|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

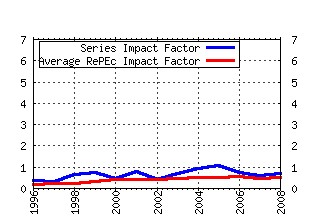

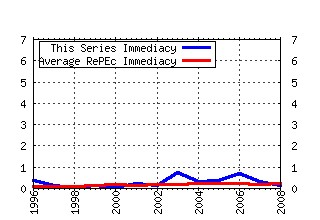

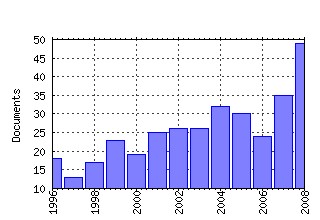

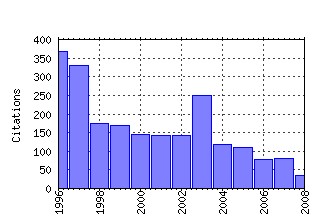

Journal of Empirical Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:empfin:v:1:y:1993:i:1:p:83-106 A long memory property of stock market returns and a new model (1993). (2) RePEc:eee:empfin:v:3:y:1996:i:2:p:123-192 The forward discount anomaly and the risk premium: A survey of recent evidence (1996). (3) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:115-158 Intraday periodicity and volatility persistence in financial markets (1997). (4) RePEc:eee:empfin:v:3:y:1996:i:1:p:15-102 The econometrics of financial markets (1996). (5) RePEc:eee:empfin:v:5:y:1998:i:4:p:397-416 Volatility and cross correlation across major stock markets (1998). (6) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:73-114 High frequency data in financial markets: Issues and applications (1997). (7) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:213-239 Volatilities of different time resolutions -- Analyzing the dynamics of market components (1997). (8) RePEc:eee:empfin:v:10:y:2003:i:1-2:p:3-56 Emerging markets finance (2003). (9) RePEc:eee:empfin:v:7:y:2000:i:3-4:p:271-300 Estimation of tail-related risk measures for heteroscedastic financial time series: an extreme value approach (2000). (10) RePEc:eee:empfin:v:10:y:2003:i:1-2:p:81-103 A simple measure of the intensity of capital controls (2003). (11) RePEc:eee:empfin:v:4:y:1997:i:4:p:317-340 The incremental volatility information in one million foreign exchange quotations (1997). (12) RePEc:eee:empfin:v:1:y:1994:i:3-4:p:313-341 Alternative constructions of Tobins q: An empirical comparison (1994). (13) RePEc:eee:empfin:v:1:y:1993:i:1:p:3-31 Common stock offerings across the business cycle : Theory and evidence (1993). (14) RePEc:eee:empfin:v:6:y:1999:i:5:p:457-477 Forecasting financial market volatility: Sample frequency vis-a-vis forecast horizon (1999). (15) RePEc:eee:empfin:v:11:y:2004:i:3:p:379-398 Modelling daily Value-at-Risk using realized volatility and ARCH type models (2004). (16) RePEc:eee:empfin:v:4:y:1997:i:2-3:p:187-212 Forecasting the frequency of changes in quoted foreign exchange prices with the autoregressive conditional duration model (1997). (17) RePEc:eee:empfin:v:9:y:2002:i:5:p:495-510 Market timing and return prediction under model instability (2002). (18) RePEc:eee:empfin:v:12:y:2005:i:3:p:476-489 Testing for contagion: a conditional correlation analysis (2005). (19) RePEc:eee:empfin:v:4:y:1997:i:4:p:295-315 Public information releases, private information arrival and volatility in the foreign exchange market (1997). (20) RePEc:eee:empfin:v:10:y:2003:i:5:p:603-621 Improved estimation of the covariance matrix of stock returns with an application to portfolio selection (2003). (21) RePEc:eee:empfin:v:8:y:2001:i:5:p:573-637 The specification of conditional expectations (2001). (22) RePEc:eee:empfin:v:10:y:2003:i:4:p:505-531 Univariate and multivariate stochastic volatility models: estimation and diagnostics (2003). (23) RePEc:eee:empfin:v:1:y:1994:i:2:p:133-160 A contingent claim approach to performance evaluation (1994). (24) RePEc:eee:empfin:v:5:y:1998:i:2:p:131-154 Testing for mean reversion in heteroskedastic data based on Gibbs-sampling-augmented randomization1 (1998). (25) RePEc:eee:empfin:v:9:y:2002:i:3:p:271-285 Asymmetric information and price discovery in the FX market: does Tokyo know more about the yen? (2002). (26) RePEc:eee:empfin:v:1:y:1994:i:3-4:p:279-311 Neglected common factors in exchange rate volatility (1994). (27) RePEc:eee:empfin:v:6:y:1999:i:4:p:335-353 Multivariate unit root tests of the PPP hypothesis (1999). (28) RePEc:eee:empfin:v:7:y:2000:i:3-4:p:225-245 Sensitivity