|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

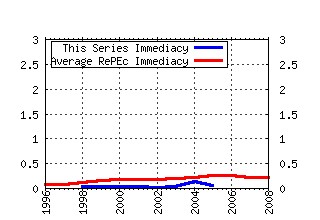

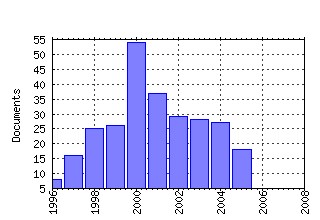

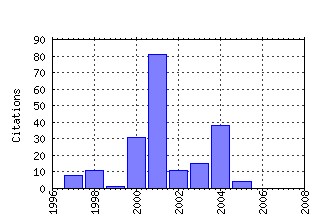

Anderson Graduate School of Management, UCLA / University of California at Los Angeles, Anderson Graduate School of Management Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cdl:anderf:71173 Valuing American Options by Simulation: A Simple Least-Squares Approach (2001). (2) RePEc:cdl:anderf:4687 Agency and Asset Pricing (1993). (3) RePEc:cdl:anderf:4684 An Analytic Solution for Interest Rate Swap Spreads (1995). (4) RePEc:cdl:anderf:4852 The MIDAS Touch: Mixed Data Sampling Regression Models (2004). (5) RePEc:cdl:anderf:2211 An Econometric Model of the Yield Curve With Macroeconomic Jump Effects (2001). (6) RePEc:cdl:anderf:6386 Facilitation of Competing Bids and the Price of a Takeover Target (1989). (7) RePEc:cdl:anderf:2304 The Components of Corporate Credit Spreads: Default, Recovery, Tax, Jumps, Liquidity, and Market Factors (2001). (8) RePEc:cdl:anderf:3343 Credit Risk and Risk Neutral Default Probabilities: Information About Migrations and Defaults (1998). (9) RePEc:cdl:anderf:3404 Bond Pricing with Default Risk (1997). (10) RePEc:cdl:anderf:2900 The Market Price of Credit Risk: An Empirical Analysis of Interest Rate Swap Spreads (2000). (11) RePEc:cdl:anderf:2887 Stochastic Correlation Across International Stock Markets (2000). (12) RePEc:cdl:anderf:2297 The Disposition Effect and Momentum (2001). (13) RePEc:cdl:anderf:5436 Price Volatility, International Market Links and their Implications for Regulatory Policies (1989). (14) RePEc:cdl:anderf:4681 Regime Shifts in Short Term Riskless Interest Rates (1995). (15) RePEc:cdl:anderf:3339 Relative Pricing of Options with Stochastic Volatility (2002). (16) RePEc:cdl:anderf:10277 How Did It Happen? (2004). (17) RePEc:cdl:anderf:13188 Bidding and Performance in Repo Auctions: Evidence from ECB Open Market Operations (2004). (18) RePEc:cdl:anderf:2291 International Risk Sharing is Better Than You Think (or Exchange Rates are Much Too Smooth! (2001). (19) RePEc:cdl:anderf:3394 Resolution of a Financial Puzzle (1998). (20) RePEc:cdl:anderf:2213 Dynamic Portfolio Selection by Augmenting the Asset Space (2004). (21) RePEc:cdl:anderf:2620 Empirical TIPs (2003). (22) RePEc:cdl:anderf:2243 Estimation and Test of a Simple Model of Intertemporal Capital Asset Pricing (2003). (23) RePEc:cdl:anderf:19658 Losing Money on Arbitrages: Optimal Dynamic Portfolio Choice in Markets with Arbitrage Opportunities (2000). (24) RePEc:cdl:anderf:11136 European M&A Regulation is Protectionist (2004). (25) RePEc:cdl:anderf:2702 A Unifying Theory of Value Based Management (2003). (26) RePEc:cdl:anderf:19666 The Relative Valuation of Caps and Swaptions: Theory and Empirical Evidence (2000). (27) RePEc:cdl:anderf:19654 ELECTRICITY FORWARD PRICES: A High-Frequency Empirical Analysis (2002). (28) RePEc:cdl:anderf:2863 Learning About Predictability: The Effects of Parameter Uncertainty on Dynamic Asset Allocation (2000). (29) RePEc:cdl:anderf:4853 The Blind Leading the Blind: Social Influence, Fads, and Informational Cascades (1993). (30) RePEc:cdl:anderf:13186 Strategic Behavior and Underpricing in Uniform Price Auctions: Evidence from Finnish Treasury Auctions (2004). (31) RePEc:cdl:anderf:2729 Electricity Forward Prices: A High-Frequency Empirical Analysis (2002). (32) RePEc:cdl:anderf:55054 Jump and Volatility Risk and Risk Premia: A New Model and Lessons from S&P 500 Options (2004). (33) RePEc:cdl:anderf:2868 Transactions Costs in the Foreign Exchange Market (2000). (34) RePEc:cdl:anderf:3329 Organization Capital and Intrafirm Communication (2003). (35) RePEc:cdl:anderf:2864 The Feds Effect on Excess Returns and Inflation is Much Bigger Than You Think (2000). (36) RePEc:cdl:anderf:13185 THE MARKET PRICE OF RISK IN INTEREST RATE SWAPS: THE ROLES OF DEFAULT AND LIQUIDITY RISKS (2004). (37) RePEc:cdl:anderf:55039 Homeownership as a Constraint on Asset Allocation (2005). (38) RePEc:cdl:anderf:2867 Electricity prices and power derivatives: Evidence from the Nordic Power Exchange (2000). (39) RePEc:cdl:anderf:4682 Is Institutional Investment in Initial Public Offerings Related to Long-Run Performance of These Firms? (1995). (40) RePEc:cdl:anderf:3124 The Term Structure with Highly Persistent Interest Rates (1999). (41) RePEc:cdl:anderf:5399 Resolution Preference and Project Choice (1990). (42) RePEc:cdl:anderf:45734 Information, Diversification, and Cost of Capital (2005). (43) RePEc:cdl:anderf:7989 A Model of R&D Valuation and the Design of Research Incentives (2003). (44) RePEc:cdl:anderf:2911 The Risk and Return of Venture Capital (2000). (45) RePEc:cdl:anderf:3402 On the Evolution of Overconfidence and Entrepreneurs (1997). (46) RePEc:cdl:anderf:6413 Common Factors in the Serial Correlation of Stock Returns (1986). (47) RePEc:cdl:anderf:2890 The Problem of Optimal Asset Allocation with Stable Distributed Returns (2000). (48) RePEc:cdl:anderf:4692 Private vs. Public Lending: Evidence from Covenants (1993). (49) RePEc:cdl:anderf:11259 Order Flow Patterns around Seasoned Equity Offerings and their Implications for Stock Price Movements (2004). (50) RePEc:cdl:anderf:2723 Extracting Inflation from Stock Returns to test Purchasing Power Parity (2002). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 (1) RePEc:hhs:nhhfms:2005_012 The perpetual American put option for jump-diffusions with applications (2005). Department of Finance and Management Science, Norwegian School of Economics and Business Administration / Discussion Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||