|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

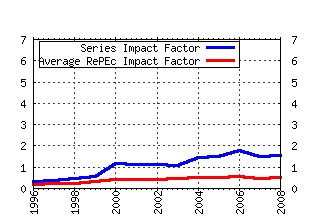

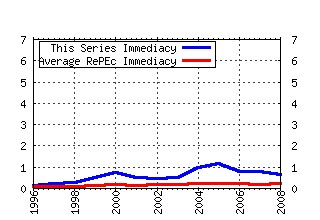

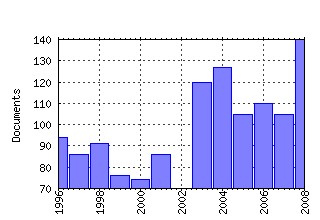

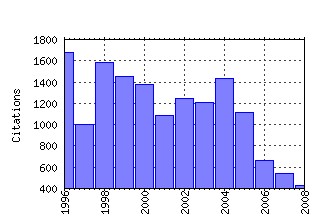

Journal of Public Economics Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:eee:pubeco:v:61:y:1996:i:3:p:359-381 Satisfaction and comparison income (1996). (2) RePEc:eee:pubeco:v:1:y:1972:i:3-4:p:323-338 Income tax evasion: a theoretical analysis (1972). (3) RePEc:eee:pubeco:v:29:y:1986:i:1:p:25-49 On the private provision of public goods (1986). (4) RePEc:eee:pubeco:v:88:y:2004:i:7-8:p:1359-1386 Well-being over time in Britain and the USA (2004). (5) RePEc:eee:pubeco:v:28:y:1985:i:1:p:59-83 Redistributive taxation in a simple perfect foresight model (1985). (6) RePEc:eee:pubeco:v:76:y:2000:i:3:p:399-457 The causes of corruption: a cross-national study (2000). (7) RePEc:eee:pubeco:v:6:y:1976:i:1-2:p:55-75 The design of tax structure: Direct versus indirect taxation (1976). (8) RePEc:eee:pubeco:v:52:y:1993:i:3:p:309-328 Strategies for the international protection of the environment (1993). (9) RePEc:eee:pubeco:v:85:y:2002:i:2:p:207-234 Who trusts others? (2002). (10) RePEc:eee:pubeco:v:68:y:1998:i:3:p:335-367 Taxes and the location of production: evidence from a panel of US multinationals (1998). (11) RePEc:eee:pubeco:v:8:y:1977:i:3:p:329-340 Voting over income tax schedules (1977). (12) RePEc:eee:pubeco:v:41:y:1990:i:1:p:45-72 The impact of the potential duration of unemployment benefits on the duration of unemployment (1990). (13) RePEc:eee:pubeco:v:76:y:2000:i:3:p:459-493 Dodging the grabbing hand: the determinants of unofficial activity in 69 countries (2000). (14) RePEc:eee:pubeco:v:83:y:2002:i:3:p:325-345 Decentralization and corruption: evidence across countries (2002). (15) RePEc:eee:pubeco:v:37:y:1988:i:3:p:291-304 Why free ride? : Strategies and learning in public goods experiments (1988). (16) RePEc:eee:pubeco:v:25:y:1984:i:3:p:329-369 A complete solution to a class of principal-agent problems with an application to the control of a self-managed firm (1984). (17) RePEc:eee:pubeco:v:52:y:1993:i:3:p:285-307 Budget spillovers and fiscal policy interdependence : Evidence from the states (1993). (18) RePEc:eee:pubeco:v:35:y:1988:i:2:p:229-240 Nash equilibria in models of fiscal competition (1988). (19) RePEc:eee:pubeco:v:74:y:1999:i:2:p:171-190 Fiscal policy and growth: evidence from OECD countries (1999). (20) RePEc:eee:pubeco:v:89:y:2005:i:5-6:p:997-1019 Income and well-being: an empirical analysis of the comparison income effect (2005). (21) RePEc:eee:pubeco:v:17:y:1982:i:2:p:213-240 Self-selection and Pareto efficient taxation (1982). (22) RePEc:eee:pubeco:v:38:y:1989:i:2:p:183-198 Overlapping families of infinitely-lived agents (1989). (23) RePEc:eee:pubeco:v:3:y:1974:i:4:p:303-328 The measurement of urban travel demand (1974). (24) RePEc:eee:pubeco:v:5:y:1976:i:3-4:p:193-208 Effluent charges and licenses under uncertainty (1976). (25) RePEc:eee:pubeco:v:69:y:1998:i:2:p:263-279 Corruption and the composition of government expenditure (1998). (26) RePEc:eee:pubeco:v:2:y:1973:i:3:p:193-216 Higher education as a filter (1973). (27) RePEc:eee:pubeco:v:10:y:1978:i:3:p:295-336 A model of social insurance with variable retirement (1978). (28) RePEc:eee:pubeco:v:84:y:2002:i:1:p:1-32 The elasticity of taxable income: evidence and implications (2002). (29) RePEc:eee:pubeco:v:35:y:1988:i:3:p:333-354 Economic competition among jurisdictions: efficiency enhancing or distortion inducing? (1988). (30) RePEc:eee:pubeco:v:11:y:1979:i:1:p:25-45 Incentives and incomplete information (1979). (31) RePEc:eee:pubeco:v:15:y:1981:i:1:p:1-22 The incidence and allocation effects of a tax on corporate distributions (1981). (32) RePEc:eee:pubeco:v:89:y:2005:i:5-6:p:897-931 Preferences for redistribution in the land of opportunities (2005). (33) RePEc:eee:pubeco:v:48:y:1992:i:1:p:21-38 Why do people pay taxes? (1992). (34) RePEc:eee:pubeco:v:6:y:1976:i:4:p:327-358 Optimal tax theory : A synthesis (1976). (35) RePEc:eee:pubeco:v:14:y:1980:i:1:p:49-68 Redistributive taxation as social insurance (1980). (36) RePEc:eee:pubeco:v:62:y:1996:i:3:p:297-325 Ends against the middle: Determining public service provision when there are private alternatives (1996). (37) RePEc:eee:pubeco:v:72:y:1999:i:3:p:329-360 The cost-effectiveness of alternative instruments for environmental protection in a second-best setting (1999). (38) RePEc:eee:pubeco:v:35:y:1988:i:1:p:57-73 Privately provided public goods in a large economy: The limits of altruism (1988). (39) RePEc:eee:pubeco:v:71:y:1999:i:1:p:121-139 Country size and tax competition for foreign direct investment (1999). (40) RePEc:eee:pubeco:v:69:y:1998:i:3:p:305-321 Openness, country size and government (1998). (41) RePEc:eee:pubeco:v:29:y:1986:i:2:p:133-172 Commodity tax competition between member states of a federation: equilibrium and efficiency (1986). (42) RePEc:eee:pubeco:v:59:y:1996:i:2:p:219-237 Majority voting with single-crossing preferences (1996). (43) RePEc:eee:pubeco:v:59:y:1996:i:3:p:313-334 Unemployment duration, unemployment benefits, and labor market programs in Sweden (1996). (44) RePEc:eee:pubeco:v:83:y:2002:i:1:p:83-107 Individual preferences for political redistribution (2002). (45) RePEc:eee:pubeco:v:87:y:2003:i:12:p:2611-2637 Centralized versus decentralized provision of local public goods: a political economy approach (2003). (46) RePEc:eee:pubeco:v:25:y:1984:i:3:p:259-298 The theory of reform and indian indirect taxes (1984). (47) RePEc:eee:pubeco:v:81:y:2001:i:3:p:345-368 Early childhood nutrition and academic achievement: a longitudinal analysis (2001). (48) RePEc:eee:pubeco:v:23:y:1984:i:1-2:p:81-114 Individual retirement and savings behavior (1984). (49) RePEc:eee:pubeco:v:88:y:2004:i:9-10:p:2009-2042 Inequality and happiness: are Europeans and Americans different? (2004). (50) RePEc:eee:pubeco:v:66:y:1997:i:1:p:99-126 On the ineffectiveness of tax policy in altering long-run growth: Harbergers superneutrality conjecture (1997). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:aub:autbar:723.08 Inter-Group Conflict and Intra-Group Punishment in an Experimental Contest Game (2008). Unitat de Fonaments de l'Anàlisi Econòmica (UAB) and Institut d'Anàlisi Econòmica (CSIC) / UFAE and IAE Working Papers (2) RePEc:awi:wpaper:0466 How Delegation Improves Commitment (2008). University of Heidelberg, Department of Economics / Working Papers (3) RePEc:awi:wpaper:0467 The Design of Permit Schemes and Environmental Innovation (2008). University of Heidelberg, Department of Economics / Working Papers (4) RePEc:bro:econwp:2008-1 Getting Punnishment Right: Do Costly Monitoring or Redustributive Punishment Help? (2008). Brown University, Department of Economics / Working Papers (5) RePEc:btx:wpaper:0813 Corporate Taxation and the Welfare State (2008). Oxford University Centre for Business Taxation / Working Papers (6) RePEc:btx:wpaper:0816 Cross-Border Tax Effects on Affiliate Investment - Evidence from European Multinationals (2008). Oxford University Centre for Business Taxation / Working Papers (7) RePEc:btx:wpaper:0817 Transfer-pricing and Measured Productivity of Multinational Firms (2008). Oxford University Centre for Business Taxation / Working Papers (8) RePEc:btx:wpaper:0830 Tax Competition in an Expanding European Union (2008). Oxford University Centre for Business Taxation / Working Papers (9) RePEc:cdh:commen:270 Limited Horizons: The 2008 Report on Federal and Provincial Budgetary Tax Policies (2008). C.D. Howe Institute / Commentaries (10) RePEc:cep:cepdps:dp0890 Comparing Willingness-to-Pay and Subjective Well-Being in the Context of Non-Market Goods (2008). Centre for Economic Performance, LSE / CEP Discussion Papers (11) RePEc:ces:ceswps:_2320 Corporate Income Taxation of Multinationals in a General Equilibrium Model (2008). CESifo GmbH / CESifo Working Paper Series (12) RePEc:ces:ceswps:_2384 Corporate Tax Competition and the Decline of Public Investment (2008). CESifo GmbH / CESifo Working Paper Series (13) RePEc:ces:ceswps:_2411 The Political Competition-Economic Performance Puzzle: Evidence from the OECD Countries and the Italian Regions (2008). CESifo GmbH / CESifo Working Paper Series (14) RePEc:ces:ceswps:_2499 Fiscal Competition over Taxes and Public Inputs: Theory and Evidence (2008). CESifo GmbH / CESifo Working Paper Series (15) RePEc:cla:levarc:122247000000002387 Ideology and Competence in Alternative Electoral Systems (2008). UCLA Department of Economics / Levine's Working Paper Archive (16) RePEc:clu:wpaper:0809-03 Skills, Schools, and Credit Constraints: Evidence from Massachusetts (2008). Columbia University, Department of