|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

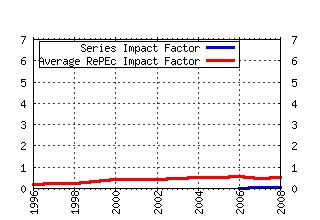

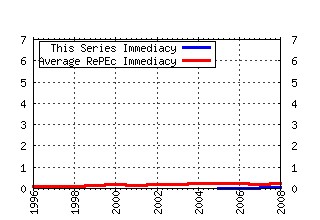

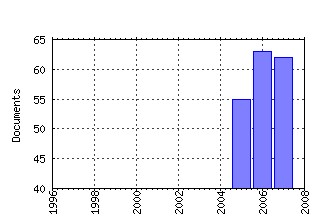

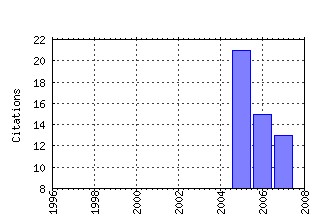

International Journal of Theoretical and Applied Finance (IJTAF) Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:wsi:ijtafx:v:12:y:2009:i:07:p:1007-1026 COUNTERPARTY RISK FOR CREDIT DEFAULT SWAPS: IMPACT OF SPREAD VOLATILITY AND DEFAULT CORRELATION (2009). (2) RePEc:wsi:ijtafx:v:08:y:2005:i:05:p:537-551 VALUE-AT-RISK AND EXPECTED SHORTFALL FOR LINEAR PORTFOLIOS WITH ELLIPTICALLY DISTRIBUTED RISK FACTORS (2005). (3) RePEc:wsi:ijtafx:v:08:y:2005:i:07:p:839-869 A GENERAL EQUILIBRIUM MODEL OF THE TERM STRUCTURE OF INTEREST RATES UNDER REGIME-SWITCHING RISK (2005). (4) RePEc:wsi:ijtafx:v:09:y:2006:i:02:p:185-197 PRICING DERIVATIVES ON TWO-DIMENSIONAL LÃÆÃâ°VY PROCESSES (2006). (5) RePEc:wsi:ijtafx:v:09:y:2006:i:06:p:915-949 PRICING OF FIRST TOUCH DIGITALS UNDER NORMAL INVERSE GAUSSIAN PROCESSES (2006). (6) RePEc:wsi:ijtafx:v:10:y:2007:i:04:p:733-748 JOINT DISTRIBUTIONS OF PORTFOLIO LOSSES AND EXOTIC PORTFOLIO PRODUCTS (2007). (7) RePEc:wsi:ijtafx:v:08:y:2005:i:02:p:161-184 AFFINE PROCESSES, ARBITRAGE-FREE TERM STRUCTURES OF LEGENDRE POLYNOMIALS, AND OPTION PRICING (2005). (8) RePEc:wsi:ijtafx:v:08:y:2005:i:06:p:807-838 PARTIAL INFORMATION AND HAZARD PROCESS (2005). (9) RePEc:wsi:ijtafx:v:10:y:2007:i:02:p:273-306 ON ERRORS AND BIAS OF FOURIER TRANSFORM METHODS IN QUADRATIC TERM STRUCTURE MODELS (2007). (10) RePEc:wsi:ijtafx:v:11:y:2008:i:01:p:87-106 A SHOT NOISE MODEL FOR FINANCIAL ASSETS (2008). (11) RePEc:wsi:ijtafx:v:11:y:2008:i:06:p:611-634 PRICING AND HEDGING OF PORTFOLIO CREDIT DERIVATIVES WITH INTERACTING DEFAULT INTENSITIES (2008). (12) RePEc:wsi:ijtafx:v:10:y:2007:i:04:p:607-631 CLUSTER-BASED EXTENSION OF THE GENERALIZED POISSON LOSS DYNAMICS AND CONSISTENCY WITH SINGLE NAMES (2007). (13) RePEc:wsi:ijtafx:v:10:y:2007:i:07:p:1203-1227 CALCULATING THE EARLY EXERCISE BOUNDARY OF AMERICAN PUT OPTIONS WITH AN APPROXIMATION FORMULA (2007). (14) RePEc:wsi:ijtafx:v:08:y:2005:i:03:p:301-319 OPTIMAL LOGARITHMIC UTILITY AND OPTIMAL PORTFOLIOS FOR AN INSIDER IN A STOCHASTIC VOLATILITY MARKET (2005). (15) RePEc:wsi:ijtafx:v:09:y:2006:i:04:p:455-481 MONTE CARLO EVALUATION OF AMERICAN OPTIONS USING CONSUMPTION PROCESSES (2006). (16) RePEc:wsi:ijtafx:v:11:y:2008:i:03:p:325-343 EQUILIBRIUM PRICES FOR MONETARY UTILITY FUNCTIONS (2008). (17) RePEc:wsi:ijtafx:v:09:y:2006:i:02:p:227-244 TECHNICAL ANALYSIS BASED ON PRICE-VOLUME SIGNALS AND THE POWER OF TRADING BREAKS (2006). (18) RePEc:wsi:ijtafx:v:12:y:2009:i:03:p:393-425 THE EVALUATION OF AMERICAN OPTION PRICES UNDER STOCHASTIC VOLATILITY AND JUMP-DIFFUSION DYNAMICS USING THE METHOD OF LINES (2009). (19) RePEc:wsi:ijtafx:v:09:y:2006:i:01:p:23-42 THE DETERMINANTS OF CREDIT DEFAULT SWAP RATES: AN EXPLANATORY STUDY (2006). (20) RePEc:wsi:ijtafx:v:08:y:2005:i:03:p:381-392 LONG MEMORY STOCHASTIC VOLATILITY IN OPTION PRICING (2005). (21) RePEc:wsi:ijtafx:v:09:y:2006:i:04:p:555-576 A MODEL FOR HIGH FREQUENCY DATA UNDER PARTIAL INFORMATION: A FILTERING APPROACH (2006). (22) RePEc:wsi:ijtafx:v:08:y:2005:i:08:p:1085-1106 IMPLIED VOLATILITY TREES AND PRICING PERFORMANCE: EVIDENCE FROM THE S&P 100 OPTIONS (2005). (23) RePEc:wsi:ijtafx:v:08:y:2005:i:02:p:255-281 PATHWISE IDENTIFICATION