|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

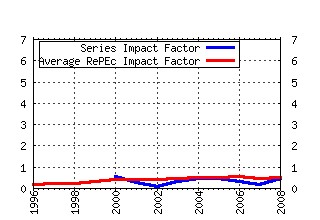

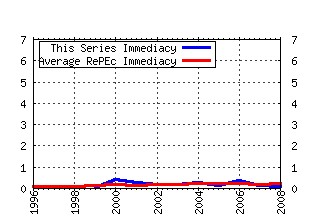

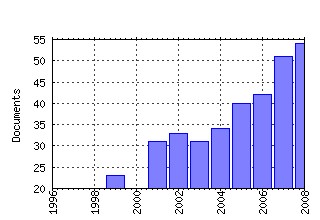

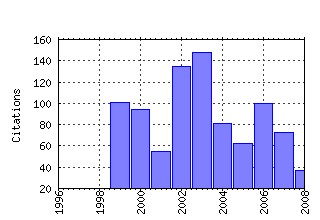

Journal of Public Economic Theory Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bla:jpbect:v:5:y:2003:i:2:p:279-303 Tax Competition and Economic Geography (2003). (2) RePEc:bla:jpbect:v:1:y:1999:i:1:p:5-50

School Finance Induced Migration and Stratification Patterns: The Impact of Private School Vouchers. (1999). (3) RePEc:bla:jpbect:v:8:y:2006:i:1:p:119-144 The Efficiency Consequences of Local Revenue Equalization: Tax Competition and Tax Distortions (2006). (4) RePEc:bla:jpbect:v:2:y:2000:i:3:p:349-63

Polarization Orderings and New Classes of Polarization Indices. (2000). (5) RePEc:bla:jpbect:v:4:y:2002:i:3:p:387-404

Optimal Factor Income Taxation in the Presence of Unemployment. (2002). (6) RePEc:bla:jpbect:v:5:y:2003:i:2:p:177-199 Leviathan and Capital Tax Competition in Federations (2003). (7) RePEc:bla:jpbect:v:4:y:2002:i:4:p:475-498 Optimal Redistribution with Heterogeneous Preferences for Leisure (2002). (8) RePEc:bla:jpbect:v:5:y:2003:i:2:p:439-446 Symmetric Tax Competition under Formula Apportionment (2003). (9) RePEc:bla:jpbect:v:6:y:2004:i:1:p:145-164 Restricted and Unrestricted Dominance for Welfare, Inequality, and Poverty Orderings (2004). (10) repec:bla:jpbect:v:5:y:2003:i:2:p:399-417 (). (11) RePEc:bla:jpbect:v:5:y:2003:i:2:p:419-437 Formula Apportionment and Transfer Pricing under Oligopolistic Competition (2003). (12) RePEc:bla:jpbect:v:9:y:2007:i:2:p:369-389 Centralization vs. Decentralization: A Principal-Agent Analysis (2007). (13) RePEc:bla:jpbect:v:1:y:1999:i:1:p:71-100

Systems of Benevolent Utility Functions. (1999). (14) RePEc:bla:jpbect:v:2:y:2000:i:2:p:183-212

Pollution Abatement Investment When Environmental Regulation Is Uncertain. (2000). (15) RePEc:bla:jpbect:v:4:y:2002:i:3:p:317-34

Press Advertising and the Political Differentiation of Newspapers. (2002). (16) RePEc:bla:jpbect:v:2:y:2000:i:4:p:435-60

Optimal Income Taxation with Quasi-linear Preferences Revisited. (2000). (17) RePEc:bla:jpbect:v:4:y:2002:i:2:p:207-41

Does Government Decentralization Increase Policy Innovation? (2002). (18) RePEc:bla:jpbect:v:5:y:2003:i:2:p:229-248 Strategic Inter-Regional Transfers (2003). (19) RePEc:bla:jpbect:v:8:y:2006:i:1:p:1-22 Leadership Giving in Charitable Fund-Raising (2006). (20) RePEc:bla:jpbect:v:3:y:2001:i:1:p:95-120

Mobility and Redistributive Politics. (2001). (21) RePEc:bla:jpbect:v:8:y:2006:i:4:p:631-676 Tax Reform with Useful Public Expenditures (2006). (22) RePEc:bla:jpbect:v:7:y:2005:i:2:p:295-315 Optimal Income Taxation with Endogenous Human Capital (2005). (23) RePEc:bla:jpbect:v:4:y:2002:i:4:p:661-677 Endogenous Public Policy, Politicization and Welfare (2002). (24) RePEc:bla:jpbect:v:1:y:1999:i:2:p:205-24

Fiscal Federalism and Capital Accumulation. (1999). (25) RePEc:bla:jpbect:v:2:y:2000:i:4:p:461-82

The Effect of Underclass Social Isolation on Schooling Choice. (2000). (26) RePEc:bla:jpbect:v:3:y:2001:i:2:p:167-84

