|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

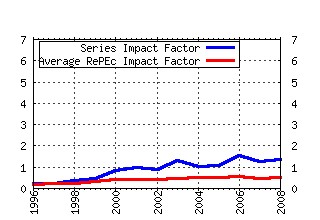

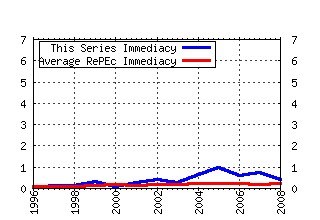

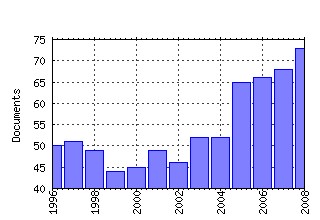

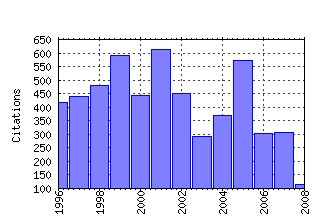

Journal of International Money and Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:jimfin:v:14:y:1995:i:4:p:467-492 Home bias and high turnover (1995). (2) RePEc:eee:jimfin:v:11:y:1992:i:3:p:304-314 The use of technical analysis in the foreign exchange market (1992). (3) RePEc:eee:jimfin:v:20:y:2001:i:2:p:249-272 Unit root tests for panel data (2001). (4) RePEc:eee:jimfin:v:18:y:1999:i:4:p:603-617 Contagion and trade: Why are currency crises regional? (1999). (5) RePEc:eee:jimfin:v:19:y:2000:i:1:p:33-53 Nonlinear adjustment, long-run equilibrium and exchange rate fundamentals (2000). (6) RePEc:eee:jimfin:v:21:y:2002:i:6:p:749-776 International financial integration and economic growth (2002). (7) RePEc:eee:jimfin:v:20:y:2001:i:4:p:439-471 Currency traders and exchange rate dynamics: a survey of the US market (2001). (8) RePEc:eee:jimfin:v:18:y:1999:i:4:p:537-560 What triggers market jitters?: A chronicle of the Asian crisis (1999). (9) RePEc:eee:jimfin:v:24:y:2005:i:7:p:1150-1175 Empirical exchange rate models of the nineties: Are any fit to survive? (2005). (10) RePEc:eee:jimfin:v:17:y:1998:i:1:p:161-190 Central bank intervention and exchange rate volatility1 (1998). (11) RePEc:eee:jimfin:v:15:y:1996:i:3:p:405-418 Purchasing power parity and unit root tests using panel data (1996). (12) RePEc:eee:jimfin:v:12:y:1993:i:4:p:413-438 A geographical model for the daily and weekly seasonal volatility in the foreign exchange market (1993). (13) RePEc:eee:jimfin:v:20:y:2001:i:3:p:379-399 Nonlinear adjustment to purchasing power parity in the post-Bretton Woods era (2001). (14) RePEc:eee:jimfin:v:10:y:1991:i:4:p:571-581 Cointegration: how short is the long run? (1991). (15) RePEc:eee:jimfin:v:24:y:2005:i:8:p:1177-1199 Some contagion, some interdependence: More pitfalls in tests of financial contagion (2005). (16) RePEc:eee:jimfin:v:1:y:1982:i::p:39-56 Fluctuations in the dollar: A model of nominal and real exchange rate determination (1982). (17) RePEc:eee:jimfin:v:12:y:1993:i:1:p:29-45 Exchange rate exposure and industry characteristics: evidence from Canada, Japan, and the USA (1993). (18) RePEc:eee:jimfin:v:19:y:2000:i:4:p:471-488 The forward premium anomaly is not as bad as you think (2000). (19) RePEc:eee:jimfin:v:2:y:1983:i:3:p:231-237 Foreign currency option values (1983). (20) RePEc:eee:jimfin:v:17:y:1998:i:4:p:671-689 On inflation and inflation uncertainty in the G7 countries (1998). (21) RePEc:eee:jimfin:v:15:y:1996:i:6:p:853-878 Central bank intervention and the volatility of foreign exchange rates: evidence from the options market (1996). (22) RePEc:eee:jimfin:v:14:y:1995:i:2:p:289-310 Markup adjustment and exchange rate fluctuations: evidence from panel data on automobile exports (1995). (23) RePEc:eee:jimfin:v:16:y:1997:i:6:p:909-919 Why do central banks intervene? (1997). (24) RePEc:eee:jimfin:v:16:y:1997:i:6:p:945-954 Real exchange rate behavior (1997). (25) RePEc:eee:jimfin:v:20:y:2001:i:6:p:895-948 The microstructure of the euro money market (2001). (26) RePEc:eee:jimfin:v:13:y:1994:i:3:p:276-290 The monetary model of the exchange rate: long-run relationships, short-run dynamics and how to beat a random walk (1994). (27) RePEc:eee:jimfin:v:21:y:2002:i:6:p:725-748 A century of current account dynamics (2002). (28) RePEc:eee:jimfin:v:16:y:1997:i:5:p:779-793 Intervention strategies and exchange rate volatility: a noise trading perspective (1997). (29) RePEc:eee:jimfin:v:18:y:1999:i:4:p:709-723 Lessons from the Asian crisis (1999). (30) RePEc:eee:jimfin:v:16:y:1997:i:1:p:19-35 Multi-country evidence on the behavior of purchasing power parity under the current float (1997). (31) RePEc:eee:jimfin:v:18:y:1999:i:4:p:561-586 Predicting currency crises:: The indicators approach and an alternative (1999). (32) RePEc:eee:jimfin:v:3:y:1984:i:1:p:5-29 An investigation of risk and return in forward foreign exchange (1984). (33) RePEc:eee:jimfin:v:16:y:1997:i:2:p:305-321 The term structure of Euro-rates: some evidence in support of the expectations hypothesis (1997). (34) RePEc:eee:jimfin:v:18:y:1999:i:4:p:587-602 Contagion:: macroeconomic models with multiple equilibria (1999). (35) RePEc:eee:jimfin:v:14:y:1995:i:6:p:747-762 Asymmetric volatility transmission in international stock markets (1995). (36) RePEc:eee:jimfin:v:19:y:2000:i:6:p:813-832 The determinants of bank interest rate margins: an international study (2000). (37) RePEc:eee:jimfin:v:12:y:1993:i:2:p:115-138 On biases in the measurement of foreign exchange risk premiums (1993). (38) RePEc:eee:jimfin:v:11:y:1992:i:1:p:3-16 Realistic cross-country consumption correlations in a two-country, equilibrium, business