|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

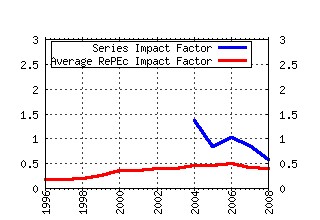

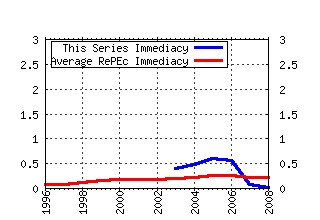

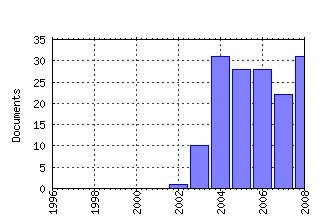

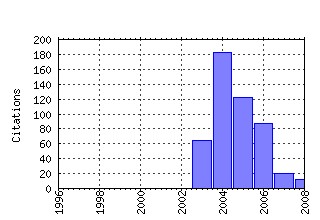

Center for Research in Economics, Management and the Arts (CREMA) / CREMA Working Paper Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:cra:wpaper:2004-11 Valuing Public Goods: The Life Satisfaction Approach (2004). (2) RePEc:cra:wpaper:2003-02 Introducing Procedural Utility: Not only What, but also How Matters (2003). (3) RePEc:cra:wpaper:2004-23 Calculating Tragedy: Assessing the Costs of Terrorism (2004). (4) RePEc:cra:wpaper:2005-27 Russian Attitudes Toward Paying Taxes â Before, During, and

After the Transition (2005). (5) RePEc:cra:wpaper:2006-01 Corruption and the Shadow Economy: An Empirical Analysis (2006). (6) RePEc:cra:wpaper:2005-13 Shadow Economies of 145 Countries all over the World: What

Do We Really Know? (2005). (7) RePEc:cra:wpaper:2005-04 Economic Consequences of Mispredicting Utility (2004). (8) RePEc:cra:wpaper:2004-03 Shadow Economies Around the World: What Do We Know? (2004). (9) RePEc:cra:wpaper:2004-09 Repetition and Reputation: Implications for Trust and

Trustworthiness When Institutions Change (2004). (10) RePEc:cra:wpaper:2004-26 Demokratische Beteiligung und Staatsausgaben: Die

Auswirkungen des Frauenstimmrechts (2004). (11) RePEc:cra:wpaper:2004-08 Social comparisons in ultimatum bargaining (2004). (12) RePEc:cra:wpaper:2005-15 Does Watching TV Make Us Happy? (2005). (13) RePEc:cra:wpaper:2004-07 Is Trust a Bad Investment? (2004). (14) RePEc:cra:wpaper:2005-12 Knight Fever: Towards an Economics of Awards (2005). (15) RePEc:cra:wpaper:2004-28 Making International Organizations More Democratic (2004). (16) RePEc:cra:wpaper:2004-14 Culture Differences and Tax Morale in the United States and

in Europe (2004). (17) RePEc:cra:wpaper:2003-09 Tax Morale and Institutions (2003). (18) RePEc:cra:wpaper:2004-20 Taxation and Conditional Cooperation (2004). (19) RePEc:cra:wpaper:2006-10 Tax Compliance as the Result of a Psychological Tax

Contract: The Role of Incentives and Responsive Regulation (2006). (20) RePEc:cra:wpaper:2005-17 Achieving Compliance when Legal Sanctions are Non-Deterrent (2005). (21) RePEc:cra:wpaper:2003-07 Reported Subjective Well-Being: A Challenge for Economic

Theory and Economic Policy (2003). (22) RePEc:cra:wpaper:2006-24 The Effect of Direct Democracy on Income Redistribution:

Evidence for Switzerland (2006). (23) RePEc:cra:wpaper:2005-19 Strategic Tax Competition in Switzerland: Evidence from a

Panel of the Swiss Cantons (2005). (24) RePEc:cra:wpaper:2005-29 Effects of Tax Morale on Tax Compliance: Experimental and

Survey Evidence (2005). (25) RePEc:cra:wpaper:2005-21 Voters as a Hard Budget Constraint: On the Determination of

