|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

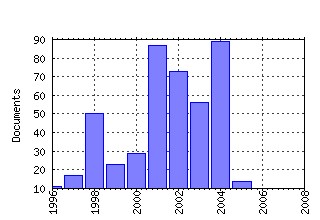

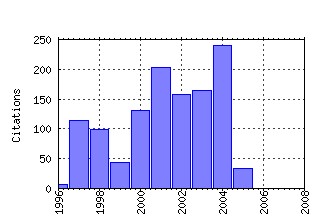

Yale School of Management / Yale School of Management Working Papers Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:ysm:somwrk:ysm355 The New Comparative Economics (2003). (2) RePEc:ysm:somwrk:ysm65 Empirical Performance of Alternative Option Pricing Models (1997). (3) RePEc:ysm:somwrk:ysm54 Empirical Performance of Alternative Option Pricing Models (1997). (4) RePEc:ysm:somwrk:ysm237 Long-Term Global Market Correlations (2001). (5) RePEc:ysm:somwrk:ysm211 On the Evolution of Overconfidence and Entrepreneurs (2001). (6) RePEc:ysm:somwrk:ysm258 A Review of IPO Activity, Pricing and Allocations (2002). (7) RePEc:ysm:somwrk:ysm122 Views of Financial Economists on the Equity Premium and on Professional Controversies (2000). (8) RePEc:ysm:somwrk:ysm376 Governance Mechanisms and Equity Prices (2003). (9) RePEc:ysm:somwrk:ysm425 Liquidity Black Holes (2004). (10) RePEc:ysm:somwrk:ysm157 Competing Against Bundles (2000). (11) RePEc:ysm:somwrk:ysm407 Intrahousehold Resource Allocation in Cote DIvoire: Social Norms, Separate Accounts and Consumption Choices (2004). (12) RePEc:ysm:somwrk:ysm74 Empowering Investors: A Market Approach to Securities Regulation (1998). (13) RePEc:ysm:somwrk:ysm380 Robust Mechanism Design (2004). (14) RePEc:ysm:somwrk:ysm346 Beauty Contests, Bubbles and Iterated Expectations in Asset Markets (2004). (15) RePEc:ysm:somwrk:ysm22 High Water Marks (2004). (16) RePEc:ysm:somwrk:ysm177 Hedge Funds With Style (2001). (17) RePEc:ysm:somwrk:ysm106 A Theoretical Analysis of the Investor Protection Regulations Argument for Global Listing of Stocks (1998). (18) RePEc:ysm:somwrk:ysm277 Courts: The Lex Mundi Project (2002). (19) RePEc:ysm:somwrk:ysm35 Teenage Employment and the Spatial Isolation of Minority and Poverty Households (1997). (20) RePEc:ysm:somwrk:ysm391 Disagreement about Inflation Expectations (2004). (21) RePEc:ysm:somwrk:ysm119 Entry Decisions in the Generic Pharmaceutical Industry (1999). (22) RePEc:ysm:somwrk:ysm146 What Makes Investors Trade? (2000). (23) RePEc:ysm:somwrk:ysm374 Consistent Estimation with a Large Number of Weak Instruments (2004). (24) RePEc:ysm:somwrk:ysm111 Re-Emerging Markets (1998). (25) RePEc:ysm:somwrk:ysm50 Re-emerging Markets (1998). (26) RePEc:ysm:somwrk:ysm409 What Drives Racial Segregation? New Evidence Using Census Microdata (2004). (27) RePEc:ysm:somwrk:ysm135 Behavioral Factors in Mutual Fund Flows (2000). (28) RePEc:ysm:somwrk:ysm73 Incomplete Contracts (1997). (29) RePEc:ysm:somwrk:ysm229 Structural Analysis of Manufacturer Pricing in the Presence of a Strategic Retailer (2001). (30) RePEc:ysm:somwrk:ysm357 Falling Trade Costs, Heterogeneous Firms, and Industry Dynamics (2003). (31) RePEc:ysm:somwrk:ysm161 The Policy Implications of Portfolio Choice in Underserved Mortgage Markets (2000). (32) RePEc:ysm:somwrk:ysm72 Priority Contracts and Priority in Bankruptcy (1997). (33) RePEc:ysm:somwrk:ysm236 Equity Portfolio Diversification (2001). (34) RePEc:ysm:somwrk:ysm228 Competitive Pricing Behavior in the US Auto Market: A Structural Analysis (2001). (35) RePEc:ysm:somwrk:ysm138 Day Trading International Mutual Funds: Evidence And Policy Solutions (2000). (36) RePEc:ysm:somwrk:ysm345 Communication and Monetary Policy (2004). (37) RePEc:ysm:somwrk:ysm103 European Equity Markets and EMU: Are the Differences Between Countries Slowly Disappearing? (1998). (38) RePEc:ysm:somwrk:ysm181 Market Timing and Capital Structure (2001). (39) RePEc:ysm:somwrk:ysm451 Performance Persistence (2005). (40) RePEc:ysm:somwrk:ysm274 Investor Sentiment in Japanese and U.S. Daily Mutual Fund Flows (2002). (41) RePEc:ysm:somwrk:ysm10 Conditions for Survival: Changing Risk and the Performance of Hedge Fund Managers and CTAs (2004). (42) RePEc:ysm:somwrk:ysm272 The Local Bias of Individual Investors (2002). (43) RePEc:ysm:somwrk:ysm281 Firm Financial Condition and Airline Price Wars (2002). (44) RePEc:ysm:somwrk:ysm147 The Essential Role of Organizational Law (2000). (45) RePEc:ysm:somwrk:ysm454 Why Do Individual Investors Hold Under-Diversified Portfolios? (2005). (46) RePEc:ysm:somwrk:ysm428 Bias in Dynamic Panel Estimation with Fixed Effects, Incidental Trends and Cross Section Dependence (2004). (47) RePEc:ysm:somwrk:ysm291 Why Dont Prices Rise During Periods of Peak Demand? Evidence from Scanner Data (2002). (48) RePEc:ysm:somwrk:ysm377 Two New Proofs of Afriats Theorem (2004). (49) RePEc:ysm:somwrk:ysm132 One Size Fits All? Specialization, Trade and Income Inequality (1999). (50) RePEc:ysm:somwrk:ysm287 Factor Price Equalization in the UK? (2002). Recent citations received in: | 2008 | 2007 | 2006 | 2005 Recent citations received in: 2008 Recent citations received in: 2007 Recent citations received in: 2006 Recent citations received in: 2005 (1) RePEc:taf:apfelt:v:1:y:2005:i:2:p:85-88 Empirical evidence of performance persistence in a relatively unexplored market: the case of Spanish investment funds (2005). Applied Financial Economics Letters (2) RePEc:wpa:wuwpga:0508007 Should Central Banks Burst Bubbles? (2005). EconWPA / Game Theory and Information (3) RePEc:wpa:wuwpif:0508004 Gains and losses. The same or different choices? (2005). EconWPA / International Finance (4) RePEc:wpa:wuwpif:0509002 Gains and losses: the same or different choices? A ânon-idealâ economics approach. (2005). EconWPA / International Finance (5) RePEc:wpa:wuwpmh:0512003 Scientific Revolution. A Farewell to EconWPA. (2005). EconWPA / Method and Hist of Econ Thought (6) RePEc:wpa:wuwppe:0511005 A Rational Irrational Man (2005). EconWPA / Public Economics Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||