|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

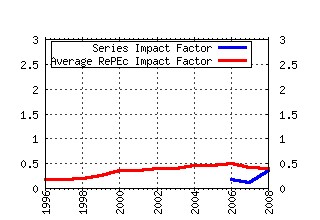

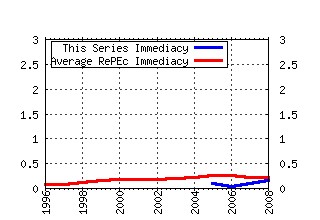

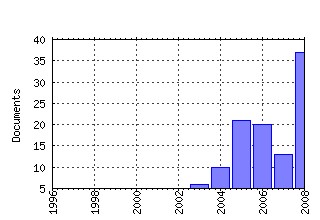

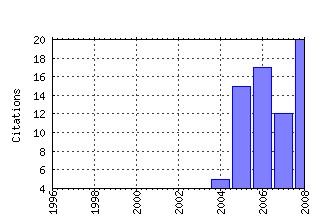

Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:mpg:wpaper:2005_23 A Contribution to the Theory of Optimal Utilitarian Income Taxation (2005). (2) RePEc:mpg:wpaper:2008_2 Modeling Option and Strategy Choices with Connectionist Networks: Towards an Integrative Model of Automatic and Deliberate Decision Making (2008). (3) RePEc:mpg:wpaper:2006_11 The Threat of Capital Drain: A Rationale for Public Banks? (2006). (4) RePEc:mpg:wpaper:2008_12 Multiple-Reason Decision Making Based on Automatic Processing (2008). (5) RePEc:mpg:wpaper:2007_2 A Contribution to the Theory of Optimal Utilitarian Income Taxation (2007). (6) RePEc:mpg:wpaper:2008_4 A Maximum Principle for Control Problems with Monotonicity Constraints (2008). (7) RePEc:mpg:wpaper:2006_27 How Much Collusion. A Meta-Analysis On Oligopoly Experiments (2006). (8) RePEc:mpg:wpaper:2008_43 Systemic Risk in the Financial Sector: An Analysis of the Subprime-Mortgage Financial Crisis (2008). (9) RePEc:mpg:wpaper:2005_06 (). (10) RePEc:mpg:wpaper:2005_25 Optimal Income Taxation and Public Good Provision in a Two-Class Economy (2005). (11) RePEc:mpg:wpaper:2006_22 Private Damage Claims and the Passing-On Defense in Horizontal Price-Fixing Cases: An Economistâs Perspective (2006). (12) RePEc:mpg:wpaper:2009_20 (). (13) RePEc:mpg:wpaper:2008_36 Can We Trust Intuitive Jurors? An Experimental Analysis (2008). (14) RePEc:mpg:wpaper:2004_12 Banks without Parachutes â Competitive Effects of Government Bail-out Policies (2004). (15) RePEc:mpg:wpaper:2006_26 Incentive Problems with Unidimensional Hidden Characteristics: A Unified Approach (2010). (16) RePEc:mpg:wpaper:2005_24 Ostracism and the Provision of a Public Good, Experimental Evidence (2005). (17) RePEc:mpg:wpaper:2005_27 The Undesirability of Randomized Income Taxation under Decreasing Risk Aversion (2005). (18) RePEc:mpg:wpaper:2004_14 Optimal Income Taxation, Public-Goods Provision and Public-Sector Pricing: A Contribution to the Foundations of Public Economics (2004). (19) RePEc:mpg:wpaper:2004_04 (). (20) RePEc:mpg:wpaper:2007_9 Switzerland and Euroland: European Monetary Union, Monetary Stability and Financial Stability (2007). (21) RePEc:mpg:wpaper:2008_42 Information Processing in Decisions under Risk: Evidence for Compensatory Strategies based on Automatic Processes (2008). (22) RePEc:mpg:wpaper:2007_12 Institutions for Intuitive Man (2007). (23) RePEc:mpg:wpaper:2004_02 (). (24) RePEc:mpg:wpaper:2006_19 The Impact of Institutions on the Decision How to Decide (2006). (25) RePEc:mpg:wpaper:2005_19 Market Discipline, Information Processing, and Corporate Governance (2005). (26) RePEc:mpg:wpaper:2007_8 A Reconsideration of the Jensen-Meckling Model of Outside Finance (2007). (27) RePEc:mpg:wpaper:2009_29 We Are Not Alone: The Impact of Externalities on Public Good Provision (2010). (28) RePEc:mpg:wpaper:2006_12 Competition as a Socially Desirable Dilemma (2006). (29) RePEc:mpg:wpaper:2009_14 Efficiency Gains from