|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

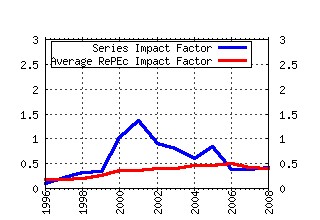

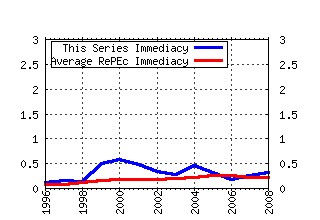

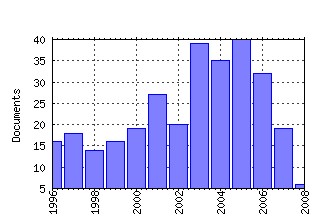

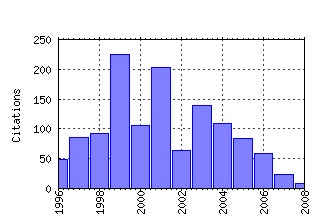

Bank of England / Bank of England working papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:boe:boeewp:91 Forward-looking rules for monetary policy (1999). (2) RePEc:boe:boeewp:143 Does it pay to be transparent? International evidence from central bank forecasts (2001). (3) RePEc:boe:boeewp:67 How do UK companies set prices? (1997). (4) RePEc:boe:boeewp:191 Endogenous price stickiness, trend inflation, and the New

Keynesian Phillips curve (2003). (5) RePEc:boe:boeewp:98 The non-linear Phillips curve and inflation forecast targeting (1999). (6) RePEc:boe:boeewp:31 Measuring Core Inflation (1995). (7) RePEc:boe:boeewp:211 An empirical analysis of the dynamic relationship between

investment-grade bonds and credit default swaps (2004). (8) RePEc:boe:boeewp:135 Hybrid inflation and price level targeting (2001). (9) RePEc:boe:boeewp:156 Equilibrium exchange rates and supply-side performance (2002). (10) RePEc:boe:boeewp:54 Monetary Policy Uncertainty and Central Bank Accountability (1996). (11) RePEc:boe:boeewp:81 Are UK inflation expectations rational? (1998). (12) RePEc:boe:boeewp:204 The dynamics of consumers expenditure: the UK consumption ECM redux (2003). (13) RePEc:boe:boeewp:192 Capital stocks, capital services, and depreciation: an

integrated framework (2003). (14) RePEc:boe:boeewp:106 Monetary policy surprises and the yield curve (2000). (15) RePEc:boe:boeewp:138 PPP and the real exchange rate-real interest rate differential puzzle revisited:

evidence from non-stationary panel data (2001). (16) RePEc:boe:boeewp:49 Independence and Accountability (1996). (17) RePEc:boe:boeewp:77 Productivity convergence and international openness (1998). (18) RePEc:boe:boeewp:82 Downward nominal rigidity and monetary policy (1998). (19) RePEc:boe:boeewp:248 Concepts of equilibrium exchange rates (2005). (20) RePEc:boe:boeewp:140 ICT and productivity growth in the United Kingdom (2001). (21) RePEc:boe:boeewp:282 Stress tests of UK banks using a VAR approach (2005). (22) RePEc:boe:boeewp:133 Stability of ratings transitions (2001). (23) RePEc:boe:boeewp:113 A small structural empirical model of the UK monetary transmission mechanism (2000). (24) RePEc:boe:boeewp:80 Are there downward nominal rigidities in product markets? (1998). (25) RePEc:boe:boeewp:132 Ratings versus equity-based credit risk modelling: an empirical analysis (2001). (26) RePEc:boe:boeewp:146 Indicators of fragility in the UK corporate sector (2001). (27) RePEc:boe:boeewp:232 Evolving post-World War II UK economic performance (2004). (28) RePEc:boe:boeewp:142 Band-pass filtering, cointegration, and business cycle analysis (2001). (29) RePEc:boe:boeewp:111 Liquidity traps: how to avoid them and how to escape them (2000). (30) RePEc:boe:boeewp:179 A Kalman filter approach to estimating the UK NAIRU (2003). (31) RePEc:boe:boeewp:222 The roles of expected profitability, Tobins Q and cash flow in econometric

models of company investment (2004). (32) RePEc:boe:boeewp:110 Imperfect competition and the dynamics of mark-ups (2000). (33) RePEc:boe:boeewp:61 The Demand for M4: A Sectoral Analysis. Part 1 - The Personal Sector (1997). (34) RePEc:boe:boeewp:96 Uncertainty and Simple Monetary Policy Rules - An illustration for the

United Kingdom (1999). (35) RePEc:boe:boeewp:120 UK monetary policy 1972-97: a guide using Taylor rules (2000). (36) RePEc:boe:boeewp:119 Optimal horizons for inflation targeting (2000). (37) RePEc:boe:boeewp:328 Cash-in-the-market pricing and optimal resolution of bank failures (2007). (38) RePEc:boe:boeewp:224 The informational content of empirical measures of real interest rate and output gaps

for the United Kingdom (2004). (39) RePEc:boe:boeewp:189 Modelling investment when relative prices are trending: theory

and evidence for the United Kingdom (2003). (40) RePEc:boe:boeewp:210 Company accounts based modelling of business failures and the

