|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

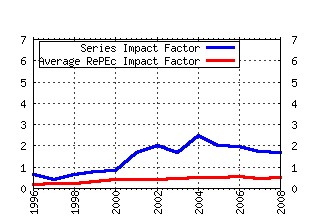

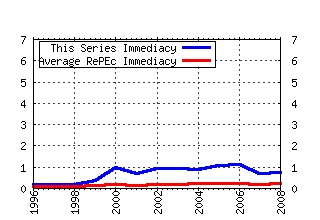

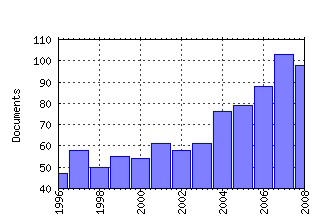

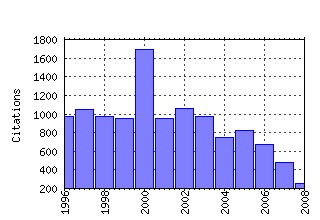

Journal of Financial Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:jfinec:v:3:y:1976:i:4:p:305-360 Theory of the firm: Managerial behavior, agency costs and ownership structure (1976). (2) RePEc:eee:jfinec:v:13:y:1984:i:2:p:187-221 Corporate financing and investment decisions when firms have information that investors do not have (1984). (3) RePEc:eee:jfinec:v:33:y:1993:i:1:p:3-56 Common risk factors in the returns on stocks and bonds (1993). (4) RePEc:eee:jfinec:v:5:y:1977:i:2:p:147-175 Determinants of corporate borrowing (1977). (5) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:261-300 Finance and the sources of growth (2000). (6) RePEc:eee:jfinec:v:5:y:1977:i:2:p:177-188 An equilibrium characterization of the term structure (1977). (7) RePEc:eee:jfinec:v:20:y:1988:i::p:293-315 Management ownership and market valuation : An empirical analysis (1988). (8) RePEc:eee:jfinec:v:19:y:1987:i:1:p:3-29 Expected stock returns and volatility (1987). (9) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:3-27 Investor protection and corporate governance (2000). (10) RePEc:eee:jfinec:v:22:y:1988:i:1:p:3-25 Dividend yields and expected stock returns (1988). (11) RePEc:eee:jfinec:v:25:y:1989:i:1:p:23-49 Business conditions and expected returns on stocks and bonds (1989). (12) RePEc:eee:jfinec:v:14:y:1985:i:1:p:3-31 Using daily stock returns : The case of event studies (1985). (13) RePEc:eee:jfinec:v:3:y:1976:i:1-2:p:125-144 Option pricing when underlying stock returns are discontinuous (1976). (14) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:81-112 The separation of ownership and control in East Asian Corporations (2000). (15) RePEc:eee:jfinec:v:27:y:1990:i:2:p:595-612 Additional evidence on equity ownership and corporate value (1990). (16) RePEc:eee:jfinec:v:18:y:1987:i:2:p:373-399 Stock returns and the term structure (1987). (17) RePEc:eee:jfinec:v:7:y:1979:i:3:p:229-263 Option pricing: A simplified approach (1979). (18) RePEc:eee:jfinec:v:17:y:1986:i:2:p:223-249 Asset pricing and the bid-ask spread (1986). (19) RePEc:eee:jfinec:v:3:y:1976:i:1-2:p:145-166 The valuation of options for alternative stochastic processes (1976). (20) RePEc:eee:jfinec:v:22:y:1988:i:1:p:27-59 Mean reversion in stock prices : Evidence and Implications (1988). (21) RePEc:eee:jfinec:v:5:y:1977:i:2:p:115-146 Asset returns and inflation (1977). (22) RePEc:eee:jfinec:v:3:y:1976:i:1-2:p:167-179 The pricing of commodity contracts (1976). (23) RePEc:eee:jfinec:v:14:y:1985:i:1:p:71-100 Bid, ask and transaction prices in a specialist market with heterogeneously informed traders (1985). (24) RePEc:eee:jfinec:v:60:y:2001:i:2-3:p:187-243 The theory and practice of corporate finance: evidence from the field (2001). (25) RePEc:eee:jfinec:v:11:y:1983:i:1-4:p:5-50 The market for corporate control : The scientific evidence (1983). (26) RePEc:eee:jfinec:v:65:y:2002:i:3:p:365-395 The ultimate ownership of Western European corporations (2002). (27) RePEc:eee:jfinec:v:7:y:1979:i:3:p:265-296 An intertemporal asset pricing model with stochastic consumption and investment opportunities (1979). (28) RePEc:eee:jfinec:v:61:y:2001:i:1:p:43-76 The distribution of realized stock return volatility (2001). (29) RePEc:eee:jfinec:v:5:y:1977:i:3:p:309-327 Estimating betas from nonsynchronous data (1977). (30) RePEc:eee:jfinec:v:8:y:1980:i:4:p:323-361 On estimating the expected return on the market : An exploratory investigation (1980). (31) RePEc:eee:jfinec:v:27:y:1990:i:2:p:473-521 The structure and governance of venture-capital organizations (1990). (32) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:187-214 Financial markets and the allocation of capital (2000). (33) RePEc:eee:jfinec:v:27:y:1990:i:1:p:67-88 The role of banks in reducing the costs of financial distress in Japan (1990). (34) RePEc:eee:jfinec:v:58:y:2000:i:1-2:p:141-186 Corporate governance in the Asian financial crisis (2000). (35) RePEc:eee:jfinec:v:20:y:1988:i::p:431-460 Outside directors and CEO turnover (1988). (36) RePEc:eee:jfinec:v:47:y:1998:i:3:p:243-277 Venture capital and the structure of capital markets: banks versus stock markets (1998). (37) RePEc:eee:jfinec:v:17:y:1986:i:2:p:357-390 Predicting returns in the stock and bond markets (1986). (38) RePEc:eee:jfinec:v:26:y:1990:i:1:p:3-27 Managerial discretion and optimal financing policies (1990). (39) RePEc:eee:jfinec:v:29:y:1991:i:1:p:97-112 The consumption of stockholders and nonstockholders (1991). (40) RePEc:eee:jfinec:v:8:y:1980:i:1:p:3-29 Optimal capital structure under corporate and personal taxation (1980). (41) RePEc:eee:jfinec:v:9:y:1981:i:1:p:3-18 The relationship between return and market value of common stocks (1981). (42) RePEc:eee:jfinec:v:77:y:2005:i:1:p:3-55 Does financial liberalization spur growth? (2005). (43) RePEc:eee:jfinec:v:19:y:1987:i:2:p:217-235 Some evidence on the uniqueness of bank loans (1987). (44) RePEc:eee:jfinec:v:43:y:1997:i:1:p:29-77 Emerging equity market volatility (1997). (45) RePEc:eee:jfinec:v:66:y:2002:i:1:p:3-27 Investor protection and equity markets (2002). (46) RePEc:eee:jfinec:v:53:y:1999:i:3:p:353-384 Understanding the determinants of managerial ownership and the link between ownership and performance (1999). (47) RePEc:eee:jfinec:v:54:y:1999:i:3:p:375-421 Predictive regressions (1999). (48) RePEc:eee:jfinec:v:49:y:1998:i:3:p:307-343 A model of investor sentiment1 (1998). (49) RePEc:eee:jfinec:v:32:y:1992:i:3:p:263-292 The investment opportunity set and corporate financing, dividend, and compensation policies (1992). (50) RePEc:eee:jfinec:v:7:y:1979:i:2:p:117-161 On financial contracting : An analysis of bond covenants (1979). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:aah:create:2008-10 Volatility Components, Affine Restrictions and Non-Normal Innovations (2008). School of Economics and Management, University of Aarhus / CREATES Research Papers (2) RePEc:alu:journl:v:1:y:2008:i:10:p:1 COMPREHENSIVE INCOME IN EUROPE: VALUATION, PREDICTION AND CONSERVATIVE ISSUES (2008). Annales Universitatis Apulensis Series Oeconomica (3) RePEc:arx:papers:0807.0925 Stochastic resonance and the trade arrival rate of stocks (2008). arXiv.org / Quantitative Finance Papers (4) RePEc:bdd:journl:v:2:y:2008:i:2:p:113-135 Dividend Policy of the ISE Industrial Corporations: The Evidence Revisited (1986-2007) (2008). Journal of BRSA Banking and Financial Markets (5) RePEc:bfr:banfra:223 Econometric Asset Pricing Modelling. (2008). Banque de France / Documents de Travail (6) RePEc:btx:wpaper:0820 What Problems and Opportunities are Created by Tax Havens? (2008). Oxford University Centre for Business Taxation / Working Papers (7) RePEc:btx:wpaper:0822 Corporate Tax Elasticities A Readerâs Guide to Empirical Findings (2008). Oxford University Centre for Business Taxation / Working Papers (8) RePEc:btx:wpaper:0825 International Taxation and Multinational Firm Location Decisions (2008). Oxford University Centre for Business Taxation / Working Papers (9) RePEc:btx:wpaper:0826 International Taxation and Takeover Premiums in Cross-border M&As (2008). Oxford University Centre for Business Taxation / Working Papers (10) RePEc:btx:wpaper:0829 Capital Structure, Corporate Taxation and Firm Age (2008). Oxford University Centre for Business Taxation / Working