Governmentsâ Discrete Choice (2005). Department of Economics, Norwegian University of Science and Technology / Working Paper Series Recent citations received in: 2004 (1) RePEc:ces:ceswps:_1326 Fertility, Mortality, and the Developed Worldâs Demographic Transition (2004). CESifo GmbH / CESifo Working Paper Series (2) RePEc:ecb:ecbwps:20040421 EU fiscal rules: issues and lessons from political economy (2004). European Central Bank / Working Paper Series (3) RePEc:ide:wpaper:2989 Retirement Age and Health Expenditures (2004). Institut d'Ãconomie Industrielle (IDEI), Toulouse / IDEI Working Papers (4) RePEc:mea:meawpa:04064 Aging, Pension Reform, and Capital Flows: A Multi-Country Simulation Model (2004). Mannheim Research Institute for the Economics of Aging (MEA), University of Mannheim / MEA discussion paper series (5) RePEc:usg:dp2004:2004-03 Aging, Labor Markets and Pension Reform in Austria (2004). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2004 (6) RePEc:wpa:wuwpge:0404002 Aging, Labor Markets and Pension Reform in Austria (2004). EconWPA / GE, Growth, Math methods (7) RePEc:xrs:meawpa:04064 Aging, Pension Reform, and Capital Flows: A Multi-Country Simulation Model (2004). Mannheim Research Institute for the Economics of Aging, University of Mannheim / MEA discussion paper series (8) RePEc:xrs:sfbmaa:04-65 Aging, Pension Reform, and Capital Flows: (2004). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||