Solidarity and Probabilistic Target Rules. (2001). (27) RePEc:bla:jpbect:v:9:y:2007:i:3:p:467-500 Help the Low Skilled or Let the Hardworking Thrive? A Study of Fairness in Optimal Income Taxation (2007). (28) RePEc:bla:jpbect:v:6:y:2004:i:1:p:65-77 Social Norms and Private Provision of Public Goods (2004). (29) RePEc:bla:jpbect:v:1:y:1999:i:4:p:499-509

Equilibrium Existence and Uniqueness in Public Good Models: An Elementary Proof via Contraction. (1999). (30) RePEc:bla:jpbect:v:2:y:2000:i:4:p:389-433

Government Policy in a Stochastic Growth Model with Elastic Labor Supply. (2000). (31) RePEc:bla:jpbect:v:5:y:2003:i:1:p:67-94 Endogenous Firm Objectives (2003). (32) RePEc:bla:jpbect:v:8:y:2006:i:2:p:247-263 Stable International Environmental Agreements: An Analytical Approach (2006). (33) RePEc:bla:jpbect:v:1:y:1999:i:3:p:309-38

The Mordukhovich Normal Cone and the Foundations of Welfare Economics. (1999). (34) RePEc:bla:jpbect:v:9:y:2007:i:6:p:1069-1078 Extendable Cooperative Games (2007). (35) RePEc:bla:jpbect:v:6:y:2004:i:3:p:397-407 Fiscal Policy in an Overlapping Generations Model with Bequest-as-Consumption (2004). (36) RePEc:bla:jpbect:v:6:y:2004:i:3:p:427-443 Characterizing Pareto Improvements (37) RePEc:bla:jpbect:v:9:y:2007:i:2:p:201-219 Aggregative Public Good Games (2007). (38) RePEc:bla:jpbect:v:6:y:2004:i:2:p:337-374 Jointly Optimal Taxes and Enforcement Policies in Response to Tax Evasion (2004). (39) RePEc:bla:jpbect:v:10:y:2008:i:4:p:547-561 Standard Tax Competition and Increasing Returns (2008). (40) RePEc:bla:jpbect:v:1:y:1999:i:4:p:399-438

Collusion-Proof Samuelson Conditions for Public Goods. (1999). (41) RePEc:bla:jpbect:v:6:y:2004:i:2:p:203-238 Scaling Up Learning Models in Public Good Games (2004). (42) RePEc:bla:jpbect:v:7:y:2005:i:1:p:107-116 Poverty-Reducing Tax Reforms with Heterogeneous Agents (2005). (43) RePEc:bla:jpbect:v:6:y:2004:i:3:p:471-490 Progressive Taxation, Moral Hazard, and Entrepreneurship (2004). (44) RePEc:bla:jpbect:v:2:y:2000:i:1:p:1-23

Social Security, Optimality, and Equilibria in a Stochastic Overlapping Generations Economy. (2000). (45) RePEc:bla:jpbect:v:9:y:2007:i:2:p:335-368 Discontinuous Payoffs, Shared Resources, and Games of Fiscal Competition: Existence of Pure Strategy Nash Equilibrium (2007). (46) RePEc:bla:jpbect:v:8:y:2006:i:4:p:529-545 Intergenerational Transfer of Human Capital and Optimal Education Policy (2006). (47) RePEc:bla:jpbect:v:4:y:2002:i:1:p:1-17

The Flypaper Effect Is Not an Anomaly. (2002). (48) RePEc:bla:jpbect:v:4:y:2002:i:3:p:347-68

