|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

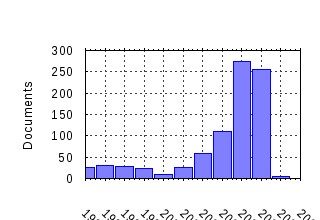

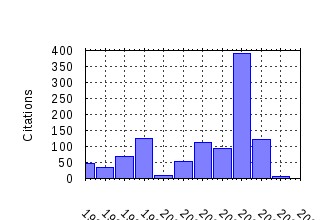

EconWPA / Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:wpa:wuwpfi:9903005 Toeholds and Takeovers (1999). (2) RePEc:wpa:wuwpfi:9808005 Is the Short Rate Drift Actually Nonlinear? (1998). (3) RePEc:wpa:wuwpfi:0111004 The Market Price of Aggregate Risk and the Wealth Distribution (2001). (4) RePEc:wpa:wuwpfi:0412006 A Theory of Overconfidence, Self-Attribution, and Security Market Under- and Over-reactions (2004). (5) RePEc:wpa:wuwpfi:0412002 Does Investor Misvaluation Drive the Takeover Market? (2004). (6) RePEc:wpa:wuwpfi:0207015 Asset Pricing Under The Quadratic Class (2002). (7) RePEc:wpa:wuwpfi:0403001 Finance and the Business Cycle: International, Inter-industry Evidence (2004). (8) RePEc:wpa:wuwpfi:0404016 Further evidence on the link between finance and growth: An international analysis of community banking and economic performance (2004). (9) RePEc:wpa:wuwpfi:0404017 Further evidence on the link between finance and growth: An international analysis of community banking and economic performance (2004). (10) RePEc:wpa:wuwpfi:0307003 International Evidence on Financial Derivatives Usage (2003). (11) RePEc:wpa:wuwpfi:0210005 Herding and Contrarian Behavior in Financial Markets - An Internet Experiment (2002). (12) RePEc:wpa:wuwpfi:9902005 Does Cash Flow Cause Investment and R&D: An Exploration Using Panel Data for French, Japanese, and United States Scientific Firms (1999). (13) RePEc:wpa:wuwpfi:0407005 Consistent high-precision volatility from high-frequency data (2004). (14) RePEc:wpa:wuwpfi:0207014 Design and Estimation of Quadratic Term Structure Models (2002). (15) RePEc:wpa:wuwpfi:0501011 Pricing in Electricity Markets: a Mean Reverting Jump Diffusion Model with Seasonality (2005). (16) RePEc:wpa:wuwpfi:9904004 When are Options Overpriced? The Black-Scholes Model and Alternative Characterisations of the Pricing Kernel. (1999). (17) RePEc:wpa:wuwpfi:0207008 Accouting for Biases in Black-Scholes (2002). (18) RePEc:wpa:wuwpfi:0404023 Initiative, Incentives and Soft Information. How Does Delegation Impact The Role of Bank Relationship Managers? (2004). (19) RePEc:wpa:wuwpfi:9712007 Estimation of Time-Varying Hedge Ratios for Corn and Soybeans: BGARCH and Random Coefficient Approaches (1997). (20) RePEc:wpa:wuwpfi:9803001 Volume, Volatility, Price and Profit When All Traders Are Above Average (1998). (21) RePEc:wpa:wuwpfi:0405003 Simulation-based stress testing of banksâ regulatory capital adequacy (2004). (22) RePEc:wpa:wuwpfi:0207011 Time-Changed Levy Processes and Option Pricing (2002). (23) RePEc:wpa:wuwpfi:0405001 Equilibrium in financial markets with adverse selection (2004). (24) RePEc:wpa:wuwpfi:0404021 Investor protection and business creation (2004). (25) RePEc:wpa:wuwpfi:0411007 Fractional calculus and continuous-time finance (2004). (26) RePEc:wpa:wuwpfi:0412001 Do Investors Overvalue Firms With Bloated Balance Sheets? (2004). (27) RePEc:wpa:wuwpfi:9610002 Trading Frequency and Event Study Test Specification (1996). (28) RePEc:wpa:wuwpfi:0504008 Econometric Tests of Asset Price Bubbles: Taking Stock (2005). (29) RePEc:wpa:wuwpfi:0201003 Stealth-Trading: Which Traders Trades Move Stock Prices? (2002). (30) RePEc:wpa:wuwpfi:0409015 Variance Risk Premia (2004). (31) RePEc:wpa:wuwpfi:0411008 Fractional calculus and continuous-time finance II: the waiting- time distribution (2004). (32) RePEc:wpa:wuwpfi:0404015 An approach to bank insolvency in transition and emerging economies (2004). (33) RePEc:wpa:wuwpfi:9810003 Housing Market Fluctuations in a Life-Cycle Economy with Credit Constraints (1998). (34) RePEc:wpa:wuwpfi:0312001 Consensus consumer and intertemporal asset pricing with heterogeneous beliefs (2003). (35) RePEc:wpa:wuwpfi:0412005 Can Individual Investors Beat the Market? (2004). (36) RePEc:wpa:wuwpfi:9507003 The Indian IPO Market: Empirical Facts (1995). (37) RePEc:wpa:wuwpfi:0411049 Information Reusability, Competition and Bank Asset Quality (2004). (38) RePEc:wpa:wuwpfi:0112003 An Empirical Comparison of Default Swap Pricing Models (2001). (39) RePEc:wpa:wuwpfi:0405017 A descriptive analysis of the Finnish treasury bond market 1991â1999 (2004). (40) RePEc:wpa:wuwpfi:0310009 Explicit bond option and swaption formula in Heath-Jarrow-Morton one factor model (2003). (41) RePEc:wpa:wuwpfi:0401002 Specification Analysis of Option Pricing Models Based on Time- Changed Levy Processes (2004). (42) RePEc:wpa:wuwpfi:0404020 The role of market discipline in handling problem banks (2004). (43) RePEc:wpa:wuwpfi:0405010 Optimal Currency Hedging (2004). (44) RePEc:wpa:wuwpfi:9608001 Toeholds and Takeovers (1996). (45) RePEc:wpa:wuwpfi:0411051 Competition, Risk Neutrality and Loan Commitments (2004). (46) RePEc:wpa:wuwpfi:0210006 Why do European Venture Capital Companies syndicate? (2002). (47) RePEc:wpa:wuwpfi:0412004 Good Day Sunshine: Stock Returns and the Weather (2004). (48) RePEc:wpa:wuwpfi:0305008 On the Stability of Different Financial Systems (2003). (49) RePEc:wpa:wuwpfi:0411015 Market Indicators, Bank Fragility, and Indirect Market Discipline (2004). (50) RePEc:wpa:wuwpfi:9703002 Empirical Evidence on the Duration of Bank Relationships (1997). Recent citations received in: | 2007 | 2006 | 2005 | 2004 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 (1) RePEc:chb:bcchwp:344 Monetary Policy and House Prices: A Cross-Country Study (2005). Central Bank of Chile / Working Papers Central Bank of Chile (2) RePEc:cpr:ceprdp:5341 Term Structure Estimation with Survey Data on Interest Rate Forecasts (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:dnb:dnbwpp:060 Bond Market and Stock Market Integration in Europe (2005). Netherlands Central Bank, Research Department / DNB Working Papers (4) RePEc:fip:fedgfe:2005-48 Term structure estimation with survey data on interest rate forecasts (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (5) RePEc:fip:fedgif:841 Monetary policy and house prices: a cross-country study (2005). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (6) RePEc:han:dpaper:dp-326 On the Rationale of Bank Lending in Pre-Crisis Thailand (2005). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (7) RePEc:ind:igiwpp:2005-007 Debt and corporate governance in emerging economies: Evidence from India (2005). Indira Gandhi Institute of Development Research, Mumbai, India / Indira Gandhi Institute of Development Research, Mumbai Working Papers (8) RePEc:kap:fmktpm:v:19:y:2005:i:1:p:109-116 Pricing American-Style Options By Simulation (2005). Financial Markets and Portfolio Management (9) RePEc:kap:fmktpm:v:19:y:2005:i:1:p:61-98 Price and Volume Effects Associated with 2003ââ¬â¢s Major Reorganization of German Stock Indices (2005). Financial Markets and Portfolio Management (10) RePEc:nbr:nberwo:11838 Persuasion in Finance (2005). National Bureau of Economic Research, Inc / NBER Working Papers (11) RePEc:ros:wpaper:52 The Number of Bank Relationships of SMEs: A Disaggregated Analysis for the Swiss Loan Market (2005). University of Rostock, Institute of Economics, Germany / Thünen-Series