Economics / Discussion Papers (17) RePEc:clu:wpaper:0809-07 Storable Votes and Agenda Order Control Theories and Experiments (2008). Columbia University, Department of Economics / Discussion Papers (18) RePEc:cpr:ceprdp:6774 Secondary Issues and Party Politics: An Application to Environmental Policy (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (19) RePEc:cpr:ceprdp:6793 The Struggle for Palestinian Hearts and Minds: Violence and Public Opinion in the Second Intifada (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (20) RePEc:cpr:ceprdp:6888 Governing the Governors: A Clinical Study of Central Banks (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (21) RePEc:cpr:ceprdp:7013 Free Flows, Limited Diversification: Explaining the Fall and Rise of Stock Market Correlations, 1890-2001 (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (22) RePEc:cpr:ceprdp:7044 Fiscal Sustainability and Demographics - Should We Save or Work More? (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (23) RePEc:cpr:ceprdp:7050 Storable Votes and Agenda Order Control. Theory and Experiments (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (24) RePEc:cpr:ceprdp:7067 The long-term effects of job search requirements: Evidence from the UK JSA reform. (2008). C.E.P.R. Discussion Papers / CEPR Discussion Papers (25) RePEc:ctc:serie6:itemq0851 Politicians Reputation and Policy (Un)persistence (2008). UniversitàCattolica del Sacro Cuore, Dipartimenti e Istituti di Scienze Economiche (DISCE) / DISCE - Quaderni dell'Istituto di Teoria Economica e Me (26) RePEc:cwm:wpaper:72 The Struggle for Palestinian Hearts and Minds: Violence and Public Opinion in the Second Intifada (2008). Department of Economics, College of William and Mary / Working Papers (27) RePEc:dgr:kubcen:200882 What is an Adequate Standard of Living During Retirement? (2008). Tilburg University, Center for Economic Research / Discussion Paper (28) RePEc:diw:diwwpp:dp829 Effective Profit Taxation and the Elasticity of the Corporate Income Tax Base: Evidence from German Corporate Tax Return Data (2008). DIW Berlin, German Institute for Economic Research / Discussion Papers of DIW Berlin (29) RePEc:dnb:dnbwpp:180 Minimum Funding Ratios for Defined-Benefit Pension Funds (2008). Netherlands Central Bank, Research Department / DNB Working Papers (30) RePEc:eab:laborw:1548 The Labor Market of Italian Politicians (2008). East Asian Bureau of Economic Research / Labor Economics Working Papers (31) RePEc:ecb:ecbwps:20080928 Corporate tax competition and the decline of public investment (2008). European Central Bank / Working Paper Series (32) RePEc:ecl:stabus:1993 The Economics and Politics of Corporate Social Performance (2008). Stanford University, Graduate School of Business / Research Papers (33) RePEc:ema:worpap:2008-36 Modelling the employment and wage outcomes of spouses: Is she outearning him? (2008). THEMA / Working papers (34) RePEc:ese:emodwp:em7/08 An Evaluation Of The Tax Transfer Treatment Of Married Couples In European Countries (2008). EUROMOD at the Institute for Social and Economic Research / EUROMOD Working Papers (35) RePEc:fce:doctra:0801 Modelling employment and wage outcomes of spouses: is she outearning him? (2008). Observatoire Francais des Conjonctures Economiques (OFCE) / Documents de Travail de l'OFCE (36) RePEc:fem:femwpa:2008.31 A Social Network Analysis of Occupational Segregation (2008). Fondazione Eni Enrico Mattei / Working Papers (37) RePEc:gla:glaewp:2008_15 Countercyclical Fiscal Policy and Cyclical Factor Utilization (2008). Department of Economics, University of Glasgow / Working Papers (38) RePEc:gra:paoner:08/01 The Big Carrot: High Stake Incentives Revisited (2008). Department of Economic Theory and Economic History of the University of Granada. / Papers on Economics of Religion (39) RePEc:hhs:umnees:0740 Positional Concerns with Multiple Reference Points: Optimal Income Taxation and Public Goods in an OLG Model (2008). UmeÃ¥ University, Department of Economics / UmeÃ¥ Economic Studies (40) RePEc:igi:igierp:346 Do Better Paid Politicians Perform Better? Disentangling Incentives from Selection (2008). IGIER (Innocenzo Gasparini Institute for Economic Research), Bocconi University / Working Papers (41) RePEc:imf:imfwpa:08/203 Zero Corporate Income Tax in Moldova: Tax Competition and Its Implications for Eastern Europe (2008). International Monetary Fund / IMF Working Papers (42) RePEc:imf:imfwpa:08/227 Tax Reforms, Free Lunches, and Cheap Lunches in Open Economies (2008). International Monetary Fund / IMF Working Papers (43) RePEc:inn:wpaper:2008-07 Choosing the carrot or the stick? ââ¬â Endogenous institutional choice in social dilemma situations (2008). Faculty of Economics and Statistics, University of Innsbruck / Working Papers (44) RePEc:irv:wpaper:080907 International Coordination and Domestic Politics (2008). University of California-Irvine, Department of Economics / Working Papers (45) RePEc:isu:genres:12939 Deviant Generations, Ricardian Equivalence, and Growth Cycles (2008). Iowa State University, Department of Economics / Staff General Research Papers (46) RePEc:iza:izadps:dp3344 On the Curvature of the Reporting Function from Objective Reality to Subjective Feelings (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers (47) RePEc:iza:izadps:dp3362 Heterogeneous Impacts in PROGRESA (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers (48) RePEc:iza:izadps:dp3439 The Struggle for Palestinian Hearts and Minds: Violence and Public Opinion in the Second Intifada (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers (49) RePEc:iza:izadps:dp3604 Happiness Dynamics with Quarterly Life Event Data (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers (50) RePEc:iza:izadps:dp3801 Intergenerational Top Income Mobility in Sweden: A Combination of Equal Opportunity and Capitalistic Dynasties (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers (51) RePEc:iza:izadps:dp3851 Age-Dependent Employment Protection (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers (52) RePEc:iza:izadps:dp3856 The Long-Term Effects of Job Search Requirements: Evidence from the UK JSA Reform (2008). Institute for the Study of Labor (IZA) / IZA Discussion Papers (53) RePEc:jku:econwp:2008_19 Layoff Tax and the Employment of the Elderly (2008). Department of Economics, Johannes Kepler University Linz, Austria / Economics working papers (54) RePEc:jku:nrnwps:2008_04 Layoff Tax and the Employment of the Elderly (2008). The Austrian Center for Labor Economics and the Analysis of the Welfare State, Johannes Kepler University Linz, Austria / NRN working papers (55) RePEc:kap:jeczfn:v:95:y:2008:i:3:p:271-276 McChesney, R. W.: Communication revolution: critical junctures and the future of media (2008). Journal of Economics - Zeitschrift für Nationalökonomie (56) RePEc:kof:wpskof:08-214 Does Aging Influence Sectoral Employment Shares? Evidence from Panel Datak (2008). Swiss Institute for Business Cycle Research (KOF), Swiss Federal Institute of Technology Zurich (ETH), / Working papers (57) RePEc:lan:wpaper:005802 Diversity, choice and the quasi-market: An empirical analysis of secondary education policy in England (2008). Lancaster University Management School, Economics Department / Working Papers (58) RePEc:ler:wpaper:08.02.246 Persuasive Subsidies in a Clean Environment (2008). LERNA, University of Toulouse / Working Papers (59) RePEc:lic:licosd:21608 Are your firms taxes set in Warsaw? Spatial tax competition in Europe (2008). LICOS - Centre for Institutions and Economic Performance, K.U.Leuven / LICOS Discussion Papers (60) RePEc:lmu:muenec:4450 Corporate Taxes, Profit Shifting and the Location of Intangibles within Multinational Firms (2008). University of Munich, Department of Economics / Discussion Papers in Economics (61) RePEc:lmu:muenec:5294 Corporate Taxes and the Location of Intangible Assets Within Multinational Firms (2008). University of Munich, Department of Economics / Discussion Papers in Economics (62) RePEc:lvl:pmmacr:2008-12 Will Formula-Based Funding and Decentralized Management Improve School Level Resources in Sri Lanka? (2008). (63) RePEc:mar:magkse:200805 Participation and Decision Making: A Three-person Power-to-take Experiment (2008). Philipps-Universität Marburg, Faculty of Business Administration and Economics, Department of Economics (Volkswirtschaftliche Abteilung) / MAGKS Pape (64) RePEc:mlb:wpaper:1036 Feedback; Punishment and Cooperation in Public Good Experiments (2008). The University of Melbourne / Department of Economics - Working Papers Series (65) RePEc:mlb:wpaper:1058 Feuds in the Laboratory? A Social Dilemma Experiment (2008). The University of Melbourne / Department of Economics - Working Papers