Team-Based Coordination â Large-Scale Experimental Evidence (2009). (30) RePEc:mpg:wpaper:2008_31 Optimal Income Taxation, Public Goods Provision and Robust Mechanism Design (2008). (31) RePEc:mpg:wpaper:2009_08 Leading with(out) Sacrifice? A Public-Goods Experiment with a Super-Additive Player (2009). (32) RePEc:mpg:wpaper:2010_07 Dictator Games: A Meta Study (2010). (33) RePEc:mpg:wpaper:2008_45 A Note on Deatons Theorem on the Undesirability of Nonuniform Excise Taxation (2008). (34) repec:mpg:wpaper:2009_31 (). (35) RePEc:mpg:wpaper:2006_18 Informative Voting and the Samuelson Rule (2006). (36) RePEc:mpg:wpaper:2005_18 Monetary Equilibria in a Cash-in-Advance Economy with Incomplete Financial Markets (2005). (37) RePEc:mpg:wpaper:2007_24 Better Than Conscious? The Brain, the Psyche, Behavior, and Institutions (2007). (38) RePEc:mpg:wpaper:2005_05 (). (39) RePEc:mpg:wpaper:2009_10 How Distinct are Intuition and Deliberation? An Eye-Tracking Analysis of Instruction-Induced Decision Modes (2009). (40) RePEc:mpg:wpaper:2005_26 Voice over IP. Competition Policy and Regulation (2005). (41) RePEc:mpg:wpaper:2008_21 Apportionment, Fiscal Equalization and Decentralized Tax Enforcement (2008). (42) RePEc:mpg:wpaper:2009_03 Survey Evidence on Conditional Norm Enforcement (2009). (43) RePEc:mpg:wpaper:2010_05 Competition, Risk-Shifting,and Public Bail-out Policies (2010). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:jdm:journl:v:3:y:2008:i:8:p:641-658 Identifying decision strategies in a consumer choice situation (2008). Judgment and Decision Making (2) RePEc:mpg:wpaper:2008_33 Preponderance of the Evidence versus Intime Conviction. A Behavioural Perspective on a Conflict between American and Continental European Law (2008). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods (3) RePEc:mpg:wpaper:2008_36 Can We Trust Intuitive Jurors? An Experimental Analysis (2008). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods (4) RePEc:mpg:wpaper:2008_39 A unified approach to the revelation of public goods preferences and to optimal income taxation (2008). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods (5) RePEc:mpg:wpaper:2008_42 Information Processing in Decisions under Risk: Evidence for Compensatory Strategies based on Automatic Processes (2008). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods (6) RePEc:mpg:wpaper:2008_47 A Generalization of the Atkinson-Stiglitz (1976) Theorem on the Undesirability of Nonuniform Excise Taxation (2008). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:mpg:wpaper:2006_24 Collectively Incentive Compatible Tax Systems (2006). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods Recent citations received in: 2005 (1) RePEc:mpg:wpaper:2005_25 Optimal Income Taxation and Public Good Provision in a Two-Class Economy (2005). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods (2) RePEc:mpg:wpaper:2005_27 The Undesirability of Randomized Income Taxation under Decreasing Risk Aversion (2005). Max Planck Institute for Reserach on Collective Goods / Working Paper Series of the Max Planck Institute for Reserach on Collective Goods Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||