|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

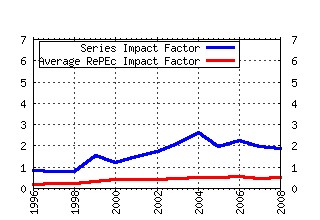

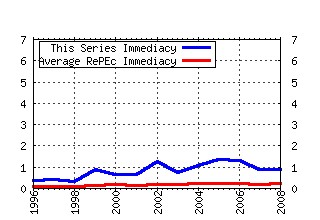

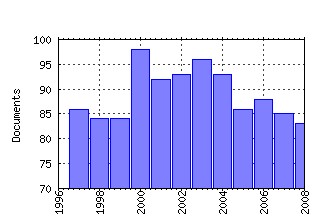

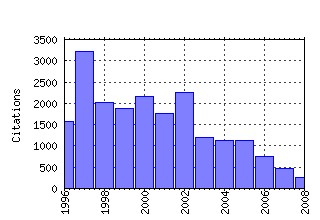

Journal of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:jfinan:v:52:y:1997:i:3:p:1131-50

Legal Determinants of External Finance. (1997). (2) RePEc:bla:jfinan:v:52:y:1997:i:2:p:737-83

A Survey of Corporate Governance. (1997). (3) RePEc:bla:jfinan:v:54:y:1999:i:2:p:471-517 Corporate Ownership Around the World (1999). (4) RePEc:bla:jfinan:v:49:y:1994:i:1:p:3-37

The Benefits of Lending Relationships: Evidence from Small Business Data. (1994). (5) RePEc:bla:jfinan:v:47:y:1992:i:2:p:427-65

The Cross-Section of Expected Stock Returns. (1992). (6) RePEc:bla:jfinan:v:25:y:1970:i:2:p:383-417 Efficient Capital Markets: A Review of Theory and Empirical Work. (1970). (7) RePEc:bla:jfinan:v:29:y:1974:i:2:p:449-70 On the Pricing of Corporate Debt: The Risk Structure of Interest Rates. (1974). (8) RePEc:bla:jfinan:v:52:y:1997:i:1:p:57-82

On Persistence in Mutual Fund Performance. (1997). (9) RePEc:bla:jfinan:v:48:y:1993:i:5:p:1779-1801

On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. (1993). (10) RePEc:bla:jfinan:v:47:y:1992:i:4:p:1367-400

Insiders and Outsiders: The Choice between Informed and Arms-Length Debt. (1992). (11) RePEc:bla:jfinan:v:42:y:1987:i:2:p:281-300

The Pricing of Options on Assets with Stochastic Volatilities. (1987). (12) RePEc:bla:jfinan:v:48:y:1993:i:5:p:1749-78

Measuring and Testing the Impact of News on Volatility. (1993). (13) RePEc:bla:jfinan:v:44:y:1989:i:5:p:1115-53

Why Does Stock Market Volatility Change over Time? (1989). (14) RePEc:bla:jfinan:v:39:y:1984:i:3:p:575-92

The Capital Structure Puzzle. (1984). (15) RePEc:bla:jfinan:v:40:y:1985:i:3:p:793-805 Does the Stock Market Overreact? (1985). (16) RePEc:bla:jfinan:v:46:y:1991:i:5:p:1575-617

Efficient Capital Markets: II. (1991). (17) RePEc:bla:jfinan:v:46:y:1991:i:1:p:297-355

The Theory of Capital Structure. (1991). (18) RePEc:bla:jfinan:v:51:y:1996:i:1:p:55-84

Multifactor Explanations of Asset Pricing Anomalies. (1996). (19) RePEc:bla:jfinan:v:32:y:1977:i:2:p:261-75 Debt and Taxes. (1977). (20) RePEc:bla:jfinan:v:48:y:1993:i:1:p:65-91

Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. (1993). (21) RePEc:bla:jfinan:v:53:y:1998:i:6:p:2107-2137 Law, Finance, and Firm Growth (1998). (22) RePEc:bla:jfinan:v:32:y:1977:i:2:p:371-87 Informational Asymmetries, Financial Structure, and Financial Intermediation. (1977). (23) RePEc:bla:jfinan:v:45:y:1990:i:4:p:1069-87

Asymmetric Information, Bank Lending, and Implicit Contracts: A Stylized Model of Customer Relationships. (1990). (24) RePEc:bla:jfinan:v:46:y:1991:i:2:p:555-76

The Term Structure as a Predictor of Real Economic Activity. (1991). (25) RePEc:bla:jfinan:v:43:y:1988:i:1:p:1-19

The Determinants of Capital Structure Choice. (1988). (26) RePEc:bla:jfinan:v:52:y:1997:i:1:p:35-55

The Limits of Arbitrage. (1997). (27) RePEc:bla:jfinan:v:47:y:1992:i:3:p:1209-27

An Empirical Comparison of Alternative Models of the Short-Term Interest Rate. (1992). (28) RePEc:bla:jfinan:v:53:y:1998:i:6:p:1839-1885 Investor Psychology and Security Market Under- and Overreactions (1998). (29) RePEc:bla:jfinan:v:55:y:2000:i:2:p:565-613 Foreign Speculators and Emerging Equity Markets (2000). (30) RePEc:bla:jfinan:v:43:y:1988:i:3:p:661-76

Stock Prices, Earnings, and Expected Dividends. (1988). (31) RePEc:bla:jfinan:v:57:y:2002:i:1:p:405-443 Term Premia and Interest Rate Forecasts in Affine Models (2002). (32) RePEc:bla:jfinan:v:57:y:2002:i:3:p:1147-1170 Investor Protection and Corporate Valuation (2002). (33) RePEc:bla:jfinan:v:50:y:1995:i:5:p:1421-60

What Do We Know about Capital Structure? Some Evidence from International Data. (1995). (34) RePEc:bla:jfinan:v:57:y:2002:i:6:p:2533-2570 Does Distance Still Matter? The Information Revolution in Small Business Lending (2002). (35) RePEc:bla:jfinan:v:48:y:1993:i:5:p:1629-58

Risk Management: Coordinating Corporate Investment and Financing Policies. (1993). (36) RePEc:bla:jfinan:v:42:y:1987:i:3:p:483-510

A Simple Model of Capital Market Equilibrium with Incomplete Information. (1987). (37) RePEc:bla:jfinan:v:50:y:1995:i:1:p:23-51

The New Issues Puzzle. (1995). (38) RePEc:bla:jfinan:v:45:y:1990:i:1:p:157-74

Purchasing Power Parity in the Long Run. (1990). (39) RePEc:bla:jfinan:v:55:y:2000:i:2:p:529-564 Stock Market Liberalization, Economic Reform, and Emerging Market Equity Prices (2000). (40) RePEc:bla:jfinan:v:57:y:2002:i:1:p:265-301 Government Ownership of Banks (2002). (41) RePEc:bla:jfinan:v:59:y:2004:i:4:p:1481-1509 Risks for the Long Run: A Potential Resolution of Asset Pricing Puzzles (2004). (42) RePEc:bla:jfinan:v:53:y:1998:i:5:p:1775-1798 Are Investors Reluctant to Realize Their Losses? (1998). (43) RePEc:bla:jfinan:v:47:y:1992:i:4:p:1343-66

Liquidation Values and Debt Capacity: A Market Equilibrium Approach. (1992). (44) RePEc:bla:jfinan:v:50:y:1995:i:1:p:301-18

Venture Capitalists and the Oversight of Private Firms. (1995). (45) RePEc:bla:jfinan:v:48:y:1993:i:3:p:831-80

The Modern Industrial Revolution, Exit, and the Failure of Internal Control Systems. (1993). (46) RePEc:bla:jfinan:v:31:y:1976:i:2:p:351-67 Valuing Corporate Securities: Some Effects of Bond Indenture Provisions. (1976). (47) RePEc:bla:jfinan:v:46:y:1991:i:1:p:179-207

Measuring the Information Content of Stock Trades. (1991). (48) RePEc:bla:jfinan:v:50:y:1995:i:5:p:1461-89

Optimal Investment, Monitoring, and the Staging of Venture Capital. (1995). (49) RePEc:bla:jfinan:v:50:y:1995:i:2:p:403-44

