|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

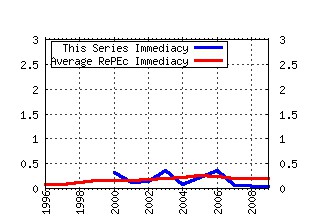

Working Papers Series Raw citation data, Impact Factor, Immediacy Index, Published documents, Citations received, , Most cited papers , Recent citations and documents published in this series in EconPapers.

Most cited documents in this series: (1) RePEc:bcb:wpaper:5 The Pass-through from Depreciation to Inflation: A Panel Study (2000). (2) RePEc:bcb:wpaper:76 Inflation Targeting in Emerging Market Economies (2003). (3) RePEc:bcb:wpaper:2 Monetary Policy and Banking Supervision Functions on the Central Bank (2000). (4) RePEc:bcb:wpaper:64 Medium-Size Macroeconomic Model for the Brazilian Economy (2003). (5) RePEc:bcb:wpaper:36 Can Emerging Markets Float? Should They Inflation Target? (2002). (6) RePEc:bcb:wpaper:16 Evaluation of the Central Bank of Brazil Structural Models Inflation Forecasts in an Inflation Targeting Framework (2001). (7) RePEc:bcb:wpaper:77 Inflation Targeting in Brazil: Constructing Credibility under Exchange Rate Volatility (2003). (8) RePEc:bcb:wpaper:109 The Recent Brazilian Disinflation Process and Costs (2006). (9) RePEc:bcb:wpaper:7 Leading Indicators of Inflation for Brazil (2000). (10) RePEc:bcb:wpaper:1 Implementing Inflation Targeting in Brazil (2000). (11) RePEc:bcb:wpaper:53 Inflation Targeting in Brazil: Lessons and Challenges (2002). (12) RePEc:bcb:wpaper:18 A Simple Model for Inflation Targeting in Brazil (2001). (13) RePEc:bcb:wpaper:129 Brazil: taming inflation expectations (2007). (14) RePEc:bcb:wpaper:46 The Determinants of Bank Interest Spread in Brazil (2002). (15) RePEc:bcb:wpaper:100 Targets and Inflation Dynamics (2005). (16) RePEc:bcb:wpaper:107 Demand for Bank Services and Market Power in Brazilian Banking (2006). (17) RePEc:bcb:wpaper:11 A Note on the Efficient Estimation of Inflation in Brazil (2001). (18) RePEc:bcb:wpaper:122 Nonlinear Mechanisms of the Exchange Rate Pass-Through: a Phillips curve model with threshold for Brazil (2006). (19) RePEc:bcb:wpaper:33 Monetary Policy and Inflation in Brazil (1975-2000): a VAR Estimation (2001). (20) RePEc:bcb:wpaper:12 A Test of Competition in Brazilian Banking (2001). (21) RePEc:bcb:wpaper:52 Generalized Hyperbolic Distributions and Brazilian Data (2002). (22) RePEc:bcb:wpaper:24 Inflation Targeting in Brazil: Shocks, Backward-Looking Prices, and IMF Conditionality (2001). (23) RePEc:bcb:wpaper:83 Does Inflation Targeting Reduce Inflation? An Analysis for the OECD Industrial Countries (2004). (24) RePEc:bcb:wpaper:56 Causality and Cointegration in Stock Markets: The Case of Latin America (2002). (25) RePEc:bcb:wpaper:101 Comparing equilibrium real interest rates: different approaches to measure Brazilian rates (2006). (26) RePEc:bcb:wpaper:143 Price Rigidity in Brazil: Evidence from CPI Micro Data (2007). (27) RePEc:bcb:wpaper:30 Testing the Expectations Hypothesis in the Brazilian Term Structure of Interest Rates (2001). (28) RePEc:bcb:wpaper:117 An Analysis of Off-Site Supervision of Banks Profitability, Risk and Capital Adequacy: a portfolio simulation approach applied to brazilian banks (2006). (29) RePEc:bcb:wpaper:26 Inflation Targeting in an Open Financially Integrated Emerging Economy: the case of Brazil (2001). (30) RePEc:bcb:wpaper:9 Estimating Exchange Market Pressure and Intervention Activity (2000). (31) RePEc:bcb:wpaper:15 Is it Worth Tracking Dollar/Real Implied Volatility? (2001). (32) RePEc:bcb:wpaper:37 Monetary Policy in Brazil: Remarks on the Inflation Targeting Regime, Public Debt Management and Open Market Operations (2002). (33) RePEc:bcb:wpaper:17 Estimating Brazilian Potential Output: A Production Function Approach (2002). (34) RePEc:bcb:wpaper:70 Monetary Policy Surprises and the Brazilian Term Structure of Interest Rates (2003). (35) RePEc:bcb:wpaper:155 Does Curvature Enhance Forecasting? (2007). (36) RePEc:bcb:wpaper:102 Judicial Risk and Credit Market Performance: Micro Evidence from Brazil Payroll Loans (2006). (37) RePEc:bcb:wpaper:130 The role of banks in the