of Applied Economic Theory (12) RePEc:ufg:qdsems:14-2005 Neural Networks to Predict Financial Time Series in a Minority Game Context (2005). Dipartimento di Scienze Economiche, Matematiche e Statistiche, Universita' di Foggia / Quaderni DSEMS (13) RePEc:wpa:wuwpco:0511001 A comparison of different trading protocols in an agent-based market (2005). EconWPA / Computational Economics (14) RePEc:wpa:wuwpem:0502003 Market price of risk implied by Asian-style electricity options (2005). EconWPA / Econometrics (15) RePEc:wpa:wuwpem:0504005 Using the correlation dimension to detect non-linear dynamics: Evidence from the Athens Stock Exchange (2005). EconWPA / Econometrics (16) RePEc:wpa:wuwpfi:0501009 Completing Markets in a One-Good, Pure Exchange Economy Without State-Contingent Securities (2005). EconWPA / Finance (17) RePEc:wpa:wuwpfi:0502006 Rank Reduction of Correlation Matrices by Majorization (2005). EconWPA / Finance (18) RePEc:wpa:wuwpfi:0502009 Generic Market Models (2005). EconWPA / Finance (19) RePEc:wpa:wuwpfi:0502011 THE ACCOUNTING VARIABLE AND STOCK PRICE DETERMINATION (2005). EconWPA / Finance (20) RePEc:wpa:wuwpfi:0503013 On the complete model with stochastic volatility by Hobson and Rogers (2005). EconWPA / Finance (21) RePEc:wpa:wuwpfi:0506018 The Number of Bank Relationships of SMEs: A Disaggregated Analysis for the Swiss Loan Market (2005). EconWPA / Finance (22) RePEc:wpa:wuwpfi:0507006 Can a Stock Index be Less Efficient than Underlying Shares? An Analysis Using Malta Stock Exchange Data. (2005). EconWPA / Finance (23) RePEc:wpa:wuwpfi:0508006 The Degree of Stability of Price Diffusion (2005). EconWPA / Finance (24) RePEc:wpa:wuwpfi:0509001 The Number of Bank Relationships of SMEs: A Disaggregated Analysis for the Swiss Loan Market (2005). EconWPA / Finance (25) RePEc:wpa:wuwpfi:0509020 Calibration of the Hobson&Rogers model: empirical tests (2005). EconWPA / Finance (26) RePEc:wpa:wuwpfi:0512034 The Indexing Paradox -- Be Thankful for Irrational Investors (2005). EconWPA / Finance (27) RePEc:wpa:wuwpif:0503007 An Empirical Analysis of Equity Default Swaps (I): Univariate Insights (2005). EconWPA / International Finance (28) RePEc:wpa:wuwpma:0502029 The Inflation Dynamics of Pegging Interest Rates (2005). EconWPA / Macroeconomics (29) RePEc:wpa:wuwpma:0504028 Multiple Critiques of Woodfordâs Model of a Cashless Economy (2005). EconWPA / Macroeconomics (30) RePEc:wpa:wuwpma:0508006 Do Stockholders Share Risk More Effectively Than Non- stockholders? (2005). EconWPA / Macroeconomics (31) RePEc:wpa:wuwpma:0512020 Pareto Efficiency vs. the Ad Hoc Standard Monetary Objective An Analysis of Inflation Targeting (2005). EconWPA / Macroeconomics (32) RePEc:wpa:wuwpmi:0509004 The Pareto-Efficient Relativity of Relative Risk Aversion (2005). EconWPA / Microeconomics (33) RePEc:wpa:wuwpri:0507004 Fast Computation of the Economic Capital, the Value at Risk and the Greeks of a Loan Portfolio in the Gaussian Factor Model (2005). EconWPA / Risk and Insurance Recent citations received in: 2004 (1) RePEc:bca:bocawp:04-30 The New Basel Capital Accord and the Cyclical Behaviour of Bank Capital (2004). Bank of Canada / Working Papers (2) RePEc:cfs:cfswop:wp200425 The Basel II Accord: Internal Ratings and Bank Differentiation (2004). Center for Financial Studies / CFS Working Paper Series (3) RePEc:cpr:ceprdp:4231 Overconfidence and Delegated Portfolio Management (2004). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:dgr:uvatin:20040016 Forecasting Daily Variability of the S&P 100 Stock Index using Historical, Realised and Implied Volatility Measurements (2004). Tinbergen Institute / Tinbergen Institute Discussion Papers (5) RePEc:ecl:ohidic:2004-15 Anticipation, Acquisitions and the Bidder Return Puzzle (2004). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (6) RePEc:ecl:ohidic:2004-19 Do Acquirers with More Uncertain Growth Prospects Gain Less from Acquisitions? (2004). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (7) RePEc:ecl:ohidic:2004-4 Do Tender Offers Create Value? New Methods and Evidence (2004). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (8) RePEc:ecl:ohidic:2004-8 Feedback and the Success of Irrational Investors (2004). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (9) RePEc:ecm:nasm04:526 Realized Variance and IID Market Microstructure Noise (2004). Econometric Society / Econometric Society 2004 North American Summer Meetings (10) RePEc:ecm:nasm04:532 Do individual investors learn from their trading experience (2004). Econometric Society / Econometric Society 2004 North American Summer Meetings (11) RePEc:fip:fedawp:2004-32 Debt maturity, risk, and asymmetric information (2004). Federal Reserve Bank of Atlanta / Working Paper (12) RePEc:fip:fedbpp:04-6 Financial development, financial constraints, and the volatility of industrial output (2004). Federal Reserve Bank of Boston / Public Policy Discussion Paper (13) RePEc:fip:fedgfe:2004-09 Testing for adverse selection and moral hazard in consumer loan markets (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (14) RePEc:fip:fedgfe:2004-60 Debt maturity, risk, and asymmetric information (2004). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (15) RePEc:fip:fedhpr:y:2004:i:may:p:412-427 Bank orientation and industry specialization (2004). Proceedings (16) RePEc:fiu:wpaper:0411 The Impact of Fat Tails on Equilibrium Rates of Return and Term Premia (2004). Florida International University, Department of Economics / Working Papers (17) RePEc:hhb:hastba:2004_009 How well do financial experts perform? A review of empirical research on performance of analysts, day-traders, forecasters, fund managers, investors, and stockbrokers (2004). Stockholm School of Economics / Working Paper Series in Business Administration (18) RePEc:hhs:bofitp:2004_021 Probability of default models of Russian banks (2004). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (19) RePEc:hhs:bofrdp:2004_014 Asymmetric information in credit markets and entrepreneurial risk taking (2004). Bank of Finland / Research Discussion Papers (20) RePEc:hhs:bofrdp:2004_017 The efficiency implications of financial conglomeration (2004). Bank of Finland / Research Discussion Papers (21) RePEc:hhs:bofrdp:2004_025 Multihoming in the market for payment media: evidence from young Finnish consumers (2004). Bank of Finland / Research Discussion Papers (22) RePEc:hhs:bofrdp:2004_026 Trading Nokia: The roles of the Helsinki vs the New York stock exchanges (2004). Bank of Finland / Research Discussion Papers (23) RePEc:hhs:bofrdp:2004_028 Stable price level and changing prices (2004). Bank of Finland / Research Discussion Papers (24) RePEc:hhs:bofrdp:2004_029 Equilibrium dynamics under lump-sum taxation in an exchange economy with skewed endowments (2004). Bank of Finland / Research Discussion Papers (25) RePEc:hhs:bofrdp:2004_031 Robust monetary policy in the New-Keynesian framework (2004). Bank of Finland / Research Discussion Papers (26) RePEc:igi:igierp:266 Active Financial Intermediation: Evidence on the Role of Organizational Specialization and Human Capital (2004). IGIER (Innocenzo Gasparini Institute for Economic