analysis of Values at Risk (2000). (29) RePEc:eee:empfin:v:14:y:2007:i:3:p:401-423 Measuring financial contagion: A Copula approach (2007). (30) RePEc:eee:empfin:v:6:y:1999:i:3:p:309-331 A primer on hedge funds (1999). (31) RePEc:eee:empfin:v:1:y:1993:i:1:p:107-131 International asset pricing with alternative distributional specifications (1993). (32) RePEc:eee:empfin:v:5:y:1998:i:3:p:281-296 International evidence on the stock market and aggregate economic activity (1998). (33) RePEc:eee:empfin:v:14:y:2007:i:2:p:150-167 Firm-level implications of early stage venture capital investment -- An empirical investigation (2007). (34) RePEc:eee:empfin:v:2:y:1995:i:3:p:199-223 Testing for continuous-time models of the short-term interest rate (1995). (35) RePEc:eee:empfin:v:10:y:2003:i:3:p:321-353 Realized volatility in the futures markets (2003). (36) RePEc:eee:empfin:v:8:y:2001:i:2:p:111-155 Testing for mean-variance spanning: a survey (2001). (37) RePEc:eee:empfin:v:2:y:1995:i:3:p:225-251 The relationship between GARCH and symmetric stable processes: Finding the source of fat tails in financial data (1995). (38) RePEc:eee:empfin:v:10:y:2003:i:5:p:641-660 Central bank interventions and jumps in double long memory models of daily exchange rates (2003). (39) RePEc:eee:empfin:v:7:y:2000:i:1:p:87-111 Coincident and leading indicators of the stock market (2000). (40) RePEc:eee:empfin:v:1:y:1994:i:2:p:211-248 Testing the covariance stationarity of heavy-tailed time series: An overview of the theory with applications to several financial datasets (1994). (41) RePEc:eee:empfin:v:4:y:1997:i:1:p:17-46 An artificial neural network-GARCH model for international stock return volatility (1997). (42) RePEc:eee:empfin:v:7:y:2000:i:5:p:531-554 Value-at-Risk: a multivariate switching regime approach (2000). (43) RePEc:eee:empfin:v:8:y:2001:i:5:p:459-491 Why long horizons? A study of power against persistent alternatives (2001). (44) RePEc:eee:empfin:v:6:y:1999:i:2:p:193-215 Real exchange rates and nontradables: A relative price approach (1999). (45) RePEc:eee:empfin:v:8:y:2001:i:3:p:325-342 Testing and comparing Value-at-Risk measures (2001). (46) RePEc:eee:empfin:v:11:y:2004:i:5:p:659-680 The rise in comovement across national stock markets: market integration or IT bubble? (2004). (47) RePEc:eee:empfin:v:13:y:2006:i:3:p:316-350 Stock market development and internationalization: Do economic fundamentals spur both similarly? (2006). (48) RePEc:eee:empfin:v:9:y:2002:i:2:p:171-195 Testing constancy of correlation and other specifications of the BGARCH model with an application to international equity returns (2002). (49) RePEc:eee:empfin:v:2:y:1995:i:3:p:173-197 The structure of international stock returns and the integration of capital markets (1995). (50) RePEc:eee:empfin:v:1:y:1993:i:1:p:33-55 The performance of international asset allocation strategies using conditioning information (1993). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:bfr:banfra:218 Long term vs. short term comovements in stock markets: the use of Markov-switching multifractal models. (2008). Banque de France / Documents de Travail (2) RePEc:cam:camdae:0840 Beta-t-(E)GARCH (2008). Faculty of Economics (formerly DAE), University of Cambridge / Cambridge Working Papers in Economics (3) RePEc:kap:rqfnac:v:31:y:2008:i:1:p:55-70 Analysing the performance of managed funds using the wavelet multiscaling method (2008). Review of Quantitative Finance and Accounting (4) RePEc:ner:tilbur:urn:nbn:nl:ui:12-384477 Transmission of Shocks across Global Financial Markets: The Role of Contagion and Investors Risk Appetite. (2008). Tilburg University / Open Access publications from Tilburg University (5) RePEc:par:dipeco:2008-me02 An improved two-step regularization scheme for spot volatility estimation (2008). Department of Economics, Parma University (Italy) / Economics Department Working Papers (6) RePEc:qed:wpaper:1173 Continuous-Time Models, Realized Volatilities, and Testable Distributional Implications for Daily Stock Returns (2008). Queen's University, Department of Economics / Working Papers (7) RePEc:usi:wpaper:534 Volatility forecasting: the jumps do matter (2008). Department of Economics, University of Siena / Experimental Economics (8) RePEc:zbw:cauewp:7368 Artificial Long Memory Effects in Two Agend-Based Asset Pricing Models (2008). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers Recent citations received in: 2007 (1) RePEc:aah:create:2007-17 Expected Stock Returns and Variance Risk Premia (2007). School of Economics and Management, University of Aarhus / CREATES Research Papers (2) RePEc:cep:stiecm:/2007/524 Efficient Estimation of a SemiparametricCharacteristic-Based Factor Model of Security Returns (2007). Suntory and Toyota International Centres for Economics and Related Disciplines, LSE / STICERD - Econometrics Paper Series (3) RePEc:cmf:wpaper:wp2007_0714 TESTING UNCOVERED INTEREST PARITY: A CONTINUOUS-TIME APPROACH (2007). CEMFI / Working Papers (4) RePEc:col:000094:003961 Evidence of non-Markovian behavior in the process of bank rating migrations (2007). TITULARIZADORA COLOMBIANA / INFORMES (5) RePEc:col:000094:004016 Evidence of non-Markovian behavior in the process of bank rating migrations (2007). TITULARIZADORA COLOMBIANA / INFORMES (6) RePEc:dgr:umamet:2007052 Testing for Asset Market Linkages: A new Approach based on Time-Varying Copulas (2007). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (7) RePEc:dgr:uvatin:20070046 Quantile Forecasting for Credit Risk Management using possibly Mis-specified Hidden Markov Models (2007). Tinbergen Institute / Tinbergen Institute Discussion Papers (8) RePEc:imf:imfwpa:07/157 What Drives Stock Market Development in the Middle East and Central Asia--Institutions, Remittances, or Natural Resources? (2007). International Monetary Fund / IMF Working Papers (9) RePEc:pra:mprapa:5319 Forecasting volatility: Evidence from the Macedonian stock exchange (2007). University Library of Munich, Germany / MPRA Paper (10) RePEc:pra:mprapa:6265 Venture Capitalists, Asymmetric Information and Ownership in the Innovation Process (2007). University Library of Munich, Germany / MPRA Paper (11) RePEc:pra:mprapa:6318 Joint Modeling of Call and Put Implied Volatility (2007). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2006 (1) RePEc:bde:opaper:0608 House prices and real interest rates in Spain (2006). Banco de Espana / Banco de Espana Occasional Papers (2) RePEc:bde:wpaper:0605 The interaction between house prices and loans for house purchase. The Spanish case (2006). Banco de Espana / Banco de Espana Working Papers (3) RePEc:bde:wpaper:0609 House prices and rents in Spain: does the discount factor matter? (2006). Banco de Espana / Banco de Espana Working Papers (4) RePEc:cam:camdae:0602 Learning, Structural Instability and Present Value Calculations (2006). Faculty of Economics (formerly DAE), University of Cambridge / Cambridge Working Papers in Economics (5) RePEc:cor:louvco:2006089 The information content of the Bond-Equity Yield Ratio: better than a random walk? (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (6) RePEc:cor:louvco:2006090 Short-term market timing using the Bond-Equity Yield Ratio (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (7) RePEc:cpr:ceprdp:5689 House Prices, Rents and Interest Rates Under Collateral Constraints (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (8) RePEc:cra:wpaper:2006-27 Using Markets to Measure Pre-War Threat Assessments: The Nordic Countries facing World War II (2006). Center for Research in Economics, Management and the Arts (CREMA) / CREMA Working Paper Series (9) RePEc:dar:ddpeco:36755 The Foreign Exchange