|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

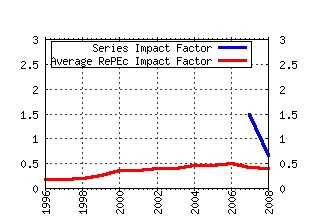

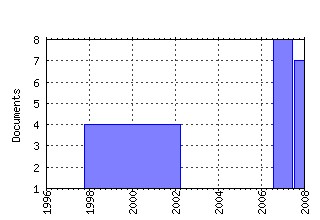

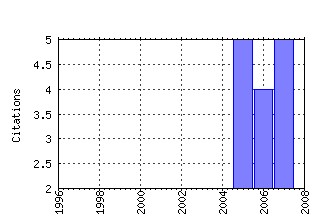

UniversitÃÂ Cattolica del Sacro Cuore, Dipartimenti e Istituti di Scienze Economiche (DISCE) / DISCE - Quaderni dell'Istituto di Economia e Finanza Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ctc:serie3:ief0064 International Financial Instability in a World of Currencies Hierarchy (2005). (2) RePEc:ctc:serie3:ief0072 Productivity shocks and Optimal Monetary Policy in a Unionized Labor Market Economy (2007). (3) RePEc:ctc:serie3:ief0067 Stock-bond correlation and the bond quality ratio: Removing the discount factor to generate a âdeflatedâ stock index (2006). (4) RePEc:ctc:serie3:ief0073 The Social Value of Public Information with Costly Information Acquisition (2007). (5) RePEc:ctc:serie3:ief0074 When do Thick Venture Capital Markets Foster Innovation? An Evolutionary Analysis (2007). (6) RePEc:ctc:serie3:ief0075 Corporate Governance as a Commitmente and Signalling Device (2007). (7) RePEc:ctc:serie3:ief0070 Lessons from the ECB experience: Frankfurt still matters! (2007). (8) RePEc:ctc:serie3:ief0076 The Role of the Local Business Environment in Banking Consolidation (2007). (9) RePEc:ctc:serie3:ief0082 Long-run Phillips Curve and Disinfation Dynamics: Calvo vs. Rotemberg Price Setting (2008). (10) RePEc:ctc:serie3:ief69 (). (11) RePEc:ctc:serie3:ief0078 Labour market imperfections, divine coincidence and the volatility of employment and inflation (2008). (12) RePEc:ctc:serie3:ief0080 Complementary Assets, Start-Ups and Incentives to Innovate (2008). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:ctc:serie3:ief0084 Constitutional reforms, fiscal decentralization and regional fiscal flows in Italy (2008). UniversitÃÂ Cattolica del Sacro Cuore, Dipartimenti e Istituti di Scienze Economiche (DISCE) / DISCE - Quaderni dell'Istituto di Economia e Finanza Recent citations received in: 2007 (1) RePEc:ctc:serie3:ief0074 When do Thick Venture Capital Markets Foster Innovation? An Evolutionary Analysis (2007). UniversitÃÂ Cattolica del Sacro Cuore, Dipartimenti e Istituti di Scienze Economiche (DISCE) / DISCE - Quaderni dell'Istituto di Economia e Finanza Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||