Time-Varying World Market Integration. (1995). (50) RePEc:bla:jfinan:v:57:y:2002:i:1:p:169-197 Venture Capital and the Professionalization of Start-Up Firms: Empirical Evidence (2002). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:aah:create:2008-39 Modelling and Forecasting Multivariate Realized Volatility (2008). School of Economics and Management, University of Aarhus / CREATES Research Papers (2) RePEc:bis:bisqtr:0809e The inflation risk premium in the term structure of interest rates (2008). BIS Quarterly Review (3) RePEc:bis:bisqtr:0812g Bank health and lending to emerging markets (2008). BIS Quarterly Review (4) RePEc:boc:bocoec:688 The Impact of Macroeconomic Uncertainty on Firms Changes in Financial Leverage (2008). Boston College Department of Economics / Boston College Working Papers in Economics (5) RePEc:cen:wpaper:08-13 On the Lifecycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms (2008). Center for Economic Studies, U.S. Census Bureau / Working Papers (6) RePEc:chb:bcchwp:470 Trade Liberalization and Industry Dynamics: A Difference in Difference Approach (2008). Central Bank of Chile / Working Papers Central Bank of Chile (7) RePEc:cpr:ceprdp:6627 Corporate Governance Externalities (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (8) RePEc:cpr:ceprdp:6657 Social Capital as Good Culture (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (9) RePEc:cpr:ceprdp:6697 Creditor Rights and Corporate Risk-taking (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (10) RePEc:cpr:ceprdp:6742 Determinants of the Block Premium and of Private Benefits of Control (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cpr:ceprdp:6877 The Secondary Market for Hedge Funds and the Closed-Hedge Fund Premium (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:cpr:ceprdp:6915 Individual Investors and Volatility (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (13) RePEc:cpr:ceprdp:6958 Lending by Example: Direct and Indirect Effects of Foreign Banks in Emerging Markets (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (14) RePEc:cpr:ceprdp:7013 Free Flows, Limited Diversification: Explaining the Fall and Rise of Stock Market Correlations, 1890-2001 (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (15) RePEc:cpr:ceprdp:7020 Do Cultural Differences Between Contracting Parties Matter? Evidence from Syndicated Bank Loans (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (16) RePEc:cpr:ceprdp:7068 An Institutional Theory of Momentum and Reversal (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (17) RePEc:cpr:ceprdp:7096 Monetary Policy Regimes and the Term Structure of Interest Rates (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (18) RePEc:dgr:kubcen:200816 Currency Denomination of Bank Loans: Evidence from Small Firms in Transition Countries (2008). Tilburg University, Center for Economic Research / Discussion Paper (19) RePEc:dgr:umamet:2008007 Shareholder Activism and the Role of Marketing: A Framework for Analyzing and Managing Investor Relations (2008). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (20) RePEc:diw:diwfin:diwfin02010 Bank Market Structure and Firm Capital Structure (2008). DIW Berlin, German Institute for Economic Research / Working Paper / FINESS (21) RePEc:ebg:heccah:0899 Individual investors and volatility (2008). Groupe HEC / Les Cahiers de Recherche (22) RePEc:ebg:heccah:0900 The role of managersâ behavior in corporate fraud (2008). Groupe HEC / Les Cahiers de Recherche (23) RePEc:ebg:iesewp:d-0748 Price efficiency and short selling (2008). IESE Business School / IESE Research Papers (24) RePEc:ebg:iesewp:d-0758 Persistence of outstanding performance and shareholder value among diversified firms: The impact of past performance, efficient internal capital market, and relatedness of business segments (2008). IESE Business School / IESE Research Papers (25) RePEc:ecl:ohidic:2008-12 Thriving in the Midst of Financial Distress? An Analysis of Firms Exposed to Abestos Litigation (2008). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (26) RePEc:ecl:ohidic:2008-14 Why Do Foreign Firms Leave U.S. Equity Markets? An Analysis of Deregistrations under SEC Exchange Act Rule 12h-6 (2008). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (27) RePEc:ecl:ohidic:2008-2 Investor Attention and the Underreaction to Stock Recommendations (2008). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (28) RePEc:edb:cedidp:08-04 Evolution of Capital Strcture in East Asia: Corporate Inertia or Endeavours? (2008). Centre for Economic Development and Institutions(CEDI), Brunel University / CEDI Discussion Paper Series (29) RePEc:ess:wpaper:id:1463 Draft Report of the Committee on financial Sector Reforms (2008). esocialsciences.com / Working Papers (30) RePEc:fip:fedcwp:0810 Estimating real and nominal term structures using treasury yields, inflation, inflation forecasts, and inflation swap rates (2008). Federal Reserve Bank of Cleveland / Working Paper (31) RePEc:fip:fedfwp:2008-14 Do banks price their informational monopoly? (2008). Federal Reserve Bank of San Francisco / Working Paper Series (32) RePEc:fip:fedfwp:2008-34 Inflation expectations and risk premiums in an arbitrage-free model of nominal and real bond yields (2008). Federal Reserve Bank of San Francisco / Working Paper Series (33) RePEc:fip:fedgfe:2008-49 Do behavioral biases adversely affect the macro-economy? (2008). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (34) RePEc:fip:fedgif:940 Friends or foes? The stock price impact of sovereign wealth fund investments and the price of keeping secrets (2008). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (35) RePEc:fip:fedgif:951 Soft information in earnings announcements: news or noise? (2008). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (36) RePEc:fip:fedmsr:408 Liquidity in asset markets with search frictions (2008). Federal Reserve Bank of Minneapolis / Staff Report (37) RePEc:fip:fednsr:348 CoVaR (2008). Federal Reserve Bank of New York / Staff Reports (38) RePEc:gla:glaewp:2008_36 The Term Structure and the Expectations Hypothesis: a Threshold Model (2008). Department of Economics, University of Glasgow / Working Papers (39) RePEc:hal:wpaper:hal-00413730_v1 Recovering portfolio default intensities implied by CDO quotes (2008). HAL / Working Papers (40) RePEc:han:dpaper:dp-407 Investor sentiment and stock returns: Some international evidence (2008). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (41) RePEc:hhs:bofitp:2008_018 How corruption affects bank lending in Russia (2008). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (42) RePEc:hhs:bofitp:2008_021 Risk-taking by Russian banks: Do location, ownership and size matter? (2008). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (43) RePEc:hum:wpaper:sfb649dp2008-062 Nonlinear Modeling of Target Leverage with Latent Determinant Variables ââ¬â New Evidence on the Trade-off Theory (2008). Sonderforschungsbereich 649, Humboldt University, Berlin, Germany / SFB 649 Discussion Papers (44) RePEc:iis:dispap:iiisdp273 An Empirical Study of Multiple Listings (2008). IIIS / The Institute for International Integration Studies Discussion Paper Series (45) RePEc:imf:imfwpa:08/265 Do Financial Sector Reforms Lead to Financial Development? Evidence from a New Dataset (2008). International Monetary Fund / IMF Working Papers (46) RePEc:inu:caeprp:2008-009 Trade Liberalization and Industry Dynamics: A Difference in Difference Approach (2008). Center for Applied Economics and Policy Research, Economics Department, Indiana University Bloomington / Caepr Working Papers (47) RePEc:iza:izadps:dp3426 Evolution of Capital Structure in East Asia: Corporate Inertia or Endeavours? (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers (48) RePEc:kap:jfsres:v:34:y:2008:i:2:p:123-149 How Do Large Banking Organizations Manage Their Capital Ratios? (2008). Journal of Financial Services Research (49) RePEc:knz:cofedp:0806 Modelling and Forecasting Multivariate Realized Volatility (2008). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (50) RePEc:knz:cofedp:0809 Recovering Delisting Returns of Hedge Funds (2008). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (51) RePEc:lmu:msmdpa:4743 Empirical Capital Structure Research: New Ideas, Recent Evidence, and Methodological Issues (2008). University of Munich, Munich School of Management / Discussion Papers in Business Administration (52) RePEc:nbr:nberwo:13804 Predictive Systems: Living with Imperfect Predictors (2008). National Bureau of Economic Research, Inc / NBER Working Papers (53) RePEc:nbr:nberwo:14015 Private Sunspots and Idiosyncratic Investor Sentiment (2008). National Bureau of Economic Research, Inc / NBER Working Papers (54) RePEc:nbr:nberwo:14245 Why Do Foreign Firms Leave U.S. Equity Markets? (2008). National Bureau of Economic Research, Inc / NBER Working Papers (55) RePEc:nbr:nberwo:14250 On the Lifecycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms (2008). National Bureau of Economic Research, Inc / NBER Working Papers (56) RePEc:nbr:nberwo:14523 An Institutional Theory of Momentum and Reversal (2008). National Bureau of Economic Research, Inc / NBER Working Papers (57) RePEc:nbr:nberwo:14574 Multi-market Delegated Asset Management (2008). National Bureau of Economic Research, Inc / NBER Working Papers (58) RePEc:nbr:nberwo:14612 Deciphering the Liquidity and Credit Crunch 2007-08 (2008). National Bureau of Economic Research, Inc / NBER Working Papers (59) RePEc:ner:leuven:urn:hdl:1979/2006 Essays on liquidity-preference in markets with borrowing restrictions.. (2008). Katholieke Universiteit Leuven / Open Access publications from Katholieke Universiteit Leuven (60) RePEc:nya:albaec:08-08 On the Objective of Corporate Boards: Theory and Evidence (2008). University at Albany, SUNY, Department of Economics / Discussion Papers (61) RePEc:pra:mprapa:10209 Modeling Trade Direction (2008). University Library of Munich, Germany / MPRA Paper (62) RePEc:pra:mprapa:11641 Recovering Delisting Returns of Hedge Funds (2008). University Library of Munich, Germany / MPRA Paper (63) RePEc:pra:mprapa:12549 The optimal liquidity principle with restricted borrowing (2008). University Library of Munich, Germany / MPRA Paper (64) RePEc:pra:mprapa:12620 Fundamental Value Investors: Characteristics and Performance (2008). University Library of Munich, Germany / MPRA Paper (65) RePEc:pra:mprapa:12778 Trust and Loss Aversion in Romanian Capital Market (2008). University Library of Munich, Germany / MPRA Paper (66) RePEc:pra:mprapa:13585 Are Short-sellers Different? (2008). University Library of Munich, Germany / MPRA Paper (67) RePEc:pra:mprapa:9164 Thought and Behavior Contagion in Capital Markets (2008). University Library of Munich, Germany / MPRA Paper (68) RePEc:pra:mprapa:9611 The term structure and the expectations hypothesis: a threshold model (2008). University Library of Munich, Germany / MPRA Paper (69) RePEc:upf:upfgen:1119 A Century of Global Equity Market Correlations (2008). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (70) RePEc:usg:dp2008:2008-11 Why Disagreement May Not Matter (much) for Asset Prices (2008). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2008 (71) RePEc:usg:dp2008:2008-12 Inflation Risk Premia and Survey Evidence on Macroeconomic Uncertainty (2008). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2008 (72) RePEc:zbw:arqudp:49 Welche privaten VeräuÃerungsgewinne sollten besteuert werden? (2008). arqus - Arbeitskreis Quantitative Steuerlehre / arqus Discussion Papers in Quantitative Tax Research (73) RePEc:zbw:zewdip:7224 The Determinants of Capital Structure: Some Evidence from Banks (2008). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers (74) RePEc:zbw:zewdip:7229 The Impact of Personal and Corporate Taxation on Capital Structure Choices (2008). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Recent citations received in: 2007 (1) RePEc:aah:create:2007-07 Habit persistence: Explaining cross sectional variation in returns and time-varying expected returns (2007). School of Economics and Management, University of Aarhus / CREATES Research Papers (2) RePEc:aah:create:2007-31 Habit Formation, Surplus Consumption and Return Predictability: International Evidence (2007). School of Economics and Management, University of Aarhus / CREATES Research Papers (3) RePEc:aah:create:2007-37 Models for S&P500 Dynamics: Evidence from Realized Volatility, Daily Returns, and Option Prices (2007). School of Economics and Management, University of Aarhus / CREATES Research Papers (4) RePEc:aea:jecper:v:21:y:2007:i:1:p:91-116 The Goals and Promise of the Sarbanesââ¬âOxley Act (2007). Journal of Economic Perspectives (5) RePEc:arx:papers:physics/0702027 A two-Factor Asset Pricing Model and the Fat Tail Distribution of Firm Sizes (2007). arXiv.org / Quantitative Finance Papers (6) RePEc:bfr:banfra:188 Pricing and Inference with Mixtures of Conditionally Normal Processes. (2007). Banque de France / Documents de Travail (7) RePEc:bol:bodewp:611 Who are the active investors? Evidence from Venture Capital (2007). Dipartimento Scienze Economiche, Universita' di Bologna / Working Papers (8) RePEc:bol:bodewp:613 What is the Role of Legal Systems in Financial Intermediation? Theory and Evidence (2007). Dipartimento Scienze Economiche, Universita' di Bologna / Working Papers (9) RePEc:bos:wpaper:wp2007-018 Data Dependent Rules for the Selection of the Number of Leads and Lags in the Dynamic OLS Cointegrating Regression* (2007). Department of Economics, Boston University / Boston University Working Papers Series (10) RePEc:bpj:bejeap:v:advances.6:y:2007:i:2:n:8 Field Experiments: A Bridge between Lab and Naturally Occurring Data (2007). The B.E. Journal of Economic Analysis & Policy (11) RePEc:ces:ceswps:_2174 The Dark Side of International Cross-Listing: Effects on Rival Firms at Home (2007). CESifo GmbH / CESifo Working Paper Series (12) RePEc:cir:cirwor:2007s-27 Risk, Timing and Overoptimism in Private Placements and Public Offerings (2007). CIRANO / CIRANO Working Papers (13) RePEc:cla:levrem:843644000000000374 What to Put on the Table (2007). UCLA Department of Economics / Levine's Bibliography (14) RePEc:cpr:ceprdp:6029 Finance and Efficiency: Do Bank Branching Regulations Matter? (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (15) RePEc:cpr:ceprdp:6044 Liquidity and Capital Structure (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (16) RePEc:cpr:ceprdp:6201 A Lobbying Approach to Evaluating the Sarbanes-Oxley Act of 2002 (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (17) RePEc:cpr:ceprdp:6210 Bargaining in Mergers and Termination Fees (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (18) RePEc:cpr:ceprdp:6239 Understanding Index Option Returns (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (19) RePEc:dgr:eureri:1765010892 A Recommitment Strategy for Long Term Private Equity Fund Investors (2007). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (20) RePEc:dgr:kubcen:2007100 Optimal Fragile Financial Networks (2007). Tilburg University, Center for Economic Research / Discussion Paper (21) RePEc:dnb:dnbwpp:144 Market timing and corporate capital structure - A transatlantic comparison (2007). Netherlands Central Bank, Research Department / DNB Working Papers (22) RePEc:ecb:ecbwps:20070787 Finance and growth - a macroeconomic assessment of the evidence from a European angle (2007). European Central Bank / Working Paper Series (23) RePEc:ecl:ohidic:2005-15 Can Short-Sellers Predict Returns? Daily Evidence (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (24) RePEc:ecl:ohidic:2006-14 Large Shareholders and Corporate Policies (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (25) RePEc:ecl:ohidic:2007-13 Fundamentals, Market Timing, and Seasoned Equity Offerings (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (26) RePEc:ecl:ohidic:2007-4 The Market for Comeback CEOs (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (27) RePEc:ecl:ohidic:2007-5 The Impact of Shareholder Power on Bondholders: Evidence from Mergers and Acquisitions (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (28) RePEc:ecl:ohidic:2007-8 Why Do Private Acquirers Pay So Little Compared to Public Acquirers? (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (29) RePEc:edj:ceauch:237 What to put in the table (2007). Centro de EconomÃa Aplicada, Universidad de Chile / Documentos de Trabajo (30) RePEc:eti:dpaper:07059 Consolidation of Banks in Japan: Causes and Consequences (2007). Research Institute of Economy, Trade and Industry (RIETI) / Discussion papers (31) RePEc:fip:fedfpr:y:2007:i:oct:x:3 The economics of private equity funds (2007). Proceedings (32) RePEc:fip:fedgfe:2007-29 Bank commercial loan fair value practices (2007). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (33) RePEc:fip:fedgfe:2007-39 An efficiency perspective on the gains from mergers and asset purchases (2007). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (34) RePEc:fip:fedlwp:2006-033 Central bank intervention with limited arbitrage (2007). Federal Reserve Bank of St. Louis / Working Papers (35) RePEc:hhs:hastef:0684 Billiards and Brains: Cognitive Ability and Behavior in a p-Beauty Contest (2007). Stockholm School of Economics / Working Paper Series in Economics and Finance (36) RePEc:hhs:sifrwp:0060 Large Shareholders and Corporate Policies (2007). Swedish Institute for Financial Research / SIFR Research Report Series (37) RePEc:iis:dispap:iiisdp195 A Pure Test for the Elasticity of Yield Spreads (2007). IIIS / The Institute for International Integration Studies Discussion Paper Series (38) RePEc:imf:imfwpa:07/186 Financial Reforms, Financial Openness, and Corporate Borrowing: International Evidence (2007). International Monetary Fund / IMF Working Papers (39) RePEc:kap:annfin:v:3:y:2007:i:3:p:389-409 Switching to a poor business activity: optimal capital structure, agency costs and covenant rules (2007). Annals of Finance (40) RePEc:kap:jfsres:v:32:y:2007:i:1:p:17-38 Basel II: Correlation Related Issues (2007). Journal of Financial Services Research (41) RePEc:nbr:nberwo:12874 On the Return to Venture Capital (2007). National Bureau of Economic Research, Inc / NBER Working Papers (42) RePEc:nbr:nberwo:12896 Collective Risk Management in a Flight to Quality Episode (2007). National Bureau of Economic Research, Inc / NBER Working Papers (43) RePEc:nbr:nberwo:12952 A Lobbying Approach to Evaluating the Sarbanes-Oxley Act of 2002 (2007). National Bureau of Economic Research, Inc / NBER Working Papers (44) RePEc:nbr:nberwo:13061 Why Do Private Acquirers Pay So Little Compared to Public Acquirers? (2007). National Bureau of Economic Research, Inc / NBER Working Papers (45) RePEc:nbr:nberwo:13093 When did Ownership Separate from Control? Corporate Governance in the Early Nineteenth Century (2007). National Bureau of Economic Research, Inc / NBER Working Papers (46) RePEc:nbr:nberwo:13121 The Small World of Investing: Board Connections and Mutual Fund Returns (2007). National Bureau of Economic Research, Inc / NBER Working Papers (47) RePEc:nbr:nberwo:13189 Investor Sentiment in the Stock Market (2007). National Bureau of Economic Research, Inc / NBER Working Papers (48) RePEc:nbr:nberwo:13285 Fundamentals, Market Timing, and Seasoned Equity Offerings (2007). National Bureau of Economic Research, Inc / NBER Working Papers (49) RePEc:nbr:nberwo:13361 Mortgage Timing (2007). National Bureau of Economic Research, Inc / NBER Working Papers (50) RePEc:nbr:nberwo:13372 A Calibratable Model of Optimal CEO Incentives in Market Equilibrium (2007). National Bureau of Economic Research, Inc / NBER Working Papers (51) RePEc:nbr:nberwo:13399 Consolidation of Banks in Japan: Causes and Consequences (2007). National Bureau of Economic Research, Inc / NBER Working Papers (52) RePEc:nbr:nberwo:13487 Optimal Mortgage Refinancing: A Closed Form Solution (2007). National Bureau of Economic Research, Inc / NBER Working Papers (53) RePEc:nbr:nberwo:13516 Observational Learning: Evidence from a Randomized Natural Field Experiment (2007). National Bureau of Economic Research, Inc / NBER Working Papers (54) RePEc:nbr:nberwo:13601 Did Firms Substitute Dividends for Share Repurchases after the 2003 Reductions in Shareholder Tax Rates? (2007). National Bureau of Economic Research, Inc / NBER Working Papers (55) RePEc:nbr:nberwo:13608 The Economic Consequences of Legal Origins (2007). National Bureau of Economic Research, Inc / NBER Working Papers (56) RePEc:nbr:nberwo:13625 When Does a Mutual Funds Trade Reveal its Skill? (2007). National Bureau of Economic Research, Inc / NBER Working Papers (57) RePEc:nbr:nberwo:13636 The Effect of Venture Capital on Innovation Strategies (2007). National Bureau of Economic Research, Inc / NBER Working Papers (58) RePEc:nbr:nberwo:13658 How Sovereign is Sovereign Credit Risk? (2007). National Bureau of Economic Research, Inc / NBER Working Papers (59) RePEc:ner:tilbur:urn:nbn:nl:ui:12-194317 The impact of overnight periods on option pricing. (2007). Tilburg University / Open Access publications from Tilburg University (60) RePEc:ner:tilbur:urn:nbn:nl:ui:12-301942 Saving and investing over the life cycle and the role of collective pension funds. (2007). Tilburg University / Open Access publications from Tilburg University (61) RePEc:ner:tilbur:urn:nbn:nl:ui:12-3508402 Big bad banks? The impact of U.S. branch deregulation on income distribution. (2007). Tilburg University / Open Access publications from Tilburg University (62) RePEc:nwu:cmsems:1447 Stock Options and Chief Executive Compensation (2007). Northwestern University, Center for Mathematical Studies in Economics and Management Science / Discussion Papers (63) RePEc:por:fepwps:240 Market Impact of International Sporting and Cultural Events (2007). Universidade do Porto, Faculdade de Economia do Porto / FEP Working Papers (64) RePEc:pra:mprapa:14918 A Semi-Analytical Parametric Model for Dependent Defaults (2007). University Library of Munich, Germany / MPRA Paper (65) RePEc:pra:mprapa:3598 Investment and firm dynamics (2007). University Library of Munich, Germany / MPRA Paper (66) RePEc:pra:mprapa:5075 Optimal Portfolio Liquidation for CARA Investors (2007). University Library of Munich, Germany / MPRA Paper (67) RePEc:pra:mprapa:5510 Do short-sellers arbrtrage accrual-based return anomalies? (2007). University Library of Munich, Germany / MPRA Paper (68) RePEc:pra:mprapa:5548 Liquidation in the Face of Adversity: Stealth Vs. Sunshine Trading, Predatory Trading Vs. Liquidity Provision (2007). University Library of Munich, Germany / MPRA Paper (69) RePEc:spe:wpaper:0720 Market Impact of International Sporting and Cultural Events (2007). International Association of Sports Economists / Working Papers (70) RePEc:uct:uconnp:2007-08 US Corporate Default Swap Valuation: The Market Liquidity Hypothesis and Autonomous Credit Risk (2007). University of Connecticut, Department of Economics / Working papers (71) RePEc:uct:uconnp:2007-10 Empirical Analysis of Credit Risk Regime Switching and Temporal Conditional Default Correlation in Credit Default Swap Valuation: The Market liquidity effect (2007). University of Connecticut, Department of Economics / Working papers (72) RePEc:use:tkiwps:0706 Bargaining in Mergers and Termination Fees (2007). Utrecht School of Economics / Working Papers (73) RePEc:wbk:wbrwps:4156 Capital market development : whither Latin America ? (2007). The World Bank / Policy Research Working Paper Series (74) RePEc:wbk:wbrwps:4184 Stock market development under globalization : whither the gains from reforms ? (2007). The World Bank / Policy Research Working Paper Series (75) RePEc:yor:yorken:07/08 Option Pricing and Spikes in Volatility: Theoretical and Empirical Analysis (2007). Department of Economics, University of York / Discussion Papers (76) RePEc:zbw:bubdp2:6927 Creditor concentration: an empirical investigation (2007). Deutsche Bundesbank, Research Centre / Discussion Paper Series 2: Banking and Financial Studies Recent citations received in: 2006 (1) RePEc:aea:jecper:v:20:y:2006:i:2:p:73-96 The Role of Family in Family Firms (2006). Journal of Economic Perspectives (2) RePEc:bfr:banfra:149 Financial (Dis)Integration. (2006). Banque de France / Documents de Travail (3) RePEc:bfr:banfra:155 The Cross-Section of Foreign Currency Risk Premia and Consumption Growth Risk. (2006). Banque de France / Documents de Travail (4) RePEc:bos:wpaper:wp2006-005 Firmsââ¬â¢ Heterogeneous Sensitivities to the Business Cycle, and the Cross-Section