|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

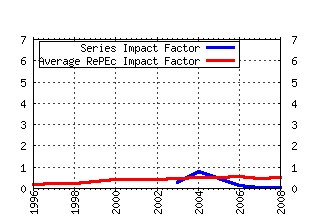

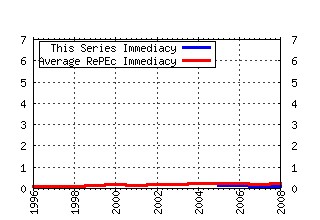

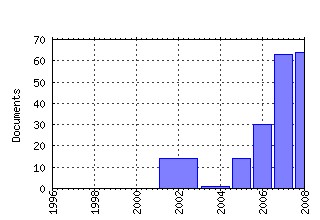

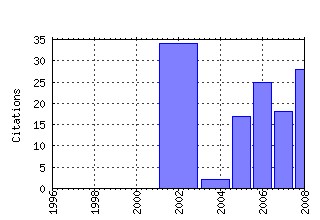

Quantitative Finance Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:taf:quantf:v:2:y:2002:i:6:p:459-467 Consistent pricing and hedging for a modified constant elasticity of variance model (2002). (2) RePEc:taf:quantf:v:2:y:2002:i:6:p:443-453 Probability distribution of returns in the Heston model with stochastic volatility* (2002). (3) RePEc:taf:quantf:v:5:y:2005:i:6:p:557-568 Multiple equilibria in a monopoly market with heterogeneous agents and externalities (2005). (4) RePEc:taf:quantf:v:2:y:2002:i:6:p:468-481 The US 2000-2002 market descent: how much longer and deeper? (2002). (5) RePEc:taf:quantf:v:2:y:2002:i:6:p:432-442 Pricing of perpetual Bermudan options (2002). (6) RePEc:taf:quantf:v:8:y:2008:i:4:p:427-434 New and robust drift approximations for the LIBOR market model (2008). (7) RePEc:taf:quantf:v:2:y:2002:i:6:p:415-431 A theory of non-Gaussian option pricing (2002). (8) RePEc:taf:quantf:v:6:y:2006:i:6:p:513-536 Fast strong approximation Monte Carlo schemes for stochastic volatility models (2006). (9) RePEc:taf:quantf:v:6:y:2006:i:4:p:359-363 The robustness of modified unit root tests in the presence of GARCH (2006). (10) RePEc:taf:quantf:v:8:y:2008:i:5:p:513-532 Financial markets in the laboratory: an experimental analysis of some stylized facts (2008). (11) RePEc:taf:quantf:v:5:y:2005:i:5:p:489-501 Empirical estimation of tail dependence using copulas: application to Asian markets (2005). (12) RePEc:taf:quantf:v:6:y:2006:i:3:p:229-242 An exact and explicit solution for the valuation of American put options (2006). (13) RePEc:taf:quantf:v:6:y:2006:i:3:p:207-218 Expensive martingales (2006). (14) RePEc:taf:quantf:v:7:y:2007:i:1:p:21-36 Multi-scaling in finance (2007). (15) RePEc:taf:quantf:v:7:y:2007:i:4:p:359-364 Coherent measures of risk in everyday market practice (2007). (16) RePEc:taf:quantf:v:6:y:2006:i:4:p:327-335 Barrier options and their static hedges: simple derivations and extensions (2006). (17) RePEc:taf:quantf:v:8:y:2008:i:7:p:723-738 Detecting log-periodicity in a regime-switching model of stock returns (2008). (18) RePEc:taf:quantf:v:5:y:2005:i:6:p:525-530 Moment swaps (2005). (19) RePEc:taf:quantf:v:7:y:2007:i:6:p:687-696 Testing asymmetry in financial time series (2007). (20) RePEc:taf:quantf:v:7:y:2007:i:5:p:507-524 Volatility surfaces: theory, rules of thumb, and empirical evidence (2007). (21) repec:taf:quantf:v:8:y:2008:i:6:p:591-604 (). (22) RePEc:taf:quantf:v:4:y:2004:i:4:p:c37-c45 Adaptive systems for foreign exchange trading (2004). (23) RePEc:taf:quantf:v:8:y:2008:i:8:p:833-843 Update rules for convex risk measures (2008). (24) RePEc:taf:quantf:v:6:y:2006:i:3:p:219-227 Symmetry and duality in Lévy markets (2006). (25) RePEc:taf:quantf:v:10:y:2010:i:1:p:23-37 Real-world jump-diffusion term structure models (2010). (26) RePEc:taf:quantf:v:6:y:2006:i:2:p:115-123 Random walks, liquidity molasses and critical response in financial markets (2006). (27) RePEc:taf:quantf:v:7:y:2007:i:4:p:435-442 Ambiguity in portfolio selection (2007). (28) RePEc:taf:quantf:v:8:y:2008:i:6:p:573-590 Coupling smiles (2008). (29) RePEc:taf:quantf:v:8:y:2008:i:1:p:59-79 Heterogeneity, convergence, and autocorrelations (2008). (30) RePEc:taf:quantf:v:9:y:2009:i:1:p:19-26 Equity with Markov-modulated dividends (2009). (31) RePEc:taf:quantf:v:5:y:2005:i:6:p:569-576 Price return autocorrelation and predictability in agent-based models of financial markets (2005). (32) RePEc:taf:quantf:v:7:y:2007:i:3:p:269-284 A positive interest rate model with sticky barrier (2007). (33) RePEc:taf:quantf:v:8:y:2008:i:8:p:765-776 Thou shalt buy and hold (2008). (34) RePEc:taf:quantf:v:5:y:2005:i:6:p:531-542 Valuation of volatility derivatives as an inverse problem (2005). (35) RePEc:taf:quantf:v:7:y:2007:i:2:p:151-160 Volatility-induced financial growth (2007). (36) RePEc:taf:quantf:v:8:y:2008:i:3:p:321-334 US corporate default swap valuation: the market liquidity hypothesis and autonomous credit risk (2008). (37) RePEc:taf:quantf:v:9:y:2009:i:6:p:757-766 Capital market equilibrium