|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

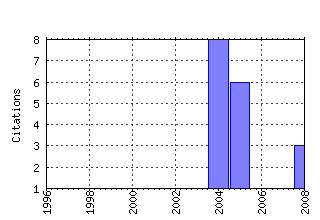

Directorate General Taxation and Customs Union, European Commission / Taxation Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) repec:tax:taxpap:0008 (). (2) RePEc:tax:taxpap:0001 Tax-based EU own resources: an assessment (2004). (3) RePEc:tax:taxpap:0007 Measuring the Effective Levels of Company Taxation in the New Member States: A Quantitative Analysis. (2004). (4) RePEc:tax:taxpap:0017 Alternative Systems of Business Tax in Europe: An applied analysis of ACE and CBIT Reforms (2009). (5) RePEc:tax:taxpap:0014 Corporate Effective Tax Rates in an Enlarged European Union (2009). (6) RePEc:tax:taxpap:0012 The corporate income tax rate-revenue paradox: Evidence in the EU (2008). (7) RePEc:tax:taxpap:0013 Study on reduced VAT applied to goods and services in the Member States of the European Union (2008). (8) repec:tax:taxpap:0011 (). (9) RePEc:tax:taxpap:0002 VAT indicators (2004). (10) RePEc:tax:taxpap:0009 The Delineation and Apportionment of an EU Consolidated Tax Base for Multi-jurisdictional Corporate Income Taxation: a Review of Issues and Options. (2006). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:pra:mprapa:14761 Tax burden by economic function A comparison for the EU Member States (2008). University Library of Munich, Germany / MPRA Paper Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||