cycle model (1992). (39) RePEc:eee:jimfin:v:26:y:2007:i:4:p:587-605 Home bias and international risk sharing: Twin puzzles separated at birth (2007). (40) RePEc:eee:jimfin:v:21:y:2002:i:3:p:295-350 The dynamics of emerging market equity flows (2002). (41) RePEc:eee:jimfin:v:13:y:1994:i:1:p:3-25 Hourly volatility spillovers between international equity markets (1994). (42) RePEc:eee:jimfin:v:23:y:2004:i:5:p:701-733 Global transmission of interest rates: monetary independence and currency regime (2004). (43) RePEc:eee:jimfin:v:15:y:1996:i:4:p:535-550 Mean reversion in real exchange rates: evidence and implications for forecasting (1996). (44) RePEc:eee:jimfin:v:8:y:1989:i:1:p:75-88 Market efficiency and cointegration: an application to the sterling and deutschemark exchange markets (1989). (45) RePEc:eee:jimfin:v:22:y:2003:i:7:p:895-923 Macroeconomic policies and performance in Latin America (2003). (46) RePEc:eee:jimfin:v:10:y:1991:i:2:p:292-307 Exchange rate volatility and international trading strategy (1991). (47) RePEc:eee:jimfin:v:3:y:1984:i:3:p:327-342 Capital mobility and the relationship between saving and investment rates in OECD countries (1984). (48) RePEc:eee:jimfin:v:24:y:2005:i:2:p:343-361 Talking heads: the effects of ECB statements on the euro-dollar exchange rate (2005). (49) RePEc:eee:jimfin:v:17:y:1998:i:1:p:41-50 Increasing evidence of purchasing power parity over the current float (1998). (50) RePEc:eee:jimfin:v:13:y:1994:i:5:p:565-571 The long memory of the forward premium (1994). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:bdi:wptemi:td_660_08 Real exchange rate volatility and disconnect: an empirical investigation (2008). Bank of Italy, Economic Research Department / Temi di discussione (Economic working papers) (2) RePEc:cdf:wpaper:2008/23 The single monetary policy and domestic macro-fundamentals: Evidence from Spain (2008). Economics Section, Cardiff Business School, Cardiff University / Cardiff Economics Working Papers (3) RePEc:ces:ceswps:_2473 High-Frequency Analysis of Foreign Exchange Interventions: What do we learn? (2008). CESifo GmbH / CESifo Working Paper Series (4) RePEc:cfs:cfswop:wp200822 How do Fiscal and Technology Shocks affect Real Exchange Rates? New Evidence for the United States (2008). Center for Financial Studies / CFS Working Paper Series (5) RePEc:fip:fedgif:934 Trade elasticity of substitution and equilibrium dynamics (2008). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (6) RePEc:fip:fedgif:949 Expected consumption growth from cross-country surveys: implications for assessing international capital markets (2008). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (7) RePEc:fip:fedgif:950 Assessing the potential for further foreign demand for U.S. assets: Has financing U.S. current account deficits made foreign investors overweight in U.S. securities? (2008). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (8) RePEc:fip:fedlrv:y:2008:i:nov:p:609-642:n:v.90no.6 Real interest rate persistence: evidence and implications (2008). Review (9) RePEc:gra:wpaper:08/19 Going Multinational under Exchange Rate Uncertainty (2008). Department of Economic Theory and Economic History of the University of Granada. / ThE Papers (10) RePEc:hai:wpaper:200802 Financial Integration in the Pacific Basin Region: RIP by PANIC Attack? (2008). University of Hawaii at Manoa, Department of Economics / Working Papers (11) RePEc:hhs:bofitp:2008_015 McCallum rule and Chinese monetary policy (2008). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (12) RePEc:hhs:bofitp:2008_022 Business surveys and inflation forecasting in China (2008). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (13) RePEc:idb:wpaper:4597 Public Investment in Developing Countries: A Blessing or a Curse? (2008). Inter-American Development Bank, Research Department / Working Papers (14) RePEc:iis:dispap:iiisdp264 Exchange Rate Regime Choice with Multiple Key Currencies (2008). IIIS / The Institute for International Integration Studies Discussion Paper Series (15) RePEc:iis:dispap:iiisdp265 The Macroeconomics of Financial Integration: A European Perspective (2008). IIIS / The Institute for International Integration Studies Discussion Paper Series (16) RePEc:iis:dispap:iiisdp272 EMU and Financial Integration (2008). IIIS / The Institute for International Integration Studies Discussion Paper Series (17) RePEc:imf:imfwpa:08/259 Is it (Still) Mostly Fiscal? Determinants of Sovereign Spreads in Emerging Markets (2008). International Monetary Fund / IMF Working Papers (18) RePEc:isc:wpaper:ercwp0308 The Welfare Cost of the EMU for Transition Countries (2008). ISCTE, UNIDE, Economics Research Centre / Working Papers (19) RePEc:jku:econwp:2008_17 The Small Open-Economy New Keynesian Phillips Curve: Empirical Evidence and Implied Inflation Dynamics (2008). Department of Economics, Johannes Kepler University Linz, Austria / Economics working papers (20) RePEc:nbr:nberwo:14190 How Has the Euro Changed the Monetary Transmission? (2008). National Bureau of Economic Research, Inc / NBER Working Papers (21) RePEc:pra:mprapa:12125 Imperfect Competition in Financial Markets and Capital Controls: A Model and a Test. (2008). University Library of Munich, Germany / MPRA Paper (22) RePEc:pra:mprapa:14018 Crossing the Lines: The Conditional Relation between Exchange Rate Exposure and Stock Returns in Emerging and Developed Markets (2008). University Library of Munich, Germany / MPRA Paper (23) RePEc:pra:mprapa:16375 The Maastricht Convergence Criteria and Monetary Regimes for the EMU Accession Countries (2008). University Library of Munich, Germany / MPRA Paper (24) RePEc:rdg:emxxdp:em-dp2008-63 The Small Open-Economy New Keynesian Phillips Curve: Empirical Evidence and Implied Inflation Dynamics (2008). (25) RePEc:ros:wpaper:101 Public-Sector Efficiency and Interjurisdictional Competition - an Empirical Investigation (2008). University of Rostock, Institute of Economics, Germany / Thünen-Series of Applied Economic Theory (26) RePEc:san:cdmawp:0808 Productivity, Preferences and UIP deviations in an Open Economy Business Cycle Model (2008). Centre for Dynamic Macroeconomic Analysis / CDMA Working Paper Series (27) RePEc:shr:wpaper:08-10 The Welfare Gains of Trade Integration in the European Monetary Union (2008). Departement d'Economique de la Faculte d'administration àl'Universite de Sherbrooke / Cahiers de recherche (28) RePEc:sol:wpaper:08-015 Observing bailout expectations during a total eclipse of the sun (2008). Université Libre de Bruxelles, Solvay Business School, Centre Emile Bernheim (CEB) / Working Papers CEB (29) RePEc:ukc:ukcedp:0808 Productivity, Preferences and UIP Deviations in an Open Economy Business Cycle Model (2008). Department of Economics, University of Kent / Studies in Economics (30) RePEc:zbw:cauewp:7412 When, how fast and by how much do trade costs change in the euro area? (2008). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers (31) RePEc:zbw:fubsbe:200818 When, how fast and by how much do trade costs change in the euro area? (2008). Free University Berlin, School of Business & Economics / Discussion Papers Recent citations received in: 2007 (1) RePEc:aah:create:2007-34 Extreme Coexceedances in New EU Member Statesâ Stock Markets (2007). School of Economics and Management, University of Aarhus / CREATES Research Papers (2) RePEc:bis:biscgc:29-07 International bank portfolios: short- and long-run responses to the business cycle (2007). CGFS Papers chapters (3) RePEc:bpj:glecon:v:7:y:2007:i:3:n:2 The US-China Currency Dispute: Is a Rise in the Yuan Necessary, Inevitable or Desirable? (2007). Global Economy Journal (4) RePEc:bpj:sndecm:v:11:y:2007:i:1:n:7 A New Application of Exact Nonparametric Methods to Long-Horizon Predictability Tests (2007). Studies in Nonlinear Dynamics & Econometrics (5) RePEc:cbi:wpaper:6/rt/07 Does Uncertainty Impact Money Growth? A Multivariate GARCH Analysis (2007). Central Bank & Financial Services Authority of Ireland (CBFSAI) / Research Technical Papers (6) RePEc:ces:ceswps:_1894 Intervention Policy of the BoJ: A Unified Approach (2007). CESifo GmbH / CESifo Working Paper Series (7) RePEc:ces:ceswps:_1943 Does the Chinese Interest Rate Follow the US Interest Rate? (2007). CESifo GmbH / CESifo Working Paper Series (8) RePEc:chb:bcchwp:418 Export Transitions (2007). Central Bank of Chile / Working Papers Central Bank of Chile (9) RePEc:chb:bcchwp:433 High Frequency Dynamics of the Exchange Rate in Chile (2007). Central Bank of Chile / Working Papers Central Bank of Chile (10) RePEc:cpr:ceprdp:6496 Risk Sharing, Finance and Institutions in International Portfolios (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (11) RePEc:cpr:ceprdp:6524 Growth, Volatility and Political Instability: Non-Linear Time-Series Evidence for Argentina, 1896-2000 (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (12) RePEc:crf:wpaper:07-19 Intervention Policy of the BoJ: a Unified Approach (2007). CREFI-LSF, University of Luxembourg / Working Papers of CREFI-LSF (Centre of Research in Finance - Luxembourg School of Finance) (13) RePEc:deg:conpap:c012_047 A Dynamic Growth Model for Flows of Foreign Direct Investment (2007). Dynamics, Economic Growth, and International Trade (DEGIT) / Conference Papers (14) RePEc:dgr:eureri:1765010774 Irving Fisher and the UIP Puzzle: Meeting the Expectations a Century Later (2007). Erasmus Research Institute of Management (ERIM), RSM Erasmus University / Research Paper (15) RePEc:dgr:umamet:2007047 Banking Market Integration in the SADC Countries: Evidence from Interest Rate Analyses (2007). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (16) RePEc:dul:wpaper:07-03rs Talks, financial operations or both? Generalizing central banks FX reaction functions (2007). Université libre de Bruxelles, Department of Applied Economics (DULBEA) / Working Papers DULBEA (17) RePEc:ebl:ecbull:v:6:y:2007:i:29:p:1-8 Modelling Central Bank Intervention Activity under Inflation Targeting (2007). Economics Bulletin (18) RePEc:ebl:ecbull:v:6:y:2007:i:39:p:1-12 Is a more stable exchange rate associated with reduced exchange rate pass-through? (2007). Economics Bulletin (19) RePEc:ebl:ecbull:v:6:y:2007:i:42:p:1-6 The impact of the appreciation of East Asian currencies on global imbalance (2007). Economics Bulletin (20) RePEc:ecb:ecbwps:20070727 Price setting in the euro area: some stylised facts from individual producer price data. (2007). European Central Bank / Working Paper Series (21) RePEc:ecb:ecbwps:20070790 Asset prices, exchange rates and the current account (2007). European Central Bank / Working Paper Series (22) RePEc:edb:cedidp:07-12 Growth, Volatility and Political Instability: Non-Linear Time-Series Evidence for Argentina, 1896-2000 (2007). Centre for Economic Development and Institutions(CEDI), Brunel University / CEDI Discussion Paper Series (23) RePEc:gla:glaewp:2007_21 Do real interest rates converge? Evidence from the European Union (2007). Department of Economics, University of Glasgow / Working Papers (24) RePEc:gmf:wpaper:2007-09 Optimal monetary policy with a regime-switching exchange rate in a forward-looking model (2007). GEMF-Grupo de Estudos Monetários e Financeiros, Faculty of Economics, University of Coimbra / GEMF's Working Papers (25) RePEc:hhs:bofitp:2007_020 The Undisclosed Renminbi Basket: Are The Markets Telling Us Something About Where The Renminbi - US Dollar Exchange Rate Is Going? (2007). Bank of Finland, Institute for Economies in Transition / BOFIT Discussion Papers (26) RePEc:iis:dispap:iiisdp236 Detecting Shift and Pure Contagion in East Asian Equity Markets: A Unified Approach (2007). IIIS / The Institute for International Integration Studies Discussion Paper Series (27) RePEc:ijf:ijfiec:v:12:y:2007:i:2:p:225-247 Option prices, exchange market intervention, and the higher moment expectations channel: a users guide (2007). International Journal of Finance & Economics (28) RePEc:imf:imfwpa:07/292 Border and Behind-the-Border Trade Barriers and Country Exports (2007). International Monetary Fund / IMF Working Papers (29) RePEc:iza:izadps:dp2903 How Does Financial Globalization Affect Risk Sharing? Patterns and Channels (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (30) RePEc:iza:izadps:dp2995 Is the Chinese Growth Miracle Built to Last? (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (31) RePEc:iza:izadps:dp3087 Growth, Volatility and Political Instability: Non-Linear Time-Series Evidence for Argentina, 1896-2000 (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (32) RePEc:jae:japmet:v:22:y:2007:i:5:p:855-889 Model-free evaluation of directional predictability in foreign exchange markets (2007). Journal of Applied Econometrics (33) RePEc:lbo:lbowps:2007_18 Volatile public spending in a model of money and sustainable growth (2007). Economics Dept, Loughborough University / Discussion Paper Series (34) RePEc:mmf:mmfc06:125 Inflation, inflation uncertainty, and Markov regime switching heteroskedasticity: Evidence from European countries (2007). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2006 (35) RePEc:nbr:nberch:0531 The Effects of Globalization on Inflation, Liquidity and Monetary Policy (2007). National Bureau of Economic Research, Inc / NBER Chapters (36) RePEc:nbr:nberch:3017 Comment on Financial Integration within EU Countries: The Role of Institutions, Confidence and Trust (2007). National Bureau of Economic Research, Inc / NBER Chapters (37) RePEc:ner:leuven:urn:hdl:123456789/175483 Home bias in international equity portfolios: a review. (2007). Katholieke Universiteit Leuven / Open Access publications from Katholieke Universiteit Leuven (38) RePEc:pab:wpaper:07.10 Demand Shocks and Trade Balance Dynamics (2007). Universidad Pablo de Olavide, Departamento de EconomiÂa / Working Papers (39) RePEc:pra:mprapa:10223 Risk Sharing among OECD and EU Countries: The Role of Capital Gains, Capital Income, Transfers, and Saving (2007). University Library of Munich, Germany / MPRA Paper (40) RePEc:pra:mprapa:10787 A new Test of Uncovered Interest Rate Parity: Evidence from Turkey (2007). University Library of Munich, Germany / MPRA Paper (41) RePEc:pra:mprapa:3493 The tail risks of FX return distributions: a comparison of the returns associated with limit orders and market orders (2007). University Library of Munich, Germany / MPRA Paper (42) RePEc:pra:mprapa:4186 Currency Preferences in a Tri-Polar Model of Foreign Exchange (2007). University Library of Munich, Germany / MPRA Paper (43) RePEc:pra:mprapa:4784 A Small Macroeconomic Model to Support Inflation Targeting in Israel (2007). University Library of Munich, Germany / MPRA Paper (44) RePEc:pra:mprapa:5114 A structural investigation of third-currency shocks to bilateral exchange rates (2007). University Library of Munich, Germany / MPRA Paper (45) RePEc:pra:mprapa:5366 China currency dispute: is a rise in the yuan inevitable, necessary or desirable? (2007). University Library of Munich, Germany / MPRA Paper (46) RePEc:pra:mprapa:7298 On Asymmetry of Exchange Rate Volatility in New EU Member and Candidate Countries (2007). University Library of Munich, Germany / MPRA Paper (47) RePEc:pra:mprapa:9412 An Estimated New Keynesian Model for Israel (2007). University Library of Munich, Germany / MPRA Paper (48) RePEc:san:cdmawp:0715 Interest Rate Rules and Welfare in Open Economies (2007). Centre for Dynamic Macroeconomic Analysis / CDMA Working Paper Series (49) RePEc:udc:wpaper:wp268 Why Should Emerging-Market Countries (Still) Concern Themselves With Capital Inflows? (2007). University of Chile, Department of Economics / Working Papers (50) RePEc:wdi:papers:2007-891 Growth, Volatility & Political Instability: Non Linear Time Series Evidence for Argentina 1896-2000 (2007). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (51) RePEc:zbw:gdec07:6549 Does it Make a Difference? Comparing Growth Effects of European and North American FDI in Latin America (2007). Verein für Socialpolitik, Research Committee Development Economics / Proceedings of the German Development Economics Conference, Göttingen 2007 Recent citations received in: 2006 (1) RePEc:boe:boeewp:291 Affine term structure models for the foreign exchange risk premium (2006). Bank of England / Bank of England working papers (2) RePEc:bos:wpaper:wp2006-042 Complementarities in information acquisition with short-term trades (2006). Department of Economics, Boston University / Boston University Working Papers Series (3) RePEc:bpj:glecon:v:6:y:2006:i:3:n:6 Long-Run Inflation and Exchange Rates Hedge of Stocks in Brazil and Mexico (2006). Global Economy Journal (4) RePEc:cir:cirwor:2006s-07 Exchange Rates and Order Flow in the Long Run (2006). CIRANO / CIRANO Working Papers (5) RePEc:cpr:ceprdp:5629 Exchange Rate Volatility and Productivity Growth: The Role of Financial Development (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (6) RePEc:dul:wpaper:06-03rs Do interactions between political authorities and central banks influence FX interventions? Evidence from Japan (2006). Université libre de Bruxelles, Department of Applied Economics (DULBEA) / Working Papers DULBEA (7) RePEc:ecb:ecbwps:20060650 A structural break in the effects of Japanese foreign exchange intervention on yen/dollar exchange rate volatility. (2006). European Central Bank / Working Paper Series (8) RePEc:ecl:ohidic:2005-18 Do Local Analysts Know More? A Cross-Country Study of the Performance of Local Analysts and Foreign Analysts (2006). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (9) RePEc:fda:fdaddt:2006-19 Implicit Bands in the Yen/Dollar Exchange Rate (2006). FEDEA / Working Papers (10) RePEc:fip:fedcwp:0618 Option prices, exchange market intervention, and the higher moment expectations channel: a userâs guide (2006). Federal Reserve Bank of Cleveland / Working Paper (11) RePEc:fip:fedfwp:2006-35 Incomplete information processing: a solution to the forward discount puzzle (2006). Federal Reserve Bank of San Francisco / Working Paper Series (12) RePEc:han:dpaper:dp-331 Local Information in Foreign Exchange Markets (2006). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (13) RePEc:hhs:iuiwop:0677 Why Does Sovereign Risk Differ for Domestic and Foreign Investors? Evidence from Scandinavia, 1938ÃÂÃÂââ¬â1948 (2006). The Research Institute of Industrial Economics / IUI Working Paper Series (14) RePEc:hhs:lunewp:2006_005 Evaluating a nonlinear asset pricing model on international data (2006). Lund University, Department of Economics / Working Papers (15) RePEc:iis:dispap:iiisdp162 The Performance of International Equity Portfolios (2006). IIIS / The Institute for International Integration Studies Discussion Paper Series (16) RePEc:ijf:ijfiec:v:11:y:2006:i:1:p:55-80 Macro lessons from microstructure (2006). International Journal of Finance & Economics (17) RePEc:imf:imfwpa:06/160 U.S. Dollar Risk Premiums and Capital Flows (2006). International Monetary Fund / IMF Working Papers (18) RePEc:imf:imfwpa:06/245 A Small Foreign Exchange Market with a Long-Term Peg: Barbados (2006). International Monetary Fund / IMF Working Papers (19) RePEc:jae:japmet:v:21:y:2006:i:1:p:79-109 Multivariate GARCH models: a survey (2006). Journal of Applied Econometrics (20) RePEc:kud:epruwp:06-04 Evaluating Foreign Exchange Market Intervention: Self-Selection, Counterfactuals and Average