with heterogeneous investors (2009). (38) RePEc:taf:quantf:v:7:y:2007:i:5:p:575-583 A jump telegraph model for option pricing (2007). (39) RePEc:taf:quantf:v:8:y:2008:i:7:p:681-692 Liquidity risk theory and coherent measures of risk (2008). (40) RePEc:taf:quantf:v:5:y:2005:i:6:p:513-517 Statistical properties of demand fluctuation in the financial market (2005). (41) RePEc:taf:quantf:v:8:y:2008:i:3:p:235-249 Price discovery in the presence of boundedly rational agents (2008). (42) RePEc:taf:quantf:v:9:y:2009:i:4:p:397-409 Option pricing with Levy-Stable processes generated by Levy-Stable integrated variance (2009). (43) RePEc:taf:quantf:v:10:y:2010:i:1:p:91-105 Portfolio optimization for student t and skewed t returns (2010). (44) RePEc:taf:quantf:v:6:y:2006:i:2:p:147-158 A new technique for calibrating stochastic volatility models: the Malliavin gradient method (2006). (45) RePEc:taf:quantf:v:6:y:2006:i:6:p:449-449 The modified Weibull distribution for asset returns (2006). (46) RePEc:taf:quantf:v:8:y:2008:i:2:p:119-133 Pricing options with Greens functions when volatility, interest rate and barriers depend on time (2008). (47) RePEc:taf:quantf:v:9:y:2009:i:1:p:27-42 Sato processes and the valuation of structured products (2009). (48) RePEc:taf:quantf:v:6:y:2006:i:2:p:107-112 Market efficiency and the long-memory of supply and demand: is price impact variable and permanent or fixed and temporary? (2006). (49) RePEc:taf:quantf:v:8:y:2008:i:1:p:19-40 The next tick on Nasdaq (2008). (50) RePEc:taf:quantf:v:7:y:2007:i:2:p:231-244 Solving ALM problems via sequential stochastic programming (2007). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:bai:series:wp0022 The Effect of Rating Agencies on Herd Behaviour (2008). Dipartimento di Scienze Economiche - Universitàdi Bari / series (2) RePEc:eei:rpaper:eeri_rp_2008_21 The Effect of Rating Agencies on Herd Behaviour (2008). Economics and Econometrics Research Institute (EERI) / EERI Research Paper Series (3) RePEc:kap:apfinm:v:15:y:2008:i:1:p:3-24 A Stochastic Receding Horizon Control Approach to Constrained Index Tracking (2008). Asia-Pacific Financial Markets (4) RePEc:pra:mprapa:6884 ON THE ABSORBABILITY OF HERD BEHAVIOUR AND INFORMATIONAL CASCADES: AN EXPERIMENTAL ANALYSIS (2008). University Library of Munich, Germany / MPRA Paper (5) RePEc:spr:joevec:v:18:y:2008:i:5:p:639-646 A simple note on herd behaviour (2008). Journal of Evolutionary Economics Recent citations received in: 2007 (1) RePEc:arx:papers:0705.0503 Change point estimation for the telegraph process observed at discrete times (2007). arXiv.org / Quantitative Finance Papers (2) RePEc:hal:wpaper:hal-00413729_v1 Robustness and sensitivity analysis of risk measurement procedures (2007). HAL / Working Papers (3) RePEc:ise:isegwp:wp52007 The Seismography of Crashes in Financial Markets (2007). Department of Economics, Institute for Economics and Business Administration (ISEG), Technical University of Lisbon / Working Papers (4) RePEc:mis:wpaper:20071101 Modelling good and bad volatility (2007). Universitàdegli Studi di Milano-Bicocca, Dipartimento di Statistica / Working Papers (5) RePEc:mis:wpaper:20071102 A Geostatistical Approach to Define Guidelines for Radon Prone Area Identification (2007). Universitàdegli Studi di Milano-Bicocca, Dipartimento di Statistica / Working Papers Recent citations received in: 2006 (1) RePEc:dgr:uvatin:20060065 Why the Rotation Count Algorithm works (2006). Tinbergen Institute / Tinbergen Institute Discussion Papers (2) RePEc:kap:revdev:v:9:y:2006:i:3:p:239-264 Static versus dynamic hedges: an empirical comparison for barrier options (2006). Review of Derivatives Research (3) RePEc:spr:finsto:v:10:y:2006:i:2:p:178-203 Consistent Variance Curve Models (2006). Finance and Stochastics (4) RePEc:taf:quantf:v:6:y:2006:i:6:p:451-451 The modified weibull distribution for asset returns: reply (2006). Quantitative Finance Recent citations received in: 2005 (1) RePEc:hal:journl:halshs-00179343_v1 How can we define the concept of long memory ? An econometric survey, (2005). HAL / Post-Print (2) RePEc:taf:quantf:v:5:y:2005:i:6:p:519-521 Two phase behaviour and the distribution of volume (2005). Quantitative Finance Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||