Papers (11) RePEc:cen:wpaper:08-13 On the Lifecycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms (2008). Center for Economic Studies, U.S. Census Bureau / Working Papers (12) RePEc:ces:ceswps:_2431 Taxes and the Efficiency Costs of Capital Distortions (2008). CESifo GmbH / CESifo Working Paper Series (13) RePEc:ces:ceswps:_2460 Learning from the Past: Trends in Executive Compensation over the Twentieth Century (2008). CESifo GmbH / CESifo Working Paper Series (14) RePEc:ces:ceswps:_2503 International Taxation and Multinational Firm Location Decisions (2008). CESifo GmbH / CESifo Working Paper Series (15) RePEc:cir:cirwor:2008s-12 Stock Exchange Markets for New Ventures (2008). CIRANO / CIRANO Working Papers (16) RePEc:cpr:ceprdp:6881 Multi-product Firms and Product Turnover in the Developing World: Evidence from India (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (17) RePEc:cpr:ceprdp:6915 Individual Investors and Volatility (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (18) RePEc:cpr:ceprdp:6959 Sovereign Wealth Funds: Their Investment Strategies and Performance (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (19) RePEc:cpr:ceprdp:7047 International Taxation and Multinational Firm Location Decisions (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (20) RePEc:cpr:ceprdp:7052 Additions to Market Indices and the Comovement of Stock Returns around the World (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (21) RePEc:cpr:ceprdp:7097 Employment Laws in Developing Countries (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (22) RePEc:dgr:kubcen:200830 What is the Role of Legal Systems in Financial Intermediation? Theory and Evidence (2008). Tilburg University, Center for Economic Research / Discussion Paper (23) RePEc:dgr:kubcen:200883 Dividend Policies in an Unregulated Market: The London Stock Exchange 1895-1905 (2008). Tilburg University, Center for Economic Research / Discussion Paper (24) RePEc:dgr:kubtil:2008014 What is the Role of Legal Systems in Financial Intermediation? Theory and Evidence (2008). Tilburg University, Tilburg Law and Economic Center / Discussion Paper (25) RePEc:ebg:heccah:0899 Individual investors and volatility (2008). Groupe HEC / Les Cahiers de Recherche (26) RePEc:ebg:iesewp:d-0749 Expected returns and liquidity risk: Does entrepreneurial income matter? (2008). IESE Business School / IESE Research Papers (27) RePEc:ecl:ohidic:2008-10 Why Do Firms Appoint CEOs as Outside Directors? (2008). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (28) RePEc:ecl:ohidic:2008-15 Why Are Buyouts Levered? The Financial Structure of Private Equity Funds (2008). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (29) RePEc:ecl:stabus:1988 Capital Account Liberalization, Real Wages, and Productivity (2008). Stanford University, Graduate School of Business / Research Papers (30) RePEc:emp:wpaper:wp08-12 The effect of relative wealth concerns on the cross-section of stock returns (2008). Instituto de Empresa, Area of Economic Environment / Working Papers Economia (31) RePEc:fip:fedgif:930 Why do U.S. cross-listings matter? (2008). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (32) RePEc:fip:fedgif:945 Escape from New York: the market impact of SEC Rule 12h-6 (2008). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (33) RePEc:hhs:nhhfms:2008_007 The Risk Components of Liquidity (2008). Department of Finance and Management Science, Norwegian School of Economics and Business Administration / Discussion Papers (34) RePEc:hhs:sifrwp:0061 Communication in the boardroom (2008). Swedish Institute for Financial Research / SIFR Research Report Series (35) RePEc:hhs:vxcafo:2009_011 Liquidity on the Scandinavian Order-driven Stock Exchanges (2008). Centre for Labour Market Policy Research (CAFO), School of Management and Economics, Växjö University / CAFO Working Papers (36) RePEc:hit:hitcei:2008-11 The helping hand, the lazy hand, or the grabbing hand? Central vs. local government shareholders in publicly listed firms in China (2008). Institute of Economic Research, Hitotsubashi University / Working Paper Series (37) RePEc:hit:hitcei:2008-13 Determinants of the Size and Structure of Corporate Boards: 1935-2000 (2008). Institute of Economic Research, Hitotsubashi University / Working Paper Series (38) RePEc:hit:hitcei:2008-4 Board Structure and Price Informativeness (2008). Institute of Economic Research, Hitotsubashi University / Working Paper Series (39) RePEc:hkg:wpaper:0810 What Drives Hong Kong Dollar Swap Spreads: Credit or Liquidity? (2008). Hong Kong Monetary Authority / Working Papers (40) RePEc:imf:imfwpa:08/265 Do Financial Sector Reforms Lead to Financial Development? Evidence from a New Dataset (2008). International Monetary Fund / IMF Working Papers (41) RePEc:inn:wpaper:2008-09 Capital Structure, Corporate Taxation and Firm Age (2008). Faculty of Economics and Statistics, University of Innsbruck / Working Papers (42) RePEc:kap:decono:v:156:y:2008:i:2:p:201-214 Financial Constraints and Other Obstacles: are they a Threat to Innovation Activity? (2008). De Economist (43) RePEc:kob:dpaper:233 Abnormal Accrual, Informed Trader, and Long-Term Stock Return: Evidence from Japan (2008). Research Institute for Economics & Business Administration, Kobe University / Discussion Paper Series (44) RePEc:may:mayecw:n1920508.pdf Investability and Firm Value (2008). Department of Economics, National University of Ireland - Maynooth / Economics Department Working Paper Series (45) RePEc:mos:moswps:2008-21 MANAGERIAL POWER, STOCK-BASED COMPENSATION, AND FIRM PERFORMANCE: THEORY AND EVIDENCE (2008). Monash University, Department of Economics / Monash Economics Working Papers (46) RePEc:nbr:nberwo:13732 Stock-Based Compensation and CEO (Dis)Incentives (2008). National Bureau of Economic Research, Inc / NBER Working Papers (47) RePEc:nbr:nberwo:13880 Capital Account Liberalization, Real Wages, and Productivity (2008). National Bureau of Economic Research, Inc / NBER Working Papers (48) RePEc:nbr:nberwo:14027 Big Business Stability and Social Welfare (2008). National Bureau of Economic Research, Inc / NBER Working Papers (49) RePEc:nbr:nberwo:14087 A Gap-Filling Theory of Corporate Debt Maturity Choice (2008). National Bureau of Economic Research, Inc / NBER Working Papers (50) RePEc:nbr:nberwo:14127 Multi-product Firms and Product Turnover in the Developing World: Evidence from India (2008). National Bureau of Economic Research, Inc / NBER Working Papers (51) RePEc:nbr:nberwo:14175 Private Information and a Macro Model of Exchange Rates: Evidence from a Novel Data Set (2008). National Bureau of Economic Research, Inc / NBER Working Papers (52) RePEc:nbr:nberwo:14193 Housing Supply and Housing Bubbles (2008). National Bureau of Economic Research, Inc / NBER Working Papers (53) RePEc:nbr:nberwo:14245 Why Do Foreign Firms Leave U.S. Equity Markets? (2008). National Bureau of Economic Research, Inc / NBER Working Papers (54) RePEc:nbr:nberwo:14250 On the Lifecycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms (2008). National Bureau of Economic Research, Inc / NBER Working Papers (55) RePEc:nbr:nberwo:14273 Racial Discrimination and Competition (2008). National Bureau of Economic Research, Inc / NBER Working Papers (56) RePEc:nbr:nberwo:14486 The Role of Boards of Directors in Corporate Governance: A Conceptual Framework and Survey (2008). National Bureau of Economic Research, Inc / NBER Working Papers (57) RePEc:nbr:nberwo:14557 The Evolution