Treatment Effects (2006). Economic Policy Research Unit (EPRU), University of Copenhagen. Department of Economics / EPRU Working Paper Series (21) RePEc:nbr:nberwo:12117 Exchange Rate Volatility and Productivity Growth: The Role of Financial Development (2006). National Bureau of Economic Research, Inc / NBER Working Papers (22) RePEc:nbr:nberwo:12346 The Performance of International Equity Portfolios (2006). National Bureau of Economic Research, Inc / NBER Working Papers (23) RePEc:nbr:nberwo:12587 Volatility in International Financial Market Issuance: The Role of the Financial Center (2006). National Bureau of Economic Research, Inc / NBER Working Papers (24) RePEc:nbr:nberwo:12620 External Imbalances in an Advanced, Commodity-Exporting Country: The Case of New Zealand (2006). National Bureau of Economic Research, Inc / NBER Working Papers (25) RePEc:ner:maastr:urn:nbn:nl:ui:27-19696 Mean reversion of short-run interest rates in emerging countries. (2006). Maastricht University / Open Access publications from Maastricht University (26) RePEc:ner:oxford:http://economics.ouls.ox.ac.uk/12245/ The Optimal Monetary Policy Response to Exchange Rate Misalignments.. (2006). University of Oxford / Open Access publications from University of Oxford (27) RePEc:ner:tilbur:urn:nbn:nl:ui:12-3125428 The influence of financial and legal institutions on firm size. (2006). Tilburg University / Open Access publications from Tilburg University (28) RePEc:nip:nipewp:7/2006 Foreign Direct Investment in Brazil and Home Country Risk (2006). NIPE - Universidade do Minho / NIPE Working Papers (29) RePEc:nzb:nzbdps:2006/12 The Present Value Model and New Zealandâs Current Account (2006). Reserve Bank of New Zealand / Reserve Bank of New Zealand Discussion Paper Series (30) RePEc:qed:wpaper:1089 Market Power, Price Adjustment, and Inflation (2006). Queen's University, Department of Economics / Working Papers (31) RePEc:san:cdmacp:0605 The Optimal Monetary Policy Response to Exchange Rate Misalignments (2006). Centre for Dynamic Macroeconomic Analysis / CDMA Conference Paper Series (32) RePEc:szg:worpap:0602 Exchange Rate Volatility and Productivity Growth: The Role of Financial Development (2006). Swiss National Bank, Study Center Gerzensee / Working Papers (33) RePEc:tcb:wpaper:0607 Corporate Sector Financial Structure in Turkey : A Descriptive Analysis (2006). Research and Monetary Policy Department, Central Bank of the Republic of Turkey / Working Papers (34) RePEc:ukc:ukcedp:0605 Inflation Targeting, Exchange Rate Pass-Through and Fear of Floating (2006). Department of Economics, University of Kent / Studies in Economics (35) RePEc:use:tkiwps:0616 The Importance of Interest Rate Volatility in Empirical Tests of Uncovered Interest Parity (2006). Utrecht School of Economics / Working Papers (36) RePEc:wbk:wbrwps:3856 Creating an efficient financial system : challenges in a global economy (2006). The World Bank / Policy Research Working Paper Series (37) RePEc:wbk:wbrwps:4026 The basic analytics of access to financial services (2006). The World Bank / Policy Research Working Paper Series (38) RePEc:wdi:papers:2006-811 Foreign Exchange Risk Premium Determinants: Case of Armenia (2006). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (39) RePEc:wlu:wpaper:eg0050 Policy Words and Policy Deeds: The ECB and the Euro (2006). Wilfrid Laurier University, Department of Economics / Working Papers Recent citations received in: 2005 (1) RePEc:acb:cbeeco:2005-451 Forecasting the Volatility of Australian Stock Returns: Do Common Factors Help? (2005). Australian National University, College of Business and Economics, School of Economics / ANUCBE School of Economics Working Papers (2) RePEc:aea:aecrev:v:95:y:2005:i:2:p:405-414 Meese-Rogoff Redux: Micro-Based Exchange-Rate Forecasting (2005). American Economic Review (3) RePEc:ags:reapec:50276 The Effect of Currency Crises on Foreign Direct Investment Activity in Emerging Markets (2005). Review of Applied Economics (4) RePEc:bis:bisbpc:24-07 The effectiveness of foreign exchange intervention in emerging market countries (2005). BIS Papers chapters (5) RePEc:bno:worpap:2005_12 Arbitrage in the foreign exchange market: Turning on the microscope (2005). Norges Bank / Working Paper (6) RePEc:bno:worpap:2005_13 ââ¬ÅLargeââ¬Â vs. ââ¬Åsmallââ¬Â players: A closer look at the dynamics of speculative attacks (2005). Norges Bank / Working Paper (7) RePEc:boe:boeewp:278 Misperceptions and monetary policy in a New Keynesian model (2005). Bank of England / Bank of England working papers (8) RePEc:chb:bcchwp:352 Monetary Policy, Exchange Rate and Inflation Inertia in Chile: a Structural Approach (2005). Central Bank of Chile / Working Papers Central Bank of Chile (9) RePEc:cor:louvco:2005012 Volatility regimes and the provision of liquidity in order book markets (2005). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (10) RePEc:cor:louvco:2005058 Exchange rate volatility and the mixture of distribution hypothesis (2005). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (11) RePEc:crt:wpaper:0521 Conditional autoregressive valu at risk by regression quantile: Estimatingmarket risk for major stock markets (2005). University of Crete, Department of Economics / Working Papers (12) RePEc:cte:werepe:we051810 CONTAGION VERSUS FLIGHT TO QUALITY IN FINANCIAL MARKETS (2005). Universidad Carlos III, Departamento de EconomÃa / Economics Working Papers (13) RePEc:ctl:louvec:2005043 Exchange Rate Volatility and the Mixture of Distribution Hypothesis (2005). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (14) RePEc:dgr:umamet:2005024 Evidences of Interdependence and Contagion using a Frequency Domain Framework (2005). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (15) RePEc:dnb:dnbwpp:033 Were Verbal Efforts to Support the Euro Effective? A High-Frequency Analysis of ECB Statements (2005). Netherlands Central Bank, Research Department / DNB Working Papers (16) RePEc:dnb:dnbwpp:060 Bond Market and Stock Market Integration in Europe (2005). Netherlands Central Bank, Research Department / DNB Working Papers (17) RePEc:ewc:wpaper:wp76 FDI and Trade - Two Way Linkages? (2005). East-West Center, Economics Study Area / Economics Study Area Working Papers (18) RePEc:ewc:wpaper:wp84 The IMF and the Liberalization of Capital Flows (2005). East-West Center, Economics Study Area / Economics Study Area Working Papers (19) RePEc:fau:fauart:v:55:y:2005:i:3-4:p:141-161 Stock Prices and Exchange Rates in the EU and the United States: Evidence on their Mutual Interactions (in English) (2005). Czech Journal of Economics and Finance (Finance a uver, ISSN: 0015-1920) (20) RePEc:fip:fedfpb:2004-15 Currency crises, capital account liberalization, and selection bias (2005). Federal Reserve Bank of San Francisco / Pacific Basin Working Paper Series (21) RePEc:fip:fedgfe:2005-63 Explaining credit default swap spreads with the equity volatility and jump risks of individual firms (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (22) RePEc:fip:fedgif:827 Financial market developments and economic activity during current account adjustments in industrial economies (2005). Board of Governors of the Federal Reserve System (U.S.) / International Finance Discussion Papers (23) RePEc:hai:wpaper:200505 FDI and Trade â Two Way Linkages? (2005). University of Hawaii at Manoa, Department of Economics / Working Papers (24) RePEc:hhs:bofrdp:2005_001 An intuitive guide to wavelets for economists (2005). Bank of Finland / Research Discussion Papers (25) RePEc:hhs:bofrdp:2005_020 Robust monetary policy in a small open economy (2005). Bank of Finland / Research Discussion Papers (26) RePEc:hkm:wpaper:052005 Exchange Rates and Markov Switching Dynamics (2005). Hong Kong Institute for Monetary Research / Working Papers (27) RePEc:imf:imfwpa:05/179 The Macroeconomic Challenges of Scaling Up Aid to Africa (2005). International Monetary Fund / IMF Working Papers (28) RePEc:imf:imfwpa:05/217 How Important Is Sovereign Risk in Determining Corporate Default Premia? The Case of South Africa (2005). International Monetary Fund / IMF Working Papers (29) RePEc:kap:fmktpm:v:19:y:2005:i:2:p:169-178 Price Linkages Between the US, Japan and UK Stock Markets (2005). Financial Markets and Portfolio Management (30) RePEc:kof:wpskof:05-113 The Intriguing Nexus between Corruption and Capital Account Restrictions (2005). Swiss Institute for Business Cycle Research (KOF), Swiss Federal Institute of Technology Zurich (ETH), / Working papers (31) RePEc:man:cgbcrp:57 The Optimal Public Expenditure Financing Policy: Does the Level of Economic Development Matter? (2005). The School of Economic Studies, The Univeristy of Manchester / Centre for Growth and Business Cycle Research Discussion Paper Series (32) RePEc:man:cgbcrp:59 Fiscal Policy and Endogenous Growth with Public Infrastructure (2005). The School of Economic Studies, The Univeristy of Manchester / Centre for Growth and Business Cycle Research Discussion Paper Series (33) RePEc:mie:wpaper:547 What Defines News in Foreign Exchange Markets (2005). Research Seminar in International Economics, University of Michigan / Working Papers (34) RePEc:mmf:mmfc05:13 Non-Linear Properties of Currency Crises in Emerging Markets (2005). Money Macro and Finance Research Group / Money Macro and Finance (MMF) Research Group Conference 2005 (35) RePEc:mse:wpsorb:j05070 A new look at the Feldstein-Horioka puzzle : an European-Regional perspective. (2005). Université Panthéon-Sorbonne (Paris 1) / Cahiers de la Maison des Sciences Economiques (36) RePEc:nbr:nberte:0305 Using Out-of-Sample Mean Squared Prediction Errors to Test the Martingale Difference (2005). National Bureau of Economic Research, Inc / NBER Technical Working Papers (37) RePEc:nbr:nberwo:11077 Testing Uncovered Interest Parity at Short and Long Horizons during the Post-Bretton Woods Era (2005). National Bureau of Economic Research, Inc / NBER Working Papers (38) RePEc:nbr:nberwo:11166 Stocks, Bonds, Money Markets and Exchange Rates: Measuring International Financial Transmission (2005). National Bureau of Economic Research, Inc / NBER Working Papers (39) RePEc:nbr:nberwo:11403 FDI and Trade -- Two Way Linkages? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (40) RePEc:nbr:nberwo:11697 Do Local Analysts Know More? A Cross-Country Study of the Performance of Local Analysts and Foreign Analysts (2005). National Bureau of Economic Research, Inc / NBER Working Papers (41) RePEc:nbr:nberwo:11701 International Capital Flows, Returns and World Financial Integration (2005). National Bureau of Economic Research, Inc / NBER Working Papers (42) RePEc:nbr:nberwo:11769 What Defines News in Foreign Exchange Markets? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (43) RePEc:nbr:nberwo:11823 Current Account Deficits in Industrial Countries: The Bigger They are, the Harder They Fall? (2005). National Bureau of Economic Research, Inc / NBER Working Papers (44) RePEc:nbr:nberwo:11840 The Information in Long-Maturity Forward Rates: Implications for Exchange Rates and the Forward Premium Anomaly (2005). National Bureau of Economic Research, Inc / NBER Working Papers (45) RePEc:ner:maastr:urn:nbn:nl:ui:27-15777 Measuring common cyclical features during financial turmoil: Evidence of interdependence not contagion. (2005). Maastricht University / Open Access publications from Maastricht University (46) RePEc:onb:oenbmp:y:2005:i:1:b:4 Fundamental and Nonfundamental Factors in the Euro/U.S. Dollar Market in 2002 and 2003 (2005). Monetary Policy & the Economy (47) RePEc:rba:rbardp:rdp2005-08 Declining Output Volatility: What Role for Structural Change? (2005). Reserve Bank of Australia / RBA Research Discussion Papers (48) RePEc:sce:scecf5:419 International Capital Flows in a World of Greater Financial Integration (2005). Society for Computational Economics / Computing in Economics and Finance 2005 (49) RePEc:taf:apfiec:v:15:y:2005:i:11:p:745-752 Testing for symmetry and proportionality in a European panel (2005). Applied Financial Economics (50) RePEc:taf:applec:v:37:y:2005:i:9:p:1063-1071 New evidence on purchasing power parity from 17 OECD countries (2005). Applied Economics (51) RePEc:tuf:tuftec:0506 International Capital Flows and Boom-Bust Cycles in the Asia Pacific Region (2005). Department of Economics, Tufts University / Discussion Papers Series, Department of Economics, Tufts University (52) RePEc:unu:wpaper:rp2005-76 Sources and Effectiveness of Financial Development: What We Know and What We Need to Know (2005). World Institute for Development Economic Research (UNU-WIDER) / Working Papers (53) RePEc:uts:rpaper:168 Multivariate Autoregressive Conditional Heteroskedasticity with Smooth Transitions in Conditional Correlations (2005). Quantitative Finance Research Centre, University of Technology, Sydney / Research Paper Series (54) RePEc:wbk:wbrwps:3555 How does the composition of public spending matter? (2005). The World Bank / Policy Research Working Paper Series (55) RePEc:wpa:wuwpem:0503017 An intuitive guide to wavelets for economists (2005). EconWPA / Econometrics (56) RePEc:wpa:wuwpge:0508009 An intuitive guide to wavelets for economists (2005). EconWPA / GE, Growth, Math methods (57) RePEc:wpa:wuwpif:0501002 CAN LONG HORIZON DATA BEAT RANDOM WALK UNDER ENGEL-WEST EXPLANATION? (2005). EconWPA / International Finance (58) RePEc:wpa:wuwpif:0510005 Health Expenditures Under the HIPC Debt Initiative (2005). EconWPA / International Finance (59) RePEc:wpa:wuwpma:0504002 ASSESSING THE MEAN REVERSION BEHAVIOR OF FISCAL POLICY: THE CASE OF ASIAN COUNTRIES (2005). EconWPA / Macroeconomics (60) RePEc:wpa:wuwpma:0506017 Regime Shifts and the Stability of Backward Looking Phillips Curves in Open Economies (2005). EconWPA / Macroeconomics (61) RePEc:zbw:cauewp:2880 Dynamic Effects of Raw Materials Price Shocks for Large Oil-Dependent Economies (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers (62) RePEc:zbw:cauewp:3196 Oil Price Shocks and Currency Denomination (A revised version of EWP 2005-01) (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers (63) RePEc:zbw:cauewp:3834 Monetary Policy Dynamics in Large Oil-Dependent Economies (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers (64) RePEc:zbw:cauewp:3836 Dynamische Effekte der Geld-und Fiskalpolitik in einem asymmetrischen Drei-Länder-Modell mit einer Währungsunion (2005). Christian-Albrechts-University of Kiel, Department of Economics / Economics working papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||