|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

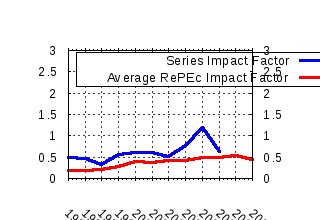

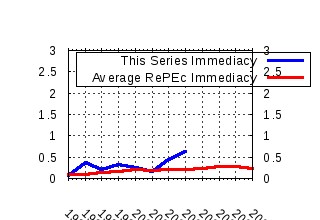

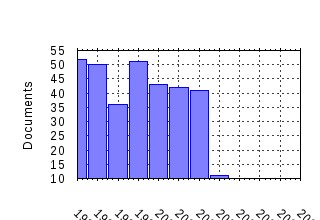

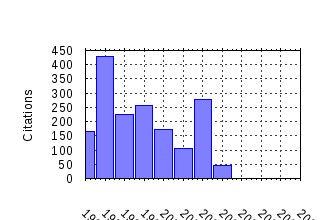

Wharton School Center for Financial Institutions, University of Pennsylvania / Center for Financial Institutions Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:wop:pennin:97-05 Efficiency of Financial Institutions: International Survey and Directions for Future Research (1997). (2) RePEc:wop:pennin:97-04 Inside the Black Box: What Explains Differences in the Efficiencies of Financial Institutions? (1997). (3) RePEc:wop:pennin:98-31 Financial Contagion Journal of Political Economy (1998). (4) RePEc:wop:pennin:96-06 The Transformation of the U.S. Banking Industry: What a Long, Strange Trip Its Been (1995). (5) RePEc:wop:pennin:95-01 The Role of Capital in Financial Institutions (1995). (6) RePEc:wop:pennin:02-23 Micro Effects of Macro Announcements: Real-Time Price Discovery in Foreign Exchange? (2002). (7) RePEc:wop:pennin:94-29 The Efficiency Cost of Market Power in the Banking Industry: A Test of the Quiet Life and Related Hypotheses (1994). (8) RePEc:wop:pennin:97-01 Optimal Financial Crises (1976). (9) RePEc:wop:pennin:96-32 The Theory of Financial Intermediation (1996). (10) RePEc:wop:pennin:96-03 The Effects of Megamergers on Efficiency and Prices: Evidence from a Bank Profit Function (1996). (11) RePEc:wop:pennin:01-21 Payout Policy (2002). (12) RePEc:wop:pennin:02-27 Parametric and Nonparametric Volatility Measurement (2002). (13) RePEc:wop:pennin:98-30 Diversity of Opinion and Financing of New Technologies (1999). (14) RePEc:wop:pennin:02-28 Financial Intermediation (2002). (15) RePEc:wop:pennin:00-26 Ratings Migration and the Business Cycle, With Application to Credit Portfolio Stress Testing (2000). (16) RePEc:wop:pennin:96-12 Catastrophe Insurance, Capital Markets and Uninsurable Risks (1996). (17) RePEc:wop:pennin:02-34 Forecasting the Term Structure of Government Bond Yields (2002). (18) RePEc:wop:pennin:99-18 The Role of Real Annuities and Indexed Bonds in an Individual Accounts Retirement Program (1999). (19) RePEc:wop:pennin:99-08 The Distribution of Exchange Rate Volatility (1999). (20) RePEc:wop:pennin:98-10 Pitfalls and Opportunities in the Use of Extreme Value Theory in Risk Management (1998). (21) RePEc:wop:pennin:00-23 Optimal Currency Crises (2000). (22) RePEc:wop:pennin:95-02 Financial Markets, Intermediaries, and Intertemporal Smoothing (1995). (23) RePEc:wop:pennin:99-28 Corporate Governance and Competition (1999). (24) RePEc:wop:pennin:99-27 Real Estate Booms and Banking Busts: An International Perspective (1999). (25) RePEc:wop:pennin:99-30 What Do Financial Intermediaries Do? (1999). (26) RePEc:wop:pennin:00-11 Should Banking Supervision and Monetary Policy Tasks Be Given to Different Agencies (1999). (27) RePEc:wop:pennin:97-12 Retirement Wealth Accumulation and Decumulation: New Developments and Outstanding Opportunities (1997). (28) RePEc:wop:pennin:01-38 Modeling Regional Interdependencies Using a Global Error-Correcting Macroeconometric Model (2002). (29) RePEc:wop:pennin:01-01 Modeling and Forecasting Realized Volatility (2001). (30) RePEc:wop:pennin:97-43 On the Profitability and Cost of Relationship Lending (1997). (31) RePEc:wop:pennin:01-15 Comparative Financial Systems: A Survey (2001). (32) RePEc:wop:pennin:95-07 Banks and Derivatives (1995). (33) RePEc:wop:pennin:99-41 At Last the Internationalization of Retail Banking? The Case of the Spanish Banks in Latin America (1999). (34) RePEc:wop:pennin:01-37 Financial Fragility, Liquidity and Asset Prices (2003). (35) RePEc:wop:pennin:98-09 Pricing Excess-of-loss Reinsurance Contracts Against Catastrophic Loss (1998). (36) RePEc:wop:pennin:01-08 The Case of the Missing Market: The Bond Market and Why It Matters for Financial Development (2000). (37) RePEc:wop:pennin:98-16 Horizon Problems and Extreme Events in Financial Risk Management (1998). (38) RePEc:wop:pennin:03-16 Political Relationships, Global Financing and Corporate Transparency (0000). (39) RePEc:wop:pennin:96-16 Risk Management by Insurers: An Analysis of the Process (1997). (40) RePEc:wop:pennin:02-44 Law, Finance, and Economic Growth in China (2002). (41) RePEc:wop:pennin:97-03 Comparison of Frontier Efficiency Methods: An Application to the U.S. Life Insurance Industry (1997). (42) RePEc:wop:pennin:00-29 Exchange Rate Returns Standardized by Realized Volatility Are (Nearly) Gaussian (1999). (43) RePEc:wop:pennin:97-34 Converting 1-Day Volatility to h-Day Volatitlity: Scaling by Root-h is Worse Than You Think (1997). (44) RePEc:wop:pennin:95-16 Recovering Technologies that Account for Generalized Managerial Preferences: An Application to Non-Risk-Neutral Banks (1995). (45) RePEc:wop:pennin:01-22 Explaining the Dramatic Changes in Performance of U.S. Banks: Technological Change, Deregulation and Dynamic Changes in Competition (2001). (46) RePEc:wop:pennin:98-22 Analyzing Firm Performance in the Insurance Industry Using Frontier Efficiency Methods (1998). (47) RePEc:wop:pennin:97-24 On the Pricing of Intermediated Risks: Theory and Application to Catastrophe Reinsurance (1997). (48) RePEc:wop:pennin:98-28 An Empirical Analysis of Personal Bankruptcy and Delinquency (1999). (49) RePEc:wop:pennin:00-27 The Distribution of Stock Return Volatility (2000). (50) RePEc:wop:pennin:00-17 A Comparative Study of Efficiency in European Banking (2000). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Recent citations received in: 2004 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||