Research), Bocconi University / Working Papers (27) RePEc:kap:jfsres:v:25:y:2004:i:2:p:85-133 The Past, Present, and Probable Future for Community Banks (2004). Journal of Financial Services Research (28) RePEc:msh:ebswps:2004-5 Long memory in the volatility of the Australian All Ordinaries Index and the Share Price Index futures (2004). Monash University, Department of Econometrics and Business Statistics / Monash Econometrics and Business Statistics Working Papers (29) RePEc:nbr:nberwo:10200 Wealth Destruction on a Massive Scale? A Study of Acquiring-Firm Returns in the Recent Merger Wave (2004). National Bureau of Economic Research, Inc / NBER Working Papers (30) RePEc:nbr:nberwo:10536 Mergers and Acquisitions in the Pharmaceutical and Biotech Industries (2004). National Bureau of Economic Research, Inc / NBER Working Papers (31) RePEc:nbr:nberwo:10559 The Stock Market and Investment: Evidence from FDI Flows (2004). National Bureau of Economic Research, Inc / NBER Working Papers (32) RePEc:nbr:nberwo:10675 Portfolio Concentration and the Performance of Individual Investors (2004). National Bureau of Economic Research, Inc / NBER Working Papers (33) RePEc:nbr:nberwo:10773 Do Acquirers With More Uncertain Growth Prospects Gain Less From Acquisitions? (2004). National Bureau of Economic Research, Inc / NBER Working Papers (34) RePEc:nbr:nberwo:10813 Who Makes Acquisitions? CEO Overconfidence and the Markets Reaction (2004). National Bureau of Economic Research, Inc / NBER Working Papers (35) RePEc:nbr:nberwo:10852 The Cross-Section of Volatility and Expected Returns (2004). National Bureau of Economic Research, Inc / NBER Working Papers (36) RePEc:nbr:nberwo:10912 Jump and Volatility Risk and Risk Premia: A New Model and Lessons from S&P 500 Options (2004). National Bureau of Economic Research, Inc / NBER Working Papers (37) RePEc:osu:osuewp:04-07 An Empirical Investigation of Collateral and Sorting in the HELOC Market (2004). Ohio State University, Department of Economics / Working Papers (38) RePEc:rif:dpaper:891 Does Patenting Increase the Probability of Being Acquired? Evidence from Cross-border and Domestic Acquisitions. (2004). The Research Institute of the Finnish Economy / Discussion Papers (39) RePEc:rif:dpaper:895 Inter-firm Collaboration and Electronic Business: Effects on Profitability in Finalnd. (2004). The Research Institute of the Finnish Economy / Discussion Papers (40) RePEc:rif:dpaper:897 A Managerial Relevance of Maintenance of Work Abilility. A Finnish Perspective. (2004). The Research Institute of the Finnish Economy / Discussion Papers (41) RePEc:rif:dpaper:898 Active Ageing Policies in Finland. (2004). The Research Institute of the Finnish Economy / Discussion Papers (42) RePEc:rif:dpaper:900 Academic Spin-offs in Finnish Biotechnology. (2004). The Research Institute of the Finnish Economy / Discussion Papers (43) RePEc:rif:dpaper:901 Diffusion of Digital Mobile Telephony - Are Devoloping Countries Different? (2004). The Research Institute of the Finnish Economy / Discussion Papers (44) RePEc:rif:dpaper:903 Are There Biases in the Market Definition Procedure?. (2004). The Research Institute of the Finnish Economy / Discussion Papers (45) RePEc:rif:dpaper:904 Foreign Ownership in Finland - Boosting Firm Performance and Changing Corporate Governance. (2004). The Research Institute of the Finnish Economy / Discussion Papers (46) RePEc:rif:dpaper:909 The Education System in Finland - Development and Equality (2004). The Research Institute of the Finnish Economy / Discussion Papers (47) RePEc:rif:dpaper:914 The Finnish