|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

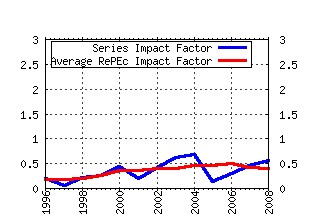

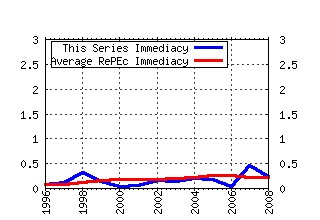

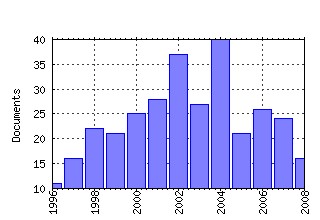

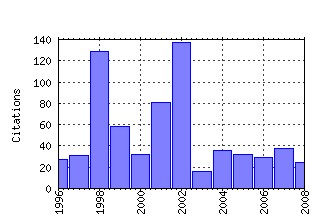

Financial Markets Group and ESRC / FMG Discussion Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:fmg:fmgdps:dp406 Family Firms (2002). (2) RePEc:fmg:fmgdps:dp580 Market Liquidity and Funding Liquidity (2007). (3) RePEc:fmg:fmgdps:dp412 Market Timing and Return Prediction under Model Instability (2002). (4) RePEc:fmg:fmgdps:dp306 Optimal Monetary Policy in a Model of Asymmetric Central Bank Preferences (1998). (5) RePEc:fmg:fmgdps:dp298 Beyond the Sample: Extreme Quantile and Probability Estimation (1998). (6) RePEc:fmg:fmgdps:dp303 Data-Snooping, Technical Trading, Rule Performance and the Bootstrap (1998). (7) RePEc:fmg:fmgdps:dp408 Coordination Failures and the Lender of Last Resort: Was Bagehot Right After All? (2002). (8) RePEc:fmg:fmgdps:dp375 Housing Market Dynamics: on the Contribution of Income Shocks and Credit Constraints (2001). (9) RePEc:fmg:fmgdps:dp313 A Model of the Lender of Last Resort (1999). (10) RePEc:fmg:fmgdps:dp296 Housing Market Fluctuations in a Life-Cycle Economy with Credit Constraints (1998). (11) RePEc:fmg:fmgdps:dp247 Optimal Monetary Policy Rules in a Rational Expectations Model of the Phillips Curve (1996). (12) RePEc:fmg:fmgdps:dp378 Agency Conflicts, Ownership Concentration, and Legal Shareholder Protection (2001). (13) RePEc:fmg:fmgdps:dp502 Estimation and Testing of Dynamic Models with Generalised Hyperbolic Innovations (2004). (14) RePEc:fmg:fmgdps:dp310 Boom In, Bust Out: Young Households and the Housing Price Cycle (1998). (15) RePEc:fmg:fmgdps:dp292 Informed Trading, Investment, and Welfare (1998). (16) RePEc:fmg:fmgdps:dp373 Coordination Risk and the Price of Debt (2001). (17) RePEc:fmg:fmgdps:dp572 Recovery Rates, Default Probabilities and the Credit Cycle (2006). (18) RePEc:fmg:fmgdps:dp253 Nonlinear Time Series With Long Memory: A Model for Stochastic Volatility (1997). (19) RePEc:fmg:fmgdps:dp320 Real Trading Patterns and Prices in Spot Foreign Exchange Markets (1999). (20) RePEc:fmg:fmgdps:dp407 Consistent Testing for Stochastic Dominance: A Subsampling Approach (2002). (21) RePEc:fmg:fmgdps:dp547 The Interest Rate Conditioning Assumption (2005). (22) RePEc:fmg:fmgdps:dp271 R&D Intensity and Finance: Are Innovative Firms Financially Constrained? (1997). (23) RePEc:fmg:fmgdps:dp326 Bank Moral Hazard and Market Discipline (1999). (24) RePEc:fmg:fmgdps:dp483 (IAM Series No 003) Simple Tests for Models of Dependence Between Multiple Financial Time Series, with Applications to U.S. Equity Returns and Exchange Rates (2004). (25) RePEc:fmg:fmgdps:dp318 Moral Hazard, Insurance and Some Collusion (1999). (26) RePEc:fmg:fmgdps:dp362 Liquidity and Credit Risk (2000). (27) RePEc:fmg:fmgdps:dp160 UK Directors Trading: The Impact of Dealings in Smaller Firms (1993). (28) RePEc:fmg:fmgdps:dp238 Announcement Effects and Seasonality in the Intra-day Foreign Exchange Market (1996). (29) RePEc:fmg:fmgdps:dp216 Central Bank Reputation and Conservativeness (1995). (30) RePEc:fmg:fmgdps:dp334 Insider Trading, Investment and Liquidity: A Welfare Analysis (1999). (31) RePEc:fmg:fmgdps:dp357 External Financing Costs and Banks Loan Supply: Does the Structure of the Bank Sector Matter? (2000). (32) RePEc:fmg:fmgdps:dp372 Does One Soros Make a Difference? A Theory of Currency Crises with Large and Small Traders (2001). (33) RePEc:fmg:fmgdps:dp428 Internal ratings, the business cycle and capital requirements: some evidence from an emerging market economy (2002). (34) RePEc:fmg:fmgdps:dp71 News and the Foreign Exchange Market (1990). (35) RePEc:fmg:fmgdps:dp421 In-Kind Finance (2002). (36) RePEc:fmg:fmgdps:dp264 An Investigation of Long Range Dependence in Intra-Day Foreign Exchange Rate Volatility (1997). (37) RePEc:fmg:fmgdps:dp401 Bubbles and Crashes (2002). (38) RePEc:fmg:fmgdps:dp327 Optimal Bail Out Policy, Conditionality and Creative Ambiguity (1999). (39) RePEc:fmg:fmgdps:dp450 Equilibrium analysis, banking, contagion and financial fragility (2003). (40) RePEc:fmg:fmgdps:dp248 Maximum Likelihood Estimation