of Expected Returns (2006). Department of Economics, Boston University / Boston University Working Papers Series (5) RePEc:bro:econwp:2006-17 Growth to Value: A Difficult Journey for IPOs and Concentrated Industries (2006). Brown University, Department of Economics / Working Papers (6) RePEc:cai:recosp:reco_572_0297 Théorie comportementale du portefeuille. Intérêt et limites (2006). Revue économique (7) RePEc:cbr:cbrwps:wp321 Legal origins: reconciling law and finance and comparative law (2006). ESRC Centre for Business Research / ESRC Centre for Business Research - Working Papers (8) RePEc:cbr:cbrwps:wp324 Shareholder Protection: A Leximetric Approach (2006). ESRC Centre for Business Research / ESRC Centre for Business Research - Working Papers (9) RePEc:cbr:cbrwps:wp332 The costs and benefits of secured creditor control in bankruptcy: Evidence from the UK (2006). ESRC Centre for Business Research / ESRC Centre for Business Research - Working Papers (10) RePEc:ces:eeagre:v::y:2006:i::p:1-120 EEAG European Economic Advisory Group at CESifo: Report on the European Economy 2006 (2006). EEAG Report on the European Economy (11) RePEc:ces:eeagre:v::y:2006:i::p:101-116 Chapter 5: Mergers and Competition Policy in Europe (2006). EEAG Report on the European Economy (12) RePEc:cfs:cfswop:wp200620 Baby Boomer Retirement Security: The Roles of Planning, Financial Literacy,and Housing Wealth (2006). Center for Financial Studies / CFS Working Paper Series (13) RePEc:cpr:ceprdp:5460 Sudden Deaths: Taking Stock of Political Connections (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (14) RePEc:cpr:ceprdp:5623 Banking Crises, Financial Dependence and Growth (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (15) RePEc:cpr:ceprdp:5735 Cognitive Abilities and Portfolio Choice (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (16) RePEc:cpr:ceprdp:5806 Venture Capital Financing: The Role of Bargaining Power and the Evolution of Informational Asymmetry (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (17) RePEc:cpr:ceprdp:6005 Direct Evidence of Dividend Tax Clienteles (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (18) RePEc:cte:wbrepe:wb063310 CREDIT SPREADS: THEORY AND EVIDENCE ABOUT THE INFORMATION CONTENT OF STOCKS, BONDS AND CDSs (2006). Universidad Carlos III, Departamento de EconomÃa de la Empresa / Business Economics Working Papers (19) RePEc:cte:wbrepe:wb066519 YET ANOTHER PUZZLE? THE RELATION BETWEEN PRICE AND PERFORMANCE IN THE MUTUAL FUND INDUSTRY (2006). Universidad Carlos III, Departamento de EconomÃa de la Empresa / Business Economics Working Papers (20) RePEc:dgr:kubcen:200667 The Impact of Organizational Structure and Lending Technology on Banking Competition (2006). Tilburg University, Center for Economic Research / Discussion Paper (21) RePEc:dgr:uvatin:20060011 Market Liquidity, Investor Participation and Managerial Autonomy: Why do Firms go Private? (2006). Tinbergen Institute / Tinbergen Institute Discussion Papers (22) RePEc:dul:wpaper:06-13rs Does financial intermediation matter for macroeconomic efficiency? (2006). Université libre de Bruxelles, Department of Applied Economics (DULBEA) / Working Papers DULBEA (23) RePEc:ebg:essewp:dr-06016 Feedback Effects of Rating Downgrades (2006). ESSEC Research Center, ESSEC Business School / ESSEC Working Papers (24) RePEc:ecb:ecbwps:20060653 Acquisition versus greenfield - the impact of the mode of foreign bank entry on information and bank lending rates. (2006). European Central Bank / Working Paper Series (25) RePEc:ecb:ecbwps:20060702 Comparing financial systems - a structural analysis (2006). European Central Bank / Working Paper Series (26) RePEc:ecl:illbus:06-0126 Legal System and Rule of Law Effects on US Cross-Listing to Bond by Emerging-Market Firms (2006). University of Illinois at Urbana-Champaign, College of Business / Working Papers (27) RePEc:ecl:ohidic:2005-18 Do Local Analysts Know More? A Cross-Country Study of the Performance of Local Analysts and Foreign Analysts (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (28) RePEc:ecl:ohidic:2006-21 The Economics of Conflicts of Interest in Financial Institutions (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (29) RePEc:ecl:ohidic:2006-8 Investor Overreaction, Cross-Sectional Dispersion of Firm Valuations, and Expected Stock Returns (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (30) RePEc:edb:cedidp:06-01 Does lending behaviour of banks in emerging economies vary by ownership? Evidence from the Indian banking sector (2006). Centre for Economic Development and Institutions(CEDI), Brunel University / CEDI Discussion Paper Series (31) RePEc:fip:fedawp:2006-06 The origins of bubbles in laboratory asset markets (2006). Federal Reserve Bank of Atlanta / Working Paper (32) RePEc:fip:fedgfe:2007-11 Expected stock returns and variance risk premia (2006). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (33) RePEc:fip:fedgif:877 International cross-listing, firm performance and top management turnover: a test of the bonding hypothesis (2006). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (34) RePEc:fip:fedgif:879 Efficiency in housing markets: do home buyers know how to discount? (2006). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (35) RePEc:fip:fedhwp:wp-06-05 The tradeoff between mortgage prepayments and tax-deferred retirement savings (2006). Federal Reserve Bank of Chicago / Working Paper Series (36) RePEc:fip:fedlrv:y:2006:i:nov:p:527-542:n:v.88no.6 The transition to electronic communications networks in the secondary treasury market (2006). Review (37) RePEc:fip:fedlwp:2004-027 Aggregate idiosyncratic volatility in G7 countries (2006). Federal Reserve Bank of St. Louis / Working Papers (38) RePEc:fip:fedlwp:2005-026 Is value premium a proxy for time-varying investment opportunities: some time series evidence (2006). Federal Reserve Bank of St. Louis / Working Papers (39) RePEc:fip:fedlwp:2006-006 Investigating the intertemporal risk-return relation in international stock markets with the component GARCH model (2006). Federal Reserve Bank of St. Louis / Working Papers (40) RePEc:fip:fedlwp:2006-019 Understanding stock return predictability (2006). Federal Reserve Bank of St. Louis / Working Papers (41) RePEc:fip:fedlwp:2006-034 Why do analysts continue to provide favorable coverage for seasoned stocks? (2006). Federal Reserve Bank of St. Louis / Working Papers (42) RePEc:fip:fedlwp:2006-036 The relation between time-series and cross-sectional effects of idiosyncratic variance on stock returns in G7 countries (2006). Federal Reserve Bank of St. Louis / Working Papers (43) RePEc:fip:fedlwp:2006-044 Corporate response to distress: evidence from the Asian financial crisis (2006). Federal Reserve Bank of St. Louis / Working Papers (44) RePEc:fip:fedlwp:2006-047 Does aggregate relative risk aversion change countercyclically over time? evidence from the stock market (2006). Federal Reserve Bank of St. Louis / Working Papers (45) RePEc:fip:fednsr:252 Visible and hidden risk factors for banks (2006). Federal Reserve Bank of New York / Staff Reports (46) RePEc:han:dpaper:dp-337 Institutional and Individual Sentiment: Smart Money and Noise Trader Risk (2006). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (47) RePEc:hhs:bofitp:2006_005 Profitability of foreign banks in Central and Eastern Europe: Does the entry mode matter? (2006). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (48) RePEc:hhs:gunwpe:0232 EFFICIENCY IN HOUSING MARKETS: DO HOME BUYERS KNOW HOW TO DISCOUNT? (2006). Göteborg University, Department of Economics / Working Papers in Economics (49) RePEc:hhs:gunwpe:0233 The Bright Side of Shiller-Swaps: A Solution to Inter-generational Risk-sharing (2006). Göteborg University, Department of Economics / Working Papers in Economics (50) RePEc:hhs:nhhfms:2006_008 Financial Distress and Idiosyncratic Volatility: An Empirical Investigation (2006). Department of Finance and Management Science, Norwegian School of Economics and Business Administration / Discussion Papers (51) RePEc:hhs:sifrwp:0043 Pay Me Later: Inside Debt and Its Role in Managerial Compensation (2006). Swedish Institute for Financial Research / SIFR Research Report Series (52) RePEc:hhs:sifrwp:0045 Market Coditions and Venture Capitalist Experience in Start-Up Financing (2006). Swedish Institute for Financial Research / SIFR Research Report Series (53) RePEc:hit:hitcei:2006-5 Reluctant privatization (2006). Institute of Economic Research, Hitotsubashi University / Working Paper Series (54) RePEc:hst:hstdps:d06-178 Subsampling-Based Tests of Stock-Return Predictability (2006). Institute of Economic Research, Hitotsubashi University / Hi-Stat Discussion Paper Series (55) RePEc:idb:wpaper:4466 Corporate Governance and Firm Value in Mexico (2006). Inter-American Development Bank, Research Department / Working Papers (56) RePEc:ijc:ijcjou:y:2006:q:2:a:3 Credit Cycles, Credit Risk, and Prudential Regulation (2006). International Journal of Central Banking (57) RePEc:imf:imfwpa:06/51 Malaysian Capital Controls: Macroeconomics and Institutions (2006). International Monetary Fund / IMF Working Papers (58) RePEc:kap:fmktpm:v:20:y:2006:i:1:p:33-47 Board Members and Company Value (2006). Financial Markets and Portfolio Management (59) RePEc:kap:jmgtgv:v:10:y:2006:i:3:p:307-323 The Adverse Consequences of Share-Based Pay in Risky Companies (2006). Journal of Management and Governance (60) RePEc:kap:revdev:v:9:y:2006:i:3:p:239-264 Static versus dynamic hedges: an empirical comparison for barrier options (2006). Review of Derivatives Research (61) RePEc:lic:licosd:16606 Profitability of foreign and domestic banks in Central and Eastern Europe: does the mode of entry matter? (2006). LICOS - Centre for Institutions and Economic Performance, K.U.Leuven / LICOS Discussion Papers (62) RePEc:mrr:papers:wp114 Baby Boomer Retirement Security: The Roles of Planning, Financial Literacy, and Housing Wealth (2006). University of Michigan, Michigan Retirement Research Center / Working Papers (63) RePEc:mrr:papers:wp138 Retirement Savings Portfolio Management (2006). University of Michigan, Michigan Retirement Research Center / Working Papers (64) RePEc:mrr:papers:wp146 Life-Cycle Asset Allocation with Annuity Markets: Is Longevity Insurance a Good Deal? (2006). University of Michigan, Michigan Retirement Research Center / Working Papers (65) RePEc:nan:wpaper:0603 A New Direction of Fund Rating Based on the Finite Normal Mixture Model (2006). Nanyang Technolgical University, School of Humanities and Social Sciences, Economic Growth centre / Economic Growth centre Working Paper Series (66) RePEc:nbr:nberwo:11912 Financial Globalization, Corporate Governance, and Eastern Europe (2006). National Bureau of Economic Research, Inc / NBER Working Papers (67) RePEc:nbr:nberwo:12036 Housing, Consumption, and Asset Pricing (2006). National Bureau of Economic Research, Inc / NBER Working Papers (68) RePEc:nbr:nberwo:12087 Financial Constraints, Asset Tangibility, and Corporate Investment (2006). National Bureau of Economic Research, Inc / NBER Working Papers (69) RePEc:nbr:nberwo:12151 Why Do IPO Auctions Fail? (2006). National Bureau of Economic Research, Inc / NBER Working Papers (70) RePEc:nbr:nberwo:12183 The Expected Value Premium (2006). National Bureau of Economic Research, Inc / NBER Working Papers (71) RePEc:nbr:nberwo:12222 Do Foreigners Invest Less in Poorly Governed Firms? (2006). National Bureau of Economic Research, Inc / NBER Working Papers (72) RePEc:nbr:nberwo:12234 Managing Bank Liquidity Risk: How Deposit-Loan Synergies Vary with Market Conditions (2006). National Bureau of Economic Research, Inc / NBER Working Papers (73) RePEc:nbr:nberwo:12270 Resolving Macroeconomic Uncertainty in Stock and Bond Markets (2006). National Bureau of Economic Research, Inc / NBER Working Papers (74) RePEc:nbr:nberwo:12288 The Effect of Dividends on Consumption (2006). National Bureau of Economic Research, Inc / NBER Working Papers (75) RePEc:nbr:nberwo:12342 Capital Gains Taxes and Asset Prices: Capitalization or Lock-In? (2006). National Bureau of Economic Research, Inc / NBER Working Papers (76) RePEc:nbr:nberwo:12360 A Skeptical Appraisal of Asset-Pricing Tests (2006). National Bureau of Economic Research, Inc / NBER Working Papers (77) RePEc:nbr:nberwo:12362 In Search of Distress Risk (2006). National Bureau of Economic Research, Inc / NBER Working Papers (78) RePEc:nbr:nberwo:12376 Flight-to-Quality or Flight-to-Liquidity? Evidence From the Euro-Area Bond Market (2006). National Bureau of Economic Research, Inc / NBER Working Papers (79) RePEc:nbr:nberwo:12397 What Drives the Disposition Effect? An Analysis of a Long-Standing Preference-Based Explanation (2006). National Bureau of Economic Research, Inc / NBER Working Papers (80) RePEc:nbr:nberwo:12500 Look at Me Now: What Attracts U.S. Shareholders? (2006). National Bureau of Economic Research, Inc / NBER Working Papers (81) RePEc:nbr:nberwo:12502 The Tradeoff Between Mortgage Prepayments and Tax-Deferred Retirement Savings (2006). National Bureau of Economic Research, Inc / NBER Working Papers (82) RePEc:nbr:nberwo:12555 Financially Constrained Stock Returns (2006). National Bureau of Economic Research, Inc / NBER Working Papers (83) RePEc:nbr:nberwo:12585 Baby Boomer Retirement Security: the Roles of Planning, Financial Literacy, and Housing Wealth (2006). National Bureau of Economic Research, Inc / NBER Working Papers (84) RePEc:nbr:nberwo:12622 Relationship Banking and the Pricing of Financial Services (2006). National Bureau of Economic Research, Inc / NBER Working Papers (85) RePEc:nbr:nberwo:12649 Why do firms hold so much cash? A tax-based explanation (2006). National Bureau of Economic Research, Inc / NBER Working Papers (86) RePEc:nbr:nberwo:12695 The Economics of Conflicts of Interest in Financial Institutions (2006). National Bureau of Economic Research, Inc / NBER Working Papers (87) RePEc:nbr:nberwo:12720 Coarse Thinking and Persuasion (2006). National Bureau of Economic Research, Inc / NBER Working Papers (88) RePEc:nbr:nberwo:12765 What Do Independent Directors Know? Evidence from Their Trading (2006). National Bureau of Economic Research, Inc / NBER Working Papers (89) RePEc:nbr:nberwo:12792 Entrepreneurial Learning, the IPO Decision, and the Post-IPO Drop in Firm Profitability (2006). National Bureau of Economic Research, Inc / NBER Working Papers (90) RePEc:nbr:nberwo:12806 Decomposing the Effects of Financial Liberalization: Crises vs. Growth (2006). National Bureau of Economic Research, Inc / NBER Working Papers (91) RePEc:ner:tilbur:urn:nbn:nl:ui:12-3508409 Creating a more efficient financial system: Challenges for Bangladesh. (2006). Tilburg University / Open Access publications from Tilburg University (92) RePEc:ner:tilbur:urn:nbn:nl:ui:12-3508413 Creating an efficient financial system: Challenges in a global economy. (2006). Tilburg University / Open Access publications from Tilburg University (93) RePEc:pra:mprapa:1076 The role of fear in home-biased decision making: first insights from neuroeconomics (2006). University Library of Munich, Germany / MPRA Paper (94) RePEc:pra:mprapa:157 How Law Affects Lending (2006). University Library of Munich, Germany / MPRA Paper (95) RePEc:pra:mprapa:1801 An Empirical Investigation of Going Public Decision of Indian Companies (2006). University Library of Munich, Germany / MPRA Paper (96) RePEc:pra:mprapa:2273 Dividend Signaling and Unions (2006). University Library of Munich, Germany / MPRA Paper (97) RePEc:pra:mprapa:718 Credit Cycles, Credit Risk, and Prudential Regulation (2006). University Library of Munich, Germany / MPRA Paper (98) RePEc:qed:wpaper:1113 Takeovers and Cooperatives (2006). Queen's University, Department of Economics / Working Papers (99) RePEc:sef:csefwp:157 Cognitive Abilities and Portfolio Choice (2006). Centre for Studies in Economics and Finance (CSEF), University of Salerno, Italy / CSEF Working Papers (100) RePEc:ste:nystbu:06-04 Multinationals Do It Better: Evidence on the Efficiency of Corporationsââ¬â¢ Capital Budgeting (2006). New York University, Leonard N. Stern School of Business, Department of Economics / Working Papers More than 100 citations. List broken... Recent citations received in: 2005 (1) RePEc:aea:aecrev:v:95:y:2005:i:4:p:1005-1030 The Political Economy of Corporate Governance (2005). American Economic Review (2) RePEc:aea:aecrev:v:95:y:2005:i:5:p:1548-1572 Crises and Capital Requirements in Banking (2005). American Economic Review (3) RePEc:aea:jecper:v:19:y:2005:i:4:p:43-66 Individual Irrationality and Aggregate Outcomes (2005). Journal of Economic Perspectives (4) RePEc:ags:aaea05:19280 Sri Lankas Rural Non-farm Economy: Removing Constraints to Pro-poor Growth (2005). American Agricultural Economics Association (New Name 2008: Agricultural and Applied Economics Association) / 2005 Annual meeting, July 24-27, Provide (5) RePEc:bca:bocawp:05-19 Bank Failures and Bank Fundamentals: A Comparative Analysis of Latin America and East Asia during the Nineties using Bank-Level Data (2005). Bank of Canada / Working Papers (6) RePEc:bca:bocawp:05-3 Pre-Bid Run-Ups Ahead of Canadian Takeovers: How Big Is the Problem? (2005). Bank of Canada / Working Papers (7) RePEc:bdi:wptemi:td_549_05 FIRM SIZE DISTRIBUTION: DO FINANCIAL CONSTRAINTS EXPLAIN IT ALL? EVIDENCE FROM SURVEY DATA (2005). Bank of Italy, Economic Research Department / Temi di discussione (Economic working papers) (8) RePEc:bos:macppr:wp2005-005 Capital Structure, Credit Risk, and Macroeconomic Conditions (2005). Department of Economics, Boston University / Boston University Working Papers Series in Macroeconomics (9) RePEc:bos:wpaper:wp2005-002 Operating Leverage,Stock Market Cyclicality,and the Cross-Section of Returns (2005). Department of Economics, Boston University / Boston University Working Papers Series (10) RePEc:bos:wpaper:wp2005-019 THE CROSS-SECTION OF FOREIGN CURRENCY RISK PREMIA AND CONSUMPTION GROWTH RISK (2005). Department of Economics, Boston University / Boston University Working Papers Series (11) RePEc:bri:uobdis:05/569 Implementation Cycles in the New Economy (2005). Department of Economics, University of Bristol, UK / Bristol Economics Discussion Papers (12) RePEc:cbi:wpaper:10/rt/05 European Monetary Policy Surprises: The Aggregate and Sectoral Stock Market Response (2005). Central Bank & Financial Services Authority of Ireland (CBFSAI) / Research Technical Papers (13) RePEc:ces:ceswps:_1589 Bank Control and the Number of Bank Relations of Japanese Firms (2005). CESifo GmbH / CESifo Working Paper Series (14) RePEc:cfs:cfswop:wp200520 Equity Culture and the Distribution of Wealth (2005). Center for Financial Studies / CFS Working Paper Series (15) RePEc:cla:levrem:784828000000000439 Business Start-ups, The Lock-in Effect, and Capital Gains Taxation (2005). UCLA Department of Economics / Levine's Bibliography (16) RePEc:cla:uclaol:369 Knowing What Others Know: Coordination Motives in Information Acquisition (March 2006, with Laura Veldkamp) (2005). UCLA Department of Economics / UCLA Economics Online Papers (17) RePEc:col:000091:002203 Corporate Valuation and Governance: Evidence from Colombia (2005). UNIVERSIDAD DEL ROSARIO - FACULTAD DE ECONOMÃÂA / BORRADORES DE INVESTIGACIÃâN (18) RePEc:cpr:ceprdp:4852 Wealth Accumulation and Portfolio Choice with Taxable and Tax-Deferred Accounts (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (19) RePEc:cpr:ceprdp:4862 Do Demand Curves for Currencies Slope Down? Evidence from the MSCI Global Index Change (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (20) RePEc:cpr:ceprdp:4921 Why is Long-Horizon Equity Less Risky? A Duration-based Explanation of the Value Premium (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (21) RePEc:cpr:ceprdp:5117 Wealth Transfers, Contagion and Portfolio Constraints (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (22) RePEc:cpr:ceprdp:5119 CEO-Firm Match and Principal-Agent Problem (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (23) RePEc:cpr:ceprdp:5121 Is There a Diversification Discount in Financial Conglomerates? (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (24) RePEc:cpr:ceprdp:5253 Financial Integration and Systemic Risk (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (25) RePEc:dgr:kubcen:200557 Royal Ahold: A Failure of Corporate Governance and an Accounting Scandal (2005). Tilburg University, Center for Economic Research / Discussion Paper (26) RePEc:dgr:kubcen:200561 Control Structures and Payout Policy (2005). Tilburg University, Center for Economic Research / Discussion Paper (27) RePEc:dgr:kubtil:2005014 Control Structures and Payout Policy (2005). Tilburg University, Tilburg Law and Economic Center / Discussion Paper (28) RePEc:dgr:unuint:200507 Learning, Product Innovation and Firm Heterogeneity in Tanzania (2005). United Nations University, Institute for New Technologies / Discussion Papers (29) RePEc:dkn:econwp:eco_2005_17 Leviathan Resists: The Endogenous Relationship Between Privatisation and Firm Performance. (2005). Deakin University, Faculty of Business and Law, School of Accounting, Economics and Finance / Economics Series (30) RePEc:dlw:wpaper:05-17 Information Asymmetries, Litigation Risk and the Demand for Fairness Opinions: Evidence from U.S. Mergers & Acquisitions, 1980-2002 (2005). University of Delaware, Department of Economics / Working Papers (31) RePEc:dnb:dnbwpp:061 Asymmetric Price Adjustment in the Dutch Mortgage Market (2005). Netherlands Central Bank, Research Department / DNB Working Papers (32) RePEc:dnb:dnbwpp:067 Valuation of pension liabilities in incomplete markets (2005). Netherlands Central Bank, Research Department / DNB Working Papers (33) RePEc:ebg:heccah:0828 Learning about Beta: time-varying factor loadings, expected returns and the conditional CAPM (2005). Groupe HEC / Les Cahiers de Recherche (34) RePEc:ebg:iesewp:d-0601 Governance structure and the weighting of performance measures in CEO compensation (2005). IESE Business School / IESE Research Papers (35) RePEc:ecb:ecbwps:20050429 Cross-border diversification in bank asset portfolios (2005). European Central Bank / Working Paper Series (36) RePEc:ecb:ecbwps:20050452 Stocks, bonds, money markets and exchange rates - measuring international financial transmission (2005). European Central Bank / Working Paper Series (37) RePEc:ecb:ecbwps:20050498 Financial integration and entrepreneurial activity - evidence from foreign bank entry in emerging markets (2005). European Central Bank / Working Paper Series (38) RePEc:ecl:corcae:05-07 Financial Deepening and Bank Runs (2005). Cornell University, Center for Analytic Economics / Working Papers (39) RePEc:ecl:ohidic:2004-23 The Cherry-Picking Option in the U.S. Treasury Buyback Auctions (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (40) RePEc:ecl:ohidic:2004-24 Institutional Investment Constraints and Stock Prices (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (41) RePEc:ecl:ohidic:2005-20 Promotion Tournaments and Capital Rationing (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (42) RePEc:ecl:ohidic:2005-27 Financial Globalization, Corporate Governance, and Eastern Europe (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (43) RePEc:ecl:ohidic:2006-10 The World Price of Liquidity Risk (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (44) RePEc:egc:wpaper:918 Whats Psychology Worth? A Field Experiment in the Consumer Credit Market (2005). Economic Growth Center, Yale University / Working Papers (45) RePEc:esi:egpdis:2005-37 Financial Constraints on New Firms: Looking for Regional Disparities (2005). Max Planck Institute of Economics, Group for Entrepreneurship, Growth and Public Policy / Discussion Papers on Entrepreneurship, Growth and Public Pol (46) RePEc:eui:euiwps:eco2005/18 Liquidity runs with endogenous information acquisition (2005). (47) RePEc:fip:fedbwp:05-7 Borrowing costs and the demand for equity over the life cycle (2005). Federal Reserve Bank of Boston / Working Papers (48) RePEc:fip:fedgfe:2005-13 Housing, house prices, and the equity premium puzzle (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (49) RePEc:fip:fedgfe:2005-36 Large investors: implications for equilibrium asset, returns, shock absorption, and liquidity (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (50) RePEc:fip:fedgfe:2005-40 Risk, uncertainty, and asset prices (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (51) RePEc:fip:fedgfe:2005-63 Explaining credit default swap spreads with the equity volatility and jump risks of individual firms (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (52) RePEc:fip:fedgif:844 The response of global equity indexes to U.S. monetary policy announcements (2005). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (53) RePEc:fip:fedhpr:y:2005:i:apr:x:11 A re-examination of the role of relationships in the loan-granting process (2005). Proceedings (54) RePEc:fip:fedhpr:y:2005:i:may:p:140-147 Information asymmetries and the effects of banking mergers of firm-bank relationships (2005). Proceedings (55) RePEc:fip:fedhpr:y:2005:i:may:p:148-165 SMEs and bank lending relationships: the impact of mergers (2005). Proceedings (56) RePEc:fip:fedhwp:wp-05-06 Price discovery in a market under stress: the U.S. Treasury market in fall 1998 (2005). Federal Reserve Bank of Chicago / Working Paper Series (57) RePEc:fip:fedhwp:wp-05-17 Why do firms go public? evidence from the banking industry (2005). Federal Reserve Bank of Chicago / Working Paper Series (58) RePEc:hhs:uunewp:2005_011 Myopic Loss Aversion, the Equity Premium Puzzle, and GARCH (2005). Uppsala University, Department of Economics / Working Paper Series (59) RePEc:hit:hitcei:2005-10 The Effect of Auditor Choice on Financing Decisions (2005). Institute of Economic Research, Hitotsubashi University / Working Paper Series (60) RePEc:hit:hitcei:2005-8 Does Market Size Structure Affect Competition? The Case of Small Business Lending (2005). Institute of Economic Research, Hitotsubashi University / Working Paper Series (61) RePEc:idb:wpaper:3216 Corporate Valuation and Governance: Evidence from Colombia (2005). Inter-American Development Bank, Research Department / Working Papers (62) RePEc:idb:wpaper:3217 Valuación y gobierno corporativo: elementos de juicio de Colombia (2005). Inter-American Development Bank, Research Department / Working Papers (63) RePEc:iec:inveco:v:29:y:2005:i:1:p:33-71 Modelos de valoración de activos condicionales: Un panorama comparativo (2005). Investigaciones Economicas (64) RePEc:igi:igierp:291 Consumption, Wealth, the Elasticity of Intertemporal Substitution and Long-Run Stock Market Returns (2005). IGIER (Innocenzo Gasparini Institute for Economic Research), Bocconi University / Working Papers (65) RePEc:ijc:ijcjou:y:2005:q:2:a:6 Exchange Rate Volatility and the Credit Channel in Emerging Markets: A Vertical Perspective (2005). International Journal of Central Banking (66) RePEc:knz:cofedp:0510 The dynamics of overconfidence: Evidence from stock market forecasters (2005). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (67) RePEc:lic:licosd:16205 Share Issuing Privatizations in China: Determinants of Public Share Allocation and Underpricing (2005). LICOS - Centre for Institutions and Economic Performance, K.U.Leuven / LICOS Discussion Papers (68) RePEc:nbr:nberwo:11104 The Cross-Section of Currency Risk Premia and US Consumption Growth Risk (2005). National Bureau of Economic Research, Inc / NBER Working Papers (69) RePEc:nbr:nberwo:11144 Why is Long-Horizon Equity Less Risky? A Duration-Based Explanation of the Value Premium (2005). National Bureau of Economic Research, Inc / NBER Working Papers (70) RePEc:nbr:nberwo:11180 UNINSURED IDIOSYNCRATIC INVESTMENT RISK (2005). National Bureau of Economic Research, Inc / NBER Working Papers (71) RePEc:nbr:nberwo:11224 SMEs, Growth, and Poverty (2005). National Bureau of Economic Research, Inc / NBER Working Papers (72) RePEc:nbr:nberwo:11247 Portfolio Choice over the Life-Cycle in the Presence of Trickle Down Labor Income (2005). National Bureau of Economic Research, Inc / NBER Working Papers (73) RePEc:nbr:nberwo:11256 Winners and Losers from Enacting the Financial Modernization Statute (2005). National Bureau of Economic Research, Inc / NBER Working Papers (74) RePEc:nbr:nberwo:11326 The Value Spread as a Predictor of Returns (2005). National Bureau of Economic Research, Inc / NBER Working Papers (75) RePEc:nbr:nberwo:11357 Asset Fire Sales (and Purchases) in Equity Markets (2005). National Bureau of Economic Research, Inc / NBER Working Papers (76) RePEc:nbr:nberwo:11361 Optimism and Economic Choice (2005). National Bureau of Economic Research, Inc / NBER Working Papers (77) RePEc:nbr:nberwo:11424 Determinants of Vertical Integration: Finance, Contracts, and Regulation (2005). National Bureau of Economic Research, Inc / NBER Working Papers (78) RePEc:nbr:nberwo:11440 Wealth Transfers, Contagion, and Portfolio Constraints (2005). National Bureau of Economic Research, Inc / NBER Working Papers (79) RePEc:nbr:nberwo:11443 The Growth of Executive Pay (2005). National Bureau of Economic Research, Inc / NBER Working Papers (80) RePEc:nbr:nberwo:11459 Investment-Based Underperformance Following Seasoned Equity Offerings (2005). National Bureau of Economic Research, Inc / NBER Working Papers (81) RePEc:nbr:nberwo:11468 Predicting the Equity Premium Out of Sample: Can Anything Beat the Historical Average? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (82) RePEc:nbr:nberwo:11500 Bank Concentration and Fragility: Impact and Mechanics (2005). National Bureau of Economic Research, Inc / NBER Working Papers (83) RePEc:nbr:nberwo:11505 Why Do Firms Become Widely Held? An Analysis of the ynamics of Corporate Ownership (2005). National Bureau of Economic Research, Inc / NBER Working Papers (84) RePEc:nbr:nberwo:11526 Dumb Money: Mutual Fund Flows and the Cross-Section of Stock Returns (2005). National Bureau of Economic Research, Inc / NBER Working Papers (85) RePEc:nbr:nberwo:11559 Solving Models with External Habit (2005). National Bureau of Economic Research, Inc / NBER Working Papers (86) RePEc:nbr:nberwo:11564 The Returns on Human Capital: Good News on Wall Street is Bad News on Main Street (2005). National Bureau of Economic Research, Inc / NBER Working Papers (87) RePEc:nbr:nberwo:11685 The Risk-Adjusted Cost of Financial Distress (2005). National Bureau of Economic Research, Inc / NBER Working Papers (88) RePEc:nbr:nberwo:11697 Do Local Analysts Know More? A Cross-Country Study of the Performance of Local Analysts and Foreign Analysts (2005). National Bureau of Economic Research, Inc / NBER Working Papers (89) RePEc:nbr:nberwo:11766 Unobserved Actions of Mutual Funds (2005). National Bureau of Economic Research, Inc / NBER Working Papers (90) RePEc:nbr:nberwo:11816 Cash-Flow Risk, Discount Risk, and the Value Premium (2005). National Bureau of Economic Research, Inc / NBER Working Papers (91) RePEc:nbr:nberwo:11824 Downside Risk (2005). National Bureau of Economic Research, Inc / NBER Working Papers (92) RePEc:nbr:nberwo:11864 Equilibrium Commodity Prices with Irreversible Investment and Non-Linear Technology (2005). National Bureau of Economic Research, Inc / NBER Working Papers (93) RePEc:nbr:nberwo:11886 Firm Expansion and CEO Pay (2005). National Bureau of Economic Research, Inc / NBER Working Papers (94) RePEc:nbr:nberwo:11901 Why Doesnt Capital Flow from Rich to Poor Countries? An Empirical Investigation (2005). National Bureau of Economic Research, Inc / NBER Working Papers (95) RePEc:ner:leuven:urn:hdl:123456789/122218 Share issuing privatizations in China: Determinants of public share allocation and underpricing. (2005). Katholieke Universiteit Leuven / Open Access publications from Katholieke Universiteit Leuven (96) RePEc:ner:tilbur:urn:nbn:nl:ui:12-3108180 A study on the impact of credit market imperfections on technology diffusion and monetary policy. (2005). Tilburg University / Open Access publications from Tilburg University (97) RePEc:pch:abante:v:8:y:2005:i:1:p:55-84 OWNERSHIP STRUCTURE AND CORPORATE GOVERNANCE IN LATIN AMERICA (2005). Abante (98) RePEc:pra:mprapa:824 Exchange Rate Volatility and the Credit Channel in Emerging Markets: A Vertical Perspective (2005). University Library of Munich, Germany / MPRA Paper (99) RePEc:taf:apfiec:v:15:y:2005:i:10:p:679-690 Long-run post-merger stock performance of UK acquiring firms: a stochastic dominance perspective (2005). Applied Financial Economics (100) RePEc:use:tkiwps:0515 The determinants of merger waves (2005). Utrecht School of Economics / Working Papers More than 100 citations. List broken... Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||