|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

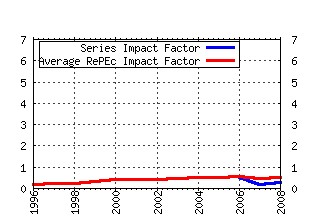

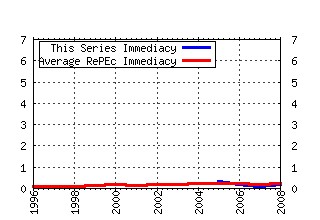

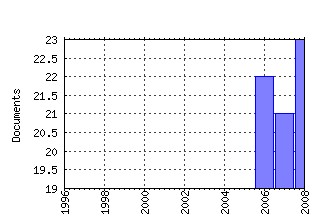

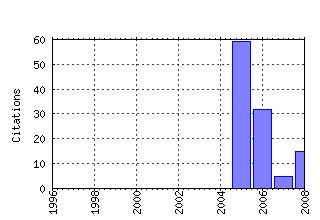

Annals of Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:annfin:v:1:y:2005:i:1:p:35-50 On user costs of risky monetary assets (2005). (2) RePEc:kap:annfin:v:1:y:2005:i:2:p:197-224 A risk assessment model for banks (2005). (3) RePEc:kap:annfin:v:1:y:2005:i:2:p:149-177 Relative arbitrage in volatility-stabilized markets (2005). (4) RePEc:kap:annfin:v:2:y:2006:i:1:p:1-21 A Time Series Analysis of Financial Fragility in the UK Banking System (2006). (5) RePEc:kap:annfin:v:2:y:2006:i:3:p:229-258 The Discounted Economic Stock of Money with VAR Forecasting (2006). (6) RePEc:kap:annfin:v:1:y:2005:i:2:p:109-147 Determinants of stock market volatility and risk premia (2005). (7) RePEc:kap:annfin:v:2:y:2006:i:3:p:259-285 Heterogeneous Beliefs, the Term Structure and Time-varying Risk Premia (2006). (8) RePEc:kap:annfin:v:1:y:2005:i:3:p:267-292 American options: the EPV pricing model (2005). (9) RePEc:kap:annfin:v:5:y:2009:i:3:p:341-359 Small firms in the SSBF (2009). (10) RePEc:kap:annfin:v:2:y:2006:i:1:p:51-71 Risk measure pricing and hedging in incomplete markets (2006). (11) RePEc:kap:annfin:v:1:y:2005:i:4:p:423-432 Option pricing and Esscher transform under regime switching (2005). (12) RePEc:kap:annfin:v:4:y:2008:i:1:p:75-103 Who controls Allianz? (2008). (13) RePEc:kap:annfin:v:2:y:2006:i:1:p:101-122 Stochastic equilibria for economies under uncertainty with intertemporal substitution (2006). (14) RePEc:kap:annfin:v:4:y:2008:i:1:p:1-28 Optimal portfolio allocation with higher moments (2008). (15) RePEc:kap:annfin:v:1:y:2005:i:1:p:73-107 On the microstructure of price determination and information aggregation with sequential and asymmetric information arrival in an experimental asset market (2005). (16) RePEc:kap:annfin:v:1:y:2005:i:3:p:293-326 Completion time structures of stock price movements (2005). (17) RePEc:kap:annfin:v:3:y:2007:i:1:p:155-192 Devaluation with contract redenomination in Argentina (2007). (18) RePEc:kap:annfin:v:5:y:2009:i:3:p:465-494 Entrepreneurship and firm heterogeneity with limited enforcement (2009). (19) RePEc:kap:annfin:v:1:y:2005:i:4:p:433-445 The non-neutrality of debt in investment timing: a new NPV rule (2005). (20) RePEc:kap:annfin:v:5:y:2009:i:3:p:295-311 Entrepreneurship in macroeconomics (2009). (21) RePEc:kap:annfin:v:4:y:2008:i:2:p:183-195 Capital market equilibrium without riskless assets: heterogeneous expectations (2008). (22) RePEc:kap:annfin:v:3:y:2007:i:1:p:131-153 Pursuing financial stability under an inflation-targeting regime (2007). (23) RePEc:kap:annfin:v:5:y:2009:i:3:p:443-464 A dynamic model of entrepreneurship with borrowing constraints: theory and evidence (2009). (24) RePEc:kap:annfin:v:2:y:2006:i:4:p:407-420 Common Shocks and Relative Compensation (2006). (25) RePEc:kap:annfin:v:6:y:2010:i:2:p:157-191 The fundamental theorem of asset pricing for continuous processes under small transaction costs (2010). (26) RePEc:kap:annfin:v:3:y:2007:i:1:p:75-105 An equilibrium approach to financial stability analysis: the Colombian case (2007). (27) RePEc:kap:annfin:v:5:y:2009:i:3:p:313-340 A conversation with 590 Nascent Entrepreneurs (2009). (28) RePEc:kap:annfin:v:1:y:2005:i:1:p:1-34 Junior must pay: pricing the implicit put in privatizing Social Security (2005). (29) RePEc:kap:annfin:v:4:y:2008:i:2:p:255-268 On the semimartingale property via bounded logarithmic utility (2008). (30) RePEc:kap:annfin:v:5:y:2009:i:3:p:521-541 Uninsurable investment risks and capital income taxation (2009). (31) RePEc:kap:annfin:v:5:y:2009:i:2:p:231-241 The profitability of carry trades (2009). (32) RePEc:kap:annfin:v:2:y:2006:i:2:p:225-227 Hedging decisions with price and output uncertainty (2006). (33) RePEc:kap:annfin:v:3:y:2007:i:1:p:107-130 Financial stability and Basel II (2007). (34) RePEc:kap:annfin:v:4:y:2008:i:4:p:455-480 Informational leverage: the problem of noise traders (2008). (35) RePEc:kap:annfin:v:5:y:2009:i:3:p:397-419 The financing of small entrepreneurs in Italy (2009). (36) RePEc:kap:annfin:v:2:y:2006:i:4:p:397-405 Generalised Rational Bias in Financial Forecasts (2006). (37) RePEc:kap:annfin:v:4:y:2008:i:3:p:369-397 Balance, growth and diversity of financial markets (2008). (38) RePEc:kap:annfin:v:3:y:2007:i:2:p:241-255 An empirical model for durations in stocks (2007). (39) RePEc:kap:annfin:v:2:y:2006:i:3:p:287-301 Arbitrage Opportunities in Diverse Markets via a Non-equivalent Measure Change (2006). (40) RePEc:kap:annfin:v:4:y:2008:i:3:p:305-344 Solving an asset pricing model with hybrid internal and external habits, and autocorrelated Gaussian shocks (2008). (41) RePEc:kap:annfin:v:6:y:2010:i:1:p:1-32 Macroeconomics of bank interest spreads: evidence from Brazil (2010). (42) RePEc:kap:annfin:v:3:y:2007:i:1:p:5-35 Financial distress, bankruptcy law and the business cycle (2007). (43) RePEc:kap:annfin:v:5:y:2009:i:3:p:495-519 Self-employment rates and business size: the roles of occupational choice and credit market frictions (2009). (44) RePEc:kap:annfin:v:5:y:2009:i:1:p:15-48 Small caps in international equity portfolios: the effects of variance risk (2009). (45) RePEc:kap:annfin:v:4:y:2008:i:1:p:55-74 A PDE approach for risk measures for derivatives with regime switching (2008). (46) RePEc:kap:annfin:v:4:y:2008:i:4:p:445-454 Short-term relative arbitrage in volatility-stabilized markets (2008). (47) RePEc:kap:annfin:v:3:y:2007:i:3:p:351-367 A multicriteria discrimination approach for the credit rating of Asian banks (2007). (48) RePEc:kap:annfin:v:5:y:2009:i:3:p:361-396 Minority self-employment in the United States and the impact of affirmative action programs (2009). (49) RePEc:kap:annfin:v:1:y:2005:i:1:p:51-72 Shaking the tree: an agency-theoretic model of asset pricing (2005). (50) RePEc:kap:annfin:v:2:y:2006:i:4:p:327-355 Asset Pricing and Hedging in Financial Markets with Transaction Costs: An Approach Based on the Von Neumannââ¬âGale Model (2006). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:ebl:ecbull:v:3:y:2008:i:73:p:1-8 Some sufficient conditions for the existence of a competitive equilibrium in economies with satiated consumers (2008). Economics Bulletin (2) RePEc:jdi:wpaper:1 Credit Crises, Risk Management Systems and Liquidity Modelling (2008). John Deutsch Institute for the Study of Economic Policy / Working Papers (3) RePEc:kap:annfin:v:4:y:2008:i:4:p:431-444 Robust portfolio optimization with a generalized expected utility model under ambiguity (2008). Annals of Finance (4) RePEc:kap:jeczfn:v:95:y:2008:i:3:p:189-212 Ownership relations in the presence of cross-shareholding (2008). Journal of Economics - Zeitschrift für Nationalökonomie Recent citations received in: 2007 (1) RePEc:ffe:journl:v:4:y:2007:i:1:p:65-90 Multicriteria Framework for the Prediction of Corporate Failure in the UK (2007). Frontiers in Finance and Economics (2) RePEc:kap:annfin:v:3:y:2007:i:1:p:1-4 Financial stability: theory and applications (2007). Annals of Finance Recent citations received in: 2006 (1) RePEc:kan:wpaper:200607 Supply of Money (2006). University of Kansas, Department of Economics / WORKING PAPERS SERIES IN THEORETICAL AND APPLIED ECONOMICS (2) RePEc:nst:samfok:6806 Evaluation of macroeconomic models for financial stability analysis (2006). Department of Economics, Norwegian University of Science and Technology / Working Paper Series (3) RePEc:pra:mprapa:247 Risk Premia, diverse belief and beauty contests (2006). University Library of Munich, Germany / MPRA Paper (4) RePEc:pra:mprapa:419 Supply of Money (2006). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2005 (1) RePEc:fip:fedgfe:2005-52 Solving stochastic money-in-the-utility-function models (2005). Board of Governors of the Federal Reserve System (U.S.) / Finance and Economics Discussion Series (2) RePEc:fip:fedlrv:y:2005:i:nov:p:735-50:n:v.87no.6 Revisions to user costs for the Federal Reserve Bank of St. Louis monetary services indices (2005). Review (3) RePEc:kan:wpaper:200513 Exchange Rate Determination from Monetary Fundamentals: an Aggregation Theoretic Approach (2005). University of Kansas, Department of Economics / WORKING PAPERS SERIES IN THEORETICAL AND APPLIED ECONOMICS (4) RePEc:wpa:wuwpfi:0511001 General option exercise rules, with applications to embedded options and monopolistic expansion (2005). EconWPA / Finance (5) RePEc:wpa:wuwpit:0505004 Exchange Rate Determination from Monetary Fundamentals: an Aggregation Theoretic Approach (2005). EconWPA / International Trade (6) RePEc:wpa:wuwpmi:0510013 Discount factors ex post and ex ante, and discounted utility anomalies (2005). EconWPA / Microeconomics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||