of Stochastic Volatility Models (1996). (41) RePEc:fmg:fmgdps:dp607 Bond Supply and Excess Bond Returns (2008). (42) RePEc:fmg:fmgdps:dp393 What Happens When You Regulate Risk? Evidence from a Simple Equilibrium Model (2001). (43) RePEc:fmg:fmgdps:dp418 You Might as Well be Hung for a Sheep as a Lamb: The Loss Function of an Agent (2002). (44) RePEc:fmg:fmgdps:dp613 Do Reputational Concerns Lead to Reliable Ratings? (2008). (45) RePEc:fmg:fmgdps:dp435 Coordination, Learning, and Delay (2002). (46) RePEc:fmg:fmgdps:dp548 On Modelling Endogenous Default (2005). (47) RePEc:fmg:fmgdps:dp610 Can Rare Events Explain the Equity Premium Puzzle? (2008). (48) RePEc:fmg:fmgdps:dp305 A Dilution Cost Approach to Financial Intermediation and Securities Markets (1998). (49) RePEc:fmg:fmgdps:dp336 A Simple Model of an International Lender of Last Resort (1999). (50) RePEc:fmg:fmgdps:dp383 Is There Chaos in the World Economy? A Nonparametric Test Using Consistent Standard Errors (2001). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:nbr:nberwo:14087 A Gap-Filling Theory of Corporate Debt Maturity Choice (2008). National Bureau of Economic Research, Inc / NBER Working Papers (2) RePEc:nbr:nberwo:14242 The Macroeconomic Implications of a Key Currency (2008). National Bureau of Economic Research, Inc / NBER Working Papers (3) RePEc:pra:mprapa:11918 Information Exchange and the Limits of Arbitrage (2008). University Library of Munich, Germany / MPRA Paper (4) RePEc:pra:mprapa:12621 Information Exchange and the Limits of Arbitrage (2008). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2007 (1) RePEc:cpr:ceprdp:6117 Slow Moving Capital (2007). C.E.P.R. Discussion Papers / CEPR Discussion Papers (2) RePEc:ecl:ohidic:2006-11 Information, Trading Volume, and International Stock Return Comovements: Evidence from Cross-Listed Stocks (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (3) RePEc:ecl:ohidic:2007-16 Common Patterns in Commonality in Returns, Liquidity, and Turnover around the World (2007). Ohio State University, Charles A. Dice Center for Research in Financial Economics / Working Paper Series (4) RePEc:fip:fedlwp:2007-052 The microstructure of the U.S. treasury market (2007). Federal Reserve Bank of St. Louis / Working Papers (5) RePEc:fip:fednsr:291 Hedge funds, financial intermediation, and systemic risk (2007). Federal Reserve Bank of New York / Staff Reports (6) RePEc:hhs:rbnkwp:0215 Earnings Inequality and the Equity Premium (2007). Sveriges Riksbank (Central Bank of Sweden) / Working Paper Series (7) RePEc:nbr:nberwo:12877 Slow Moving Capital (2007). National Bureau of Economic Research, Inc / NBER Working Papers (8) RePEc:nbr:nberwo:12887 Liquidity and Risk Management (2007). National Bureau of Economic Research, Inc / NBER Working Papers (9) RePEc:nbr:nberwo:13658 How Sovereign is Sovereign Credit Risk? (2007). National Bureau of Economic Research, Inc / NBER Working Papers (10) RePEc:usg:dp2007:2007-22 Safe Haven Currencies (2007). Department of Economics, University of St. Gallen / University of St. Gallen Department of Economics working paper series 2007 (11) RePEc:wbk:wbrwps:4445 Emerging market liquidity and crises (2007). The World Bank / Policy Research Working Paper Series Recent citations received in: 2006 (1) RePEc:cfs:cfswop:wp200612 Why Do Contracts Differ between VC Types? Market Segmentation versus Corporate Governance Varieties (2006). Center for Financial Studies / CFS Working Paper Series Recent citations received in: 2005 (1) RePEc:csl:devewp:202 Prolonged Use and Conditionality Failure: Investigating the IMF Responsibility (2005). Centro Studi Luca d'Agliano, University of Milano / Development Working Papers (2) RePEc:ecb:ecbwps:20050564 Forecasting the central bankâs inflation objective is a good rule of thumb (2005). European Central Bank / Working Paper Series (3) RePEc:kap:annfin:v:1:y:2005:i:2:p:197-224 A risk assessment model for banks (2005). Annals of Finance (4) RePEc:ner:leuven:urn:hdl:123456789/122216 Risk measurement with the equivalent utility principles. (2005). Katholieke Universiteit Leuven / Open Access publications from Katholieke Universiteit Leuven Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||