|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

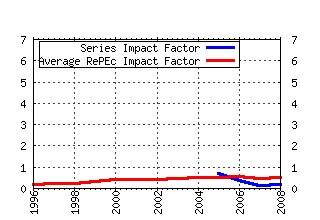

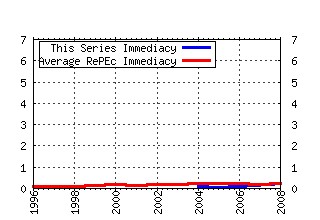

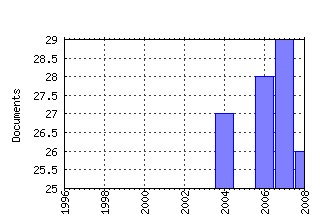

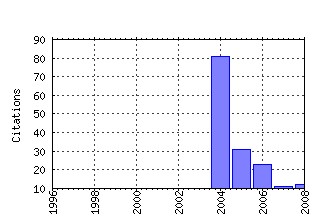

Finance Research Letters Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:finlet:v:1:y:2004:i:1:p:24-34 Limited stock market participation and the equity premium (2004). (2) RePEc:eee:finlet:v:1:y:2004:i:1:p:11-23 Asymmetric information, bank lending and implicit contracts: the winners curse (2004). (3) RePEc:eee:finlet:v:1:y:2004:i:2:p:85-89 Maximizing the expected net future value as an alternative strategy to gamma discounting (2004). (4) RePEc:eee:finlet:v:1:y:2004:i:4:p:215-225 Reported and secret interventions in the foreign exchange markets (2004). (5) RePEc:eee:finlet:v:1:y:2004:i:1:p:56-73 On more robust estimation of skewness and kurtosis (2004). (6) RePEc:eee:finlet:v:2:y:2005:i:4:p:185-194 The long-run equity risk premium (2005). (7) RePEc:eee:finlet:v:3:y:2006:i:3:p:212-233 The interaction between technical currency trading and exchange rate fluctuations (2006). (8) RePEc:eee:finlet:v:2:y:2005:i:1:p:1-14 tays as good as cay (2005). (9) RePEc:eee:finlet:v:1:y:2004:i:1:p:47-55 The effect of market conditions on capital structure adjustment (2004). (10) RePEc:eee:finlet:v:2:y:2005:i:4:p:210-226 Solving models with external habit (2005). (11) RePEc:eee:finlet:v:3:y:2006:i:2:p:154-162 Explosive bubbles in the cointegrated VAR model (2006). (12) RePEc:eee:finlet:v:2:y:2005:i:1:p:15-22 tays as good as cay: Reply (2005). (13) RePEc:eee:finlet:v:3:y:2006:i:2:p:96-101 Asset trading volume in infinite-horizon economies with dynamically complete markets and heterogeneous agents: Comment (2006). (14) RePEc:eee:finlet:v:5:y:2008:i:2:p:79-87 Option prices as probabilities (2008). (15) RePEc:eee:finlet:v:2:y:2005:i:2:p:75-88 Another look at the relationship between cross-market correlation and volatility (2005). (16) RePEc:eee:finlet:v:1:y:2004:i:3:p:143-153 On the consequences of state dependent preferences for the pricing of financial assets (2004). (17) RePEc:eee:finlet:v:4:y:2007:i:4:p:203-216 Why inexperienced investors do not learn: They do not know their past portfolio performance (2007). (18) RePEc:eee:finlet:v:4:y:2007:i:3:p:137-145 Optimality of the RiskMetrics VaR model (2007). (19) RePEc:eee:finlet:v:2:y:2005:i:4:p:260-269 The price-dividend relationship in inflationary and deflationary regimes (2005). (20) RePEc:eee:finlet:v:1:y:2004:i:3:p:171-177 Myopic loss aversion and the equity premium puzzle reconsidered (2004). (21) RePEc:eee:finlet:v:4:y:2007:i:1:p:2-9 Pitfalls in static superhedging of barrier options (2007). (22) RePEc:eee:finlet:v:5:y:2008:i:4:p:191-203 Time-series predictability in the disaster model (2008). (23) RePEc:eee:finlet:v:3:y:2006:i:2:p:114-132 Modeling dynamic conditional correlations in WTI oil forward and futures returns (2006). (24) RePEc:eee:finlet:v:1:y:2004:i:4:p:226-235 Optimal investment with fixed financing costs (2004). (25) RePEc:eee:finlet:v:2:y:2005:i:3:p:125-130 A note on sufficient conditions for no arbitrage (2005). (26) RePEc:eee:finlet:v:1:y:2004:i:3:p:178-189 Institutional trading and stock returns (2004). (27) RePEc:eee:finlet:v:3:y:2006:i:3:p:165-172 Modeling default risk: A new structural approach (2006). (28) RePEc:eee:finlet:v:5:y:2008:i:1:p:59-67 On measuring concentration in banking systems (2008). (29) RePEc:eee:finlet:v:4:y:2007:i:1:p:10-18 Exploring the components of credit risk in credit default swaps (2007). (30) RePEc:eee:finlet:v:5:y:2008:i:4:p:228-235 Dollar-weighted returns to stock investors: A new look at the evidence (2008). (31) RePEc:eee:finlet:v:2:y:2005:i:1:p:30-40 Single stock futures: Listing selection and trading volume (2005). (32) RePEc:eee:finlet:v:3:y:2006:i:4:p:235-243 Exchange rates and order flow in the long run (2006). (33) RePEc:eee:finlet:v:5:y:2008:i:3:p:172-182 