|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

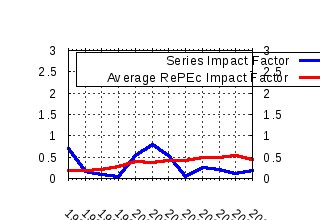

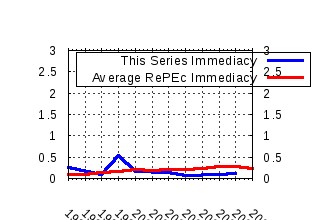

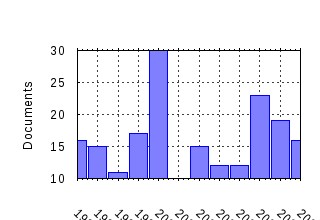

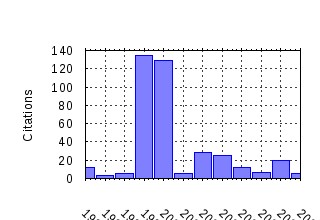

Department of Economics PUC-Rio (Brazil) / Textos para discussão Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:rio:texdis:400 Financial market contagion in the Asian crisis (1999). (2) RePEc:rio:texdis:423 The pass-through from depreciation to inflation : a panel study (2000). (3) RePEc:rio:texdis:420 The Russian default and the contagion to Brazil. (2000). (4) RePEc:rio:texdis:396 Does monetary policy stabilize the exchange rate following a currency crisis? (1999). (5) RePEc:rio:texdis:478 Inequality of outcomes and inequality of opportunities in Brazil (2003). (6) RePEc:rio:texdis:264 A post-Keynesian theory of growth, interest and money. (1991). (7) RePEc:rio:texdis:475 Labor Turnover and Labor Legislation in Brazil (2003). (8) RePEc:rio:texdis:452 Beyond Oaxaca-Blinder: accounting for differences in household income distributions across countries (2002). (9) RePEc:rio:texdis:398 Labor market regulations and the demand for labor in Brazil (1999). (10) RePEc:rio:texdis:456 Educational expansion and income distribution. A Micro-Simulation for Ceará (2002). (11) RePEc:rio:texdis:357 Capital flows to Brazil in the nineties: Macroeconomic aspects and the effectiveness of capital controls (1996). (12) RePEc:rio:texdis:304 Capital flows and monetary control under a domestic currency substitution regime: The recent Brazilian experience (1993). (13) RePEc:rio:texdis:416 Is adopting Full Dollarization the solution? Looking at the evidence. (2000). (14) RePEc:rio:texdis:342 The role of capital markets in economic growth (1995). (15) RePEc:rio:texdis:531 Realized volatility: a review (2006). (16) RePEc:rio:texdis:486 Modelling multiple regimes in financial volatility with a flexible coefficient GARCH model (2004). (17) RePEc:rio:texdis:328 Multiple equilibria and protectionism (1994). (18) RePEc:rio:texdis:415 Os determinantes da desigualdade de renda no Brasil: Luta de classes ou heterogeneidade educacional? (2000). (19) RePEc:rio:texdis:267 The formation of inflation expectations in Brazil: A study of the Fisher effect in a signal extraction framework (1991). (20) RePEc:rio:texdis:335 Regulations and flexibility of the labor market in Brazil (1995). (21) repec:rio:texdis:485 (). (22) RePEc:rio:texdis:461 Building Neural Network Models for Time Series: A Statistical Approach (2002). (23) RePEc:rio:texdis:354 The Real Plan (1996). (24) RePEc:rio:texdis:418 A new poverty profile for Brazil using PPV, PNAD and census data (2000). (25) RePEc:rio:texdis:341 The contribution of speculators to effective financial markets. (1995). (26) RePEc:rio:texdis:349 Unit roots in the presence of abrupt governmental interventions with an application to Brazilian to Brazilian data (1995). (27) repec:rio:texdis:297 (). (28) RePEc:rio:texdis:333 Private international capital flows to Brazil (1995). (29) RePEc:rio:texdis:307 Strengthening the financial sector in the Brazilian economy (1993). (30) RePEc:rio:texdis:401 Liquidity crises and the international financial architecture (1999). (31) RePEc:rio:texdis:169 Expectations in a steady state model of capacity utilization (1987). (32) RePEc:rio:texdis:67 Minimum wage in Brazil theory, policy and empirical evidence (1984). (33) RePEc:rio:texdis:399 Monetary policy in the aftermath of currency crisis: the case of Asia (1999). (34) RePEc:rio:texdis:153 The neo-Ricardian Keynesians and the post Keynesians (1987). (35) RePEc:rio:texdis:340 Macroeconomic coordination and economic integration: lessons for a Western Hemisphere Free Trade Area (1995). (36) RePEc:rio:texdis:362 The effects of openness on industrial employment in Brazil (1996). (37) RePEc:rio:texdis:449 Non-monotone insurance contracts and their empirical consequences (2001). (38) RePEc:rio:texdis:324 Inflation and economic policy reform: social implications in Brazil (1994). (39) RePEc:rio:texdis:345 The Brazilian debt renogotiation : a cure for overhang? (1995). (40) RePEc:rio:texdis:438 Hard currency and financial development (2000). (41) RePEc:rio:texdis:85 Inertial inflation and monetary reform in Brazil (1985). (42) RePEc:rio:texdis:424 Adverse selection problems without the Spence-Mirrlees condition (2000). (43) repec:rio:texdis:464 (). (44) RePEc:rio:texdis:346 Dual resource transfers and interruptions in external debt service. (1995). (45) RePEc:rio:texdis:422 The swings in capital flows and the brazilian crisis (2000). (46) RePEc:rio:texdis:516 Ineffective controls on capital inflows under sophisticated financial markets: Brazil in the nineties (2006). (47) RePEc:rio:texdis:284 Consumption and equilibrium asset pricing: An empirical assessment (1992). (48) RePEc:rio:texdis:428 Rural non-agricultural activities and poverty in the Brazilian northeast (2000). (49) RePEc:rio:texdis:466 Brazil in the 21st century: How to escape the high real interest trap? (2002). (50) RePEc:rio:texdis:532 Asymmetric effects and long memory in the volatility of Dow Jones stocks (2006). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:rio:texdis:531 Realized volatility: a review (2006). Department of Economics PUC-Rio (Brazil) / Textos para discussão (2) RePEc:rio:texdis:532 Asymmetric effects and long memory in the volatility of Dow Jones stocks (2006). Department of Economics PUC-Rio (Brazil) / Textos para discussão Recent citations received in: 2005 (1) RePEc:fgv:epgewp:591 The Contagion Effect of Public Debt on Monetary Policy: The Brazilian Experience (2005). Graduate School of Economics, Getulio Vargas Foundation (Brazil) / Economics Working Papers (Ensaios Economicos da EPGE) (2) RePEc:fgv:epgewp:597 Special Interests and Political Business Cycles (2005). Graduate School of Economics, Getulio Vargas Foundation (Brazil) / Economics Working Papers (Ensaios Economicos da EPGE) Recent citations received in: 2004 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||