Series (66) RePEc:nbr:nberch:6795 Redistribution and Tax Expenditures: The Earned Income Tax Credit (2008). National Bureau of Economic Research, Inc / NBER Chapters (67) RePEc:nbr:nberwo:13956 The Struggle for Palestinian Hearts and Minds: Violence and Public Opinion in the Second Intifada (2008). National Bureau of Economic Research, Inc / NBER Working Papers (68) RePEc:nbr:nberwo:14307 Redistribution and Tax Expenditures: The Earned Income Tax Credit (2008). National Bureau of Economic Research, Inc / NBER Working Papers (69) RePEc:nbr:nberwo:14487 Storable Votes and Agenda Order Control. Theory and Experiments (2008). National Bureau of Economic Research, Inc / NBER Working Papers (70) RePEc:nbr:nberwo:14606 Can Hearts and Minds Be Bought? The Economics of Counterinsurgency in Iraq (2008). National Bureau of Economic Research, Inc / NBER Working Papers (71) RePEc:nbr:nberwo:14622 Behavioral Welfare Economics (2008). National Bureau of Economic Research, Inc / NBER Working Papers (72) RePEc:ner:sciepo:info:hdl:2441/9644 Wealth Effects and Public Debt in an Endogenous Growth Model. Banca dItalia Public Finance Workshop Fiscal Sustainability : Analytical Developments and Emerging Policy Issues, Perugia, 3-5 April 2008. (2008). Sciences Po / Open Access publications from Sciences Po (73) RePEc:ner:sciepo:info:hdl:2441/9665 Modelling the employment and wage outcomes of spouses: is she outearning him?. (2008). Sciences Po / Open Access publications from Sciences Po (74) RePEc:pra:mprapa:10218 Comparison of neighborhood trust between generations in a racially homogeneous society: A case study from Japan. (2008). University Library of Munich, Germany / MPRA Paper (75) RePEc:pra:mprapa:8585 The effects of population aging on optimal redistributive taxes in an overlapping generations model (2008). University Library of Munich, Germany / MPRA Paper (76) RePEc:pse:psecon:2008-43 Immigration and natives attitudes towards the welfare state: Evidence from the European Social Survey (2008). PSE (Ecole normale supérieure) / PSE Working Papers (77) RePEc:pse:psecon:2008-61 Happiness, habits and high rank: Comparisons in economic and social life (2008). PSE (Ecole normale supérieure) / PSE Working Papers (78) RePEc:rdg:emxxdp:em-dp2008-65 His and Hers: Exploring Gender Puzzles and the Meaning of Life Satisfaction (2008). (79) RePEc:rdg:emxxdp:em-dp2008-73 Are We Getting It Right? Values and Life Satisfaction (2008). (80) RePEc:shr:wpaper:08-22 Intertwined Federalism: Accountability Problems under Partial Decentralization (2008). Departement d'Economique de la Faculte d'administration àl'Universite de Sherbrooke / Cahiers de recherche (81) RePEc:spr:portec:v:7:y:2008:i:1:p:17-41 Equality of opportunity and educational achievement in Portugal (2008). Portuguese Economic Journal (82) RePEc:ssb:dispap:552 Top Incomes in Norway (2008). Research Department of Statistics Norway / Discussion Papers (83) RePEc:ste:nystbu:08-27 Similarity and Polarization in Groups (2008). New York University, Leonard N. Stern School of Business, Department of Economics / Working Papers (84) RePEc:ums:papers:2008-13 Is altruism bad for cooperation? (2008). University of Massachusetts Amherst, Department of Economics / Working Papers (85) RePEc:upf:upfgen:1119 A Century of Global Equity Market Correlations (2008). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (86) RePEc:usg:dp2008:2008-18 Corporate Taxation and the Welfare State (2008). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2008 (87) RePEc:uto:dipeco:200804 Spend more, get more? An inquiry into English local government performance (2008). University of Turin / Department of Economics Working Papers (88) RePEc:uwo:hcuwoc:20084 Evidence About the Potential Role for Affirmative Action in Higher Education (2008). University of Western Ontario, CIBC Human Capital and Productivity Project / University of Western Ontario, CIBC Human Capital and Productivity Proj (89) RePEc:wbk:wbrwps:3935 Empowering parents to improve education : evidence from rural Mexico (2008). The World Bank / Policy Research Working Paper Series (90) RePEc:wrk:warwec:839 On the Curvature of the Reporting Function from Objective Reality to Subjective Feelings (2008). University of Warwick, Department of Economics / The Warwick Economics Research Paper Series (TWERPS) (91) RePEc:yor:yorken:08/08 Optimal Nonlinear Income Taxation with Learning-by-Doing (2008). Department of Economics, University of York / Discussion Papers (92) RePEc:yor:yorken:08/21 Ill-Health as a Household Norm: Evidence from Other Peoples Health Problems (2008). Department of Economics, University of York / Discussion Papers (93) RePEc:zbw:arqudp:47 Auswirkungen der deutschen Unternehmensteuerreform 2008 und der österreichischen Gruppenbesteuerung auf den grenzüberschreitenden Unternehmenserwerb (2008). arqus - Arbeitskreis Quantitative Steuerlehre / arqus Discussion Papers in Quantitative Tax Research (94) RePEc:zbw:arqudp:57 Effective profit taxation and the elasticity of the corporate income tax base: Evidence from German corporate tax return data (2008). arqus - Arbeitskreis Quantitative Steuerlehre / arqus Discussion Papers in Quantitative Tax Research (95) RePEc:zbw:uoccpe:7451 Fiscal Equalisation and the Soft Budget Constraint (2008). University of Cologne, CPE - Cologne Center for Public Economics / FiFo-CPE Discussion Papers - Finanzwissenschaftliche Diskussionsbeiträge Recent citations received in: 2007 (1) RePEc:aub:autbar:711.07 Does Affirmative Action Reduce Effort Incentives? A Contest Game Analysis (2007). Unitat de Fonaments de l'Anàlisi Econòmica (UAB) and Institut d'Anàlisi Econòmica (CSIC) / UFAE and IAE Working Papers (2) RePEc:ays:ispwps:paper0720 Myth and Reality of Flat Tax Reform: Micro Estimates of Tax Evasion Response and Welfare Effects in Russia (2007). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (3) RePEc:ays:ispwps:paper0727 Tax Compliance, Tax Morale, and Governance Quality (2007). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (4) RePEc:ays:ispwps:paper0728 Myth and Reality of Flat Tax Reform: Tax Evasion and Real Side Response of Russian Households (2007). International Studies Program, Andrew Young School of Policy Studies, Georgia State University / International Studies Program Working P (5) RePEc:bpj:bejeap:v:7:y:2007:i:1:n:61 Gender Specialization of Skill Acquisition (2007). The B.E. Journal of Economic Analysis & Policy (6) RePEc:cam:camdae:0742 Do Autocratic States Trade Less? (2007). Faculty of Economics (formerly DAE), University of Cambridge / Cambridge Working Papers in Economics (7) RePEc:ces:ceswps:_1952 Fiscal Interactions Among European Countries. Does the EU Matter? (2007). CESifo GmbH / CESifo Working Paper Series (8) RePEc:ces:ceswps:_2013 Greasing the Wheels of Entrepreneurship? The Impact of Regulations and Corruption on Firm Entry (2007). CESifo GmbH / CESifo Working Paper Series (9) RePEc:ces:ceswps:_2054 Federal Tax-Transfer Policy and Intergovernmental Pre-Commitment (2007). CESifo GmbH / CESifo Working Paper Series (10) RePEc:ces:ceswps:_2069 Exit and Voice. Yardstick versus Fiscal Competition across Governments (2007). CESifo GmbH / CESifo Working Paper Series (11) RePEc:ces:ceswps:_2072 The Choice of Apportionment Factors under Formula Apportionment (2007). CESifo GmbH / CESifo Working Paper Series (12) RePEc:ces:ceswps:_2122 From Separate Accounting to Formula Apportionment: Analysis in a Dynamic Framework (2007). CESifo GmbH / CESifo Working Paper Series (13) RePEc:cir:cirwor:2007s-22 Tax Evasion: Cheating Rationally or Deciding Emotionally? (2007). CIRANO / CIRANO Working Papers (14) RePEc:cla:levrem:122247000000001769 Crowding out Both Sides of the Philanthropy Market: Evidence from a Panel of Charities (2007). UCLA Department of Economics / Levine's Bibliography (15) RePEc:cla:levrem:321307000000000886 Political Economy of Mechanisms (2007). UCLA Department of Economics / Levine's Bibliography (16) RePEc:cpr:ceprdp:6129 Social Interactions and Labour Market Outcomes in Cities (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (17) RePEc:cpr:ceprdp:6130 Ethnicity and Spatial Externalities in Crime (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (18) RePEc:cpr:ceprdp:6362 Should Egalitarians Expropriate Philanthropists? (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (19) RePEc:crm:wpaper:0711 How Immigration Affects U.S. Cities (2007). Centre for Research and Analysis of Migration (CReAM), Department of Economics, University College London / CReAM Discussion Paper Series (20) RePEc:cte:werepe:we078551 Tax rates, governance, and the informal economy in high-income countries (2007). Universidad Carlos III, Departamento de EconomÃa / Economics Working Papers (21) RePEc:dgr:uvatin:20070076 Will Corporate Tax Consolidation improve Efficiency in the EU ? (2007). Tinbergen Institute / Tinbergen Institute Discussion Papers (22) RePEc:diw:diwesc:diwesc2 Determinants of Poverty during Transition: Household Survey Evidence from Ukraine (2007). DIW Berlin, German Institute for Economic Research / ESCIRRU Working Papers (23) RePEc:diw:diwwpp:dp748 Determinants of Poverty during Transition: Household Survey Evidence from Ukraine (2007). DIW Berlin, German Institute for Economic Research / Discussion Papers of DIW Berlin (24) RePEc:ecl:corcae:07-04 A Dynamic Theory of Public Spending, Taxation and Debt (2007). Cornell University, Center for Analytic Economics / Working Papers (25) RePEc:eui:euiwps:eco2007/09 The Value Added Tax: Its Causes and Consequences (2007). (26) RePEc:exc:wpaper:2007-09 An experimental inquiry into the effect of yardstick competition on corruption (2007). Experimental Economics Center, Andrew Young School of Policy Studies, Georgia State University / Experimental Economics Center Working Paper Series (27) RePEc:fem:femwpa:2007.45 Trust in International Organizations: An Empirical Investigation Focusing on the United Nations (2007). Fondazione Eni Enrico Mattei / Working Papers (28) RePEc:fip:fedbwp:07-3 Impatience and credit behavior: evidence from a field experiment (2007). Federal Reserve Bank of Boston / Working Papers (29) RePEc:fip:fedbwp:07-9 Doing good or doing well? Image motivation and monetary incentives in behaving prosocially (2007). Federal Reserve Bank of Boston / Working Papers (30) RePEc:gat:wpaper:0707 Endogenous Leadership Selection and Influence (2007). Groupe d'Analyse et de Théorie Economique (GATE), Centre national de la recherche scientifique (CNRS), Université Lyon 2, Ecole Normale Supérieure / W (31) RePEc:gat:wpaper:0724 Tax Evasion: Cheating Rationally or Deciding Emotionally? (2007). Groupe d'Analyse et de Théorie Economique (GATE), Centre national de la recherche scientifique (CNRS), Université Lyon 2, Ecole Normale Supérieure / W (32) RePEc:gde:journl:gde_v66_n2_p207-246 Gone for Good? Determinants of School Dropout in Southern Italy (2007). Giornale degli Economisti (33) RePEc:hal:journl:halshs-00142461_v1 Endogenous Leadership Selection and Influence (2007). HAL / Post-Print (34) RePEc:hal:wpaper:hal-00243056_v1 Point-record incentives, asymmetric information and dynamic data (2007). HAL / Working Papers (35) RePEc:idb:wpaper:4521 Institutional Quality and Government Efficiency (2007). Inter-American Development Bank, Research Department / Working Papers (36) RePEc:idb:wpaper:4526 Informality and Productivity in the Labor Market: Peru 1986 - 2001 (2007). Inter-American Development Bank, Research Department / Working Papers (37) RePEc:idb:wpaper:4527 Informalidad y Productividad en el Mercado Laboral: Perú 1986-2001 (Informality and Productivity in the Labor Market: Peru 1986 - 2001) (2007). Inter-American Development Bank, Research Department / Working Papers (38) RePEc:imf:imfwpa:07/142 VAT Attacks! (2007). International Monetary Fund / IMF Working Papers (39) RePEc:imf:imfwpa:07/183 The Value-Added Tax: Its Causes and Consequences (2007). International Monetary Fund / IMF Working Papers (40) RePEc:isu:genres:12780 Unit Vs. Ad Valorem Taxes in Multi-Product Cournot Oligopoly (2007). Iowa State University, Department of Economics / Staff General Research Papers (41) RePEc:ivi:wpasad:2007-16 MODELLING SEGREGATION THROUGH CELLULAR AUTOMATA: A THEORETICAL ANSWER (2007). Instituto Valenciano de Investigaciones Económicas, S.A. (Ivie) / Working Papers. Serie AD (42) RePEc:iza:izadps:dp2843 Electoral Accountability and Corruption in Local Governments: Evidence from Audit Reports (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (43) RePEc:iza:izadps:dp2968 Doing Good or Doing Well? Image Motivation and Monetary Incentives in Behaving Prosocially (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (44) RePEc:iza:izadps:dp3103 Tax Evasion: Cheating Rationally or Deciding Emotionally? (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (45) RePEc:iza:izadps:dp3134 Incentives and Services for College Achievement: Evidence from a Randomized Trial (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (46) RePEc:iza:izadps:dp3228 Determinants of Poverty during Transition: Household Survey Evidence from Ukraine (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (47) RePEc:iza:izadps:dp3267 Myth and Reality of Flat Tax Reform: Micro Estimates of Tax Evasion Response and Welfare Effects in Russia (2007). Institute for the Study of Labor (IZA) / IZA Discussion Papers (48) RePEc:jku:econwp:2007_01 Shadow economy, tax morale, governance and institutional quality: A panel analysis (2007). Department of Economics, Johannes Kepler University Linz, Austria / Economics working papers (49) RePEc:jku:econwp:2007_02 The impact of tax morale and institutional quality on the shadow economy (2007). Department of Economics, Johannes Kepler University Linz, Austria / Economics working papers (50) RePEc:kap:itaxpf:v:14:y:2007:i:4:p:365-381 VAT attacks! (2007). International Tax and Public Finance (51) RePEc:kap:itaxpf:v:14:y:2007:i:5:p:605-626 How would the introduction of an EU-wide formula apportionment affect the distribution and size of the corporate tax base? An analysis based on German multinationals (2007). International Tax and Public Finance (52) RePEc:kap:jfsres:v:31:y:2007:i:1:p:1-32 Defined Contribution Pension Plans: Determinants of Participation and Contributions Rates (2007). Journal of Financial Services Research (53) RePEc:kap:jrisku:v:35:y:2007:i:3:p:237-264 Predicted risk perception and risk-taking behavior: The case of impaired driving (2007). Journal of Risk and Uncertainty (54) RePEc:kof:wpskof:07-181 Terrorism and Cabinet Duration: An Empirical Analysis (2007). Swiss Institute for Business Cycle Research (KOF), Swiss Federal Institute of Technology Zurich (ETH), / Working papers (55) RePEc:lau:crdeep:07.13 Do Agglomeration Economies Reduce the Sensitivity of Firm Location to Tax Differentials? (2007). Université de Lausanne, Ecole des HEC, DEEP / Cahiers de Recherches Economiques du Département d'Econométrie et d'Economie politique (DEEP) (56) RePEc:lpf:wpaper:04-2007 Shadow Economy, Tax Morale, Governance and Institutional Quality: A Panel Analysis (2007). Institute of Local Public Finance / Working Papers (57) RePEc:lpf:wpaper:05-2007 Trust in International Organizations: An Empirical Investigation Focusing on the United Nations (2007). Institute of Local Public Finance / Working Papers (58) RePEc:lvl:lacicr:0745 Physicians Multitasking and Incentives: Empirical Evidence from a Natural Experiment (2007). (59) RePEc:mod:recent:005 The Comparative Evolution of Bequest Taxation in Historical Perspective (2007). University of Modena and Reggio E., Dept. of Economics / Center for Economic Research (RECent) (60) RePEc:mrr:papers:wp156 A Longitudinal Analysis of Entries and Exits of the Low-Income Elderly to and from the Supplemental Security Income Program (2007). University of Michigan, Michigan Retirement Research Center / Working Papers (61) RePEc:nbr:nberwo:13013 Is the US Population Behaving Healthier? (2007). National Bureau of Economic Research, Inc / NBER Working Papers (62) RePEc:nbr:nberwo:13105 The Joy of Giving or Assisted Living? Using Strategic Surveys to Separate Bequest and Precautionary Motives (2007). National Bureau of Economic Research, Inc / NBER Working Papers (63) RePEc:nbr:nberwo:13188 Maternal employment, breastfeeding, and health: Evidence from maternity leave mandates (2007). National Bureau of Economic Research, Inc / NBER Working Papers (64) RePEc:nbr:nberwo:13323 Race and Charitable Church Activity (2007). National Bureau of Economic Research, Inc / NBER Working Papers (65) RePEc:nbr:nberwo:13348 Diversity and Crowd-out: A Theory of Cold-Glow Giving (2007). National Bureau of Economic Research, Inc / NBER Working Papers (66) RePEc:nbr:nberwo:13352 The Impact of Employer Matching on Savings Plan Participation under Automatic Enrollment (2007). National Bureau of Economic Research, Inc / NBER Working Papers (67) RePEc:nbr:nberwo:13656 Mental Accounting in Portfolio Choice: Evidence from a Flypaper Effect (2007). National Bureau of Economic Research, Inc / NBER Working Papers (68) RePEc:ner:tilbur:urn:nbn:nl:ui:12-301942 Saving and investing over the life cycle and the role of collective pension funds. (2007). Tilburg University / Open Access publications from Tilburg University (69) RePEc:ner:tilbur:urn:nbn:nl:ui:12-321895 Consumption Tax Competition Among Governments: Evidence from the United States. (2007). Tilburg University / Open Access publications from Tilburg University (70) RePEc:ner:tilbur:urn:nbn:nl:ui:12-387569 