EMU Buffers and the Labour Market under Asymmetric Shocks (2004). The Research Institute of the Finnish Economy / Discussion Papers (48) RePEc:rif:dpaper:920 Analyzing Entrepreneurship with the Finnish Linked Employer-Employee Data (FLEED).Matching and qualitative properties of the data (2004). The Research Institute of the Finnish Economy / Discussion Papers (49) RePEc:taf:acbsfi:v:14:y:2004:i:3:p:355-370 Information and communication technology: organisational challenges for Italian banks (2004). Accounting, Business and Financial History (50) RePEc:taf:apfiec:v:14:y:2004:i:10:p:717-729 Volatility and risk estimation with linear and nonlinear methods based on high frequency data (2004). Applied Financial Economics (51) RePEc:uct:uconnp:2004-09 Corporate Tax Avoidance and High Powered Incentives (2004). University of Connecticut, Department of Economics / Working papers (52) RePEc:udt:wpbsdt:marketdiscipline Market Discipline in Emerging Economies: Beyond Bank Fundamentals (2004). Universidad Torcuato Di Tella / Business School Working Papers (53) RePEc:udt:wpbsdt:systemicrisk Market Discipline under Systemic Risk: Evidence from Bank Runs in Emerging Economies (2004). Universidad Torcuato Di Tella / Business School Working Papers (54) RePEc:uno:wpaper:2004-11 Strategic trading against retail investors with disposition effects (2004). University of New Orleans, Department of Economics and Finance / Working Papers (55) RePEc:uow:depec1:wp04-20 The Efficient Market Hypothesis: Is It Applicable to the Foreign Exchange Market? (2004). School of Economics, University of Wollongong, NSW, Australia / Economics Working Papers (56) RePEc:upf:upfgen:786 Overconfidence and Market Efficiency with Heterogeneous Agents (2004). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (57) RePEc:use:tkiwps:0517 Do Acquirers With More Uncertain Growth Prospects Gain Less From Acquisitions? (2004). Utrecht School of Economics / Working Papers (58) RePEc:uts:rpaper:149 A Note on the Bias of using Futures Rates as a Proxy for the Instantaneous Forward Rate (2004). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (59) RePEc:wbk:wbrwps:3440 Market discipline under systemic risk - evidence from bank runs in emerging economies (2004). The World Bank / Policy Research Working Paper Series (60) RePEc:wpa:wuwpem:0411013 Model Uncertainty, Complexity and Rank in Finance (2004). EconWPA / Econometrics (61) RePEc:wpa:wuwpfi:0401001 Dampened Power Law: Reconciling the Tail Behavior of Financial Security Returns (2004). EconWPA / Finance (62) RePEc:wpa:wuwpfi:0402014 Using the Scaling Analysis to Characterize Financial Markets (2004). EconWPA / Finance (63) RePEc:wpa:wuwpfi:0403003 The Price of Gold: A Global Required Yield Theory (2004). EconWPA / Finance (64) RePEc:wpa:wuwpfi:0404011 Tournaments in Mutual Fund Families (2004). EconWPA / Finance (65) RePEc:wpa:wuwpfi:0404020 The role of market discipline in handling problem banks (2004). EconWPA / Finance (66) RePEc:wpa:wuwpfi:0404022 Financial contracts and contingent control rights (2004). EconWPA / Finance (67) RePEc:wpa:wuwpfi:0405015 Bank exit legislation in US, EU and Japanese financial centres (2004). EconWPA / Finance (68) RePEc:wpa:wuwpfi:0405024 American options: the EPV pricing model (2004). EconWPA / Finance (69) RePEc:wpa:wuwpfi:0406005 Mutual Fund Growth in Standard and Specialist Market Segments (2004). EconWPA / Finance (70) RePEc:wpa:wuwpfi:0407014 Investment, Hedging, and Consumption Smoothing (2004). EconWPA / Finance (71) RePEc:wpa:wuwpfi:0409014 Stochastic Skew in Currency Options (2004). EconWPA / Finance (72) RePEc:wpa:wuwpfi:0409015 Variance Risk Premia (2004). EconWPA / Finance (73) RePEc:wpa:wuwpfi:0409018 Multiple equilibrium overnight rates in a dynamic interbank market game (2004). EconWPA / Finance (74) RePEc:wpa:wuwpfi:0409030 Capital Regulation and Credit Risk Taking : Empirical Evidence from Banks in Emerging Market Economies (2004). EconWPA / Finance (75) RePEc:wpa:wuwpfi:0409034 The Changing Concept of Financial Risk (2004). EconWPA / Finance (76) RePEc:wpa:wuwpfi:0409035 Visualization of Chaos for Finance Majors (2004). EconWPA / Finance (77) RePEc:wpa:wuwpfi:0409037 Wavelet Multiresolution Analysis of High-Frequency Asian FX Rates, Summer 1997 (2004). EconWPA / Finance (78) RePEc:wpa:wuwpfi:0409042 Multiple equilibrium overnight rates in a dynamic interbank market game (2004). EconWPA / Finance (79) RePEc:wpa:wuwpfi:0409046 Measuring Financial Cash Flow and Term Structure Dynamics (2004). EconWPA / Finance (80) RePEc:wpa:wuwpfi:0410016 Optimal stopping made easy (2004). EconWPA / Finance (81) RePEc:wpa:wuwpfi:0410018 Long-Run Regressions: Theory and Application to US Asset Markets (2004). EconWPA / Finance (82) RePEc:wpa:wuwpfi:0410019 Proxying for Expected Returns with Price Earnings Ratios (2004). EconWPA / Finance (83) RePEc:wpa:wuwpfi:0411008 Fractional calculus and continuous-time finance II: the waiting- time distribution (2004). EconWPA / Finance (84) RePEc:wpa:wuwpfi:0411014 Waiting-times and returns in high-frequency financial data: an empirical study (2004). EconWPA / Finance (85) RePEc:wpa:wuwpfi:0411017 Shareholder Preferences and Dividend Policy (2004). EconWPA / Finance (86) RePEc:wpa:wuwpfi:0411018 Is Fairly Priced Deposit Insurance Possible? (2004). EconWPA / Finance (87) RePEc:wpa:wuwpfi:0411027 Capital Requirements, Monetary Policy, and Aggregate Bank (2004). EconWPA / Finance (88) RePEc:wpa:wuwpfi:0411031 A Theory of Stock Price Responses to Alternative Corporate Cash Disbursement Methods: Stock Repurchase and Dividends (2004). EconWPA / Finance (89) RePEc:wpa:wuwpfi:0411032 The Valuation of Assets under Moral Hazard (2004). EconWPA / Finance (90) RePEc:wpa:wuwpfi:0412003 Do Individual Investors Drive Post-Earnings Announcement Drift? Direct Evidence from Personal Trades (2004). EconWPA / Finance (91) RePEc:wpa:wuwpfi:0412005 Can Individual Investors Beat the Market? (2004). EconWPA / Finance (92) RePEc:wpa:wuwpfi:0412008 A Generalized Earnings-Based Stock Valuation Model (2004). EconWPA / Finance (93) RePEc:wpa:wuwpfi:0412011 Do Tender Offers Create Value? New Methods and Evidence (2004). EconWPA / Finance (94) RePEc:wpa:wuwpfi:0412012 A piecewise linear model for trade sign inference (2004). EconWPA / Finance (95) RePEc:wpa:wuwpfi:0412014 Why VAR Fails: Long Memory and Extreme Events in Financial Markets (2004). EconWPA / Finance (96) RePEc:wpa:wuwpfi:0412016 Optimal Choice Models for Executing Time to American Options (2004). EconWPA / Finance (97) RePEc:wpa:wuwpga:0404003 Banks equity stakes in borrowing firms: A corporate finance approach (2004). EconWPA / Game Theory and Information (98) RePEc:wpa:wuwpio:0405003 Links between securities settlement systems: An oligopoly theoretic approach (2004). EconWPA / Industrial Organization (99) RePEc:wpa:wuwpio:0409001 Getting Carried Away in Auctions as Imperfect Value Discovery (2004). EconWPA / Industrial Organization (100) RePEc:wpa:wuwpio:0411005 Market Discipline in Indian Bank: Does the Data Tell a Story (2004). EconWPA / Industrial Organization More than 100 citations. List broken... Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||