Intergovernmental Grants (2005). (26) RePEc:cra:wpaper:2005-03 Yes, Managers Should Be Paid Like Bureaucrats (2004). (27) RePEc:cra:wpaper:2006-08 Blood and Ink! The Common-Interest-Game Between Terrorists

and the Media (2006). (28) RePEc:cra:wpaper:2005-07 Fiscal Autonomy and Tax Morale: Evidence from Germany (2005). (29) RePEc:cra:wpaper:2006-21 On the Effectiveness of Debt Brakes: The Swiss Experience (2006). (30) RePEc:cra:wpaper:2006-17 Environmental Morale and Motivation (2006). (31) RePEc:cra:wpaper:2006-03 Relative Income Position and Performance: An Empirical

Panel Analysis (2006). (32) RePEc:cra:wpaper:2005-05 Trust and Fiscal Performance: A Panel Analysis with Swiss Data (2005). (33) RePEc:cra:wpaper:2004-01 Moral Suasion: An alternative tax policy strategy? Evidence

from a controlled field experiment in Switzerland (2004). (34) RePEc:cra:wpaper:2004-27 Attitudes Towards Paying Taxes in Austria: An Empirical Analysis (2004). (35) RePEc:cra:wpaper:2007-17 Tax Compliance, Tax Morale and Governance Quality (2007). (36) RePEc:cra:wpaper:2003-08 The Importance of Faith: Tax Morale and Religiosity (2003). (37) RePEc:cra:wpaper:2004-17 Does Culture Influence Tax Morale? Evidence from Different

European Countries (2004). (38) RePEc:cra:wpaper:2006-15 Women and Illegal Activities: Gender Differences and

Womenâs Willingness to Comply over Time (2006). (39) RePEc:cra:wpaper:2005-18 On Government Centralization and Fiscal Referendums: A

Theoretical Model and Evidence from Switzerland (2005). (40) RePEc:cra:wpaper:2005-33 The Evolution of Tax Morale in Modern Spain (2005). (41) RePEc:cra:wpaper:2004-21 Societal Institutions and Tax Effort in Developing Countries (2004). (42) RePEc:cra:wpaper:2007-01 The Impact of Tax Morale and Institutional Quality on the

Shadow Economy (2007). (43) RePEc:cra:wpaper:2008-22 Do Rankings Reflect Research Quality? (2008). (44) RePEc:cra:wpaper:2004-24 Corruption and Age (2004). (45) RePEc:cra:wpaper:2004-04 Tax Morale in Australia: What Shapes it and Has it Changed

over Time? (2004). (46) RePEc:cra:wpaper:2006-19 The Power of Positional Concerns: A Panel Analysis (2006). (47) RePEc:cra:wpaper:2008-01 Differences in Preferences Towards the Environment: The