Sharing Risk: The Netherlands New Approach to Pensions. (2007). Tilburg University / Open Access publications from Tilburg University (71) RePEc:nys:sunysb:07-05 An Empirical Study of the Effects of Social Security Reforms on Claming Behavior and Benefits Receipt Using Aggregate and Public-Use Administrative Micro Data (2007). SUNY-Stony Brook, Department of Economics / Department of Economics Working Papers (72) RePEc:pia:wpaper:32/2007 Location choices of multinational firms in Europe: the role of EU cohesion policy (2007). Universitàdi Perugia, Dipartimento Economia, Finanza e Statistica / Quaderni del Dipartimento di Economia, Finanza e Statistica (73) RePEc:pra:mprapa:5236 The Effect of Information on the Bidding and Survival of Entrants in Procurement Auctions (2007). University Library of Munich, Germany / MPRA Paper (74) RePEc:pru:wpaper:40 Determinants Of Poverty During Transition: Household Survey Evidence From Ukraine (2007). Poverty Research Unit at Sussex, University of Sussex / PRUS Working Papers (75) RePEc:qut:dpaper:213 Trust in International Organizations: An Empirical Investigation Focusing on the United Nations (2007). School of Economics and Finance, Queensland University of Technology / School of Economics and Finance Discussion Papers and Working Papers Series (76) RePEc:ssb:dispap:507 Driven to Drink. Sin Taxes Near a Border (2007). Research Department of Statistics Norway / Discussion Papers (77) RePEc:upf:upfgen:1062 Do Agglomeration Economies Reduce the Sensitivity of Firm Location to Tax Differentials? (2007). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers (78) RePEc:use:tkiwps:0723 Financial Literacy and Stock Market Participation (2007). Utrecht School of Economics / Working Papers (79) RePEc:wdi:papers:2007-892 The Political Economy of Corruption & the Role of Financial Institutions (2007). William Davidson Institute at the University of Michigan Stephen M. Ross Business School / William Davidson Institute Working Papers Series (80) RePEc:wrk:warwec:797 Unit Versus Ad Valorem Taxes : The Private Ownership of Monopoly In General Equilibrium (2007). University of Warwick, Department of Economics / The Warwick Economics Research Paper Series (TWERPS) (81) RePEc:yca:wpaper:2007_9 Do Agglomeration Economies Reduce the Sensitivity of Firm Location to Tax Differentials? (2007). York University, Department of Economics / Working Papers (82) RePEc:yor:yorken:07/10 A Tax Reform Analysis of the Laffer Argument (2007). Department of Economics, University of York / Discussion Papers (83) RePEc:zbw:gdec07:6805 Determinants of Poverty during Transition: Household Survey Evidence from Ukraine (2007). Verein für Socialpolitik, Research Committee Development Economics / Proceedings of the German Development Economics Conference, Göttingen 2007 Recent citations received in: 2006 (1) RePEc:ags:gewi06:14961 WHY AND HOW SHOULD THE GOVERNMENT FINANCE PUBLIC GOODS IN RURAL AREAS? A REVIEW OF ARGUMENTS (2006). German Association of Agricultural Economists (GEWISOLA) / 46th Annual Conference, Giessen, Germany, October 4-6, 2006 (2) RePEc:boc:bocoec:639 Changing the Boston School Choice Mechanism (2006). Boston College Department of Economics / Boston College Working Papers in Economics (3) RePEc:brn:wpaper:0602 Teaching to the Rating: School Accountability and the Distribution of Student Achievement (2006). Barnard College, Department of Economics / Working Papers (4) RePEc:cbt:econwp:06/04 Another Look at what to do with Time-series Cross-section Data (2006). University of Canterbury, Department of Economics / Working Papers in Economics (5) RePEc:cbt:econwp:06/05 The Determinants of U. S. State Economic Growth: A Less Extreme Bounds Analysis (2006). University of Canterbury, Department of Economics / Working Papers in Economics (6) RePEc:cep:stipep:20 BEING THE NEW YORK TIMES: THEPOLITICAL BEHAVIOUR OF A NEWSPAPER (2006). Suntory and Toyota International Centres for Economics and Related Disciplines, LSE / STICERD - Political Economy and Public Policy Paper Series (7) RePEc:ces:ceswps:_1656 Efficient Revenue Sharing and Upper Level Governments: Theory and Application to Germany (2006). CESifo GmbH / CESifo Working Paper Series (8) RePEc:ces:ceswps:_1661 Fiscal Policy, Monopolistic Competition, and Finite Lives (2006). CESifo GmbH / CESifo Working Paper Series (9) RePEc:ces:ceswps:_1721 The Capital Structure of Multinational Companies under Tax Competition (2006). CESifo GmbH / CESifo Working Paper Series (10) RePEc:ces:ceswps:_1741 Subsidies for Wages and Infrastructure: How to Restrain Undesired Immigration (2006). CESifo GmbH / CESifo Working Paper Series (11) RePEc:ces:ceswps:_1754 Ex-Post Redistribution in a Federation: Implications for Corrective Policy (2006). CESifo GmbH / CESifo Working Paper Series (12) RePEc:ces:ceswps:_1784 A Simple Explanation for the Unfavorable Tax Treatment of Investment Costs (2006). CESifo GmbH / CESifo Working Paper Series (13) RePEc:ces:ceswps:_1795 Reforming the Taxation of Multijurisdictional Enterprises in Europe, a Tentative Appraisal (2006). CESifo GmbH / CESifo Working Paper Series (14) RePEc:ces:ceswps:_1860 Reforming the Taxation of Multijurisdictional Enterprises in Europe, âCoopetitionâ in a Bottom-up Federation (2006). CESifo GmbH / CESifo Working Paper Series (15) RePEc:ces:ceswps:_1865 Fiscal Equalization and Yardstick Competition (2006). CESifo GmbH / CESifo Working Paper Series (16) RePEc:cfr:cefirw:w0063 Media Freedom, Bureaucratic Incentives, and the Resource Curse (2006). Center for Economic and Financial Research / CEFIR Working Papers (17) RePEc:cla:levrem:122247000000001022 Changing the Boston School Choice Mechanism (2006). UCLA Department of Economics / Levine's Bibliography (18) RePEc:cor:louvco:2006109 Competing in taxes and investment under fiscal equalization (2006). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (19) RePEc:cpr:ceprdp:5645 Multi-Battle Contests (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (20) RePEc:cpr:ceprdp:5748 Media Freedom, Bureaucratic Incentives and the Resource Curse (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (21) RePEc:cpr:ceprdp:5769 Exports, Foreign Direct Investment and the Costs of Coporate Taxation (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (22) RePEc:cpr:ceprdp:5844 Multi-Stage Contests with Stochastic Ability (2006). C.E.P.R. Discussion Papers / CEPR Discussion Papers (23) RePEc:crr:crrwps:wp2006-26 Annuitized Wealth and Consumption at Older Ages (2006). Center for Retirement Research / Working Papers, Center for Retirement Research at Boston College (24) RePEc:ctl:louvec:2006062 Competing in taxes and investment under fiscal equalization (2006). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (25) RePEc:dul:wpaper:06-04rr Analyse exploratoire dun programme dallocations-loyers en Région de Bruxelles-Capitale: comparaison internationale et évaluation budgétaire et économique selon trois scénarios (2006). Université libre de Bruxelles, Department of Applied Economics (DULBEA) / Working Papers DULBEA (26) RePEc:ebl:ecbull:v:15:y:2006:i:11:p:1-10 Endogenous Market Structure and Fiscal Policy in an Endogenous Growth Model with Public Capital (2006). Economics Bulletin (27) RePEc:ecl:stabus:1927 Prediction Markets in Theory and Practice (2006). Stanford University, Graduate School of Business / Research Papers (28) RePEc:ecl:wisagr:497 Should the Government Finance Public Goods in Rural Areas? A Review of Arguments (2006). University of Wisconsin, Agricultural and Applied Economics / Staff Paper Series (29) RePEc:edb:cedidp:06-10 Media Freedom, Bureaucratic Incentives, and the Resource Curse (2006). Centre for Economic Development and Institutions(CEDI), Brunel University / CEDI Discussion Paper Series (30) RePEc:edj:ceauch:220 Using School Scholarships to Estimate the Effect of Government Subsidized Private Education on Academic Achievement in Chile (2006). Centro de EconomÃa Aplicada, Universidad de Chile / Documentos de Trabajo (31) RePEc:edj:ceauch:225 Socioeconomic status or noise? Tradeoffs in the generation of school quality information (2006). Centro de EconomÃa Aplicada, Universidad de Chile / Documentos de Trabajo (32) RePEc:euf:ecopap:0265 Reforming the taxation of multijurisdictional enterprises in Europe: a tentative appraisal (2006). Directorate General Economic and Monetary Affairs, European Commission / European Economy - Economic Papers (33) RePEc:fem:femwpa:2006.121 A Bayesian Approach to the Estimation of Environmental Kuznets Curves for CO2 Emissions (2006). Fondazione Eni Enrico Mattei / Working Papers (34) RePEc:fip:fedfwp:2006-17 Measuring the miracle: market imperfections and Asias growth experience (2006). Federal Reserve Bank