Population Principles with Number-Dependent Critical Levels. (2002). (49) RePEc:bla:jpbect:v:6:y:2004:i:1:p:79-108 Decentralization via Federal and Unitary Referenda (2004). (50) RePEc:bla:jpbect:v:7:y:2005:i:1:p:1-25 Social Welfare Functionals on Restricted Domains and in Economic Environments (2005). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:fem:femwpa:2008.62 Coalition Formation and the Ancillary Benefits of Climate Policy (2008). Fondazione Eni Enrico Mattei / Working Papers (2) RePEc:han:dpaper:dp-406 Anticipated Tax Reforms and Temporary Tax Cuts: A General Equilibrium Analysis (2008). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (3) RePEc:pra:mprapa:11460 Are Progressive Income Taxes Stabilizing? : A Reply (2008). University Library of Munich, Germany / MPRA Paper (4) RePEc:pra:mprapa:8627 on the efficiency of team-based meritocracies (2008). University Library of Munich, Germany / MPRA Paper (5) RePEc:rjr:romjef:v:5:y:2008:i:4:p:146-160 MODELING THE ECONOMIC GROWTH IN ROMANIA. THE INFLUENCE OF FISCAL REGIMES (2008). Journal for Economic Forecasting (6) RePEc:roc:wallis:wp55 Strategy-Proofness and Single-Crossing (2008). University of Rochester - Wallis Institute of Political Economy / Wallis Working Papers Recent citations received in: 2007 (1) RePEc:bie:wpaper:387 On core stability and extendability (2007). Bielefeld University, Institute of Mathematical Economics / Working Papers (2) RePEc:ces:ceswps:_1993 Bribery vs. Extortion: Allowing the Lesser of two Evils (2007). CESifo GmbH / CESifo Working Paper Series (3) RePEc:dgr:kubcen:200754 Convex Multi-Choice Cooperative Games and their Monotonic Allocation Schemes (2007). Tilburg University, Center for Economic Research / Discussion Paper (4) RePEc:lvl:pmmacr:2007-18 Is the Value Added Tax Reform in India Poverty-Improving? An Analysis of Data from Two Major States (2007). (5) RePEc:pra:mprapa:11328 Driving while black: do police pass the test? (2007). University Library of Munich, Germany / MPRA Paper (6) RePEc:pse:psecon:2007-15 Optimality conditions and comparative static properties of non-linear income taxes revisited (2007). PSE (Ecole normale supérieure) / PSE Working Papers (7) RePEc:spr:jogath:v:36:y:2007:i:1:p:1-15 On some families of cooperative fuzzy games (2007). International Journal of Game Theory (8) RePEc:van:wpaper:0708 The Impact of Changing Skill Levels on Optimal Nonlinear Income Taxes (2007). Department of Economics, Vanderbilt University / Working Papers Recent citations received in: 2006 (1) RePEc:brn:wpaper:0701 Useful Government Spending and Macroeconomic (In)stability under Balanced-Budget Rules (2006). Barnard College, Department of Economics / Working Papers (2) RePEc:ces:ceswps:_1754 Ex-Post Redistribution in a Federation: Implications for Corrective Policy (2006). CESifo GmbH / CESifo Working Paper Series (3) RePEc:ces:ceswps:_1865 Fiscal Equalization and Yardstick Competition (2006). CESifo GmbH / CESifo Working Paper Series (4) RePEc:cor:louvco:2006035 Family altruism with a renewable resource and population growth (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (5) RePEc:cor:louvco:2006109 Competing in taxes and investment under fiscal equalization (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (6) RePEc:ctl:louvec:2006062 Competing in taxes and investment under fiscal equalization (2006). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (7) RePEc:ehu:dfaeii:200603 Second-best tax policy in a growing economy with externalities. (2006). University of the Basque Country - Department of Foundations of Economic Analysis II / DFAEII Working Papers (8) RePEc:hum:wpaper:sfb649dp2006-023 How Far Are We From The Slippery Slope? The Laffer Curve Revisited (2006). Sonderforschungsbereich 649, Humboldt University, Berlin, Germany / SFB 649 Discussion Papers (9) RePEc:ifr:wpaper:2006-15 Fiscal Equalization and Yardstick Competition (2006). University of Kentucky, Institute for Federalism and Intergovernmental Relations / Working Papers (10) RePEc:kap:itaxpf:v:13:y:2006:i:6:p:717-732 Disability insurance and optimal income taxation (2006). International Tax and Public Finance (11) RePEc:lmu:dissen:4901 Predicting the Gap between Willingness to Accept and Willingness to Pay (2006). University of Munich, Department of Economics / Munich Dissertations in Economics (12) RePEc:man:cgbcrp:74 Human Capital Accumulation in a Stochastic Environment: Some New Results on the Relationship Between Growth and Volatility (2006). The School of Economic Studies, The Univeristy of Manchester / Centre for Growth and Business Cycle Research Discussion Paper Series (13) RePEc:ner:leuven:urn:hdl:1979/341 Countering the scrooge in each of us: On the marketing of cooperative behavior.. (2006). Katholieke Universiteit Leuven / Open Access publications from Katholieke Universiteit Leuven (14) RePEc:pra:mprapa:5373 Local government responsiveness to federal transfers: theory and evidence (2006). University Library of Munich, Germany / MPRA Paper (15) RePEc:rut:rutres:200629 Decentralizing Aid with Interested Parties (2006). Rutgers University, Department of Economics / Departmental Working Papers Recent citations received in: 2005 (1) RePEc:ces:ceswps:_1466 Pawns and Queens Revisited: Public Provision of Private Goods when Individuals make Mistakes (2005). CESifo GmbH / CESifo Working Paper Series (2) RePEc:ces:ceswps:_1496 S-Based Taxation under Default Risk (2005). CESifo GmbH / CESifo Working Paper Series (3) RePEc:shr:wpaper:05-04 Public Transfers, Equivalence Scales and Poverty in Canada and the United States. (2005). Departement d'Economique de la Faculte d'administration àl'Universite de Sherbrooke / Cahiers de recherche (4) RePEc:ubs:wpaper:ubs0506 S-Based Taxation under Default Risk (2005). University of Brescia, Department of Economics / Working Papers (5) RePEc:uca:ucapdv:49 Mean voting rule and strategical behavior: an experiment (2005). Department of Public Policy and Public Choice - POLIS / P.O.L.I.S. department's Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||