Impact of a Gender, Age and Parental Effect (2007). (48) RePEc:cra:wpaper:2009-01 Editorial Ruminations: Publishing Kyklos (2009). (49) RePEc:cra:wpaper:2008-02 Awards - A View from Psychological Economics (2008). (50) RePEc:cra:wpaper:2004-19 The Determinants of Womenâs International Soccer Performances (2004). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:iza:izadps:dp3771 Social Image Concerns and Pro-Social Behavior (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers Recent citations received in: 2007 (1) RePEc:ays:ispwps:paper0727 Tax Compliance, Tax Morale, and Governance Quality (2007). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (2) RePEc:ttp:itpwps:0707 Tax Policy in Emerging Countries (2007). International Tax Program, Institute for International Business, Joseph L. Rotman School of Management, University of Toronto / Working Papers Recent citations received in: 2006 (1) RePEc:ces:ceswps:_1689 Sustainability of Swiss Fiscal Policy (2006). CESifo GmbH / CESifo Working Paper Series (2) RePEc:ces:ceswps:_1758 Tax Avoidance, Endogenous Social Norms, and the Comparison Income Effect (2006). CESifo GmbH / CESifo Working Paper Series (3) RePEc:cra:wpaper:2006-13 Tax Evasion in Switzerland: The Roles of Deterrence and Tax Morale (2006). Center for Research in Economics, Management and the Arts (CREMA) / CREMA Working Paper Series (4) RePEc:hhs:iuiwop:0677 Why Does Sovereign Risk Differ for Domestic and Foreign Investors? Evidence from Scandinavia, 1938ÃÂÃÂââ¬â1948 (2006). The Research Institute of Industrial Economics / IUI Working Paper Series (5) RePEc:hhs:ratioi:0109 Reciprocity and Payment Schemes: When Equality Is Unfair (2006). The Ratio Institute / Ratio Working Papers (6) RePEc:iza:izadps:dp2315 Shadow Economies and Corruption All Over the World: What Do We Really Know? (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (7) RePEc:iza:izadps:dp2430 Labour Market Regulation in the EU-15: Causes and Consequences - A Survey (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (8) RePEc:iza:izadps:dp2500 Reciprocity and Payment Schemes: When Equality Is Unfair (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (9) RePEc:jku:econwp:2006_17 Shadow Economies and Corruption all over the World: What do we really know? (2006). Department of Economics, Johannes Kepler University Linz, Austria / Economics working papers (10) RePEc:lmu:muenec:1202 Social Norms and Conditional Cooperative Taxpayers (2006). University of Munich, Department of Economics / Discussion Papers in Economics (11) RePEc:ner:leuven:urn:hdl:123456789/103684 A behavioural finance model of the exchange rate with many forecasting rules. (2006). Katholieke Universiteit Leuven / Open Access publications from Katholieke Universiteit Leuven (12) RePEc:ner:tilbur:urn:nbn:nl:ui:12-199394 The Transitional Dynamics of Fiscal Policy in Small Open Economies. (2006). Tilburg University / Open Access publications from Tilburg University (13) RePEc:ses:arsjes:2006-iii-1 The Swiss Debt Brake: How it Works and What Can Go Wrong (2006). Swiss Journal of Economics and Statistics (SJES) (14) RePEc:ses:arsjes:2006-iii-4 Tax Morale: A Survey with a Special Focus on Switzerland (2006). Swiss Journal of Economics and Statistics (SJES) (15) RePEc:ude:wpaper:0806 An experiment on corruption and gender (2006). Department of Economics - dECON / Documentos de Trabajo (working papers) (16) RePEc:zur:iewwpx:284 Tax Evasion in Switzerland: The Roles of Deterrence and Tax Morale (2006). Institute for Empirical Research in Economics - IEW / IEW - Working Papers Recent citations received in: 2005 (1) RePEc:ays:ispwps:paper0518 Russian Attitudes Toward Paying Taxes â Before, During, and After the Transition (2005). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (2) RePEc:ays:ispwps:paper0521 The Evolution of Tax Morale in Modern Spain (2005). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (3) RePEc:cpr:ceprdp:5115 The Behavioural Effects of Minimum Wages (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:cpr:ceprdp:5127 Neuroeconomic Foundation of Trust and Social Preferences (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (5) RePEc:cpr:ceprdp:5128 The Neuroconomics of Mind Reading and Empathy (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (6) RePEc:cra:wpaper:2005-30 Tax Morale and Fiscal Policy (2005). Center for Research in Economics, Management and the Arts (CREMA) / CREMA Working Paper Series (7) RePEc:cra:wpaper:2005-33 The Evolution of Tax Morale in Modern Spain (2005). Center for Research in Economics, Management and the Arts (CREMA) / CREMA Working Paper Series (8) RePEc:fem:femwpa:2005.61 Trust and Fiscal Performance: A Panel Analysis with Swiss Data (2005). Fondazione Eni Enrico Mattei / Working Papers (9) RePEc:iza:izadps:dp1641 Neuroeconomic Foundations of Trust and Social Preferences (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (10) RePEc:iza:izadps:dp1647 The Neuroeconomics of Mind Reading and Empathy (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (11) RePEc:jep:wpaper:05001 Learning from Decentralised Policy: The Demand Side (2005). JEPS / JEPS Working Papers (12) RePEc:kap:pubcho:v:122:y:2005:i:3:p:417-448 The European constitution project from the perspective of constitutional political economy (2005). Public Choice (13) RePEc:mar:volksw:200506 Milton Friedman und der Wissenschaftliche Beirat für Familienfragen Elternkompetenz und Anteilscheine am Schulbudget â Gedanken über Reformpotenziale (2005). Philipps-Universität Marburg, Faculty of Business Administration and Economics, Department of Economics (Volkswirtschaftliche Abteilung) / Working Pap (14) RePEc:mib:wpaper:89 Income Aspirations, Television and Happiness: Evidence from the World Value Surveys (2005). University of Milano-Bicocca, Department of Economics / Working Papers (15) RePEc:mib:wpaper:90 Watching alone: Relational Goods, Television and Happiness (2005). University of Milano-Bicocca, Department of Economics / Working Papers (16) RePEc:nip:nipewp:8/2005 The Political Economy of Portuguese Intergovernmental Grants (2005). NIPE - Universidade do Minho / NIPE Working Papers (17) RePEc:wpa:wuwppe:0511014 Tax morale and (de-)centralization: An experimental study (2005). EconWPA / Public Economics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||