of San Francisco / Working Paper Series (35) RePEc:fip:fedhwp:wp-06-05 The tradeoff between mortgage prepayments and tax-deferred retirement savings (2006). Federal Reserve Bank of Chicago / Working Paper Series (36) RePEc:han:dpaper:dp-348 TAXATION AND INTERNAL MIGRATION - EVIDENCE FROM THE SWISS CENSUS USING COMMUNITY-LEVEL VARIATION IN INCOME TAX RATES (2006). Universität Hannover, Wirtschaftswissenschaftliche Fakultät / Diskussionspapiere der Wirtschaftswissenschaftlichen Fakultät der Universität Hanno (37) RePEc:hhs:gunwpe:0219 Bridging the Great Divide in South Africa: Inequality and Punishment in the Provision of Public Goods (2006). Göteborg University, Department of Economics / Working Papers in Economics (38) RePEc:idb:wpaper:4487 The Political Economy of Fiscal Policy: Survey (2006). Inter-American Development Bank, Research Department / Working Papers (39) RePEc:iep:wpidep:0608 Are Equalization Payments Making Canadians Better Off? A Two-Dimensional Dominance Answer (2006). Institut d'economie publique (IDEP), Marseille, France / IDEP Working Papers 2004 (40) RePEc:ifr:wpaper:2006-07 Disasters: Issues for State and Federal Government Finances (2006). University of Kentucky, Institute for Federalism and Intergovernmental Relations / Working Papers (41) RePEc:ifr:wpaper:2006-10 Reforming the taxation of Multijurisdictional Enterprises in Europe, Coopetition in a Bottom-up Federation (2006). University of Kentucky, Institute for Federalism and Intergovernmental Relations / Working Papers (42) RePEc:ifr:wpaper:2006-15 Fiscal Equalization and Yardstick Competition (2006). University of Kentucky, Institute for Federalism and Intergovernmental Relations / Working Papers (43) RePEc:iza:izadps:dp2333 Elder Parent Health and the Migration Decision of Adult Children: Evidence from Rural China (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (44) RePEc:iza:izadps:dp2374 Taxation and Internal Migration: Evidence from the Swiss Census Using Community-Level Variation in Income Tax Rates (2006). Institute for the Study of Labor (IZA) / IZA Discussion Papers (45) RePEc:kap:ijhcfe:v:6:y:2006:i:1:p:25-47 Employer choices of family premium sharing (2006). International Journal of Health Care Finance and Economics (46) RePEc:kap:revind:v:29:y:2006:i:1:p:149-169 Public-Private Partnerships and Prices: Evidence from Water Distribution in France (2006). Review of Industrial Organization (47) RePEc:lmu:muenec:1153 Die Besteuerung multinationaler Unternehmen (2006). University of Munich, Department of Economics / Discussion Papers in Economics (48) RePEc:lsu:lsuwpp:2006-04 School Choice and the Flight to Private Schools: To What Extent Are Public and Private Schools Substitutes? (2006). Department of Economics, Louisiana State University / Departmental Working Papers (49) RePEc:man:cgbcrp:73 The Tyranny of Rules: Fiscal Discipline, Productive Spending, and Growth (2006). The School of Economic Studies, The Univeristy of Manchester / Centre for Growth and Business Cycle Research Discussion Paper Series (50) RePEc:mcm:sedapp:163 Tax Incentives and Household Portfolios: A Panel Data Analysis (2006). McMaster University / Social and Economic Dimensions of an Aging Population Research Papers (51) RePEc:mol:ecsdps:esdp06029 Wealth Accumulation and Growth in a Specific-Factors Model of Trade and Finance. (2006). University of Molise, Dept. SEGeS / Economics & Statistics Discussion Papers (52) RePEc:nbr:nberwo:11965 Changing the Boston School Choice Mechanism (2006). National Bureau of Economic Research, Inc / NBER Working Papers (53) RePEc:nbr:nberwo:12009 The Importance of Default Options for Retirement Savings Outcomes: Evidence from the United States (2006). National Bureau of Economic Research, Inc / NBER Working Papers (54) RePEc:nbr:nberwo:12049 Who Adjusts and When? On the Political Economy of Reforms (2006). National Bureau of Economic Research, Inc / NBER Working Papers (55) RePEc:nbr:nberwo:12103 Dynamic Scoring: Alternative Financing Schemes (2006). National Bureau of Economic Research, Inc / NBER Working Papers (56) RePEc:nbr:nberwo:12108 Persistence of Power, Elites and Institutions (2006). National Bureau of Economic Research, Inc / NBER Working Papers (57) RePEc:nbr:nberwo:12132 Antitrust in the Not-For-Profit Sector (2006). National Bureau of Economic Research, Inc / NBER Working Papers (58) RePEc:nbr:nberwo:12190 Pork Barrel Cycles (2006). National Bureau of Economic Research, Inc / NBER Working Papers (59) RePEc:nbr:nberwo:12259 Capital Levies and Transition to a Consumption Tax (2006). National Bureau of Economic Research, Inc / NBER Working Papers (60) RePEc:nbr:nberwo:12339 Optimal Control of Externalities in the Presence of Income Taxation (2006). National Bureau of Economic Research, Inc / NBER Working Papers (61) RePEc:nbr:nberwo:12502 The Tradeoff Between Mortgage Prepayments and Tax-Deferred Retirement Savings (2006). National Bureau of Economic Research, Inc / NBER Working Papers (62) RePEc:nbr:nberwo:12628 Cramming: The Effects of School Accountability on College-Bound Students (2006). National Bureau of Economic Research, Inc / NBER Working Papers (63) RePEc:nbr:nberwo:12641 Crime and Punishment in the American Dream (2006). National Bureau of Economic Research, Inc / NBER Working Papers (64) RePEc:nbr:nberwo:12707 What Drives Media Slant? Evidence from U.S. Daily Newspapers (2006). National Bureau of Economic Research, Inc / NBER Working Papers (65) RePEc:nbr:nberwo:12730 Taxing Consumption and Other Sins (2006). National Bureau of Economic Research, Inc / NBER Working Papers (66) RePEc:nbr:nberwo:12802 Which Countries Become Tax Havens? (2006). National Bureau of Economic Research, Inc / NBER Working Papers (67) RePEc:pab:wpaper:06.15 Side Effects of Campaign Finance Reform (2006). Universidad Pablo de Olavide, Departamento de EconomiÂa / Working Papers (68) RePEc:pab:wpaper:06.21 Biased Contests (2006). Universidad Pablo de Olavide, Departamento de EconomiÂa / Working Papers (69) RePEc:pra:mprapa:186 The Effect of Spillovers on the Provision of Local Public Goods (2006). University Library of Munich, Germany / MPRA Paper (70) RePEc:pra:mprapa:500 Crime and Punishment in the American Dream (2006). University Library of Munich, Germany / MPRA Paper (71) RePEc:pra:mprapa:9707 Budgetary Dynamics in The Local Authorities in Israel (2006). University Library of Munich, Germany / MPRA Paper (72) RePEc:pur:prukra:1187 Multi-battle contests. (2006). Purdue University, Department of Economics / Purdue University Economics Working Papers (73) RePEc:pur:prukra:1192 Multi-Stage Contests with Stochastic Ability (2006). Purdue University, Department of Economics / Purdue University Economics Working Papers (74) RePEc:qed:wpaper:1096 The Control of Land Rent in the Fortified Farming Town (2006). Queen's University, Department of Economics / Working Papers (75) RePEc:red:issued:v:9:y:2006:i:2:p:211-223 Redistribution, Taxes and the Median Voter (2006). Review of Economic Dynamics (76) RePEc:rff:dpaper:dp-06-51 Fiscal and Externality Rationales for Alcohol Taxes (2006). Resources For the Future / Discussion Papers (77) RePEc:taf:eurjhp:v:6:y:2006:i:2:p:131-149 Determinants of Mortgage Debt Growth in EU Countries (2006). European Journal of Housing Policy (78) RePEc:trf:wpaper:122 Multi-battle contests (2006). SFB/TR 15 Governance and the Efficiency of Economic Systems, University of Mannheim / Discussion Papers (79) RePEc:trf:wpaper:125 Contests with multi-tasking (2006). SFB/TR 15 Governance and the Efficiency of Economic Systems, University of Mannheim / Discussion Papers (80) RePEc:ubs:wpaper:ubs0606 The Capital Structure of Multinational Companies Under Tax Competition (2006). University of Brescia, Department of Economics / Working Papers (81) RePEc:ucn:wpaper:200613 Where Do the Sick Go? Health Insurance and Employment in Small and Large Firms (2006). School Of Economics, University College Dublin / Working Papers (82) RePEc:udb:wpaper:uwec-2007-17-p Education, Corruption and Constitutional Reform (2006). University of Washington, Department of Economics / Working Papers (83) RePEc:usg:dp2006:2006-16 Extensive and Intensive Investment and the Dead Weight Loss of Corporate Taxation (2006). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2006 (84) RePEc:usg:dp2006:2006-17 Exports, Foreign Direct Investment and the Costs of Corporate Taxation (2006). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2006 (85) RePEc:uto:dipeco:200605 Declared vs. revealed yardstick competition: local government efficiency in Norway (2006). University of Turin / Department of Economics Working Papers (86) RePEc:wbk:wbrwps:4064 Public infrastructure and growth : new channels and policy implications (2006). The World Bank / Policy Research Working Paper Series (87) RePEc:wly:jpamgt:v:25:y:2006:i:3:p:691-735 Aiming for evidence-based gun policy (2006). Journal of Policy Analysis and Management Recent citations received in: 2005 (1) RePEc:aah:aarhec:2005-21 Tax-tariff reform with costs of tax administration (2005). Department of Economics, University of Aarhus / Department of Economics, Working Papers (2) RePEc:adl:wpaper:2005-15 Regional Trade Agreements (2005). University of Adelaide, School of Economics / Working Papers (3) RePEc:adl:wpaper:2005-18 How are Oil Revenues Redistributed in an Oil Economy? The Case of Kazakhstan (2005). University of Adelaide, School of Economics / Working Papers (4) RePEc:aea:aecrev:v:95:y:2005:i:3:p:530-545 The Willingness to Pay–Willingness to Accept Gap, the Endowment Effect, Subject Misconceptions, and Experimental Procedures for Eliciting Valuations (2005). American Economic Review (5) RePEc:aea:aecrev:v:95:y:2005:i:4:p:960-980 Fairness and Redistribution (2005). American Economic Review (6) RePEc:aea:aecrev:v:95:y:2005:i:5:p:1525-1547 How Do Hospitals Respond to Price Changes? (2005). American Economic Review (7) RePEc:ags:aaea05:19123 EMPOWERING POOR RURAL WOMEN IN INDIA: EMPIRICAL EVIDENCE FROM ANDHRA PRADESH (2005). American Agricultural Economics Association (New Name 2008: Agricultural and Applied Economics Association) / 2005 Annual meeting, July 24-27, Provide (8) RePEc:ags:eaae05:24696 Spousal Effect and Timing of Farmers Early Retirement Decisions (2005). European Association of Agricultural Economists / 2005 International Congress, August 23-27, 2005, Copenhagen, Denmark (9) RePEc:ags:eaae94:24412 Timing of the Early Retirement Decisions of Farming Couples (2005). European Association of Agricultural Economists / 94th Seminar, April 9-10, 2005, Ashford, UK (10) RePEc:auu:dpaper:488 Optimal Design of Earned Income Tax Credits: Evidence from a British Natural Experiment (2005). Centre for Economic Policy Research, RSSS, ANU / Discussion Papers (11) RePEc:bos:iedwpr:dp-152 Decentralization, Corruption and Government Accountability: An Overview (2005). Boston University - Department of Economics / Boston University - Department of Economics - The Institute for Economic Development Working Papers Seri (12) RePEc:bos:wpaper:wp2005-023 Decentralization, Corruption And Government Accountability: An Overview (2005). Department of Economics, Boston University / Boston University Working Papers Series (13) RePEc:cdx:dpaper:2005-07 Testing for feedback-conditional regret effects using a natural lottery (2005). The Centre for Decision Research and Experimental Economics, School of Economics, University of Nottingham / Discussion Papers (14) RePEc:ces:ceswps:_1429 Optimal Redistributive Taxation when Governmentâs and Agentsâ Preferences Differ (2005). CESifo GmbH / CESifo Working Paper Series (15) RePEc:ces:ceswps:_1466 Pawns and Queens Revisited: Public Provision of Private Goods when Individuals make Mistakes (2005). CESifo GmbH / CESifo Working Paper Series (16) RePEc:ces:ceswps:_1542 Early Retirement: Free Choice or Forced Decision (2005). CESifo GmbH / CESifo Working Paper Series (17) RePEc:ces:ceswps:_1568 Risk Sharing and Efficiency Implications of Progressive Pension Arrangements (2005). CESifo GmbH / CESifo Working Paper Series (18) RePEc:ces:ceswps:_1592 Optimal Tax Policy when Firms are Internationally Mobile (2005). CESifo GmbH / CESifo Working Paper Series (19) RePEc:chk:cuhkdc:00010 Relative Performance Evaluation and the Turnover of Provincial Leaders in China (2005). Chinese University of Hong Kong, Department of Economics / Discussion Papers (20) RePEc:cla:levrem:784828000000000476 Modeling the Psychology of Consumer and Firm Behavior with Behavioral Economics (2005). UCLA Department of Economics / Levine's Bibliography (21) RePEc:cor:louvco:2005056 Balance of power and divergence of policies in a model of electoral competition (2005). Université catholique de Louvain, Center for Operations Research and Econometrics (CORE) / Discussion Papers (22) RePEc:cpb:discus:52 Early retirement behaviour in the Netherlands; evidence from a policy reform. (2005). CPB Netherlands Bureau for Economic Policy Analysis / CPB Discussion Papers (23) RePEc:cpr:ceprdp:5013 Democratic Mechanisms: Double Majority Rules and Flexible Agenda Costs (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (24) RePEc:cpr:ceprdp:5018 Peer Effects in Austrian Schools (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (25) RePEc:cpr:ceprdp:5047 Human Capital and Optimal Positive Taxation of Capital Income (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (26) RePEc:cpr:ceprdp:5170 Optimum Income Taxation and Layoff Taxes (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (27) RePEc:cpr:ceprdp:5218 Make Trade not War? (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (28) RePEc:cpr:ceprdp:5227 Whats the monetary value of distributive justice? (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (29) RePEc:cpr:ceprdp:5267 Factor Adjustments after Deregulation: Panel Evidence from Colombian Plants (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (30) RePEc:cpr:ceprdp:5274 A Political Economy Theory of the Soft Budget Constraint (2005). C.E.P.R. Discussion Papers / CEPR Discussion Papers (31) RePEc:crs:ecosta:es381-382b Why Are Low-Income Households Paying Increasingly High Rents? The Effect of Housing Benefit in France (1973-2002) (2005). Economie et Statistique (32) RePEc:ctl:louvec:2005007 Equilibrium Evaluation of Active Labor Market Programmes Enhancing Matching Effectiveness (2005). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (33) RePEc:ctl:louvec:2005033 Pareto-Improving Unemployment Policies (2005). Université catholique de Louvain, Département des Sciences Economiques / Université catholique de Louvain, Département des Sciences Economiques Workin (34) RePEc:deg:conpap:c010_054 Natural Resources, Innovation, and Growth (2005). Dynamics, Economic Growth, and International Trade (DEGIT) / Conference Papers (35) RePEc:dgr:kubcen:2005130 Labour Force Participation of the Elderly in Europe: The Importance of Being Healthy (2005). Tilburg University, Center for Economic Research / Discussion Paper (36) RePEc:dgr:umamet:2005032 In Search of Stars: Network Formation among Heterogeneous Agents (2005). Maastricht : METEOR, Maastricht Research School of Economics of Technology and Organization / Research Memoranda (37) RePEc:dgr:uvatin:20050035 Human Capital and Optimal Positive Taxation of Capital Income (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (38) RePEc:dgr:uvatin:20050119 The Anatomy of Job Satisfaction and the Role of Contingent Employment Contracts (2005). Tinbergen Institute / Tinbergen Institute Discussion Papers (39) RePEc:dnb:dnbwpp:064 Risk Sharing and Efficiency Implications of Progressive Pension Arrangements (2005). Netherlands Central Bank, Research Department / DNB Working Papers (40) RePEc:ecl:harjfk:rwp05-047 Insuring Consumption and Happiness through Religious Organizations (2005). Harvard University, John F. Kennedy School of Government / Working Paper Series (41) RePEc:ecl:prirpe:10-04-2005 Local Public Good Provision: Voting, Peer Effects, and Mobility (2005). Princeton University, Research Program in Political Economy / Papers (42) RePEc:esi:discus:2005-38 Collaborative Networks in Experimental Triopolies (2005). Max Planck Institute of Economics, Strategic Interaction Group / Discussion Papers on Strategic Interaction (43) RePEc:hal:wpaper:hal-00243022_v1 The régulation of transborder network services (2005). HAL / Working Papers (44) RePEc:hhs:gunwpe:0164 Tax avoidance and intra-family transfers (2005). Göteborg University, Department of Economics / Working Papers in Economics (45) RePEc:hhs:lunewp:2005_027 The Problem of Cooperation and Reputation Based Choice (2005). Lund University, Department of Economics / Working Papers (46) RePEc:hhs:nhhfms:2005_008 Access regulation and cross-border mergers: Is international coordination beneficial? (2005). Department of Finance and Management Science, Norwegian School of Economics and Business Administration / Discussion Papers (47) RePEc:hhs:uunewp:2005_006 Tax Avoidance and Intra-Family Transfers (2005). Uppsala University, Department of Economics / Working Paper Series (48) RePEc:ide:wpaper:1535 The Stability Threshold and Two Facets of Polarization (2005). Institut d'Ãconomie Industrielle (IDEI), Toulouse / IDEI Working Papers (49) RePEc:ieb:wpaper:330932art1 Expenditure spillovers and fiscal interactions: Empirical evidence from local governments in Spain (2005). Institut d'Economia de Barcelona (IEB) / Working Papers (50) RePEc:ifs:ifsewp:05/14 Measuring the marginal efficiency cost of redistribution in the UK (2005). Institute for Fiscal Studies / IFS Working Papers (51) RePEc:ihs:ihsesp:170 Peer Effects in Austrian Schools (2005). Institute for Advanced Studies / Economics Series (52) RePEc:imf:imfwpa:05/160 What Causes Firms to Hide Output? The Determinants of Informality (2005). International Monetary Fund / IMF Working Papers (53) RePEc:ivi:wpasad:2005-12 PEER GROUP EFFECTS AND OPTIMAL EDUCATION SYSTEM (2005). Instituto Valenciano de Investigaciones Económicas, S.A. (Ivie) / Working Papers. Serie AD (54) RePEc:iza:izadps:dp1460 Optimal Redistributive Taxation in a Search Equilibrium Model (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (55) RePEc:iza:izadps:dp1526 Equilibrium Evaluation of Active Labor Market Programmes Enhancing Matching Effectiveness (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (56) RePEc:iza:izadps:dp1573 It Wasnââ¬â¢t Me, It Was Them! Social Influence in Risky Behavior by Adolescents (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (57) RePEc:iza:izadps:dp1678 Optimum Income Taxation and Layoff Taxes (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (58) RePEc:iza:izadps:dp1679 The Perverse Effects of Partial Employment Protection Reform: Experience Rating and French Older Workers (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (59) RePEc:iza:izadps:dp1754 In Search of Stars: Network Formation among Heterogeneous Agents (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (60) RePEc:iza:izadps:dp1887 Labour Force Participation of the Elderly in Europe: The Importance of Being Healthy (2005). Institute for the Study of Labor (IZA) / IZA Discussion Papers (61) RePEc:jku:econwp:2005_02 Peer effects in Austrian schools (2005). Department of Economics, Johannes Kepler University Linz, Austria / Economics working papers (62) RePEc:kap:enreec:v:32:y:2005:i:1:p:55-89 Preference Anomalies, Preference Elicitation and the Discovered Preference Hypothesis (2005). Environmental & Resource Economics (63) RePEc:kap:itaxpf:v:12:y:2005:i:4:p:475-492 On Spatial Public Finance Empirics (2005). International Tax and Public Finance (64) RePEc:kap:jrisku:v:30:y:2005:i:1:p:63-97 Updating Subjective Risks in the Presence of Conflicting Information: An Application to Climate Change (2005). Journal of Risk and Uncertainty (65) RePEc:kap:jrisku:v:31:y:2005:i:2:p:217-236 Individual and Household Values of Mortality Reductions with Intrahousehold Bargaining (2005). Journal of Risk and Uncertainty (66) RePEc:kap:pubcho:v:122:y:2005:i:1:p:39-68 Testing the Mill hypothesis of fiscal illusion (2005). Public Choice (67) RePEc:liv:livedp:200512 Network Learning, Principal-Agent Conflict, and Award-Winning Wine-Making in Chiles Colchagua Valley (2005). University of Liverpool, Department of Economics and Accounting / Research Papers (68) RePEc:mcm:deptwp:2005-01 Keeping It Off The Books: An Empirical Investigation Into the Characteristics of Firms That Engage In Tax Non-Compliance (2005). McMaster University / Department of Economics Working Papers (69) RePEc:mpg:wpaper:2005_24 Ostracism and the Provision of a Public Good, Experimental Evidence (2005). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods (70) RePEc:nbr:nberwo:11091 Stemming the Tide? The Effect of Expanding Medicaid Eligibility on Health Insurance (2005). National Bureau of Economic Research, Inc / NBER Working Papers (71) RePEc:nbr:nberwo:11194 Testing, Crime and Punishment (2005). National Bureau of Economic Research, Inc / NBER Working Papers (72) RePEc:nbr:nberwo:11241 Corporate Tax Avoidance and Firm Value (2005). National Bureau of Economic Research, Inc / NBER Working Papers (73) RePEc:nbr:nberwo:11332 Faith-Based Charity and Crowd Out during the Great Depression (2005). National Bureau of Economic Research, Inc / NBER Working Papers (74) RePEc:nbr:nberwo:11420 Do Report Cards Tell Consumers Anything They Dont Already Know? The Case of Medicare HMOs (2005). National Bureau of Economic Research, Inc / NBER Working Papers (75) RePEc:nbr:nberwo:11463 Principals as Agents: Subjective Performance Measurement in Education (2005). National Bureau of Economic Research, Inc / NBER Working Papers (76) RePEc:nbr:nberwo:11539 The Collection Efficiency of the Value Added Tax: Theory and International Evidence (2005). National Bureau of Economic Research, Inc / NBER Working Papers (77) RePEc:nbr:nberwo:11568 The Impact of Child SSI Enrollment on Household Outcomes: Evidence from the Survey of Income and Program Participation (2005). National Bureau of Economic Research, Inc / NBER Working Papers (78) RePEc:nbr:nberwo:11681 Poverty in America: Trends and Explanations (2005). National Bureau of Economic Research, Inc / NBER Working Papers (79) RePEc:nbr:nberwo:11686 Who Bears the Corporate Tax? A review of What We Know (2005). National Bureau of Economic Research, Inc / NBER Working Papers (80) RePEc:nbr:nberwo:11700 Good bye Lenin (or not?): The Effect of Communism on Peoples Preferences (2005). National Bureau of Economic Research, Inc / NBER Working Papers (81) RePEc:nbr:nberwo:11720 Local Public Good Provision: Voting, Peer Effects, and Mobility (2005). National Bureau of Economic Research, Inc / NBER Working Papers (82) RePEc:nbr:nberwo:11725 Using Experimental Economics to Measure the Effects of a Natural Educational Experiment on Altruism (2005). National Bureau of Economic Research, Inc / NBER Working Papers (83) RePEc:nbr:nberwo:11786 Pay Inequality, Pay Secrecy, and Effort: Theory and Evidence (2005). National Bureau of Economic Research, Inc / NBER Working Papers (84) RePEc:nbr:nberwo:11811 Aching to Retire? The Rise in the Full Retirement Age and its Impact on the Disability Rolls (2005). National Bureau of Economic Research, Inc / NBER Working Papers (85) RePEc:ner:maastr:urn:nbn:nl:ui:27-16452 Tax liability side equivalence in gift-exchange labor markets. (2005). Maastricht University / Open Access publications from Maastricht University (86) RePEc:noj:journl:v:31:y:2005:p:111-125 Why is there so little redistribution? (2005). Nordic Journal of Political Economy (87) RePEc:nst:samfok:5305 Decentralization with Property Taxation to Improve Incentives: Evidence from Local Governmentsâ Discrete Choice (2005). Department of Economics, Norwegian University of Science and Technology / Working Paper Series (88) RePEc:pid:journl:v:44:y:2005:i:3:p:253-269 Determinants of Collective Action under Devolution Initiatives: The Case of Citizen Community Boards in Pakistan (2005). The Pakistan Development Review (89) RePEc:pra:mprapa:17601 A Sensitivity Analysis of the Elasticity of Taxable Income (2005). University Library of Munich, Germany / MPRA Paper (90) RePEc:pra:mprapa:18214 Tax systems and tax reforms in south and East Asia: Overview of the tax systems and main policy tax issues (2005). University Library of Munich, Germany / MPRA Paper (91) RePEc:pra:mprapa:1869 Tax Systems and Tax Reforms in South and East Asia: Overview of Tax Systems and main policy issues (2005). University Library of Munich, Germany / MPRA Paper (92) RePEc:pra:mprapa:6870 The paradox of Happiness: towards an alternative explanation (2005). University Library of Munich, Germany / MPRA Paper (93) RePEc:pse:psecon:2005-43 Deliver us from evil: religion as insurance. (2005). PSE (Ecole normale supérieure) / PSE Working Papers (94) RePEc:rpi:rpiwpe:0503 Environmental Awareness and Happiness (2005). Rensselaer Polytechnic Institute, Department of Economics / Rensselaer Working Papers in Economics (95) RePEc:ses:arsjes:2005-iii-7 A New Approach to Pollution Modelling in Models of the Environmental Kuznets Curve (2005). Swiss Journal of Economics and Statistics (SJES) (96) RePEc:taf:jdevst:v:41:y:2005:i:5:p:788-838 The Social Impact of Social Funds in Jamaica: A Participatory Econometric’ Analysis of Targeting, Collective Action, and Participation in Community-Driven Development (2005). The Journal of Development Studies (97) RePEc:taf:jdevst:v:41:y:2005:i:5:p:839-864 Targeting at the Margin: the Glass of Milk’ Subsidy Programme in Peru (2005). The Journal of Development Studies (98) RePEc:tor:tecipa:tecipa-241 Market Structure and Communicable Diseases (2005). University of Toronto, Department of Economics / Working Papers (99) RePEc:ttp:itpwps:0503 VAT in Ukraine: An Interim Report (2005). International Tax Program, Institute for International Business, Joseph L. Rotman School of Management, University of Toronto / Working Papers (100) RePEc:tuf:tuftec:0509 Income Segregation from Local Income Taxation When Households Differ in Both Preferences and Incomes (2005). Department of Economics, Tufts University / Discussion Papers Series, Department of Economics, Tufts University More than 100 citations. List broken... Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||