of Corporate Ownership After IPO: The Impact of Investor Protection (2008). National Bureau of Economic Research, Inc / NBER Working Papers (58) RePEc:ner:maastr:urn:nbn:nl:ui:27-22862 Financial constraints and other obstacles: are they a threat to innovation activity?. (2008). Maastricht University / Open Access publications from Maastricht University (59) RePEc:nya:albaec:08-08 On the Objective of Corporate Boards: Theory and Evidence (2008). University at Albany, SUNY, Department of Economics / Discussion Papers (60) RePEc:pra:mprapa:10122 Foreign Currency Exposure and Hedging: Evidence from Foreign Acquisitions (2008). University Library of Munich, Germany / MPRA Paper (61) RePEc:pra:mprapa:14843 The effects of stock options accounting regulation on corporate governance: A comparative European study (2008). University Library of Munich, Germany / MPRA Paper (62) RePEc:pra:mprapa:8226 Mergers, acquisitions and technological regimes: the European experience over the period 2002- 2005 (2008). University Library of Munich, Germany / MPRA Paper (63) RePEc:rug:rugwps:08/537 Agency and similarity effects and the VCâs attitude towards academic spin-out investing (2008). Ghent University, Faculty of Economics and Business Administration / Working Papers of Faculty of Economics and Business Administration, Ghent Univers (64) RePEc:sol:wpaper:08-037 International Taxation and Multinational Firm Location Decisions (2008). Université Libre de Bruxelles, Solvay Business School, Centre Emile Bernheim (CEB) / Working Papers CEB (65) RePEc:upf:upfgen:1109 A New Method for Constructing Exact Tests without Making any Assumptions (2008). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (66) RePEc:vlg:vlgwps:2008-09 Towards an evolutionary model of the entrepreneurial financing process: insights from biotechnology startups (2008). Vlerick Leuven Gent Management School / Vlerick Leuven Gent Management School Working Paper Series (67) RePEc:vlg:vlgwps:2008-22 Agency and similarity effects and the VCs attitude towards academic spin-out investing (2008). Vlerick Leuven Gent Management School / Vlerick Leuven Gent Management School Working Paper Series (68) RePEc:wbk:wbrwps:4649 Bank involvement with SMEs : beyond relationship lending (2008). The World Bank / Policy Research Working Paper Series (69) RePEc:wbk:wbrwps:4687 Patterns of international capital raisings (2008). The World Bank / Policy Research Working Paper Series (70) RePEc:wbk:wbrwps:4770 Crises, capital controls, and financial integration (2008). The World Bank / Policy Research Working Paper Series (71) RePEc:wbk:wbrwps:4788 Drivers and obstacles to banking SMEs : the role of competition and the institutional framework (2008). The World Bank / Policy Research Working Paper Series (72) RePEc:zbw:zewdip:7229 The Impact of Personal and Corporate Taxation on Capital Structure Choices (2008). ZEW - Zentrum für Europäische Wirtschaftsforschung / Center for European Economic Research / ZEW Discussion Papers Recent citations received in: 2007 (1) RePEc:aah:create:2007-22 A Discrete-Time Model for Daily S&P500 Returns and Realized Variations: Jumps and Leverage Effects (2007). School of Economics and Management, University of Aarhus / CREATES Research Papers (2) RePEc:aah:create:2007-37 Models for S&P500 Dynamics: Evidence from Realized Volatility, Daily Returns, and Option Prices (2007). School of Economics and Management, University of Aarhus / CREATES Research Papers (3) RePEc:boe:boeewp:328 Cash-in-the-market pricing and optimal resolution of bank failures (2007). Bank of England / Bank of England working papers (4) RePEc:bol:bodewp:611 Who are the active investors? Evidence from Venture Capital (2007). Dipartimento Scienze Economiche, Universita' di Bologna / Working Papers (5) RePEc:bsu:wpaper:200703 Universal Banking, Conficts of Interest and Firm Growth. (2007). Ball State University, Department of Economics / Working Papers (6) RePEc:ces:ceswps:_2179 Creditor Passivity: The Effects of Bank Competition and Institutions on the Strategic Use of Bankruptcy Filings (2007). CESifo GmbH / CESifo Working Paper Series (7) RePEc:cpr:ceprdp:6029 Finance and Efficiency: Do Bank Branching Regulations Matter? (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (8) RePEc:cpr:ceprdp:6202 Finance and Efficiency: Do Bank Branching Regulations Matter? (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (9) RePEc:cpr:ceprdp:6309 Fire Sales, Foreign Entry and Bank Liquidity (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (10) RePEc:cpr:ceprdp:6319 Fire-sale FDI (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cpr:ceprdp:6480 Finance and Welfare States in Globalizing Markets (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:cpr:ceprdp:6489 Pension Reform, Ownership Structure, and Corporate Governance: Evidence from Sweden (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (13) RePEc:cpr:ceprdp:6514 Hazardous Times for Monetary Policy: What Do Twenty-Three Million Bank Loans Say About the Effects of Monetary Policy on Credit Risk? (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (14) RePEc:dgr:eureri:300011304 When Do Managers Seek Private Equity Backing in Public-to-Private Transactions? (2007). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (15) RePEc:dgr:kubtil:2007015 Credit Derivatives and Loan Pricing (2007). Tilburg University, Tilburg Law and Economic Center / Discussion Paper (16) RePEc:dnb:dnbwpp:144 Market timing and corporate capital structure - A transatlantic comparison (2007). Netherlands Central Bank, Research Department / DNB Working Papers (17) RePEc:ebg:heccah:0878 Acquisition Values and Optimal Financial (In)Flexibility (2007). Groupe HEC / Les Cahiers de Recherche (18) RePEc:ecl:ohidic:2006-14 Large Shareholders and Corporate Policies (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (19) RePEc:ecl:ohidic:2006-17 Why Do U.S. Firms Hold So Much More Cash Than They Used To? (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (20) RePEc:ecl:ohidic:2007-13 Fundamentals, Market Timing, and Seasoned Equity Offerings (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (21) RePEc:ecl:ohidic:2007-14 Differences in Governance Practices between U.S. and Foreign Firms: Measurement, Causes, and Consequences (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (22) RePEc:ecl:ohidic:2007-6 Complex Times: Asset Pricing and Conditional Moments under Non-affine Diffusions (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (23) RePEc:eti:dpaper:07043 Credit Contagion and Trade Credit Supply: Evidence from Small Business Data in Japan (2007). Research Institute of Economy, Trade and Industry (RIETI) / Discussion papers (24) RePEc:eti:dpaper:07058 How Do Relationship Lenders Price Loans to Small Firms?: Hold-Up Costs, Transparency, and Private and Public Security (2007). Research Institute of Economy, Trade and Industry (RIETI) / Discussion papers (25) RePEc:fem:femwpa:2007.78 Legal Families and Environmental Protection: Is there a Causal Relationship? (2007). Fondazione Eni Enrico Mattei / Working Papers (26) RePEc:fip:fedbqu:qau07-5 Asset liquidity, debt valuation and credit risk (2007). Federal Reserve Bank of Boston / Quantitative Analysis Unit Working Paper (27) RePEc:fip:fedcwp:0706 Liquidity in asset markets with search frictions (2007). Federal Reserve Bank of Cleveland / Working Paper (28) RePEc:fip:fedgfe:2007-29 Bank commercial loan fair value practices (2007). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (29) RePEc:fip:fedgfe:2007-39 An efficiency perspective on the gains from mergers and asset purchases (2007). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (30) RePEc:fip:fednsr:290 Has the credit derivatives swap market lowered the cost of corporate debt? (2007). Federal Reserve Bank of New York / Staff Reports (31) RePEc:hhs:rbnkwp:0210 Acquisition versus greenfield: The impact of the mode of foreign bank entry on information and bank lending rates (2007). Sveriges Riksbank (Central Bank of Sweden) / Working Paper Series (32) RePEc:hhs:sifrwp:0053 Learning by Investing: Evidence from Venture Capital (2007). Swedish Institute for Financial Research / SIFR Research Report Series (33) RePEc:ide:wpaper:7373 The Microstructure of the Bond Market in the 20th Century (2007). Institut d'Ãconomie Industrielle (IDEI), Toulouse / IDEI Working Papers (34) RePEc:ime:imemes:v:25:y:2007:i:2:p:1-44 Lending Channels and Financial Shocks: The Case of Small and Medium-Sized Enterprise Trade Credit and the Japanese Banking Crisis (2007). Monetary and Economic Studies (35) RePEc:imf:imfwpa:07/186 Financial Reforms, Financial Openness, and Corporate Borrowing: International Evidence (2007). International Monetary Fund / IMF Working Papers (36) RePEc:iza:izadps:dp3237 Credit Constraints as a Barrier to the Entry and Post-Entry Growth of Firms (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (37) RePEc:kap:annfin:v:3:y:2007:i:3:p:369-387 IPO share allocation and conflicts of interest (2007). Annals of Finance (38) RePEc:kap:decono:v:155:y:2007:i:2:p:183-206 Market Timing and Capital Structure: Evidence for Dutch Firms (2007). De Economist (39) RePEc:kap:fmktpm:v:21:y:2007:i:3:p:293-324 Corporate cash holdings: Evidence from Switzerland (2007). Financial Markets and Portfolio Management (40) RePEc:kap:jfsres:v:32:y:2007:i:1:p:1-16 A Critique of Revised Basel II (2007). Journal of Financial Services Research (41) RePEc:kap:jfsres:v:32:y:2007:i:1:p:17-38 Basel II: Correlation Related Issues (2007). Journal of Financial Services Research (42) RePEc:kap:jfsres:v:32:y:2007:i:3:p:141-159 Trading Credit Default Swaps via Interdealer Brokers (2007). Journal of Financial Services Research (43) RePEc:kap:jfsres:v:32:y:2007:i:3:p:177-202 Universal Banking, Conflicts of Interest and Firm Growth (2007). Journal of Financial Services Research (44) RePEc:kap:jrefec:v:35:y:2007:i:4:p:385-410 CEO Involvement in Director Selection: Implications for REIT Dividend Policy (2007). The Journal of Real Estate Finance and Economics (45) RePEc:kap:rqfnac:v:29:y:2007:i:2:p:129-154 Underwriter warrants, underwriter reputation, and growth signaling (2007). Review of Quantitative Finance and Accounting (46) RePEc:knz:cofedp:0709 Securitisation of Mezzanine Capital in Germany (2007). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (47) RePEc:knz:cofedp:0710 Information asymmetries and securitization design (2007). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (48) RePEc:lmu:muenec:2007 The Effect of Bank Competition on the Banks Incentive to Collateralize (2007). University of Munich, Department of Economics / Discussion Papers in Economics (49) RePEc:lmu:muenec:2028 Creditor Passivity: The Effects of Bank Competition and Institutions on the Strategic Use of Bankruptcy Filings (2007). University of Munich, Department of Economics / Discussion Papers in Economics (50) RePEc:mie:wpaper:565 The Case for Financial Sector Liberalization in Ethiopia (2007). Research Seminar in International Economics, University of Michigan / Working Papers (51) RePEc:nbr:nberwo:12874 On the Return to Venture Capital (2007). National Bureau of Economic Research, Inc / NBER Working Papers (52) RePEc:nbr:nberwo:13014 Human Capital, Bankruptcy and Capital Structure (2007). National Bureau of Economic Research, Inc / NBER Working Papers (53) RePEc:nbr:nberwo:13285 Fundamentals, Market Timing, and Seasoned Equity Offerings (2007). National Bureau of Economic Research, Inc / NBER Working Papers (54) RePEc:nbr:nberwo:13288 Differences in Governance Practices between U.S. and Foreign Firms: Measurement, Causes, and Consequences (2007). National Bureau of Economic Research, Inc / NBER Working Papers (55) RePEc:nbr:nberwo:13430 Linearity-Generating Processes: A Modelling Tool Yielding Closed Forms for Asset Prices (2007). National Bureau of Economic Research, Inc / NBER Working Papers (56) RePEc:nbr:nberwo:13608 The Economic Consequences of Legal Origins (2007). National Bureau of Economic Research, Inc / NBER Working Papers (57) RePEc:nbr:nberwo:13660 Financial Structure, Liquidity, and Firm Locations (2007). National Bureau of Economic Research, Inc / NBER Working Papers (58) RePEc:ner:tilbur:urn:nbn:nl:ui:12-301942 Saving and investing over the life cycle and the role of collective pension funds. (2007). Tilburg University / Open Access publications from Tilburg University (59) RePEc:ner:tilbur:urn:nbn:nl:ui:12-3508392 Efficiency in financial intermediation: Theory and empirical measurement. (2007). Tilburg University / Open Access publications from Tilburg University (60) RePEc:nip:nipewp:28/2007 Wealth Shocks and Risk Aversion (2007). NIPE - Universidade do Minho / NIPE Working Papers (61) RePEc:nip:nipewp:29/2007 Expectations, Shocks, and Asset Returns (2007). NIPE - Universidade do Minho / NIPE Working Papers (62) RePEc:pra:mprapa:23244 Agency Conflicts and Corporate Payout Policies: A Global Study (2007). University Library of Munich, Germany / MPRA Paper (63) RePEc:pra:mprapa:3110 Driven to distraction: Extraneous events and underreaction to earnings news (2007). University Library of Munich, Germany / MPRA Paper (64) RePEc:pra:mprapa:5101 Larger crises cost more: impact of banking sector instability on output growth (2007). University Library of Munich, Germany / MPRA Paper (65) RePEc:pra:mprapa:6600 The Effects of Corporate Governance and Institutional Environments on Export Behaviour: Evidence from Chinese Listed Firms (2007). University Library of Munich, Germany / MPRA Paper (66) RePEc:qed:wpaper:1131 Credit Risk Transfer: To Sell or to Insure (2007). Queen's University, Department of Economics / Working Papers (67) RePEc:sol:wpaper:07-003 Social justice with credits to the poor (2007). Université Libre de Bruxelles, Solvay Business School, Centre Emile Bernheim (CEB) / Working Papers CEB (68) RePEc:spr:finsto:v:11:y:2007:i:4:p:495-519 Efficient estimation of drift parameters in stochastic volatility models (2007). Finance and Stochastics (69) RePEc:uct:uconnp:2007-10 Empirical Analysis of Credit Risk Regime Switching and Temporal Conditional Default Correlation in Credit Default Swap Valuation: The Market liquidity effect (2007). University of Connecticut, Department of Economics / Working papers (70) RePEc:wbk:wbrwps:4204 Formal finance and trade credit during Chinas transition (2007). The World Bank / Policy Research Working Paper Series (71) RePEc:wbk:wbrwps:4296 When do creditor rights work? (2007). The World Bank / Policy Research Working Paper Series (72) RePEc:wbk:wbrwps:4435 When do enterprises prefer informal credit ? (2007). The World Bank / Policy Research Working Paper Series Recent citations received in: 2006 (1) RePEc:acb:cbeeco:2006-463 International Prudential Regulation, Regulatory Risk and the Cost of Bank Capital (2006). Australian National University, College of Business and Economics, School of Economics / ANUCBE School of Economics Working Papers (2) RePEc:bca:bocawp:06-44 The Long-Term Effects of Cross-Listing