Option pricing in a Garch model with tempered stable innovations (2008). (34) RePEc:eee:finlet:v:3:y:2006:i:2:p:102-105 Reply to Asset trading volume in infinite-horizon economies with dynamically complete markets and heterogeneous agents: Comment (2006). (35) RePEc:eee:finlet:v:2:y:2005:i:3:p:131-151 Proxy-quality thresholds: Theory and applications (2005). (36) RePEc:eee:finlet:v:3:y:2006:i:3:p:207-211 A note on a barrier exchange option: The worlds simplest option formula? (2006). (37) RePEc:eee:finlet:v:5:y:2008:i:2:p:88-95 Positivity constraints on the conditional variances in the family of conditional correlation GARCH models (2008). (38) RePEc:eee:finlet:v:4:y:2007:i:2:p:82-91 Rare events and annuity market participation (2007). (39) repec:eee:finlet:v:1:y:2004:i:1:p:2-10 (). (40) RePEc:eee:finlet:v:2:y:2005:i:3:p:107-124 Industry momentum and common factors (2005). (41) RePEc:eee:finlet:v:3:y:2006:i:3:p:181-193 Disentangling risk aversion and intertemporal substitution through a reference level (2006). (42) RePEc:eee:finlet:v:5:y:2008:i:2:p:118-127 Robustness of the risk-return relationship in the U.S. stock market (2008). (43) RePEc:eee:finlet:v:2:y:2005:i:4:p:227-233 Financial forecasts in the presence of asymmetric loss aversion, skewness and excess kurtosis (2005). (44) RePEc:eee:finlet:v:6:y:2009:i:2:p:56-72 The diversification cost of large, concentrated equity stakes. How big is it? Is it justified? (2009). (45) RePEc:eee:finlet:v:2:y:2005:i:2:p:67-74 The generalized asymmetric dynamic covariance model (2005). (46) RePEc:eee:finlet:v:5:y:2008:i:1:p:11-20 Modeling loan commitments (2008). (47) RePEc:eee:finlet:v:1:y:2004:i:2:p:90-99 How do stock prices respond to fundamental shocks? (2004). (48) RePEc:eee:finlet:v:2:y:2005:i:4:p:195-200 Hedging the smirk (2005). (49) RePEc:eee:finlet:v:3:y:2006:i:4:p:277-289 Quadratic term structure models in discrete time (2006). (50) RePEc:eee:finlet:v:4:y:2007:i:3:p:146-154 The tail risks of FX return distributions: A comparison of the returns associated with limit orders and market orders (2007). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:arx:papers:0806.0239 From Black-Scholes and Dupire formulae to last passage times of local martingales. Part A : The infinite time horizon (2008). arXiv.org / Quantitative Finance Papers (2) RePEc:awi:wpaper:0475 Modeling Volatility Spillovers between the Variabilities of US Inflation and Output: the UECCC GARCH Model (2008). University of Heidelberg, Department of Economics / Working Papers (3) RePEc:kap:apfinm:v:15:y:2008:i:2:p:97-115 Unifying Blackââ¬âScholes Type Formulae Which Involve Brownian Last Passage Times up to a Finite Horizon (2008). Asia-Pacific Financial Markets (4) RePEc:nbr:nberwo:14386 Can Time-Varying Risk of Rare Disasters Explain Aggregate Stock Market Volatility? (2008). National Bureau of Economic Research, Inc / NBER Working Papers (5) RePEc:uts:rpaper:229 On Honest Times in Financial Modeling (2008). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (6) RePEc:wbk:wbrwps:4696 Bank competition and financial stability (2008). The World Bank / Policy Research Working Paper Series Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:han:dpaper:dp-352 The Obstinate Passion of Foreign Exchange Professionals: Technical Analysis (2006). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (2) RePEc:wrk:warwec:769 The Obstinate Passion of Foreign Exchange Professionals : Technical Analysis (2006). University of Warwick, Department of Economics / The Warwick Economics Research Paper Series (TWERPS) (3) RePEc:yor:yorken:06/12 Equity Valuation Under Stochastic Interest Rates (2006). Department of Economics, University of York / Discussion Papers Recent citations received in: 2005 (1) RePEc:rdg:icmadp:icma-dp2004-15 Cross Hedging with Single Stock Futures (2005). Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||