implications for financial stability (2003). (41) RePEc:boe:boeewp:127 Sticky prices and volatile output (2001). (42) RePEc:boe:boeewp:4 Testing for short-termism in the UK stock market (1992). (43) RePEc:boe:boeewp:86 Shoe-leather costs reconsidered (1998). (44) RePEc:boe:boeewp:154 A monetary model of factor utilisation (2002). (45) RePEc:boe:boeewp:93 Business cycles and the labour market can theory fit the facts? (1999). (46) RePEc:boe:boeewp:102 Monetary stabilisation policy in a monetary union: some simple analytics (1999). (47) RePEc:boe:boeewp:164 Understanding UK inflation: the role of openness (2002). (48) RePEc:boe:boeewp:235 Rule-based monetary policy under central bank learning (2004). (49) RePEc:boe:boeewp:323 Forecast combination and the Bank of Englandâs suite of statistical forecasting models (2007). (50) RePEc:boe:boeewp:14 House prices, arrears and possessions: A three equation model for the UK (1993). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:fip:fedlwp:2008-025 Is inflation an international phenomenon? (2008). Federal Reserve Bank of St. Louis / Working Papers (2) RePEc:zbw:bubdp1:7556 The global dimension of inflation: evidence from factor-augmented Phillips curves (2008). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies Recent citations received in: 2007 (1) RePEc:boe:boeewp:319 Too many to fail - an analysis of time-inconsistency in bank closure policies (2007). Bank of England / Bank of England working papers (2) RePEc:cpr:ceprdp:6319 Fire-sale FDI (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (3) RePEc:dgr:uvatin:20070069 Idiosyncratic Labour Income Risk and Aggregate Consumption: an Unobserved Component Approach (2007). Tinbergen Institute / Tinbergen Institute Discussion Papers (4) RePEc:hhs:oruesi:2007_013 Bayesian Forecast Combination for VAR Models (2007). Ãrebro University, Department of Business, Economics, Statistics and Informatics / Working Papers (5) RePEc:hhs:rbnkwp:0216 Bayesian forecast combination for VAR models (2007). Sveriges Riksbank (Central Bank of Sweden) / Working Paper Series Recent citations received in: 2006 (1) RePEc:boe:boeewp:299 Optimal discretionary policy in rational expectations models with regime switching (2006). Bank of England / Bank of England working papers (2) RePEc:boe:boeewp:303 The danger of inflating expectations of macroeconomic stability: heuristic switching in an overlapping generations monetary model (2006). Bank of England / Bank of England working papers (3) RePEc:mpc:wpaper:16 Diverging Trends in Aggregate and Firm-Level Volatility in the UK (2006). Monetary Policy Committee Unit, Bank of England / Discussion Papers (4) RePEc:sce:scecfa:12 Exchange Rates and Fundamentals: Is there a Role for Nonlinearities in Real Time? (2006). Society for Computational Economics / Computing in Economics and Finance 2006 (5) RePEc:taf:apfiec:v:16:y:2006:i:8:p:607-615 Variance ratio tests for a unit root in the presence of a mean shift: small sample properties and an application to purchasing power parity (2006). Applied Financial Economics (6) RePEc:taf:intecj:v:20:y:2006:i:2:p:161-177 Asymmetric adjustment towards long-run PPP: Some new evidence for Asian economies (2006). International Economic Journal Recent citations received in: 2005 (1) RePEc:bde:wpaper:0513 Skill mix and technology in Spain: evidence from firm level data (2005). Banco de Espana / Banco de Espana Working Papers (2) RePEc:bde:wpaper:0542 Sticky prices in the euro area: a summary of new micro evidence (2005). Banco de Espana / Banco de Espana Working Papers (3) RePEc:ecl:ucdeco:05-10 A Search for a Structural Phillips Curve (2005). University of California at Davis, Department of Economics / Working Papers (4) RePEc:fau:wpaper:wp075 Real Equilibrium Exchange Rate Estimates: To What Extent Are They Applicable for Setting the Central Parity? (2005). Charles University Prague, Faculty of Social Sciences, Institute of Economic Studies / Working Papers IES (5) RePEc:fau:wpaper:wp076 Fiscal Policy in New EU Member States: Go East, Prudent Man! (2005). Charles University Prague, Faculty of Social Sciences, Institute of Economic Studies / Working Papers IES (6) RePEc:fip:fednsr:203 A search for a structural Phillips curve (2005). Federal Reserve Bank of New York / Staff Reports (7) RePEc:idb:wpaper:3171 The Elasticity of Substitution in Demand for Non-Tradable Goods in Uruguay (2005). Inter-American Development Bank, Research Department / Working Papers (8) RePEc:idb:wpaper:3172 Elasticidad de la sustitución en la demanda de bienes no transables en Uruguay (2005). Inter-American Development Bank, Research Department / Working Papers (9) RePEc:imf:imfwpa:05/232 FIRST: A Market-Based Approach to Evaluate Financial System Risk and Stability (2005). International Monetary Fund / IMF Working Papers (10) RePEc:prg:jnlpep:v:2005:y:2005:i:4:id:267:p:291-316 WOULD FAST SAILING TOWARDS THE EURO BE SMOOTH? WHAT FUNDAMENTAL REAL EXCHANGE RATES TELL US (2005). Prague Economic Papers (11) RePEc:wdi:papers:2005-781 Equilibrium Exchange Rate in the Czech Republic: How Good is the Czech BEER? (2005). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (12) RePEc:wpa:wuwpif:0509006 Real Equilibrium Exchange Rate Estimates: To What Extent Applicable for Setting the Central Parity? (2005). EconWPA / International Finance (13) RePEc:wpa:wuwpma:0512006 Technology Shocks and UK Business Cycles (2005). EconWPA / Macroeconomics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||