Investor Recognition, and Ownership Structure on Valuation (2006). Bank of Canada / Working Papers (3) RePEc:bde:wpaper:0606 The joint size and ownership specialization in banks lending (2006). Banco de Espana / Banco de Espana Working Papers (4) RePEc:boe:boeewp:310 Returns to equity, investment and Q: evidence from the United Kingdom (2006). Bank of England / Bank of England working papers (5) RePEc:bol:bodewp:577 Last Resort Gambles, Risky Debt and Liquidation Policy (2006). Dipartimento Scienze Economiche, Universita' di Bologna / Working Papers (6) RePEc:bos:wpaper:wp2006-042 Complementarities in information acquisition with short-term trades (2006). Department of Economics, Boston University / Boston University Working Papers Series (7) RePEc:bos:wpaper:wp2006-047 A Habit-Based Explanation of the Exchange Rate Risk Premium (2006). Department of Economics, Boston University / Boston University Working Papers Series (8) RePEc:bri:cmpowp:06/153 Is Locking Domestic Funds into the Local Market Beneficial? Evidence from the Polish Pension Reforms (2006). Department of Economics, University of Bristol, UK / The Centre for Market and Public Organisation (9) RePEc:cbr:cbrwps:wp335 How do family ties, boards and regulation affect pay at the top? Evidence for Indian CEOs (2006). ESRC Centre for Business Research / ESRC Centre for Business Research - Working Papers (10) RePEc:cbt:econwp:06/14 A Monte Carlo Evaluation of the Efficiency of the PCSE Estimator (2006). University of Canterbury, Department of Economics / Working Papers in Economics (11) RePEc:cep:cepdps:dp0755 International Financial Integration and Entrepreneurship (2006). Centre for Economic Performance, LSE / CEP Discussion Papers (12) RePEc:cep:stiecm:/2006/509 Estimating Quadratic VariationConsistently in thePresence of Correlated MeasurementError (2006). Suntory and Toyota International Centres for Economics and Related Disciplines, LSE / STICERD - Econometrics Paper Series (13) RePEc:cfs:cfswop:wp200604 Risk Transfer with CDOs and Systemic Risk in Banking (2006). Center for Financial Studies / CFS Working Paper Series (14) RePEc:cns:cnscwp:200616 What determines entrepreneurial clusters? (2006). Centre for North South Economic Research, University of Cagliari and Sassari, Sardinia / Working Paper CRENoS (15) RePEc:cor:louvco:2006088 International stock return predictability: statistical evidence and economic significance (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (16) RePEc:cor:louvco:2006089 The information content of the Bond-Equity Yield Ratio: better than a random walk? (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (17) RePEc:cpr:ceprdp:5449 The Organization of the Innovation Industry: Entrepreneurs, Venture Capitalists and Oligopolists (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (18) RePEc:cpr:ceprdp:5524 Optimal Asset Allocation and Risk Shifting in Money Management (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (19) RePEc:cpr:ceprdp:5604 Marketwide Private Information in Stocks: Forecasting Currency Returns (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (20) RePEc:cpr:ceprdp:5618 Risk Transfer with CDOs and Systemic Risk in Banking (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (21) RePEc:cpr:ceprdp:5623 Banking Crises, Financial Dependence and Growth (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (22) RePEc:cpr:ceprdp:5722 Stock Price Informativeness, Cross-Listings and Investment Decisions (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (23) RePEc:cpr:ceprdp:5758 Conditional Allocation of Control Rights in Venture Capital Firms (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (24) RePEc:cpr:ceprdp:5770 Predictability in Financial Markets: What Do Survey Expectations Tell Us? (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (25) RePEc:cpr:ceprdp:5773 Optimal Value and Growth Tilts in Long-Horizon Portfolios (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (26) RePEc:cpr:ceprdp:5821 Ex Ante Effects of Ex Post Managerial Ownership (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (27) RePEc:cpr:ceprdp:5946 Liquidity and Expected Returns: Lessons from Emerging Markets (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (28) RePEc:cpr:ceprdp:5951 Stock and Bond Returns with Moody Investors (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (29) RePEc:crf:wpaper:06-07 Why Do Banks Ask for Collateral and Which Ones? (2006). CREFI-LSF, University of Luxembourg / Working Papers of CREFI-LSF (Centre of Research in Finance - Luxembourg School of Finance) (30) RePEc:csl:devewp:219 Trade Openness and Volatility (2006). Centro Studi Luca d'Agliano, University of Milano / Development Working Papers (31) RePEc:dgr:kubcen:2006103 Agency Theory of Overvalued Equity as an Explanation for the Accrual Anomaly (2006). Tilburg University, Center for Economic Research / Discussion Paper (32) RePEc:dgr:kubcen:200673 How Relevant is Divident Policy under Low Shareholder Protection? (2006). Tilburg University, Center for Economic Research / Discussion Paper (33) RePEc:dgr:kubcen:200678 Optimal Portfolio Choice with Annuitization (2006). Tilburg University, Center for Economic Research / Discussion Paper (34) RePEc:ebg:heccah:0840 Stock price informativeness, cross-listings and investment decisions (2006). Groupe HEC / Les Cahiers de Recherche (35) RePEc:ebg:iesewp:d-0663 A general formula for the WACC: A correction (2006). IESE Business School / IESE Research Papers (36) RePEc:ecb:ecbwps:20060689 The effect of financial development on the investment-cash flow relationship - cross-country evidence from Europe (2006). European Central Bank / Working Paper Series (37) RePEc:ecl:ohidic:2004-20 Founder-CEOs, Investment Decisions, and Stock Market Performance (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (38) RePEc:ecl:ohidic:2005-18 Do Local Analysts Know More? A Cross-Country Study of the Performance of Local Analysts and Foreign Analysts (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (39) RePEc:ecl:ohidic:2006-20 Managerial Risk-Taking Behavior and Equity-Based Compensation (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (40) RePEc:ecl:ohidic:2006-21 The Economics of Conflicts of Interest in Financial Institutions (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (41) RePEc:ecl:ohidic:2006-23 R2 and Price Inefficiency (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (42) RePEc:ecl:ohidic:2006-7 How Has CEO Turnover Changed? Increasingly Performance Sensitive Boards and Increasingly Uneasy CEOs (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (43) RePEc:ecl:ohidic:2006-8 Investor Overreaction, Cross-Sectional Dispersion of Firm Valuations, and Expected Stock Returns (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (44) RePEc:fip:fedfwp:2006-16 The bond yield conundrum from a macro-finance perspective (2006). Federal Reserve Bank of San Francisco / Working Paper Series (45) RePEc:fip:fedfwp:2006-35 Incomplete information processing: a solution to the forward discount puzzle (2006). Federal Reserve Bank of San Francisco / Working Paper Series (46) RePEc:fip:fedfwp:2006-46 Macroeconomic implications of changes in the term premium (2006). Federal Reserve Bank of San Francisco / Working Paper Series (47) RePEc:fip:fedgfe:2006-11 Credit market competition and capital regulation (2006). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (48) RePEc:fip:fedgfe:2007-11 Expected stock returns and variance risk premia (2006). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (49) RePEc:fip:fedgif:853 New methods for inference in long-run predictive regressions (2006). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (50) RePEc:fip:fedgif:855 Should we expect significant out-of-sample results when predicting stock returns? (2006). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (51) RePEc:fip:fedgif:869 Predictive regressions with panel data (2006). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (52) RePEc:fip:fedgif:877 International cross-listing, firm performance and top management turnover: a test of the bonding hypothesis (2006). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (53) RePEc:fip:fednsr:252 Visible and hidden risk factors for banks (2006). Federal Reserve Bank of New York / Staff Reports (54) RePEc:fip:fedreq:y:2006:i:fall:p:317-336:n:v.92no.4 Bond price premiums (2006). Economic Quarterly (55) RePEc:hhs:bofrdp:2006_025 Monetary policy and rejections of the expectations hypothesis (2006). Bank of Finland / Research Discussion Papers (56) RePEc:hit:hitcei:2005-13 Ownership, Foreign Listings, and Market Valuation (2006). Institute of Economic Research, Hitotsubashi University / Working Paper Series (57) RePEc:hkm:wpaper:102006 Predictability in Financial Markets: What Do Survey Expectations Tell Us? (2006). Hong Kong Institute for Monetary Research / Working Papers (58) RePEc:iis:dispap:iiisdp162 The Performance of International Equity Portfolios (2006). IIIS / The Institute for International Integration Studies Discussion Paper Series (59) RePEc:imf:imfwpa:06/231 Barriers to Retail Competition and Prices: Evidence from Spain (2006). International Monetary Fund / IMF Working Papers (60) RePEc:iza:izadps:dp2086 Reforms, Entry and Productivity: Some Evidence from the Indian Manufacturing Sector (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (61) RePEc:iza:izadps:dp2433 The Economic Effects of Employment Protection: Evidence from International Industry-Level Data (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (62) RePEc:jae:japmet:v:21:y:2006:i:2:p:147-173 Estimation of multivariate models for time series of possibly different lengths (2006). Journal of Applied Econometrics (63) RePEc:kap:revind:v:29:y:2006:i:1:p:93-126 Simple money-based tests for choosing between private and public delivery: a discussion of the issues (2006). Review of Industrial Organization (64) RePEc:knz:cofedp:0609 Wieweit tragen rationale Modelle in der Finanzmarktforschung? (2006). Center of Finance and Econometrics, University of Konstanz / CoFE Discussion Paper (65) RePEc:lar:wpaper:2006-02 Does Collateral Help Mitigate Adverse Selection? A Cross-Country Analysis (2006). Laboratoire de Recherche en Gestion et Economie, Université Louis Pasteur, Strasbourg (France) / Working Papers of LaRGE (Laboratoire de Recherche en (66) RePEc:lar:wpaper:2006-03 Why Do Banks Ask for Collateral and Which Ones ? (2006). Laboratoire de Recherche en Gestion et Economie, Université Louis Pasteur, Strasbourg (France) / Working Papers of LaRGE (Laboratoire de Recherche en (67) RePEc:msh:ebswps:2006-10 Assessing the Impact of Market Microstructure Noise and Random Jumps on the Relative Forecasting Performance of Option-Implied and Returns-Based Volatility (2006). Monash University, Department of Econometrics and Business Statistics / Monash Econometrics and Business Statistics Working Papers (68) RePEc:nbr:nberwo:12026 The Dog That Did Not Bark: A Defense of Return Predictability (2006). National Bureau of Economic Research, Inc / NBER Working Papers (69) RePEc:nbr:nberwo:12144 Optimal Decentralized Investment Management (2006). National Bureau of Economic Research, Inc / NBER Working Papers (70) RePEc:nbr:nberwo:12151 Why Do IPO Auctions Fail? (2006). National Bureau of Economic Research, Inc / NBER Working Papers (71) RePEc:nbr:nberwo:12247 Stock and Bond Returns with Moody Investors (2006). National Bureau of Economic Research, Inc / NBER Working Papers (72) RePEc:nbr:nberwo:12346 The Performance of International Equity Portfolios (2006). National Bureau of Economic Research, Inc / NBER Working Papers (73) RePEc:nbr:nberwo:12360 A Skeptical Appraisal of Asset-Pricing Tests (2006). National Bureau of Economic Research, Inc / NBER Working Papers (74) RePEc:nbr:nberwo:12465 How has CEO Turnover Changed? Increasingly Performance Sensitive Boards and Increasingly Uneasy CEOs (2006). National Bureau of Economic Research, Inc / NBER Working Papers (75) RePEc:nbr:nberwo:12671 Testing Models of Low-Frequency Variability (2006). National Bureau of Economic Research, Inc / NBER Working Papers (76) RePEc:nbr:nberwo:12695 The Economics of Conflicts of Interest in Financial Institutions (2006). National Bureau of Economic Research, Inc / NBER Working Papers (77) RePEc:nbr:nberwo:12781 Heterogeneous Expectations and Bond Markets (2006). National Bureau of Economic Research, Inc / NBER Working Papers (78) RePEc:ner:tilbur:urn:nbn:nl:ui:12-3125497 Financial intermediary development and growth volatility: Do intermediaries dampen or magnify shocks?. (2006). Tilburg University / Open Access publications from Tilburg University (79) RePEc:ntd:wpaper:2006-14 Dividends: New evidence on the catering theory (2006). Interuniversitary Doctorate Program New Trends on Business Administration, Universities of Valladolid, Burgos and Salamanca (Spain). Programa de Docto (80) RePEc:nus:nusewp:wp0603 The Persistence and Predictive Power of the Dividend-Price Ratio (2006). National University of Singapore, Department of Economics / Departmental Working Papers (81) RePEc:pra:mprapa:2508 Does Collateral Help Mitigate Adverse Selection ? A Cross-Country Analysis (2006). University Library of Munich, Germany / MPRA Paper (82) RePEc:qed:wpaper:1107 Work-Related Perks, Agency Problems, and Optimal Incentive Contracts (2006). Queen's University, Department of Economics / Working Papers (83) RePEc:qed:wpaper:1108 A Rent Extraction View of Employee Discounts and Benefits (2006). Queen's University, Department of Economics / Working Papers (84) RePEc:rdg:icmadp:icma-dp2006-09 Momentum Profits and Time-Varying Unsystematic Risk (2006). (85) RePEc:red:issued:05-109 A Simple Explanation of the Relative Performance Evaluation Puzzle (2006). Review of Economic Dynamics (86) RePEc:rut:rutres:200620 Predictive Density Estimators for Daily Volatility Based on the Use of Realized Measures (2006). Rutgers University, Department of Economics / Departmental Working Papers (87) RePEc:sbs:wpsefe:2006fe13 IPO pricing and allocation: a survey of the views of institutional investors (2006). Oxford Financial Research Centre / OFRC Working Papers Series (88) RePEc:ste:nystbu:06-14 Knowing What Others Know: Coordination Motives in Information Acquisition (2006). New York University, Leonard N. Stern School of Business, Department of Economics / Working Papers (89) RePEc:ste:nystbu:06-28 Do Financial Conglomerates Create or Destroy Economic Value? (2006). New York University, Leonard N. Stern School of Business, Department of Economics / Working Papers (90) RePEc:szg:worpap:0604 Predictability in Financial Markets: What Do Survey Expectations Tell Us? (2006). Swiss National Bank, Study Center Gerzensee / Working Papers (91) RePEc:upf:upfgen:1009 Testing Financing Constraints on Firm Investment using Variable Capital (2006). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (92) RePEc:upf:upfgen:1010 Financing Constraints and Fixed-Term Employment Contracts (2006). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (93) RePEc:wbk:wbrwps:3856 Creating an efficient financial system : challenges in a global economy (2006). The World Bank / Policy Research Working Paper Series (94) RePEc:wbk:wbrwps:3892 Promoting access to primary equity markets : a legal and regulatory approach (2006). The World Bank / Policy Research Working Paper Series (95) RePEc:wbk:wbrwps:3955 Finance and economic development : policy choices for developing countries (2006). The World Bank / Policy Research Working Paper Series (96) RePEc:wbk:wbrwps:4079 Banking services for everyone ? Barriers to bank access and use around the world (2006). The World Bank / Policy Research Working Paper Series (97) RePEc:wdi:papers:2006-822 Reforms, Entry and Productivity: Some Evidence from the Indian Manufacturing Sector (2006). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (98) RePEc:wrk:warwec:772 Internal consistency of survey respondents.forecasts : Evidence based on the Survey of Professional Forecasters (2006). University of Warwick, Department of Economics / The Warwick Economics Research Paper Series (TWERPS) (99) RePEc:xrs:sfbmaa:06-13 Der Diversification Discount in Deutschland: Existiert ein Bewertungsabschlag für diversifizierte Unternehmen? (2006). Sonderforschungsbereich 504, University of Mannheim / Sonderforschungsbereich 504 Publications Recent citations received in: 2005 (1) RePEc:aea:jecper:v:19:y:2005:i:3:p:163-180 Dividend Taxation and Corporate Governance (2005). Journal of Economic Perspectives (2) RePEc:bca:bocawp:05-42 Order Submission: The Choice between Limit and Market Orders (2005). Bank of Canada / Working Papers (3) RePEc:bde:wpaper:0525 The mix of international banksforeign claims: determinants and implications (2005). Banco de Espana / Banco de Espana Working Papers (4) RePEc:ces:ceswps:_1451 Systemic Crises and Growth (2005). CESifo GmbH / CESifo Working Paper Series (5) RePEc:cfr:cefirw:w0055 Earnings Manipilation and Incentives in Firms (2005). Center for Economic and Financial Research / CEFIR Working Papers (6) RePEc:cfs:cfswop:wp200527 Trusting the Stock Market (2005). Center for Financial Studies / CFS Working Paper Series (7) RePEc:chb:bcchwp:356 Bank Ownership and Performance Does Politics Matter? (2005). Central Bank of Chile / Working Papers Central Bank of Chile (8) RePEc:cor:louvco:2005011 Commonalities in the order book (2005). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (9) RePEc:cpr:ceprdp:4829 Limits of Arbitrage and Corporate Financial Policy (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (10) RePEc:cpr:ceprdp:4921 Why is Long-Horizon Equity Less Risky? A Duration-based Explanation of the Value Premium (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cpr:ceprdp:5061 SMEs and Bank Lending Relationships: The Impact of Mergers (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:cpr:ceprdp:5240 Minority Blocks and Takeover Premia (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (13) RePEc:cpr:ceprdp:5288 Trusting the Stock Market (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (14) RePEc:cpr:ceprdp:5371 Do Entrenched Managers Pay Their Workers More? (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (15) RePEc:cpr:ceprdp:5420 Demand-Based Option Pricing (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (16) RePEc:cte:wbrepe:wb054611 The Influence of Blockholders on R&D Investments Intensity: Evidence From Spain (2005). Universidad Carlos III, Departamento de EconomÃa de la Empresa / Business Economics Working Papers (17) RePEc:ctl:louvec:2005014 Commonalities in the order book (2005). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (18) RePEc:dlw:wpaper:05-17 Information Asymmetries, Litigation Risk and the Demand for Fairness Opinions: Evidence from U.S. Mergers & Acquisitions, 1980-2002 (2005). University of Delaware, Department of Economics / Working Papers (19) RePEc:dnb:dnbwpp:072 Correlated Trading and Returns (2005). Netherlands Central Bank, Research Department / DNB Working Papers (20) RePEc:ecb:ecbwps:20050428 Who benefits from IPO underpricing? Evidence form hybrid bookbuilding offerings (2005). European Central Bank / Working Paper Series (21) RePEc:ecb:ecbwps:20050498 Financial integration and entrepreneurial activity - evidence from foreign bank entry in emerging markets (2005). European Central Bank / Working Paper Series (22) RePEc:ecl:ohidic:2004-24 Institutional Investment Constraints and Stock Prices (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (23) RePEc:ecl:ohidic:2005-1 The Limits of Financial Globalization (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (24) RePEc:ecl:ohidic:2005-14 Why Do Firms Become Widely Held? An Analysis of the Dynamics of Corporate Ownership (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (25) RePEc:ecl:ohidic:2005-8 Supply and Demand Shifts in the Shorting Market (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (26) RePEc:ecl:ohidic:2006-10 The World Price of Liquidity Risk (2005). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (27) RePEc:ecl:stabus:1821r1 Accounting, Governance, and Broad-Based Stock Option Grants (2005). Stanford University, Graduate School of Business / Research Papers (28) RePEc:eej:eeconj:v:31:y:2005:i:2:p:245-263 Finance and Development: Institutional and Policy Alternatives to Financial Liberalization Theory (2005). Eastern Economic Journal (29) RePEc:feb:artefa:0045 Do Professional Traders Exhibit Myopic Loss Aversion? An Experimental Analysis (2005). The Field Experiments Website / Artefactual Field Experiments (30) RePEc:fip:fedbwp:06-4 Supply matters for asset prices: evidence from IPOs in emerging markets (2005). Federal Reserve Bank of Boston / Working Papers (31) RePEc:fip:fedgfe:2005-15 The effects of competition from large, multimarket firms on the performance of small, single-market firms: evidence from the banking industry (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (32) RePEc:fip:fedgif:840 International capital flows and U.S. interest rates (2005). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (33) RePEc:fip:fedhpr:y:2005:i:may:p:140-147 Information asymmetries and the effects of banking mergers of firm-bank relationships (2005). Proceedings (34) RePEc:fip:fedhpr:y:2005:i:may:p:148-165 SMEs and bank lending relationships: the impact of mergers (2005). Proceedings (35) RePEc:fip:fedhwp:wp-05-04 Risk overhang and loan portfolio decisions (2005). Federal Reserve Bank of Chicago / Working Paper Series (36) RePEc:fip:fedkrw:rwp05-06 Term structure transmission of monetary policy (2005). Federal Reserve Bank of Kansas City / Research Working Paper (37) RePEc:fip:fedlwp:2003-028 Idiosyncratic volatility, stock market volatility, and expected stock returns (2005). Federal Reserve Bank of St. Louis / Working Papers (38) RePEc:hhs:iiessp:0736 How Does Financial Liberalization affect Economic Growth? (2005). Stockholm University, Institute for International Economic Studies / Seminar Papers (39) RePEc:hkm:wpaper:022005 Optimal Transaction Filters Under Transitory Trading Opportunities: Theory and Empirical Illustration (2005). Hong Kong Institute for Monetary Research / Working Papers (40) RePEc:iis:dispap:iiisdp062 Courage to Capital? A Model of the Effects of Rating Agencies on Sovereign Debt Rollâover (2005). IIIS / The Institute for International Integration Studies Discussion Paper Series (41) RePEc:iis:dispap:iiisdp103 International Capital Flows and U.S. Interest Rates (2005). IIIS / The Institute for International Integration Studies Discussion Paper Series (42) RePEc:imf:imfwpa:05/83 The Impact of Macroeconomic Announcements on Emerging Market Bonds (2005). International Monetary Fund / IMF Working Papers (43) RePEc:ipf:finteo:v:29:y:2005:i:4:p:327-340 The outlook for the development of the investment funds in the republic of Croatia (2005). journal articles from Financial Theory and Practice (44) RePEc:iuk:wpaper:2005-13 Capital Account Liberalization for a Small, Open Economy (2005). Indiana University, Kelley School of Business, Department of Business Economics and Public Policy / Working Papers (45) RePEc:kan:wpaper:200512 Monetary Policy and Long-term Interest Rates (2005). University of Kansas, Department of Economics / WORKING PAPERS SERIES IN THEORETICAL AND APPLIED ECONOMICS (46) RePEc:mib:wpaper:88 The Impact of Financial Openness on Economic Integration: Evidence from the Europe and the Cis (2005). University of Milano-Bicocca, Department of Economics / Working Papers (47) RePEc:mmf:mmfc05:28 Testing the Trade-off and Pecking Order Theory: Some UK Evidence (2005). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2005 (48) RePEc:mmf:mmfc05:92 The Equity Premium: 101 years of Empirical Evidence from the UK (2005). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2005 (49) RePEc:nbb:docwpp:200507-1 Financial intermediation theory and implications for the sources of value in structured finance markets (2005). National Bank of Belgium / Documents series (50) RePEc:nbb:docwpp:200510-1 Importance économique du Port Autonome de Liège: rapport 2003 (2005). National Bank of Belgium / Documents series (51) RePEc:nbb:reswpp:200507-2 Liquidity risk in securities settlement (2005). National Bank of Belgium / Research series (52) RePEc:nbr:nberwo:11070 The Limits of Financial Globalization (2005). National Bureau of Economic Research, Inc / NBER Working Papers (53) RePEc:nbr:nberwo:11082 A Theory of Takeovers and Disinvestment (2005). National Bureau of Economic Research, Inc / NBER Working Papers (54) RePEc:nbr:nberwo:11144 Why is Long-Horizon Equity Less Risky? A Duration-Based Explanation of the Value Premium (2005). National Bureau of Economic Research, Inc / NBER Working Papers (55) RePEc:nbr:nberwo:11170 Capital Controls, Sudden Stops and Current Account Reversals (2005). National Bureau of Economic Research, Inc / NBER Working Papers (56) RePEc:nbr:nberwo:11256 Winners and Losers from Enacting the Financial Modernization Statute (2005). National Bureau of Economic Research, Inc / NBER Working Papers (57) RePEc:nbr:nberwo:11323 Expected Returns, Yield Spreads, and Asset Pricing Tests (2005). National Bureau of Economic Research, Inc / NBER Working Papers (58) RePEc:nbr:nberwo:11364 Eat or Be Eaten: A Theory of Mergers and Merger Waves (2005). National Bureau of Economic Research, Inc / NBER Working Papers (59) RePEc:nbr:nberwo:11385 Venture Capital Investment Cycles: The Impact of Public Markets (2005). National Bureau of Economic Research, Inc / NBER Working Papers (60) RePEc:nbr:nberwo:11389 Growth or Glamour? Fundamentals and Systematic Risk in Stock Returns (2005). National Bureau of Economic Research, Inc / NBER Working Papers (61) RePEc:nbr:nberwo:11409 Employee Sentiment and Stock Option Compensation (2005). National Bureau of Economic Research, Inc / NBER Working Papers (62) RePEc:nbr:nberwo:11413 Liquidity and Expected Returns: Lessons From Emerging Markets (2005). National Bureau of Economic Research, Inc / NBER Working Papers (63) RePEc:nbr:nberwo:11439 Caught On Tape: Institutional Order Flow and Stock Returns (2005). National Bureau of Economic Research, Inc / NBER Working Papers (64) RePEc:nbr:nberwo:11469 Taxation and the Evolution of Aggregate Corporate Ownership Concentration (2005). National Bureau of Economic Research, Inc / NBER Working Papers (65) RePEc:nbr:nberwo:11505 Why Do Firms Become Widely Held? An Analysis of the ynamics of Corporate Ownership (2005). National Bureau of Economic Research, Inc / NBER Working Papers (66) RePEc:nbr:nberwo:11648 Trusting the Stock Market (2005). National Bureau of Economic Research, Inc / NBER Working Papers (67) RePEc:nbr:nberwo:11824 Downside Risk (2005). National Bureau of Economic Research, Inc / NBER Working Papers (68) RePEc:nbr:nberwo:11841 The Myth of Long-Horizon Predictability (2005). National Bureau of Economic Research, Inc / NBER Working Papers (69) RePEc:nbr:nberwo:11843 Demand-Based Option Pricing (2005). National Bureau of Economic Research, Inc / NBER Working Papers (70) RePEc:nbr:nberwo:11886 Firm Expansion and CEO Pay (2005). National Bureau of Economic Research, Inc / NBER Working Papers (71) RePEc:nbr:nberwo:11903 CAPM Over the Long Run: 1926-2001 (2005). National Bureau of Economic Research, Inc / NBER Working Papers (72) RePEc:nuf:econwp:0514 Openness and inflation volatility: Cross-country evidence (2005). Economics Group, Nuffield College, University of Oxford / Economics Papers (73) RePEc:sba:wpaper:05ou Banking Consolidation and Small Business Lending:A Review of Recent Research (2005). U.S. Small Business Administration, Office of Advocacy / The Office of Advocacy Small Business Working Papers (74) RePEc:sce:scecf5:24 Financial Development and Property Valuation (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (75) RePEc:ste:nystbu:05-02 The Effects of Competition from Large, Multimarket Firms on the Performance of Small, Single-Market Firms: Evidence from the Banking Industry Author-Name: Allen N. Berger (2005). New York University, Leonard N. Stern School of Business, Department of Economics / Working Papers (76) RePEc:tcd:tcduee:200056 Risk, Strategy, and Optimal Timing of M&A Activity (2005). Trinity College Dublin, Department of Economics / Trinity Economics Papers (77) RePEc:tcd:tcduee:tep7 Risk, Strategy, and Optimal Timing of M&A Activity (2005). Trinity College Dublin, Department of Economics / Trinity Economics Papers (78) RePEc:tcd:wpaper:tep7 Risk, Strategy, and Optimal Timing of M&A Activity (2005). (79) RePEc:unu:wpaper:rp2005-69 Does Financial Liberalization Influence Saving, Investment and Economic Growth? Evidence from 25 Emerging Market Economies, 1973-96 (2005). World Institute for Development Economic Research (UNU-WIDER) / Working Papers (80) RePEc:unu:wpaper:rp2005-74 Does Financial Openness Promote Economic Integration? Some Evidence from Europe and the CIS (2005). World Institute for Development Economic Research (UNU-WIDER) / Working Papers (81) RePEc:use:tkiwps:0515 The determinants of merger waves (2005). Utrecht School of Economics / Working Papers (82) RePEc:wai:econwp:05/07 A New Framework for Yield Curve, Output and Inflation Relationships (2005). University of Waikato, Department of Economics / Working Papers in Economics (83) RePEc:wpa:wuwpfi:0509009 Imperfect Market or Imperfect Theory: A Unified Analytical Theory of Production and Capital Structure of Firms (2005). EconWPA / Finance (84) RePEc:wpa:wuwpif:0512006 Libéralisation financière : Impacts et conditions de réussite Un essai dapplication pour les pays du Maghreb (2005). EconWPA / International Finance (85) RePEc:wvu:wpaper:05-05 Productivity-Based Asset Pricing: Theory and Evidence (2005). Department of Economics, West Virginia University / Working Papers (86) RePEc:wzb:wzebiv:spii2005-09 Merger Failures (2005). Wissenschaftszentrum Berlin (WZB), Research Unit: Competitiveness and Industrial Change (CIC) / CIC Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||