|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

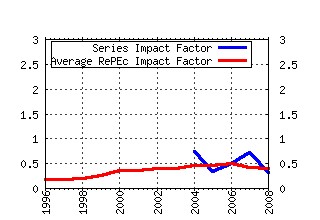

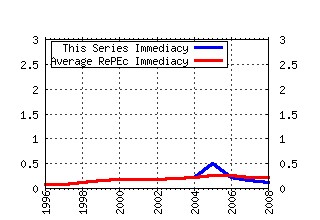

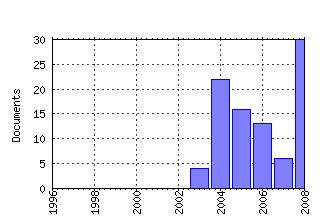

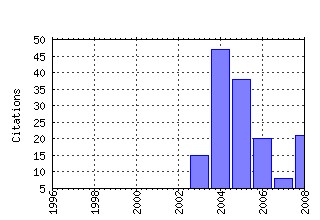

Norges Bank / Working Paper Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bno:worpap:2003_10 Dealer Behavior and Trading Systems in Foreign Exchange Markets (2003). (2) RePEc:bno:worpap:2004_03 New Perspectives on Capital and Sticky Prices (2004). (3) RePEc:bno:worpap:2005_07 Monetary policy predictability in the euro area: An international comparison (2005). (4) RePEc:bno:worpap:2005_14 The natural real interest rate and the output gap in the euro area: A joint estimation (2005). (5) RePEc:bno:worpap:2004_11 Cross-Border Diversification in Bank Asset Portfolios (2004). (6) RePEc:bno:worpap:2004_14 Wage formation under low inflation (2004). (7) RePEc:bno:worpap:2006_01 Evaluation of macroeconomic models for financial stability analysis (2006). (8) RePEc:bno:worpap:2006_06 Firm-specific capital, nominal rigidities, and the Taylor principle (2006). (9) RePEc:bno:worpap:2004_13 Liquidity provision in the overnight foreign exchange market (2004). (10) RePEc:bno:worpap:2004_05 Downward Nominal Wage Rigidity in Europe (2004). (11) RePEc:bno:worpap:2008_25 Asymmetric information in the interbank foreign exchange market (2009). (12) RePEc:bno:worpap:2004_18 Savers, Spenders and Fiscal Policy in a Small Open Economy (2004). (13) RePEc:bno:worpap:2005_08 What determines banksââ¬â¢ market power? Akerlof versus Herfindahl (2005). (14) RePEc:bno:worpap:2003_07 Volume and Volatility in the FX Market: Does it matter who you are? (2003). (15) RePEc:bno:worpap:2007_03 What captures liquidity risk? A comparison of trade and order based liquidity factors (2007). (16) RePEc:bno:worpap:2008_24 The role of house prices in the monetary policy transmission mechanism in the U.S. (2008). (17) RePEc:bno:worpap:2007_01 Are real wages rigid downwards? (2007). (18) RePEc:bno:worpap:2007_10 Estimating the natural rates in a simple New Keynesian framework (2008). (19) RePEc:bno:worpap:2005_16 Monetary policy and exchange rate interactions in a small open economy (2005). (20) RePEc:bno:worpap:2005_13 ââ¬ÅLargeââ¬Â vs. ââ¬Åsmallââ¬Â players: A closer look at the dynamics of speculative attacks (2005). (21) repec:bno:worpap:2006_07 (). (22) RePEc:bno:worpap:2008_12 Commodity prices, interest rates and the dollar (2008). (23) RePEc:bno:worpap:2005_11 Monetary policy and the illusionary exchange rate puzzle (2005). (24) RePEc:bno:worpap:2008_10 Fiscal shocks and real rigidities (2008). (25) RePEc:bno:worpap:2005_06 Is lumpy investment really irrelevant for the business cycle? (2005). (26) RePEc:bno:worpap:2008_03 The risk components of liquidity (2008). (27) RePEc:bno:worpap:2009_15 Macro modelling with many models (2009). (28) RePEc:bno:worpap:2005_03 Collective economic decisions and the discursive dilemma (2005). (29) RePEc:bno:worpap:2006_10 Managing uncertainty through robust-satisficing monetary policy (2006). (30) RePEc:bno:worpap:2004_10 Modelling inflation in the Euro Area (2004). (31) RePEc:bno:worpap:2006_02 Forecasting inflation with an uncertain output gap (2006). (32) RePEc:bno:worpap:2008_09 Liquidity at the Oslo Stock Exchange (2008). (33) RePEc:bno:worpap:2008_04 Identifying the interdependence between US monetary policy and the stock market (2008). (34) RePEc:bno:worpap:2008_01 Combining forecast densities from VARs with uncertain instabilities (2008). (35) RePEc:bno:worpap:2009_07 The political economy of fiscal deficits and government production (2009). (36) RePEc:bno:worpap:2005_01 Efficient consumption of revenues from natural resources ââ¬â