Brazilian Interbank Market: Does bank type matter? (2007). (38) RePEc:bcb:wpaper:95 Comment on Market Discipline and Monetary Policy by Carl Walsh (2005). (39) RePEc:bcb:wpaper:189 Linking Financial and Macroeconomic Factors to Credit Risk Indicators of Brazilian Banks (2009). (40) RePEc:bcb:wpaper:55 Componentes de Curto e Longo Prazo das Taxas de Juros no Brasil (2002). (41) RePEc:bcb:wpaper:69 r-filters: a Hodrick-Prescott Filter Generalization (2003). (42) RePEc:bcb:wpaper:141 Forecasting Bonds Yields in the Brazilian Fixed Income Market (2007). (43) RePEc:bcb:wpaper:68 Real Balances in the Utility Function: Evidence for Brazil (2003). (44) RePEc:bcb:wpaper:228 Forecasting Brazilian Inflation Using a Large Data Set (2010). (45) RePEc:bcb:wpaper:91 Credit Risk Measurement and the Regulation of Bank Capital and Provision Requirements in Brazil - A Corporate Analysis (2004). (46) RePEc:bcb:wpaper:150 A Probabilistic Approach for Assessing the Significance of Contextual Variables in Nonparametric Frontier Models: an Application for Brazilian Banks (2007). (47) RePEc:bcb:wpaper:42 Modelo Estrutural com Setor Externo: Endogenização do Prêmio de Risco e do Câmbio (2002). (48) RePEc:bcb:wpaper:174 Foreign Exchange Market Volatility Information: An Investigation of Real-Dollar Exchange Rate (2008). (49) RePEc:bcb:wpaper:58 The Random Walk Hypothesis and the Behavior of Foreign Capital Portfolio Flows: the Brazilian Stock Market Case (2002). (50) RePEc:bcb:wpaper:217 Financial Stability and Monetary Policy - The case of Brazil (2010). Recent citations received in: | 2009 | 2008 | 2007 | 2006 Recent citations received in: 2009 (1) RePEc:imf:imfwpa:09/109 Estimating Default Frequencies and Macrofinancial Linkages in the Mexican Banking Sector (2009). IMF Working Papers Recent citations received in: 2008 Recent citations received in: 2007 (1) RePEc:anp:en2007:028 IS BRAZIL DIFFERENT? RISK, DOLLARIZATION, AND INTEREST IN EMERGING MARKETS (2007). Anais do XXXV Encontro Nacional de Economia [Proceedings of the 35th Brazilian Economics Meeting] (2) RePEc:chb:bcchwp:432 Dynamics of Price Adjustments: Evidence From Micro Level Data for Chile (2007). Working Papers Central Bank of Chile Recent citations received in: 2006 (1) RePEc:bcb:wpaper:112 Interdependence and Contagion: an Analysis of Information Transmission in Latin Americas Stock Markets (2006). Working Papers Series (2) RePEc:bcb:wpaper:114 The Inequality Channel of Monetary Transmission (2006). Working Papers Series (3) RePEc:bcb:wpaper:116 Out-Of-The_Money Monte Carlo Simulation Option Pricing: the join use of Importance Sampling and Descriptive Sampling (2006). Working Papers Series (4) RePEc:bcb:wpaper:118 Contagion, Bankruptcy and Social Welfare Analysis in a Financial Economy with Risk Regulation Constraint (2006). Working Papers Series (5) RePEc:bcb:wpaper:122 Nonlinear Mechanisms of the Exchange Rate Pass-Through: a Phillips curve model with threshold for Brazil (2006). Working Papers Series (6) RePEc:bcb:wpaper:123 A Neoclassical Analysis of the Brazilian Lost-Decades (2006). Working Papers Series (7) RePEc:bcb:wpaper:124 The Dynamic Relationship between Stock Prices and Exchange Rates: evidence for Brazil (2006). Working Papers Series (8) RePEc:bcb:wpaper:125 Herding Behavior by Equity Foreign Investors on Emerging Markets (2006). Working Papers Series (9) RePEc:col:000094:003088 La Tasa de Interés Natural en Colombia (2006). BORRADORES DE ECONOMIA (10) RePEc:nbr:nberwo:12047 The Causes of Political Integration: An Application to School Districts (2006). NBER Working Papers Warning!! This is still an experimental service. The results of this service should be interpreted with care, especially in research assessment exercises. The processing of documents is automatic. There still are errors and omissions in the identification of references. We are working to improve the software to increase the accuracy of the results. Source data used to compute the impact factor of RePEc series. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||