OF THE MEMORY FUNCTION OF MULTIFRACTIONAL BROWNIAN MOTION WITH APPLICATION TO FINANCE (2005). (24) RePEc:wsi:ijtafx:v:09:y:2006:i:04:p:517-532 PRICING PARTICIPATING POLICIES WITH RATE GUARANTEES (2006). (25) RePEc:wsi:ijtafx:v:11:y:2008:i:05:p:415-445 SCENARIOS FOR PRICE DETERMINATION IN INCOMPLETE MARKETS (2008). (26) RePEc:wsi:ijtafx:v:10:y:2007:i:02:p:363-387 VALUATION OF GUARANTEED ANNUITY OPTIONS IN AFFINE TERM STRUCTURE MODELS (2007). (27) RePEc:wsi:ijtafx:v:12:y:2009:i:07:p:949-967 PRICING AND HEDGING IN CARBON EMISSIONS MARKETS (2009). (28) RePEc:wsi:ijtafx:v:09:y:2006:i:03:p:415-453 PRICING AND HEDGING CONVERTIBLE BONDS: DELAYED CALLS AND UNCERTAIN VOLATILITY (2006). (29) RePEc:wsi:ijtafx:v:11:y:2008:i:02:p:163-197 A NEW FRAMEWORK FOR DYNAMIC CREDIT PORTFOLIO LOSS MODELLING (2008). (30) RePEc:wsi:ijtafx:v:08:y:2005:i:06:p:717-735 AN ALTERNATIVE INTEREST RATE TERM STRUCTURE MODEL (2005). (31) RePEc:wsi:ijtafx:v:10:y:2007:i:02:p:203-233 STOCHASTIC MODEL PREDICTIVE CONTROL AND PORTFOLIO OPTIMIZATION (2007). (32) RePEc:wsi:ijtafx:v:12:y:2009:i:06:p:745-765 IMPLIED AND REALIZED VOLATILITY IN THE CROSS-SECTION OF EQUITY OPTIONS (2009). (33) RePEc:wsi:ijtafx:v:08:y:2005:i:04:p:523-536 A NOTE ON ASSET BUBBLES IN CONTINUOUS-TIME (2005). (34) RePEc:wsi:ijtafx:v:09:y:2006:i:06:p:825-841 OPTION PRICING FOR GARCH MODELS WITH MARKOV SWITCHING (2006). (35) RePEc:wsi:ijtafx:v:12:y:2009:i:01:p:45-62 A DYNAMIC APPROACH TO THE MODELING OF CORRELATION CREDIT DERIVATIVES USING MARKOV CHAINS (2009). (36) RePEc:wsi:ijtafx:v:08:y:2005:i:08:p:1135-1155 THE IMPACT OF STOCK RETURNS VOLATILITY ON CREDIT DEFAULT SWAP RATES: A COPULA STUDY (2005). (37) RePEc:wsi:ijtafx:v:10:y:2007:i:04:p:633-652 STOCHASTIC INTENSITY MODELING FOR STRUCTURED CREDIT EXOTICS (2007). (38) RePEc:wsi:ijtafx:v:09:y:2006:i:04:p:533-553 PRICING AND HEDGING AMERICAN BARRIER OPTIONS BY A MODIFIED BINOMIAL METHOD (2006). (39) RePEc:wsi:ijtafx:v:11:y:2008:i:05:p:503-528 MULTI-FACTOR JUMP-DIFFUSION MODELS OF ELECTRICITY PRICES (2008). (40) RePEc:wsi:ijtafx:v:08:y:2005:i:07:p:933-946 EXPERTS EARNING FORECASTS: BIAS, HERDING AND GOSSAMER INFORMATION (2005). (41) RePEc:wsi:ijtafx:v:10:y:2007:i:03:p:505-516 KERNEL-BASED SEMI-LOG-OPTIMAL EMPIRICAL PORTFOLIO SELECTION STRATEGIES (2007). (42) RePEc:wsi:ijtafx:v:12:y:2009:i:07:p:969-1005 ARBITRAGE-FREE INTERPOLATION OF THE SWAP CURVE (2009). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 (1) RePEc:arx:papers:0809.4781 On contingent claims pricing in incomplete markets: A risk sharing approach (2008). arXiv.org / Quantitative Finance Papers (2) RePEc:cte:wbrepe:wb084912 Statistical Properties and Economic Implications of Jump-Diffusion Processes with Shot-Noise Effects (2008). Universidad Carlos III, Departamento de EconomÃa de la Empresa / Business Economics Working Papers Recent citations received in: 2007 Recent citations received in: 2006 (1) RePEc:hum:wpaper:sfb649dp2006-051 Regression methods in pricing American and Bermudan options using consumption processes (2006). Sonderforschungsbereich 649, Humboldt University, Berlin, Germany / SFB 649 Discussion Papers Recent citations received in: 2005 (1) RePEc:upf:upfgen:880 A Note on the Malliavin differentiability of the Heston Volatility (2005). Department of Economics and Business, Universitat Pompeu Fabra / Economics Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||