An application to Norwegian petroleum revenues (2005). (37) RePEc:bno:worpap:2007_05 Rule-of-thumb consumers, productivity and hours (2007). (38) RePEc:bno:worpap:2009_01 Does forecast combination improve Norges Bank inflation forecasts? (2009). (39) RePEc:bno:worpap:2006_03 Price-level determinacy, lower bounds on the nominal interest rate, and liquidity traps (2006). (40) RePEc:bno:worpap:2008_07 Does monetary policy react to asset prices? Some international evidence (2008). (41) RePEc:bno:worpap:2004_01 Pitfalls in the Modelling of Forward-Looking Price Setting and Inverstment Behavior (2004). (42) RePEc:bno:worpap:2008_21 Revealing the preferences of the US Federal Reserve (2008). (43) RePEc:bno:worpap:2004_12 Firm-Specific Investment, Sticky Prices, and the Taylor Principle (2004). (44) RePEc:bno:worpap:2003_09 Strategic Investor Behaviour and the Volume-Volatility Relation in Equity Markets (2003). (45) RePEc:bno:worpap:2008_16 Oil Price Shocks and Stock Market Booms in an Oil Exporting Country (2008). (46) RePEc:bno:worpap:2005_12 Arbitrage in the foreign exchange market: Turning on the microscope (2005). (47) RePEc:bno:worpap:2009_05 Lumpy investment and state-dependent pricing in general equilibrium (2009). (48) RePEc:bno:worpap:2004_19 The degree of independence in European goods markets : An I(2) analysis of German and Norwegian trade data (2004). (49) RePEc:bno:worpap:2008_11 Liquidity and the business cycle (2008). (50) repec:bno:worpap:2004_04 (). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:hhs:bofrdp:2008_020 Estimating regime-switching Taylor rules with trend inflation (2008). Bank of Finland / Research Discussion Papers (2) RePEc:hhs:vxcafo:2009_010 Do Macroeconomic Variables Forecast Changes in Liquidity? An Out-of-sample Study on the Order-driven Stock Markets in Scandinavia (2008). Centre for Labour Market Policy Research (CAFO), School of Management and Economics, Växjö University / CAFO Working Papers (3) RePEc:irv:wpaper:070819 Learning about the Interdependence between the Macroeconomy and the Stock Market (2008). University of California-Irvine, Department of Economics / Working Papers (4) RePEc:pra:mprapa:11585 Macro-finance VARs and bond risk premia: a caveat (2008). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2007 (1) RePEc:lau:crdeep:07.11 Fiscal Shocks and the Consumption Response when Wages are Sticky (2007). Université de Lausanne, Ecole des HEC, DEEP / Cahiers de Recherches Economiques du Département d'Econométrie et d'Economie politique (DEEP) Recent citations received in: 2006 (1) RePEc:bfr:banfra:161 Bubble-free interest-rate rules. (2006). Banque de France / Documents de Travail (2) RePEc:col:000094:002543 EL RIESGO DE MERCADO DE LA DEUDA PÃBLICA:¿UNA RESTRICCIÃN A LA POLÃTICA MONETARIA?EL CASO COLOMBIANO (2006). TITULARIZADORA COLOMBIANA / INFORMES (3) RePEc:dnb:dnbwpp:119 Modelling Scenario Analysis and Macro Stress-testing (2006). Netherlands Central Bank, Research Department / DNB Working Papers Recent citations received in: 2005 (1) RePEc:bno:worpap:2005_05 Is the price level in Norway determined by fiscal policy? (2005). Norges Bank / Working Paper (2) RePEc:bno:worpap:2005_10 Strategic bank monitoring and firmsââ¬â¢ debt structure (2005). Norges Bank / Working Paper (3) RePEc:bno:worpap:2005_11 Monetary policy and the illusionary exchange rate puzzle (2005). Norges Bank / Working Paper (4) RePEc:cpr:ceprdp:5101 Monetary Policy in the Euro Area: Lessons from Five Years of ECB and Implications for Turkey (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:ecb:ecbwps:20050506 Settlement finality as a public good in large-value payment systems (2005). European Central Bank / Working Paper Series (6) RePEc:hhs:osloec:2005_026 Monetary Policy and the Illusionary Exchange Rate Puzzle (2005). Oslo University, Department of Economics / Memorandum (7) RePEc:hhs:osloec:2005_031 Monetary policy and exchange rate interactions in a small open economy (2005). Oslo University, Department of Economics / Memorandum (8) RePEc:upf:upfgen:922 Monetary Policy in the Euro area: Lessons from 5 years of ECB and implications for Turkey (2005). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||