|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

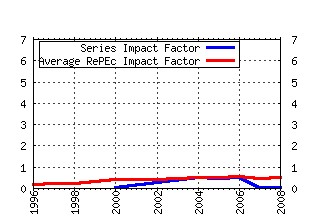

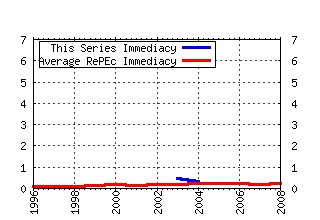

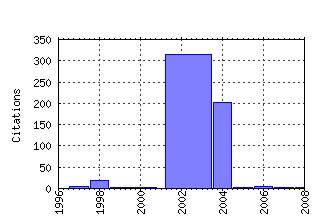

Asia-Pacific Financial Markets Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:kap:apfinm:v:10:y:2003:i:6:p:673-693 Taxation and Foreign Direct Investment: A Synthesis of Empirical Research (2003). (2) RePEc:kap:apfinm:v:10:y:2003:i:2:p:107-126 Evaluating Tax Policy for Location Decisions (2003). (3) RePEc:kap:apfinm:v:11:y:2004:i:5:p:601-622 The Effects of Bilateral Tax Treaties on U.S. FDI Activity (2004). (4) RePEc:kap:apfinm:v:10:y:2003:i:4:p:469-487 Taxing Multinationals (2003). (5) RePEc:kap:apfinm:v:10:y:2003:i:3:p:259-280 Is Targeted Tax Competition Less Harmful than its Remedies? (2003). (6) RePEc:kap:apfinm:v:11:y:2004:i:1:p:71-89 Debating Proposed Reforms of the Taxation of Corporate Income in the European Union (2004). (7) RePEc:kap:apfinm:v:10:y:2003:i:4:p:489-503 On Forest Rotation under Interest Rate Variability (2003). (8) RePEc:kap:apfinm:v:10:y:2003:i:6:p:651-671 Tax Competition and Tax Coordination in the European Union (2003). (9) RePEc:kap:apfinm:v:11:y:2004:i:4:p:469-485 Economic Effects of Taxing Different Organizational Forms under the Nordic Dual Income Tax (2004). (10) RePEc:kap:apfinm:v:11:y:2004:i:3:p:335-353 Quantifying the Impact of Immigration on the Spanish Welfare State (2004). (11) RePEc:kap:apfinm:v:11:y:2004:i:6:p:775-802 Tax Treaties and Foreign Direct Investment: Potential versus Performance (2004). (12) RePEc:kap:apfinm:v:11:y:2004:i:5:p:623-645 Agglomeration Effects and the Competition for Firms (2004). (13) RePEc:kap:apfinm:v:10:y:2003:i:3:p:211-228 Globalization and Risky Human-Capital Investment (2003). (14) RePEc:kap:apfinm:v:10:y:2003:i:6:p:713-734 Financing Retirement in the European Union (2003). (15) RePEc:kap:apfinm:v:10:y:2003:i:6:p:695-711 Exploring Formula Allocation for the European Union (2003). (16) RePEc:kap:apfinm:v:5:y:1998:i:2:p:99-128 Unconditional and Conditional Distributional Models for the Nikkei Index (1998). (17) RePEc:kap:apfinm:v:10:y:2003:i:2:p:189-203 Behavioral Public Finance: Tax Design as Price Presentation (2003). (18) RePEc:kap:apfinm:v:11:y:2004:i:1:p:91-115 Company Tax Reform in the European Union (2004). (19) RePEc:kap:apfinm:v:11:y:2004:i:4:p:487-506 Reduced Tax Progressivity in Norway in the Nineties: The Effect from Tax Changes (2004). (20) RePEc:kap:apfinm:v:10:y:2003:i:1:p:5-23 Urban Sprawl and the Property Tax (2003). (21) RePEc:kap:apfinm:v:11:y:2004:i:2:p:155-174 Revenue Sharing versus Expenditure Sharing in a Federal System (2004). (22) RePEc:kap:apfinm:v:11:y:2004:i:4:p:419-434 Conduit Entities: Implications of Indirect Tax-Efficient Financing Structures for Real Investment (2004). (23) RePEc:kap:apfinm:v:10:y:2003:i:5:p:549-564 Mobility and the Role of Education as a Commitment Device (2003). (24) RePEc:kap:apfinm:v:11:y:2004:i:2:p:221-234 Corporate Tax Harmonization in Europe: Its All About Compliance (2004). (25) RePEc:kap:apfinm:v:10:y:2003:i:4:p:419-434 The Double Dividend of Postponing Retirement (2003). (26) RePEc:kap:apfinm:v:11:y:2004:i:5:p:663-693 