|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

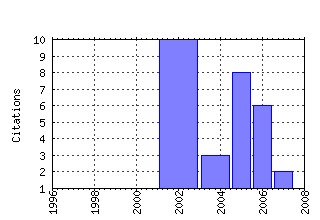

Magyar Nemzeti Bank (The Central Bank of Hungary) / MNB Occasional Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:mnb:opaper:2002/24 Adopting the euro in Hungary: expected costs, benefits and timing (2002). (2) RePEc:mnb:opaper:2006/60 The Hungarian Quarterly Projection Model (NEM) (2006). (3) RePEc:mnb:opaper:2004/30 The Effects of Macroeconomic News on Money Markets (2004). (4) RePEc:mnb:opaper:2005/46 Hungarian Inflation Dynamics (2005). (5) RePEc:mnb:opaper:2005/40 The sustainability of the Hungarian pension system: a reassessment (2005). (6) RePEc:mnb:opaper:2007/67 Basel II and financial stability: An investigation of sensitivity and cyclicality of capital requirements based on QIS 5 (2007). (7) RePEc:mnb:opaper:2005/38 Estimating the immediate impact of monetary policy shocks on the exchange rate and other asset prices in Hungary (2005). (8) RePEc:mnb:opaper:2002/10 Studies on the procyclical behaviour of banks (2002). (9) RePEc:mnb:opaper:2009/78 The information content of Hungarian sovereign CDS spreads (2009). (10) RePEc:mnb:opaper:2006/59 Adjustment of global imbalances: Illustrative scenarios for Hungary (2006). (11) RePEc:mnb:opaper:2006/52 Myths and Maths: Macroeconomic Effects of Fiscal Adjustments in Hungary (2006). (12) RePEc:mnb:opaper:2005/43 Potential Output Estimations for Hungary: A Survey of Different Approaches (2005). (13) RePEc:mnb:opaper:2008/64 The forint interest rate swap market and the main drivers of swap spreads (2008). (14) RePEc:mnb:opaper:2005/39 Implied volatility of foreign exchange options: is it worth tracking? (2005). (15) RePEc:mnb:opaper:2006/57 Topology of the Hungarian large-value transfer system (2006). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:imf:imfwpa:08/174 A Framework for Developing Secondary Markets for Government Securities (2008). International Monetary Fund / IMF Working Papers Recent citations received in: 2007 (1) RePEc:mnb:bullet:v:2:y:2007:i:2:p:47-53 Impacts of financial regulation on the cyclicality of banksâ capital requirements and on financial stability (2007). MNB Bulletin Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||