Rate Exposure of Nations (2006). Darmstadt Technical University, Department of Business Administration, Economics and Law, Institute of Economics (VWL) / Darmstadt Discussion Papers i (10) RePEc:dar:vpaper:36755 The Foreign Exchange Rate Exposure of Nations (2006). Darmstadt Technical University, Department of Business Administration, Economics and Law, Institute of Economics (VWL) / Publications of Darmstadt Tec (11) RePEc:hhs:iuiwop:0676 Using Markets to Measure Pre-War Threat Assessments: The Nordic Countries Facing World War II (2006). The Research Institute of Industrial Economics / IUI Working Paper Series (12) RePEc:par:dipeco:2006-se02 Robust volatility forecasts and model selection in financial time series (2006). Department of Economics, Parma University (Italy) / Economics Department Working Papers (13) RePEc:sce:scecfa:529 Learning, structural instability and present value calculations (2006). Society for Computational Economics / Computing in Economics and Finance 2006 (14) RePEc:wbk:wbrwps:3854 Competitive implications of cross-border banking (2006). The World Bank / Policy Research Working Paper Series (15) RePEc:wbk:wbrwps:3933 Internationalization and the evolution of corporate valuation (2006). The World Bank / Policy Research Working Paper Series (16) RePEc:wbk:wbrwps:3963 Financial development in Latin America : big emerging issues, limited policy answers (2006). The World Bank / Policy Research Working Paper Series (17) RePEc:zbw:bubdp1:4756 Learning, structural instability and present value calculations (2006). Deutsche Bundesbank, Research Centre / Discussion Paper Series 1: Economic Studies Recent citations received in: 2005 (1) RePEc:bru:bruedp:05-08 TESTING FOR FINANCIAL CONTAGION BETWEEN DEVELOPED AND EMERGING MARKETS DURING THE 1997 EAST ASIAN CRISIS (2005). Economics and Finance Section, School of Social Sciences, Brunel University / Economics and Finance Discussion Papers (2) RePEc:cfs:cfswop:wp200533 The Volatility of Realized Volatility (2005). Center for Financial Studies / CFS Working Paper Series (3) RePEc:cpr:ceprdp:5261 Rational Inattention: A Solution to the Forward Discount Puzzle (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (4) RePEc:crt:wpaper:0521 Conditional autoregressive valu at risk by regression quantile: Estimatingmarket risk for major stock markets (2005). University of Crete, Department of Economics / Working Papers (5) RePEc:dgr:kubcen:200599 Testing for Mean-Coherent Regular Risk Spanning (2005). Tilburg University, Center for Economic Research / Discussion Paper (6) RePEc:eab:financ:1676 Do the technical indicators reward chartists? A study on the stock markets of China, Hong Kong and Taiwan (2005). East Asian Bureau of Economic Research / Finance Working Papers (7) RePEc:eea:boewps:wp2005-06 Application of investment models in foreign exchange reserve management in Eesti Pank (2005). Bank of Estonia / Bank of Estonia Working Papers (8) RePEc:ijf:ijfiec:v:10:y:2005:i:4:p:359-367 Testing for financial contagion between developed and emerging markets during the 1997 East Asian crisis (2005). International Journal of Finance & Economics (9) RePEc:nbr:nberwo:11452 The Effects of Taxes on Market Responses to Dividend Announcements and Payments: What Can we Learn from the 2003 Dividend Tax Cut? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (10) RePEc:sca:scaewp:0512 Do the technical indicators reward chartists? A study on the stock markets of China, Hong Kong and Taiwan (2005). National University of Singapore, Department of Economics, SCAPE / SCAPE Policy Research Working Paper Series (11) RePEc:sce:scecf5:384 The Long and the Short of It: Long Memory Regressors and Predictive Regressions (2005). Society for Computational Economics / Computing in Economics and Finance 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||