Sharing the Spoils: Taxing International Human Capital Flows (2004). (27) RePEc:kap:apfinm:v:11:y:2004:i:4:p:507-529 Improving the Equity-Efficiency Trade-Off: Mandatory Savings Accounts for Social Insurance (2004). (28) RePEc:kap:apfinm:v:11:y:2004:i:2:p:199-220 The European Commissions Report on Company Income Taxation: What the EU Can Learn from the Experience of the US States (2004). (29) RePEc:kap:apfinm:v:11:y:2004:i:1:p:1-22 Diversified Portfolios with Jumps in a Benchmark Framework (2004). (30) RePEc:kap:apfinm:v:10:y:2003:i:5:p:591-610 Addressing the Transfer-Pricing Problem in an Origin-Basis X Tax (2003). (31) RePEc:kap:apfinm:v:4:y:1997:i:2:p:97-124 Subordinated Market Index Models: A Comparison (1997). (32) RePEc:kap:apfinm:v:10:y:2003:i:5:p:535-547 Flypaper Effect and Sluggishness: Evidence from Regional Health Expenditure in Italy (2003). (33) RePEc:kap:apfinm:v:10:y:2003:i:4:p:403-418 The Distributional Efficiency of Alternative Regulatory Regimes: A Real Option Approach (2003). (34) RePEc:kap:apfinm:v:10:y:2003:i:2:p:87-127 A Class of Jump-Diffusion Bond Pricing Models within the HJM Framework (2003). (35) RePEc:kap:apfinm:v:10:y:2003:i:2:p:147-168 Employment and Welfare Effects of a Two-Tier Unemployment Compensation System (2003). (36) RePEc:kap:apfinm:v:10:y:2003:i:4:p:377-401 Market Power and the Power Market: Multi-Unit Bidding and (In)Efficiency in Electricity Auctions (2003). (37) RePEc:kap:apfinm:v:11:y:2004:i:4:p:369-390 Taxation and Venture Capital Backed Entrepreneurship (2004). (38) RePEc:kap:apfinm:v:11:y:2004:i:1:p:55-77 Understanding the Implied Volatility Surface for Options on a Diversified Index (2004). (39) RePEc:kap:apfinm:v:11:y:2004:i:4:p:391-417 Irrational Exuberance, Entrepreneurial Finance and Public Policy (2004). (40) RePEc:kap:apfinm:v:11:y:2004:i:1:p:17-29 The Marginal Cost of Funds and the Shadow Prices of Public Sector Inputs and Outputs (2004). (41) RePEc:kap:apfinm:v:11:y:2004:i:6:p:703-719 Political Sustainability and the Design of Environmental Taxes (2004). (42) RePEc:kap:apfinm:v:10:y:2003:i:1:p:29-44 Price Linkages in Asian Equity Markets: Evidence Bordering the Asian Economic, Currency and Financial Crises (2003). (43) RePEc:kap:apfinm:v:11:y:2004:i:3:p:243-263 Testing for Vertical Fiscal Externalities (2004). (44) RePEc:kap:apfinm:v:10:y:2003:i:2:p:127-145 Tax Competition and Foreign Capital (2003). (45) RePEc:kap:apfinm:v:10:y:2003:i:4:p:453-468 Redistributive Taxation in the Era of Globalization (2003). (46) RePEc:kap:apfinm:v:10:y:2003:i:6:p:625-649 How Much Tax Coordination in the European Union? (2003). (47) RePEc:kap:apfinm:v:10:y:2003:i:1:p:79-97 Network Externalities and Indirect Tax Preferences for Electronic Commerce (2003). (48) RePEc:kap:apfinm:v:11:y:2004:i:6:p:763-772 Competition in Unit vs. Ad Valorem Taxes (2004). (49) RePEc:kap:apfinm:v:5:y:1998:i:3:p:191-209 The Impact of the U.S. and the Japanese Equity Markets on the Emerging Asia-Pacific Equity Markets (1998). (50) RePEc:kap:apfinm:v:10:y:2003:i:5:p:511-533 Indirect Taxation in Greece: Evaluation and Possible Reform (2003). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||